Biofertilizers Market Share, Size, Trends, Industry Analysis Report, By Crop (Grains & Cereals, Pulses & Oilseeds, Fruits & Vegetables, Commercial Crops, Others); By Microorganism; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM1143

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

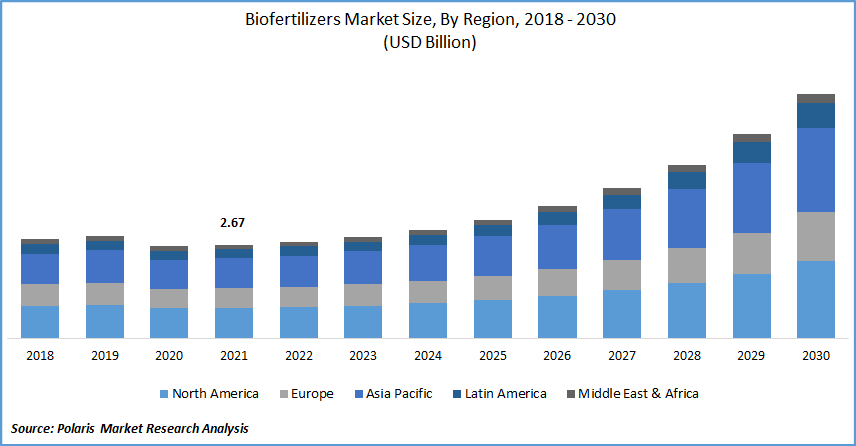

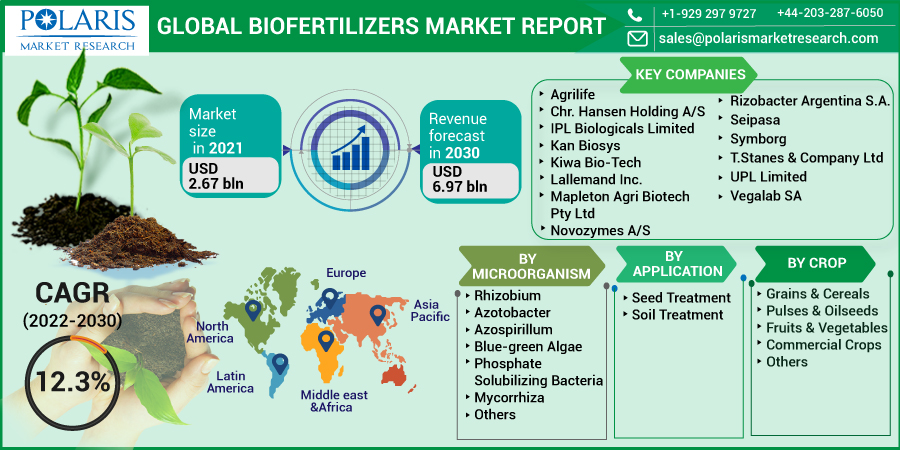

The global biofertilizers market was valued at USD 2.67 billion in 2021 and is expected to grow at a CAGR of 12.3% from the forecast period. The increased market demand for fertilizers that are consistent with sustainable and organic farming and agriculture techniques is expected to drive this biofertilizers market forward in the future years.

Know more about this report: Request for sample pages

As these fertilizers are both cost-effective and environmentally beneficial, their use is increasing over the world. Other reasons driving biofertilizers industry growth include improved soil fertility, increased nutrient uptake by plants, and less danger to human health linked with the usage of bio-based fertilizers.

For instance, in May 2021, Rizobacter introduced Microstar BIO, a new specialized fertilizer product line that combines biologicals with chemical fertilizers. These integrated bacteria can solubilize minerals and drive root growth, improving nutrient usage efficiency by boosting availability and soil exploration.

Further, in July 2021, Rizobacter and Marrone Bio (MBI) announced that Rizonema would be available in Brazil through a distribution arrangement for use in row crops. Rizonema's efficacy against important nematode species in soybeans and corn has been demonstrated in multiple regulatory studies in Brazil.

During the 2021 growing season, MBI will continue to undertake field trials to expand the product label for use in cotton and to include new nematodes and soil-dwelling insects. However, the cost of producing biological and organic fertilizers is higher than that of conventional fertilizers since they require specialized machinery and equipment.

This aspect is expected to limit biofertilizers market expansion in the next years. Furthermore, the short shelf life of some biological fertilizers, as well as their limited adaptability, are expected to limit biofertilizers industry growth throughout the forecast period.

Industry Dynamics

Growth Drivers

Organic farming is one of the most rapidly expanding agricultural practices across the globe. The growing market demand for biofertilizers and organic food is encouraging farmers to use biological fertilizers that are compatible with organic food production. Concerns over diminishing soil quality caused by misuse of chemical fertilizers, as well as their possible negative health impacts, have prompted governments around the world to promote their use.

For instance, the "National Center for Organic Farming" (NCOF) and the "Indian Council of Agricultural Research" (ICAR) offer regular training courses and frontline demonstrations to educate farmers' communities on the use of biological fertilizers. According to the Paramparagat Krishi Vikas Yojana in 2020, the GOI provided financial assistance of around USD 424 per ha for three years to covert to the adoption of biofertilizers and organic fertilizers.

Further, due to growing health concerns, consumers are becoming increasingly concerned about food safety issues, increased residue levels in food, and environmental difficulties. As a result, large retail chains including Wal-Mart and the Cosco, are in expansion mode through diversification in their portfolio of offerings.

As the organic food market expands, so does the demand for biofertilizers and organic manures, which are required for organic farming. People have been more concerned about healthy organic food products since the onset of the COVID-19 pandemic, which has fueled the biofertilizers industry expansion of biological inputs such as biofertilizers.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on the microorganism, application, crop, and region.

|

By Microorganism |

By Application |

By Crop |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Application

Based on the application market segment, the rhizobium segment is expected to be the most significant revenue contributor in the global biofertilizers industry. The market for agriculture business uses Rhizobium bacteria extensively to meet high crop production goals.

It is effective at improving the ability of crops, particularly legumes, to fix nitrogen from the atmosphere. Furthermore, the usage of rhizobium as bio-fertilizers is increasing due to their great performance in crop production while remaining environmentally friendly and cost-effective.

However, azotobacter is expected to become more widely used in agrarian economies as it is most effective at creating benefit reactions in the growth of the crops and enhancing seed germination. Azotobacter is involved in the production of growth regulators such as gibberellic acid, auxin, and cytokinins. Furthermore, it boosts rhizospheric bacteria, protects plants from phytopathogens, boosts nutrient uptake, and boosts biological nitrogen fixation. Soil pH, fertility, and other factors all contribute to the abundance of azotobacter in the soil.

Geographic Overview

North America had the largest revenue share in the global market. The attributable factor for the dominance is the increased government participation in regional farming techniques resulted in considerable changes in agricultural patterns and methods across the US and Canada. The biofertilizers industry has grown favorably due to a tight regulatory environment and a growing preference for the use of biofertilizer products. In North America, industrialization, mining, and urbanization have resulted in a loss of arable land.

Moreover, Asia Pacific market is expected to witness a high CAGR in the global biofertilizers market. The region is being attributed is that the Fertilizer consumption is highest in the Asia Pacific and African areas. The rising rate of population, particularly in Asia, has resulted in greater market demand for food, which will lead to higher fertilizer usage.

However, pollution and soil contamination, as well as their detrimental impacts on humans, are serious concerns in this region. To counteract the negative impacts of chemical fertilizers, governments in these areas are promoting the use of environmentally benign fertilizers such as biofertilizers and organic manure.

Competitive Insight

Some of the major players operating in the global biofertilizers market include Agrilife, Chr. Hansen Holding A/S, IPL Biologicals Limited, Kan Biosys, Kiwa Bio-Tech, Lallemand Inc., Mapleton Agri Biotech Pty Ltd, Novozymes A/S, Nutramax Laboratories, Inc., Rizobacter Argentina S.A., Seipasa, Symborg, T.Stanes & Company Limited, UPL Limited, and Vegalab SA.

Recent Development

- August 2024: IPL Biologicals and AFEPASA signed a partnership agreement to jointly register and market microbial biopesticides globally. This partnership aims to targets pest control by providing sustainable solutions and reduce dependence on chemical pesticides.

- September 2024: Nutramax Laboratories Veterinary Sciences announced the release of convenient Cosequin ASU functional tablets for joint and digestive health. Nutramax aims to improve equine health by providing joints and digestive supplements.

Biofertilizers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.67 billion |

|

Revenue forecast in 2030 |

USD 6.97 billion |

|

CAGR |

12.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Microorganism, By Application, By Crop, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Agrilife, Chr. Hansen Holding A/S, IPL Biologicals Limited, Kan Biosys, Kiwa Bio-Tech, Lallemand Inc., Mapleton Agri Biotech Pty Ltd, Novozymes A/S, Nutramax Laboratories, Inc., Rizobacter Argentina S.A., Seipasa, Symborg, T.Stanes & Company Limited, UPL Limited, and Vegalab SA |