Global Catheters Market Share, Size, Trends, Industry Analysis Report: Information By Product Type (Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters), By Lumen, By Material, By End-Use And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Market Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM1132

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Catheters Market Overview:

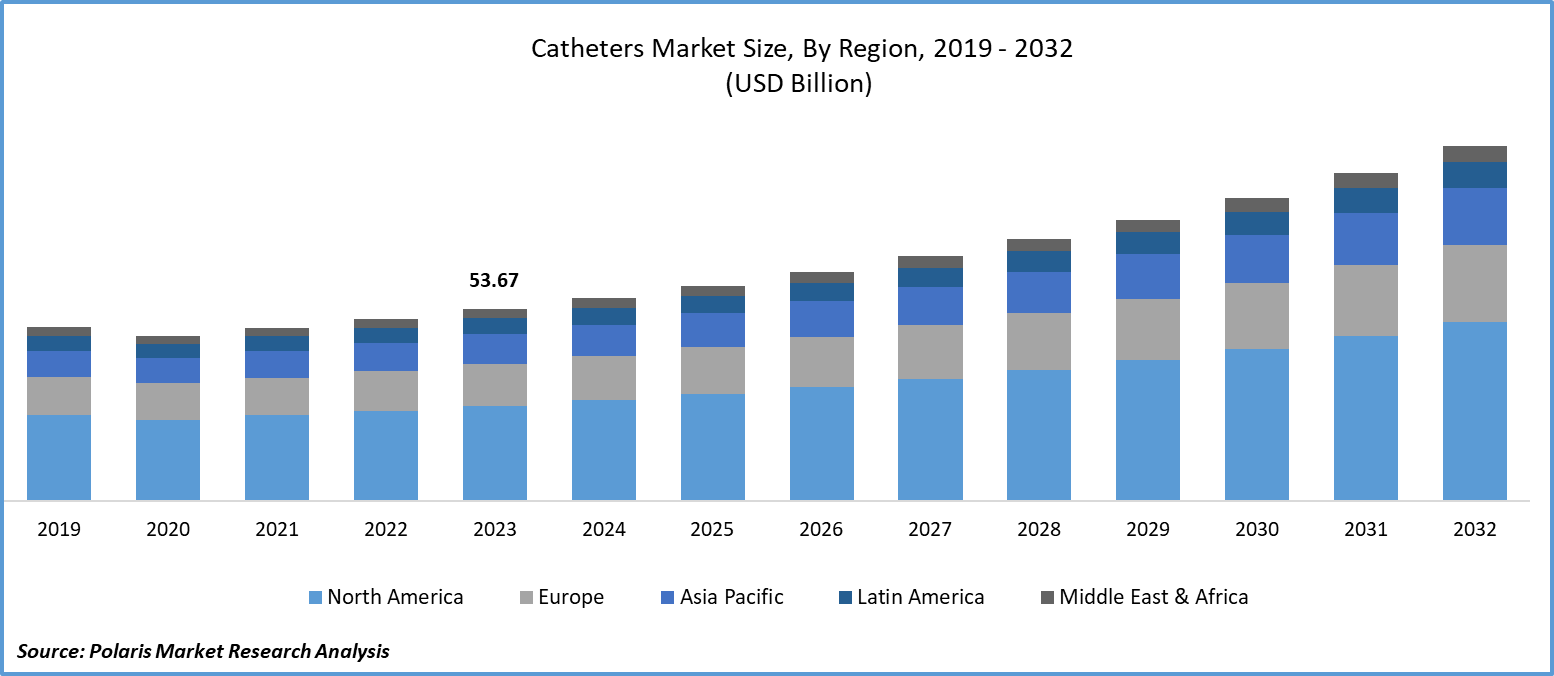

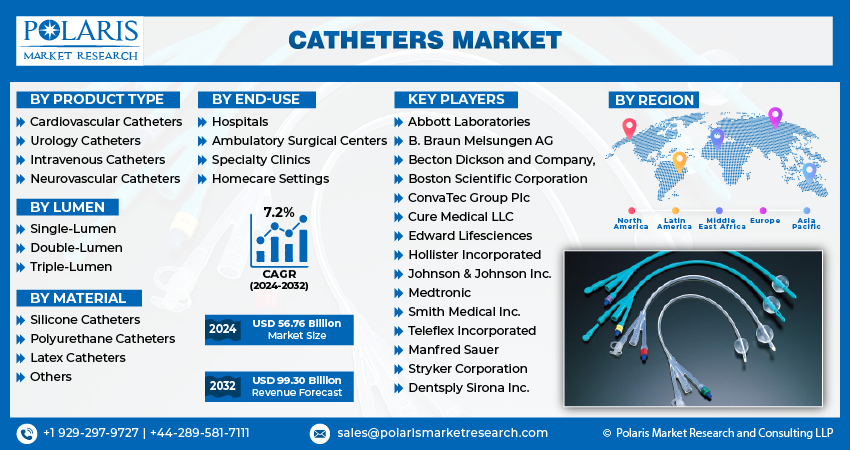

Global catheters market size was valued at USD 53.67 billion in 2023. The catheters industry is projected to grow from USD 56.76 billion in 2024 to USD 99.30 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% during the forecast period (2024 - 2032).

The catheters market is experiencing the increasing prevalence of diabetes and cancer patients, coupled with continuous technological advancements leading to the introduction of new catheter types, which are the primary drivers of the catheter market growth. Furthermore, the market is expected to be propelled by the increasing demand for minimally invasive surgeries in emerging markets during the forecast period. The high adoption rate of catheters in ambulatory care centers and technological innovations aimed at helping patients manage specific side effects of catheter use will also contribute to the catheters market growth throughout the projection period.

To Understand More About this Research: Request a Free Sample Report

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

A catheter is a medical device inserted into a vessel, duct, or cavity in the body. It serves functional purposes such as facilitating the administration of gas or fluid, draining bodily fluids, and providing access to surgical instruments. Catheterization refers to the use of catheters in medical procedures. Depending on the treatment requirements, catheters may be left in the body either temporarily or indefinitely. Major applications of catheters include neurological, urological, and cardiovascular therapy.

For instance, in March 2024, Boston Scientific Corporation announced that its AGENT Drug-Coated Balloon (DCB) had received approval from the U.S. Food and Drug Administration (FDA). This device is intended to treat in-stent restenosis (ISR) in patients with coronary artery disease, which occurs when a stented vessel becomes blocked or narrowed by plaque or scar tissue.

Moreover, there is a growing preference for minimally invasive procedures like catheterization, especially for treating conditions like peripheral artery disease (PAD). Patients increasingly opt for angioplasty procedures instead of traditional surgery, which contributes to the rising demand for such interventions. Peripheral angioplasty has become more popular in recent years due to its minimally invasive nature and improved patient outcomes. This trend towards minimally invasive procedures is further supported by advancements in technology, such as the use of smaller catheters and antimicrobial coatings, which help reduce the risk of complications like restenosis and drive the technological advancement in the catheter market.

Catheters Market Trends

The Frequency of Chronic Illnesses Driving the Market Growth

The global incidence of chronic diseases such as diabetes, renal disease, urinary tract issues, and cardiovascular disease is increasing. Catheters play a vital role in managing and treating these conditions. With the global population aging, there is a growing need for medical treatments and care among older individuals. Moreover, advancing age is associated with a higher likelihood of developing illnesses that may necessitate catheterization. As per the World Health Organization (WHO), the rising burden of non-communicable diseases (NCDs) implies that if the existing trend persists, by approximately 2050, conditions like cardiovascular diseases, diabetes, cancer, and respiratory illnesses will contribute to 86% of the total 90 million annual deaths. This marks a significant 90% increase in absolute numbers since 2019.

As the elderly population grows, the necessity for catheters is also on the rise. Healthcare providers and manufacturers are focusing on creating innovative and personalized products to meet the specific needs of patients with chronic diseases, aiming to address the growing demand for catheters market development during the projection period.

Rising Rates of Cardiovascular Illnesses

The global increase in rates of cardiovascular diseases is a major factor fueling the growth of the catheter industry. According to the American Heart Association, cardiovascular diseases were expected to account for nearly 19 million deaths worldwide in 2020. Additionally, it was estimated that 244 million individuals globally had ischemic heart disease (IHD) in 2020.

The prevalence and mortality of cardiovascular diseases have risen due to significant shifts in behavioral risk factors, including poor diet, reduced physical activity, increasing tobacco use, and excessive alcohol consumption. The increasing incidence of cardiovascular diseases is expected to lead to longer hospital stays and more medical procedures, driving the catheters market revenue.

Catheters Market Segment Insights:

Catheters Product Type Insights:

The global catheters market segmentation, based on product type, includes cardiovascular catheters, urology catheters, intravenous catheters, specialty catheters, and neurovascular catheters. The specialty catheters segment is projected to grow at the fastest CAGR during the projected period. This segment is expected to expand due to the rising incidence of target diseases and the increasing preference for minimally invasive procedures, driven by a greater number of regulatory approvals. For instance, Teleflex Incorporated received approval from the U.S. FDA in February 2022 for its specialized catheters designed to navigate Chronic Total Occlusion (CTO) during Percutaneous Coronary Intervention (PCI). Specialty catheters feature fewer surfaces, reduced friction, and less irritating materials, enhancing patient comfort and compliance, especially in cases requiring long-term catheterization.

The cardiovascular catheters segment led the industry market with a substantial revenue share in 2023. It is expected to experience accelerated growth in the forecast period, driven by factors such as the increasing prevalence of cardiovascular diseases, the growing demand for interventional cardiac procedures, and the rising acceptance of cardiac catheters. For instance, data from the American College of Cardiology in July 2023 revealed that more than 12 million people in the United States and nearly 200 million people worldwide are affected by peripheral artery disease (PAD).

Catheters Lumen Insights:

The global catheter market segmentation, based on lumen, includes single-lumen, double-lumen, and triple-lumen. The double-lumen segment accounted for the largest catheter market share in 2023 and is likely to retain its position throughout the forecast period. The significant market share of double-lumen catheters can be attributed to several benefits they offer, such as efficient medication administration, reduced need for vascular punctures, and simultaneous access. The use of double-lumen catheters can decrease the number of vascular punctures needed during medical treatments. This is particularly advantageous for individuals with fragile veins, as it reduces the likelihood of complications, irritation, and discomfort from repeated needle sticks.

Moreover, double-lumen catheters feature two separate lumens within a single catheter, eliminating the need for additional catheters or access sites and enabling healthcare providers to perform multiple tasks simultaneously. The FDA clearance is a significant milestone for medical device companies like Access Vascular, as it validates the safety and effectiveness of their product. Healthcare providers can now consider using the HydroPICC Dual-Lumen catheter as part of their patient care protocols, offering improved outcomes and patient experiences compared to traditional single-lumen catheters.

For instance, in May 2022, Access Vascular, Inc. revealed that it had obtained FDA 510(k) clearance for its HydroPICC Dual-Lumen catheter. Constructed with the same proprietary hydrophilic biomaterial as AVI’s single-lumen HydroMID and HydroPICC catheters, these devices demonstrated a notable decrease in complications, including replacements, occlusions, phlebitis, and Deep Vein Thrombosis, according to recent studies. Such innovative advancements by companies like Access Vascular contribute to the growth in catheters market demand for their products.

Global Catheters Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Catheters Regional Insights :

The study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. Several factors contribute to the growth of the catheter market in North America. These include an aging population, increasing rates of chronic illnesses, and the positive impact of major manufacturers such as Boston Scientific Corporation, Medtronic, and Teleflex Incorporated on regional prosperity.

Additionally, the awareness among patients and healthcare professionals about the importance of early diagnosis and treatment of chronic diseases could positively impact the demand for catheters. According to the CMS (Centers for Medicare & Medicaid Services), health spending in the United States is anticipated to reach 7.5% of GDP in 2022 and surpass $1 trillion in 2023. Additionally, a significant portion of the catheter market opportunity is influenced by skilled professionals and high discretionary income in developed economies.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and offer better offerings in North America, further driving the market during the forecast period.

The United States catheter market accounts for the largest market share due to the significant prevalence of chronic diseases such as cardiovascular conditions, diabetes, and urinary disorders. Catheters are often essential for managing these conditions, leading to a consistent demand for these medical devices. With a large aging population, there is an increased incidence of age-related health issues that may require catheterization, such as urinary retention or cardiovascular procedures.

The competitive environment among catheter manufacturers fosters ongoing innovation, resulting in the creation of new catheter varieties, enhanced materials, and advanced functionalities. This dynamic setting drives market expansion and product diversification.

For instance, in February 2024, BIOTRONIK launched the Micro Rx catheter, a revolutionary rapid exchange microcatheter designed to improve guidewire support during percutaneous coronary interventions (PCI) with ease. This state-of-the-art device, exclusively distributed by BIOTRONIK, is produced by Interventional Medical Device Solutions. The Micro Rx catheter joins BIOTRONIK's existing lineup of IMDS products in the U.S., which includes TrapIT, NHancer Rx, and ReCross catheters, forming a compelling portfolio of devices.

Moreover, the Canadian catheter market is expected to continue growing due to the increasing demand driven by an aging population, rising prevalence of chronic diseases, and ongoing technological advancements. The continuous introduction of innovative catheter products by leading medical device companies further propels market growth. As healthcare infrastructure and services improve and as minimally invasive procedures become more preferred, the demand for catheters in Canada is likely to remain robust.

For instance, in March 2024, B. Braun Canada Ltd. introduced its latest innovation, the Introcan Safety 2 IV Multi-Access Blood Control Catheter. This new catheter is the newest addition to B. Braun's vast line of inactive needlestick prevention catheters. Such ongoing innovation increases the market opportunity and contributes to driving the catheter market growth in the forecast year.

Further, the major countries studied in the market report are The US, Canada, German, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and others.

CATHETERS MARKET, REGIONAL COVERAGE, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Catheters Key Market Players & Competitive Insights

Leading market players play a pivotal role in shaping the market dynamics through their extensive research and development, strategic partnerships, product launches, and market expansion efforts. Understanding the competitive landscape is crucial for stakeholders to identify growth opportunities and make informed decisions. Market players are also launching a variety of strategic activities to boost their global footprint, with significant market developments including new product launches, mergers and acquisitions, contractual agreements, higher investments, and collaboration with other organizations. To expand and survive in an additional competitive and growing market climate, the Catheter industry must offer cost-effective products.

Manufacturing locally to minimize operating expenses is one of the key industry tactics used by manufacturers in the global catheter industry to benefit clients and increase the market sector. In recent years, the catheter industry has offered some technological advancements. Major players in the catheters market, including Abbott Laboratories, B. Braun Melsungen AG, Becton Dickson and Company, Boston Scientific Corporation, ConvaTec Group Plc, Cure Medical LLC, Edward Lifesciences, Hollister Incorporated, Johnson & Johnson Inc., Medtronic, Smith Medical Inc., Teleflex Incorporated, Manfred Sauer, Stryker Corporation, Dentsply Sirona Inc.

Abbott Laboratories is a manufacturer and supplier of diagnostics, pharmaceuticals, medical devices, and nutritional products and services. The company has 24 manufacturing facilities and development centers across 65 countries globally. In May 2023, Abbott announced that the U.S. Food and Drug Administration (FDA) had approved its TactiFlex Ablation Catheter, Sensor Enabled, the world's first ablation catheter featuring a flexible tip and contact force technology.

Boston Scientific Corporation is a medical equipment manufacturing company dedicated to creating innovative medical solutions that enhance the well-being of patients globally. The company offers a wide range of groundbreaking solutions for diverse health conditions, addressing issues such as aortic valve stenosis, atrial fibrillation, stroke, chronic pain, deep vein thrombosis, dystonia, essential tremor, liver cancer, Parkinson's disease, and peripheral artery disease. In May 2019, Boston Scientific Corporation announced the launch of the Sterling SL PTA Balloon Dilatation Catheter in the U.S. and Europe. This high-performance catheter is specifically designed for peripheral angioplasty procedures below the knee. The company plans to make the product available immediately in both markets.

Key Companies in the catheters market include

- Abbott Laboratories

- B. Braun Melsungen AG

- Becton Dickson and Company,

- Boston Scientific Corporation

- ConvaTec Group Plc

- Cure Medical LLC

- Edward Lifesciences

- Hollister Incorporated

- Johnson & Johnson Inc.

- Medtronic

- Smith Medical Inc.

- Teleflex Incorporated

- Manfred Sauer

- Stryker Corporation

- Dentsply Sirona Inc.

Catheters Industry Developments

- January 2024: Boston Scientific Corporation has received FDA approval for the FARAPULSE PFA (Pulsed Field Ablation) System. This system isolates pulmonary veins in the treatment of drug-refractory, recurrent, symptomatic paroxysmal AF (atrial fibrillation). It offers a unique alternative to standard thermal ablation treatments. The FARAPULSE PFA System includes the FARAWAVE Ablation Catheter.

- October 2023: Linear Health Sciences announced that the Orchid SRV Safety Released Valve had received approval from the U.S. FDA. This catheter is intended for use in all IV access procedures and is designed to reduce the risk of IV catheter rupture and repair in hospitals.

- July 2021: Medtronic plc launched the Prevail DCB (drug-coated balloon) Catheter after receiving CE (Conformité Européene) mark approval. The Prevail DCB, the latest coronary DCB on the market, is operated during percutaneous coronary intervention (PCI) processes to treat narrowed or obstructed coronary arteries in patients with coronary artery disease (CAD).

Catheters Market Segmentation:

Catheters Product Type Outlook

- Cardiovascular Catheters

- PTA Balloon Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- Urology Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Hemodialysis Catheters

- Intravenous Catheters

- Central Venous Catheters

- Midline Peripheral Catheters

- Peripheral Catheters

- Specialty Catheters

- Thermodilution Catheters

- IUI Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Neurovascular Catheters

Catheters Lumen Outlook

- Single-Lumen

- Double-Lumen

- Triple-Lumen

Catheters, Material Outlook

- Silicone Catheters

- Polyurethane Catheters

- Latex Catheters

- Others

Catheters End-Use Outlook

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Homecare Settings

Catheters Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Catheters Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 53.67 billion |

|

Market size value in 2024 |

USD 56.76 billion |

|

Revenue Forecast in 2032 |

USD 99.30 billion |

|

CAGR |

7.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key segments covered in the catheters market report are product type, lumen, material, end-use and region

The global catheters market size was valued at USD 53.67 billion in 2023

The global market is projected to grow at a CAGR of 7.2% during the forecast period, 2023-2032

North America held the largest share in the global market

The key players in the market are Abbott Laboratories, B. Braun Melsungen AG, Becton Dickson and Company, Boston Scientific Corporation, ConvaTec Group Plc, Cure Medical LLC, Edward Lifesciences, Hollister Incorporated, Johnson & Johnson Inc., Medtronic, Smith Medical Inc., Teleflex Incorporated, Manfred Sauer, Stryker Corporation, Dentsply Sirona Inc.

The specialty catheters segment is projected to grow at the fastest CAGR during the projected period