Botulinum Toxin Market Size, Share, Trends, Industry Analysis Report: By Product Type (Type A and Type B), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 117

- Format: PDF

- Report ID: PM1318

- Base Year: 2024

- Historical Data: 2020-2023

Botulinum Toxin Market Overview

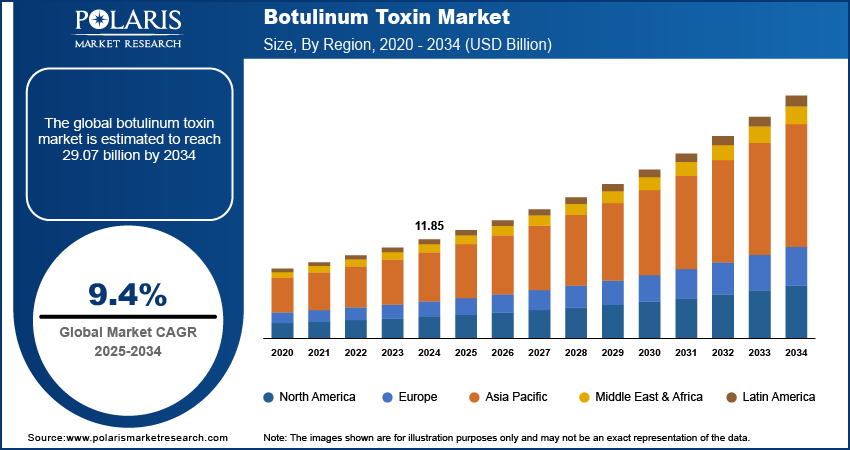

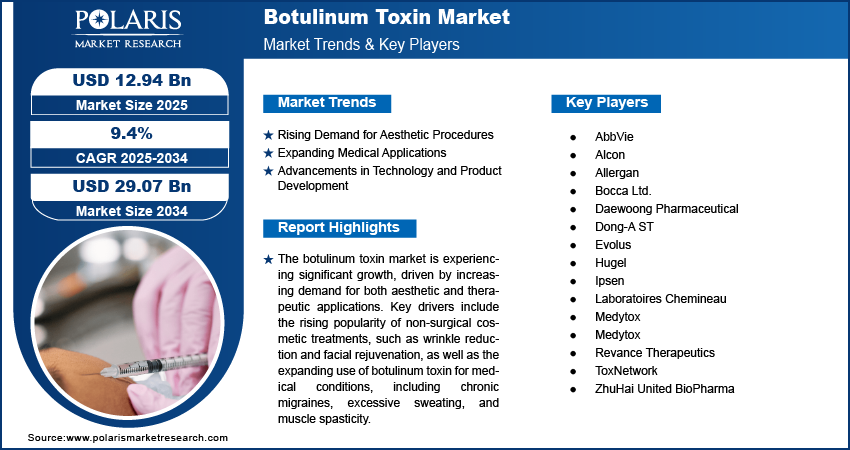

The botulinum toxin market size was valued at USD 11.85 billion in 2024. The market is projected to grow from USD 12.94 billion in 2025 to USD 29.07 billion by 2034, exhibiting a CAGR of 9.4% during 2025–2034.

The botulinum toxin market focuses on the production, distribution, and application of botulinum toxin, a neurotoxic protein primarily used for cosmetic and medical purposes. This market has experienced significant growth due to increasing demand for non-surgical aesthetic treatments, such as wrinkle reduction and facial rejuvenation. Additionally, the rising prevalence of medical conditions such as chronic migraines, excessive sweating, and muscle spasms has driven the market expansion. Key botulinum toxin market trends include the development of new formulations, expanding indications, and advancements in delivery systems. Furthermore, the growing acceptance of aesthetic procedures and the aging global population are contributing factors to the market growth.

To Understand More About this Research: Request a Free Sample Report

Botulinum Toxin Market Dynamics

Rising Demand for Aesthetic Procedures

Botulinum toxin is widely used for wrinkle reduction and facial rejuvenation, offering patients a minimally invasive alternative to traditional cosmetic surgery. According to the American Society of Plastic Surgeons (ASPS), botulinum toxin injections have been among the most commonly performed non-surgical cosmetic procedures in the US, with millions of treatments administered annually. The appeal of quick recovery times and minimal discomfort, along with more affordable options compared to surgery, has made botulinum toxin a preferred choice for individuals seeking cosmetic enhancements. There is an increasing consumer awareness and acceptance of aesthetic procedures globally. Therefore, the increasing popularity of non-surgical aesthetic treatments propels the botulinum toxin market demand.

Expanding Medical Applications

Botulinum toxin is increasingly being used for a range of medical conditions, including chronic migraine treatment, hyperhidrosis (excessive sweating), and spasticity from conditions such as cerebral palsy or multiple sclerosis. The versatility of botulinum toxin in treating various health issues has expanded its market beyond the cosmetic industry. The demand for botulinum toxin in these medical indications continues to grow as more patients seek alternative solutions for these conditions. Hence, expanding medical applications of botulinum toxin are expected to emerge as botulinum toxin market trends during the forecast period.

Advancements in Technology and Product Development

Manufacturers are focused on improving the efficacy, safety, and convenience of botulinum toxin products. Recent innovations include longer-lasting formulations and new methods of administration, which enhance patient satisfaction and encourage more widespread use. For instance, the development of combined botulinum toxin and dermal filler treatments allows for enhanced cosmetic outcomes. The FDA’s approval of newer botulinum toxin products and improved delivery mechanisms is expected to further boost the botulinum toxin market development by providing healthcare providers with more options to meet patient needs. Therefore, the ongoing advancements in botulinum toxin formulations and delivery systems are playing a crucial role in market growth.

Botulinum Toxin Market Segment Insights

Botulinum Toxin Market Assessment – Product Type-Based Insights

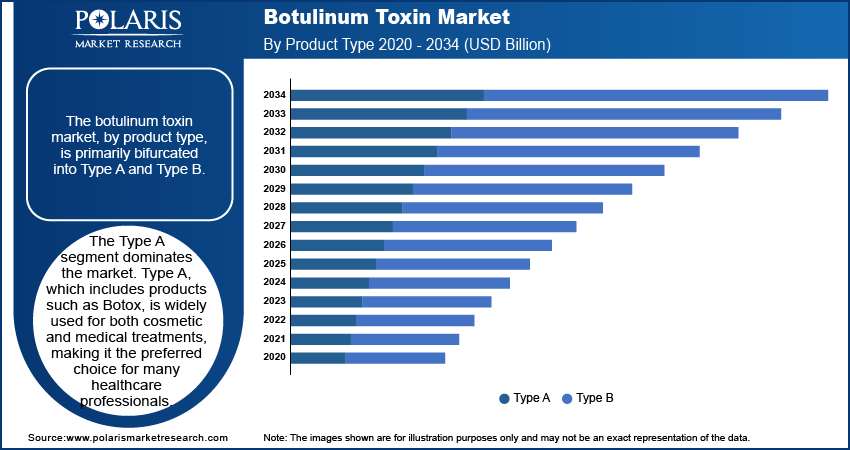

The botulinum toxin market, by product type, is primarily bifurcated into Type A and Type B. The Type A segment dominates the market in terms of both market share and growth rate. Type A, which includes products such as Botox, is widely used for cosmetic and medical treatments, making it the preferred choice for many healthcare professionals. The growing popularity of Type A in aesthetic procedures, including wrinkle reduction and facial rejuvenation, along with its broad medical applications such as chronic migraines and excessive sweating, significantly contributes to its leading position in the market. Additionally, advancements in the formulations of Type A products, such as longer-lasting effects, have further enhanced its appeal and adoption.

The Type B segment, while holding a smaller market share, is also experiencing notable growth, especially in markets with a high prevalence of neurological conditions that can benefit from its use. It is primarily used for medical conditions such as cervical dystonia and focal spasticity, though its application is more limited compared to Type A. The increasing recognition of its potential in treating certain neurological disorders and muscle spasticity is driving demand for Type B products.

Botulinum Toxin Market Outlook – Application-Based Insights

By application, the botulinum toxin market is segmented into therapeutic and aesthetic. The aesthetic segment holds a larger botulinum toxin market share. Aesthetic procedures, such as wrinkle reduction and facial rejuvenation, have become increasingly popular globally due to the growing demand for non-surgical cosmetic treatments. The aesthetic application of botulinum toxin is expected to continue its dominance, driven by factors such as a rising aging population seeking minimally invasive solutions, as well as increasing consumer awareness of cosmetic treatments. Additionally, the expansion of aesthetic treatments into new demographics and regions, particularly in emerging markets, further contributes to the growth of this segment.

The therapeutic segment is also experiencing significant growth during forecast period. The therapeutic use of botulinum toxin for medical conditions such as chronic migraines, excessive sweating, spasticity, and overactive bladder has led to a steady increase in its adoption. The FDA’s approval of botulinum toxin for additional therapeutic indications has further fueled the growth of this segment. The therapeutic application, though smaller in market share compared to the aesthetic segment, is registering a higher growth rate, as more healthcare providers recognize the benefits of botulinum toxin in managing various neurological and musculoskeletal disorders. This trend is expected to continue during the forecast period as the medical community explores further uses for botulinum toxin.

Botulinum Toxin Market Assessment – End User-Based Insights

Based on end user, the botulinum toxin market is segmented into hospitals, dermatology clinics, and spas & cosmetic centers. The hospitals segment holds the largest market share. Hospitals are the primary setting for botulinum toxin applications, particularly for therapeutic uses such as the treatment of chronic migraines, muscle spasms, and neurological disorders. The presence of specialized healthcare professionals and advanced medical equipment in hospitals makes them the preferred choice for patients seeking botulinum toxin treatments for medical conditions. Furthermore, the growing demand for minimally invasive procedures within hospital settings is expected to maintain this segment's dominance in the market.

The spas and cosmetic centers segment are registering the highest growth, driven by the increasing demand for aesthetic procedures. The popularity of noninvasive cosmetic treatments, such as wrinkle reduction and facial rejuvenation, is particularly high in spas and cosmetic centers due to their focus on aesthetic enhancements. These centers cater to a broad consumer base, offering more flexible pricing and treatment options compared to hospitals and clinics. As consumer interest in aesthetic treatments rises, spas and cosmetic centers are expected to drive the growth of botulinum toxin usage, contributing to a notable expansion of this segment in the coming years.

Botulinum Toxin Market Regional Insights

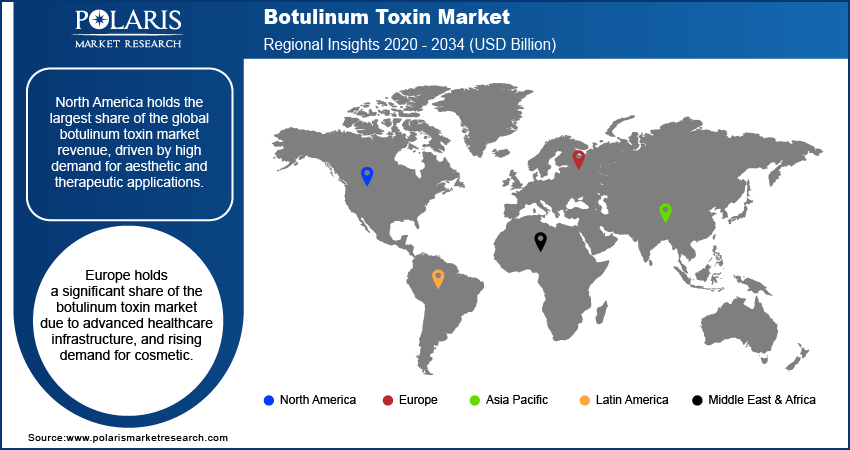

By region, the study provides botulinum toxin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global market, driven by high demand for aesthetic and therapeutic applications. The region benefits from advanced healthcare infrastructure, high consumer awareness, and the presence of key market players. The US, in particular, is a significant contributor to the regional market growth, with a large number of botulinum toxin procedures performed annually, particularly in aesthetic treatments. Additionally, the growing acceptance of minimally invasive procedures and the increasing prevalence of medical conditions treatable with botulinum toxin, such as chronic migraines and excessive sweating, have fueled the market expansion in North America. The region's mature healthcare systems and established regulatory frameworks continue to support its dominant position in the global market.

Europe holds a significant share of the botulinum toxin market due to advanced healthcare infrastructure, and rising demand for cosmetic. The region has a well-established medical and cosmetic industry, supported by highly developed healthcare systems in countries such as Germany, France, and the UK. The growing popularity of non-invasive aesthetic procedures, such as anti-aging, has boosted the market, particularly in Western Europe. Additionally, the rising adoption of botulinum toxin for medical conditions such as chronic migraines and spasticity has further expanded its application in the region. The approval of newer botulinum toxin products and formulations by regulatory bodies such as the European Medicines Agency (EMA) has also propelled the botulinum toxin market expansion in Europe.

The Asia Pacific botulinum toxin market is experiencing rapid growth, driven by a rising middle-class population and increased consumer demand for aesthetic treatments. Countries such as Japan, China, and South Korea are leading the regional market, with Japan being one of the largest consumers of botulinum toxin for cosmetic and medical applications. The growing awareness of noninvasive cosmetic procedures, along with expanding healthcare access, has led to increased adoption of botulinum toxin in aesthetic clinics and hospitals. Moreover, the region’s aging population and increasing prevalence of conditions treatable with botulinum toxin, such as neurological disorders, are also contributing to the market expansion. The increasing number of regional players and more accessible pricing are expected to further fuel the botulinum toxin market growth in Asia Pacific in the coming years.

Botulinum Toxin Market – Key Players and Competitive Insights

A few key players in the botulinum toxin market include Allergan, Ipsen, Medytox, Revance Therapeutics, Hugel, ToxNetwork, Dong-A ST, Medytox, ZhuHai United BioPharma, Daewoong Pharmaceutical, Evolus, Laboratoires Chemineau, Bocca Ltd., Alcon, and AbbVie. These companies are actively involved in the production and distribution of botulinum toxin products. Allergan is well-known for its botulinum toxin product, Botox, which is widely used for aesthetic and medical treatments. Ipsen’s Dysport is another prominent product in the market, offering therapeutic and cosmetic uses. Medytox and Revance Therapeutics have introduced newer formulations, such as Innotox and DaxibotulinumtoxinA, respectively. These products aim to improve treatment outcomes. Other companies, including Hugel and ToxNetwork, have also contributed significantly to the growing demand for botulinum toxin, particularly in aesthetic procedures.

In terms of competition, the botulinum toxin market is highly concentrated among a few large players such as Allergan and Ipsen, but smaller companies are emerging with competitive products. Allergan’s dominance, driven by Botox’s established market presence, faces increasing competition from newer, more innovative alternatives from companies such as Revance Therapeutics, which focuses on extended-duration products, and Medytox, which is trying to capture market share with new formulations. Companies such as Evolus, which markets Jeuveau, and Hugel have positioned themselves as direct competitors to Botox, targeting price-sensitive customers while emphasizing product performance. The competition is further driven by advancements in botulinum toxin formulations and delivery mechanisms, which help increase product efficacy and patient satisfaction.

The competitive dynamics of the botulinum toxin market are influenced by factors such as product differentiation, pricing strategies, and regulatory approvals. While Botox remains a dominant product, there is an ongoing shift toward longer-lasting formulations, such as those from Revance Therapeutics, which aim to reduce the frequency of treatments required. This has resulted in increased competition in terms of product innovation and pricing, especially in emerging markets. Companies that can expand their product offerings into new therapeutic areas or improve the patient experience through enhanced formulations will likely have a competitive edge in the market. Additionally, regulatory approvals play a key role, with companies seeking to expand the approved indications for botulinum toxin to tap into new patient populations.

Allergan, a part of AbbVie, is a major player in the botulinum toxin market, known for its product Botox. Botox is widely used for both aesthetic and medical treatments, such as wrinkle reduction and chronic migraine management. Allergan’s strong market presence is driven by its continuous focus on research and development, along with its extensive global reach.

Ipsen is another significant player in the botulinum toxin market with its product, Dysport. Dysport is used in both aesthetic and therapeutic settings, similar to Botox, and is known for its effectiveness in treating conditions such as spasticity and wrinkles.

List of Key Companies in Botulinum Toxin Market

- AbbVie

- Alcon

- Allergan

- Bocca Ltd.

- Daewoong Pharmaceutical

- Dong-A ST

- Evolus

- Hugel

- Ipsen

- Laboratoires Chemineau

- Medytox

- Medytox

- Revance Therapeutics

- ToxNetwork

- ZhuHai United BioPharma

Botulinum Toxin Industry Developments

- In December 2024, Ipsen announced the launch of a new dosing system for Dysport aimed at improving ease of administration. This move is part of Ipsen’s strategy to enhance the user experience and improve outcomes for patients and healthcare providers.

- In August 2024, AbbVie, the parent company of Allergan, announced that Botox had received approval in more countries for the treatment of pediatric spasticity, further expanding its therapeutic use. This development highlights Allergan’s ongoing efforts to extend Botox's market applications.

Botulinum Toxin Market Segmentation

By Product Type Outlook

- Type A

- Type B

By Application Outlook

- Therapeutic

- Aesthetic

By End User Outlook

- Hospitals

- Dermatology Clinics

- Spas & Cosmetic Centers

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Botulinum Toxin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.85 billion |

|

Market Size Value in 2025 |

USD 12.94 billion |

|

Revenue Forecast by 2034 |

USD 29.07 billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The botulinum toxin market has been segmented into detailed segments of product type, application, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The botulinum toxin market growth and marketing strategies focus on expanding product offerings, enhancing customer experience, and increasing market penetration. Companies are investing in research and development to introduce new formulations and longer-lasting products, aiming to meet the growing demand for both aesthetic and therapeutic treatments. Strategic partnerships, and mergers and acquisitions are also being used to broaden market reach and expand product portfolios. Additionally, firms are focusing on geographic expansion, particularly in emerging markets, to capitalize on the increasing adoption of noninvasive cosmetic procedures and the rising prevalence of medical conditions treatable with botulinum toxin. Marketing efforts are often centered around patient education and leveraging digital channels to raise awareness of treatment benefits

FAQ's

The botulinum toxin market size was valued at USD 11.85 billion in 2024 and is projected to grow to USD 29.07 billion by 2034.

The market is projected to register a CAGR of 9.4% during the forecast period.

North America accounted for the largest share of the market in 2024.

A few key players in the botulinum toxin market are Allergan, Ipsen, Medytox, Revance Therapeutics, Hugel, ToxNetwork, Dong-A ST, Medytox, ZhuHai United BioPharma, Daewoong Pharmaceutical, Evolus, Laboratoires Chemineau, Bocca Ltd., Alcon, and AbbVie.

The Type-A segment accounted for a larger share of the market in 2024.

The aesthetic application segment accounted for a larger share of the market in 2024.

Botulinum toxin is a neurotoxic protein produced by the bacterium Clostridium botulinum. It is used medically and cosmetically to block nerve activity in muscles, leading to temporary muscle paralysis. In medical settings, it is used to treat various conditions such as chronic migraines, muscle spasms, excessive sweating (hyperhidrosis), and overactive bladder. In cosmetic applications, botulinum toxin is most commonly used to reduce wrinkles and fine lines by temporarily paralyzing facial muscles. Botulinum toxin is injected into targeted areas and works by preventing the release of acetylcholine, a neurotransmitter that signals muscles to contract.

A few key trends in the market are described below: Increased Demand for Non-Surgical Aesthetic Procedures: Rising popularity of minimally invasive treatments, such as wrinkle reduction and facial rejuvenation, is driving market growth. Product Innovation: Development of longer-lasting formulations and improved delivery systems, such as needle-free options, to enhance patient experience and treatment outcomes. Expansion of Therapeutic Applications: Growing use of botulinum toxin for managing medical conditions such as chronic migraines, excessive sweating, and spasticity. Geographic Expansion: Companies are focusing on entering emerging markets, where demand for both aesthetic and therapeutic treatments is on the rise.

A new company entering the botulinum toxin market must focus on developing innovative, longer-lasting formulations or alternative delivery methods to differentiate itself from established players. Targeting underserved regions or emerging markets, where demand for both aesthetic and therapeutic treatments is growing, could offer significant growth opportunities. Additionally, focusing on expanding the therapeutic use of botulinum toxin for conditions such as chronic migraines or spasticity may attract a broader customer base. Emphasizing patient safety, offering cost-effective solutions, and building strong digital marketing strategies to increase consumer awareness can also help gain a competitive edge. Finally, forming strategic partnerships with healthcare providers could improve product visibility and credibility.

Companies manufacturing, distributing, or purchasing botulinum toxin and related products and other consulting firms must buy the report.