Breast Implants Market Size, Share, Trends, Industry Analysis Report: By Product (Silicone Breast Implants and Saline Breast Implants), Shape, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1319

- Base Year: 2024

- Historical Data: 2020-2023

Breast Implants Market Overview

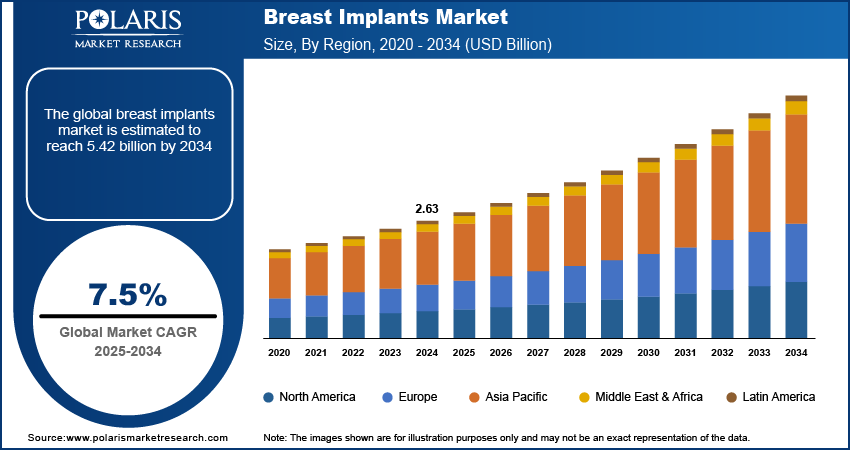

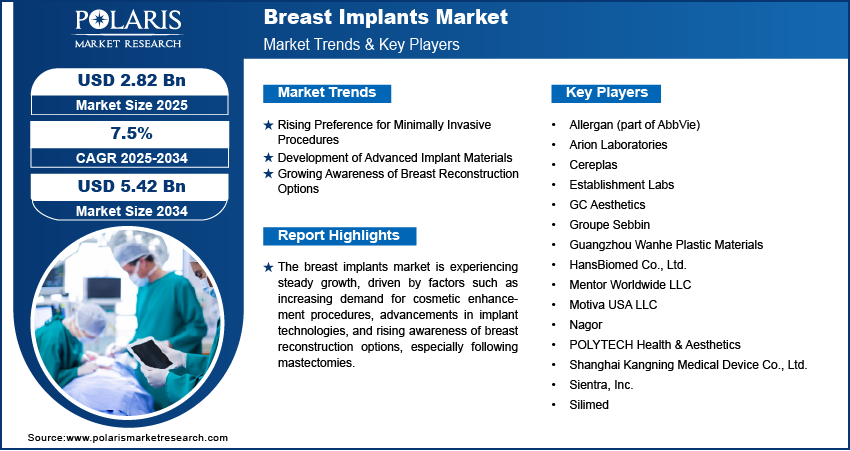

The breast implants market size was valued at USD 2.63 billion in 2024. The market is projected to grow from USD 2.82 billion in 2025 to USD 5.42 billion by 2034, exhibiting a CAGR of 7.5% during 2025–2034.

The breast implants market encompasses the production and sale of medical devices designed to enhance or reconstruct breast size and shape, commonly used in cosmetic and reconstructive surgeries. Key drivers include the growing demand for aesthetic enhancement procedures, increasing awareness about reconstructive options following mastectomy, and advancements in implant technologies offering improved safety and durability. Notable breast implants market trends include the rising popularity of minimally invasive procedures, the development of lightweight and natural-feel implants, and an increasing focus on regulatory compliance to ensure product safety. Expanding healthcare infrastructure and higher disposable incomes in emerging markets further support market growth.

To Understand More About this Research: Request a Free Sample Report

Breast Implants Market Dynamics

Rising Preference for Minimally Invasive Procedures

There is an increasing shift toward minimally invasive surgeries in the breast implants market, driven by patient demand for reduced recovery times and less scarring. Surgeons are adopting methods such as endoscopic breast augmentation, breast lesion localization methods and advanced fat grafting techniques to minimize the invasiveness of traditional procedures. According to a report by the American Society of Plastic Surgeons, minimally invasive cosmetic procedures grew by 2% in 2023 compared to 2022, reflecting this ongoing trend. These advancements align with patient preferences for faster procedures with fewer complications, further influencing the adoption of such techniques. Thus, the rising preference for minimally invasive procedures propels the breast implants market demand.

Development of Advanced Implant Materials

Manufacturers are focusing on silicone implants with cohesive gel technology and lightweight options that provide a natural feel while reducing risks such as rupture or capsular contracture. Textured implants designed to prevent displacement are also gaining traction. Research published in Plastic and Reconstructive Surgery highlighted that advanced silicone gel implants demonstrate improved durability and patient satisfaction, contributing to their growing adoption in both cosmetic and reconstructive surgeries. Hence, innovations in implant materials are becoming a key breast implants market trend.

Growing Awareness of Breast Reconstruction Options

Awareness of post-mastectomy breast reconstruction is increasing due to campaigns by healthcare organizations and rising emphasis on mental well-being following breast cancer therapies and treatment. Initiatives such as Breast Reconstruction Awareness (BRA) Day have significantly contributed to educating patients about available implant options. The American Cancer Society estimates that in 2023, around 100,000 women underwent breast reconstruction surgery in the US, underscoring this trend. This increased awareness, coupled with improved surgical outcomes and insurance coverage, is driving the demand for breast implants for reconstructive purposes.

Breast Implants Market Segment Insights

Breast Implants Market Assessment – Product-Based Insights

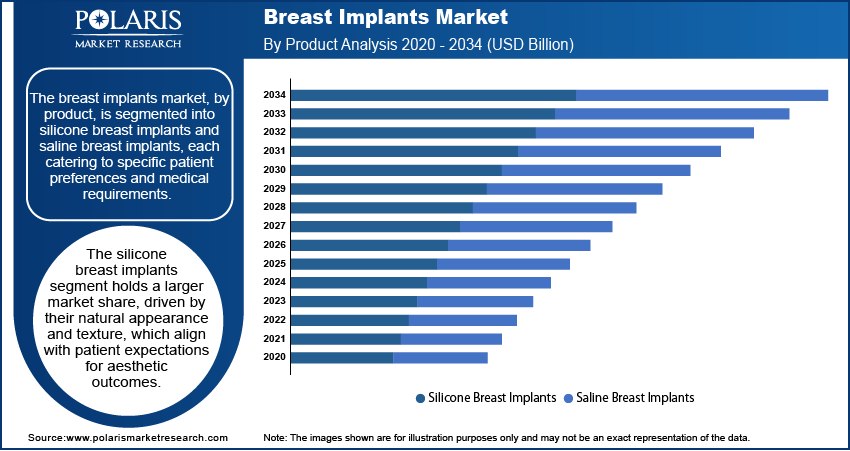

The breast implants market, by product, is bifurcated into silicone breast implants and saline breast implants, each catering to specific patient preferences and medical requirements. The silicone breast implants segment holds a larger market share, driven by their natural appearance and texture, which align with patient expectations for aesthetic outcomes. These implants are particularly favored in cosmetic surgeries due to advancements in cohesive gel technology, which enhances durability and minimizes complications such as rupture. Their widespread adoption is also supported by regulatory approvals and the availability of various sizes and shapes, enabling tailored solutions for patients.

The saline breast implants segment, while less dominant, is experiencing steady demand in specific demographics, particularly where adjustable volume is a critical factor. These implants are preferred in reconstructive surgeries and by patients who prioritize procedures involving smaller incisions, as they are filled after placement. Additionally, saline implants are perceived to have fewer long-term safety concerns due to their biocompatible saline solution. Despite slower growth compared to silicone implants, their appeal in niche applications and ongoing material innovations sustain their relevance in the market.

Breast Implants Market Outlook – Shape-Based Insights

By shape, the breast implants market is segmented into round and anatomical implants, each designed to address different aesthetic and reconstructive needs. The round breast implants segment holds a larger market share due to their widespread use in cosmetic procedures, offering enhanced fullness and symmetry. These implants are favored for their versatility and ability to maintain shape regardless of orientation, making them a popular choice among patients seeking noticeable volume enhancement. The demand for round implants is supported by their availability in various profiles, allowing surgeons to achieve personalized results.

The anatomical implants segment is experiencing significant growth, particularly in reconstructive surgeries and among patients prioritizing a more natural appearance. Anatomical implants are shaped to mimic the natural contour of the breast. These implants are increasingly preferred for their ability to provide a subtle and proportionate outcome, especially in cases where precise shaping is required. Technological advancements in anatomical implant designs, such as textured surfaces to prevent rotation, are contributing to their rising adoption. Their growth is also driven by heightened awareness of breast reconstruction options and expanding access to skilled surgical expertise globally.

Breast Implants Market Assessment – Application-Based Insights

The breast implants market, based on application, is segmented into reconstructive surgery and cosmetic surgery, each addressing distinct patient needs. The cosmetic surgery segment dominates the breast implants market share due to the increasing demand for aesthetic enhancements. Rising focus on maintaining body image, coupled with advancements in implant technologies that ensure natural and durable outcomes, has fueled the adoption of breast implants in cosmetic procedures. Additionally, social media influence and higher disposable incomes, particularly in developed regions, are a few key factors driving the growth of this segment.

The reconstructive surgery is registering a higher growth rate, driven by increasing awareness of post-mastectomy reconstruction options and supportive healthcare policies. Initiatives to educate patients about reconstructive choices and mental health benefits following breast cancer treatment are contributing to the segment's expansion. Surgeons and patients alike are benefiting from innovative implant designs and improved surgical techniques that enhance procedural outcomes. Furthermore, the inclusion of reconstructive surgeries in insurance coverage plans in many countries has made these procedures more accessible, driving robust growth within this segment.

Breast Implants Market Regional Insights

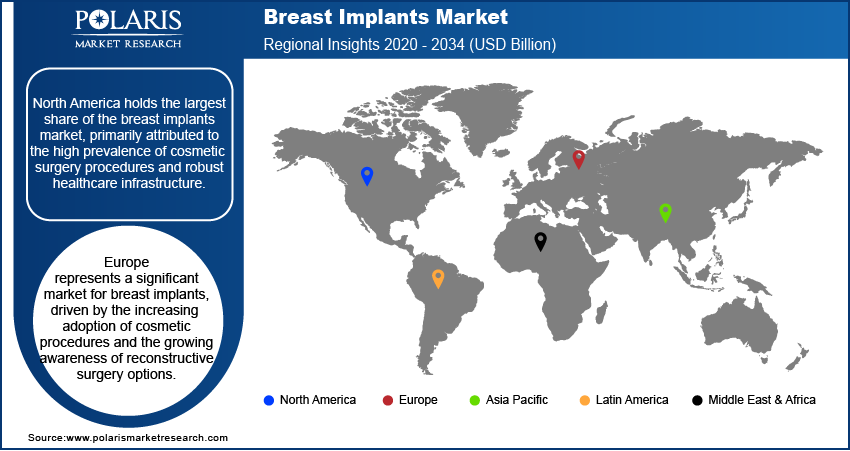

By region, the study provides breast implants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global breast implants market revenue, primarily attributed to the high prevalence of cosmetic surgery procedures and robust healthcare infrastructure. The US leads the regional market, driven by increasing consumer awareness of aesthetic enhancement options, a strong presence of skilled plastic surgeons, and advanced technological developments in implant materials and designs. Favorable regulatory frameworks and widespread insurance coverage for reconstructive procedures also contribute to market dominance. Additionally, the cultural acceptance of cosmetic surgeries and higher disposable incomes boost the demand for breast implants in North America. Other regions, including Europe and Asia Pacific, are witnessing growth due to rising awareness and improving healthcare facilities, though they trail behind North America in market share.

Europe represents a significant market for breast implants, driven by the increasing adoption of cosmetic procedures and the growing awareness of reconstructive surgery options. Countries such as Germany, the UK, and France lead the market due to their advanced healthcare systems and strong presence of experienced plastic surgeons. Additionally, cultural shifts and the rising acceptance of aesthetic enhancements are fueling demand. The availability of advanced implant technologies and supportive healthcare policies, particularly in reconstructive surgeries, contribute to the steady growth of the breast implants market in this region.

The Asia Pacific breast implants market is experiencing rapid growth, primarily due to rising disposable incomes and increasing demand for aesthetic procedures in emerging economies such as China, India, and South Korea. The region's expanding healthcare infrastructure and growing medical tourism industry further support market growth. Cultural shifts toward body positivity and awareness campaigns on reconstructive surgeries are also driving demand. Additionally, advancements in surgical techniques and implant technologies are attracting patients seeking high-quality yet cost-effective procedures, making Asia Pacific a prominent growth region for breast implants.

Breast Implants Market – Key Players and Competitive Insights

A few key players actively operating in the breast implants market are Allergan (a part of AbbVie), Mentor Worldwide LLC (a subsidiary of Johnson & Johnson), Sientra, Inc., Establishment Labs, GC Aesthetics, POLYTECH Health & Aesthetics, and HansBiomed Co., Ltd. Other notable companies include Groupe Sebbin; Arion Laboratories; Shanghai Kangning Medical Device Co., Ltd.; Cereplas; Guangzhou Wanhe Plastic Materials; Silimed; Nagor; and Motiva USA LLC. These companies focus on innovation, quality, and patient satisfaction through the development of advanced implant materials and improved safety features.

The breast implants market is characterized by significant competition, with companies differentiating themselves through product portfolios, technological advancements, and strategic collaborations. For example, Allergan and Mentor Worldwide LLC are well-established due to their extensive range of silicone and saline implants and global distribution networks. Establishment Labs and Motiva have gained traction by emphasizing patient safety and comfort, particularly with lightweight and ergonomic designs. Companies such as Sientra target specific consumer bases, leveraging strong clinical trial data to ensure product reliability and effectiveness.

The competitive landscape is influenced by regional players who cater to local markets with cost-effective solutions, especially in emerging economies. While multinational corporations dominate in developed regions, these smaller firms find opportunities in addressing underserved markets. Increasing focus on regulatory compliance and product certifications is shaping competition, with companies investing in R&D and ensuring adherence to evolving medical standards. The market's dynamics suggest ongoing innovation and strategic positioning as key to maintaining relevance and growth in a competitive environment.

Allergan, now part of AbbVie since its acquisition in May 2020, is a significant player in the breast implants market. It offers a wide range of silicone and saline implants. The company focuses on developing innovative implant designs with advanced safety features.

Mentor Worldwide LLC, a subsidiary of Johnson & Johnson, specializes in breast implants, including silicone and saline options, catering to diverse patient needs. Known for its continuous focus on research and product innovation, Mentor emphasizes safety and customization in its offerings.

List of Key Companies in Breast Implants Market

- Allergan, now part of AbbVie

- Arion Laboratories

- Cereplas

- Establishment Labs

- GC Aesthetics

- Groupe Sebbin

- Guangzhou Wanhe Plastic Materials

- HansBiomed Co., Ltd.

- Mentor Worldwide LLC (subsidiary of Johnson & Johnson)

- Motiva USA LLC

- Nagor

- POLYTECH Health & Aesthetics

- Shanghai Kangning Medical Device Co., Ltd.

- Sientra, Inc.

- Silimed

Breast Implants Industry Developments

- August 2024: CollPlant Biotechnologies and Stratasys Ltd. announced the start of pre-clinical research using 200cc commercial-sized regenerative implants manufactured on a Stratasys Origin® 3D printer. The collaboration between CollPlant and Stratasys focuses on the development of a bioprinting solution for CollPlant’s breast implants, in addition to finding solutions to scale up the implant’s fabrication process.

- October 2023: GC Aesthetics, a well-known breast aesthetics brand, and Bimini Health Tech, a leader in innovative healthcare solutions, announced their ground-breaking

- In October 2023, Mentor Worlwide LLC launched a new range of implants with enhanced durability and a focus on natural aesthetics, reflecting its commitment to addressing patient and surgeon preferences. Mentor’s extensive distribution network and focus on clinical evidence contribute to its prominent position in the market.

- In September 2023, Allergan announced updates to its breast implant product line to comply with evolving safety standards and provide enhanced patient outcomes. The company’s global presence and comprehensive portfolio make it a key provider for cosmetic and reconstructive surgeries.

Breast Implants Market Segmentation

By Product Outlook

- Silicone Breast Implants

- Saline Breast Implants

By Shape Outlook

- Round

- Anatomical

By Application Outlook

- Reconstructive Surgery

- Cosmetic Surgery

By End Use Outlook

- Cosmetology Clinics

- Ambulatory Surgical Centers

- Hospital

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Breast Implants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.63 billion |

|

Market Size Value in 2025 |

USD 2.82 billion |

|

Revenue Forecast by 2034 |

USD 5.42 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The breast implants market has been broadly segmented on the basis of product, shape, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The breast implants market growth and marketing strategies focus on expanding product offerings, improving safety features, and increasing consumer awareness. Companies are investing in research and development to introduce innovative implant designs, such as lightweight and ergonomic options, to enhance patient satisfaction. Strategic partnerships with healthcare providers and aesthetic surgeons are key to building brand credibility and expanding reach. Additionally, effective marketing through digital channels, medical conferences, and educational campaigns helps companies engage with both consumers and medical professionals, driving market expansion. Companies also focus on regulatory compliance and certifications to ensure product quality and patient trust.

FAQ's

? The breast implants market size was valued at USD 2.63 billion in 2024 and is projected to grow to USD 5.42 billion by 2034.

? The market is projected to register a CAGR of 7.5% during the forecast period.

? North America had the largest share of the market in 2024.

? A few key players actively operating in the breast implants market include Allergan (a part of AbbVie); Mentor Worldwide LLC (a subsidiary of Johnson & Johnson); Sientra, Inc.; Establishment Labs; GC Aesthetics; POLYTECH Health & Aesthetics; and HansBiomed Co., Ltd.

? The silicone breast implants segment accounted for a larger share of the market in 2024.

? The round breast implants segment accounted for a larger share of the market in 2024.

? Breast implants are medical devices designed to enhance or reconstruct the shape and size of the breasts. They typically consist of a silicone or saline outer shell filled with a silicone gel or sterile saline solution. These implants are commonly used in cosmetic surgeries to increase breast volume or improve symmetry, as well as in reconstructive surgeries following mastectomy or injury. Breast implants come in various shapes, sizes, and textures, allowing customization to meet individual patient needs and preferences. They are typically inserted through small incisions made in discreet areas to minimize scarring.

? A few key trends in the market are described below: Minimally Invasive Procedures: Growing demand for less invasive techniques that offer faster recovery times and reduced scarring. Advanced Implant Materials: Development of silicone implants with cohesive gel technology and lightweight, natural-feel implants. Customization and Personalization: Increasing focus on tailored implant options, such as various shapes, sizes, and profiles, to suit individual patient needs. Enhanced Safety Features: Stricter regulatory compliance and innovations aimed at reducing complications such as rupture or capsular contracture.

? A new company entering the breast implants market could focus on developing innovative, patient-centric products with advanced safety features, such as implants with enhanced durability, natural feel, and reduced risk of complications. Focusing on personalized solutions, including a wider range of shapes, sizes, and profiles, would cater to diverse patient needs. Investing in minimally invasive procedures and cutting-edge technologies could further differentiate the company. Additionally, building strong relationships with healthcare providers and surgeons through education and collaborations would help establish credibility. Targeting emerging markets and focusing on regulatory compliance would also provide a competitive edge.

? Companies manufacturing, distributing, or purchasing breast implants and related products, and other consulting firms must buy the report.