B2B E-commerce in Agriculture Market Share, Size, Trends, Industry Analysis Report, By Type (Commerce Catalog, Commerce Content, Collaboration); By Deployment; By Marketplace; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 115

- Format: PDF

- Report ID: PM1142

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

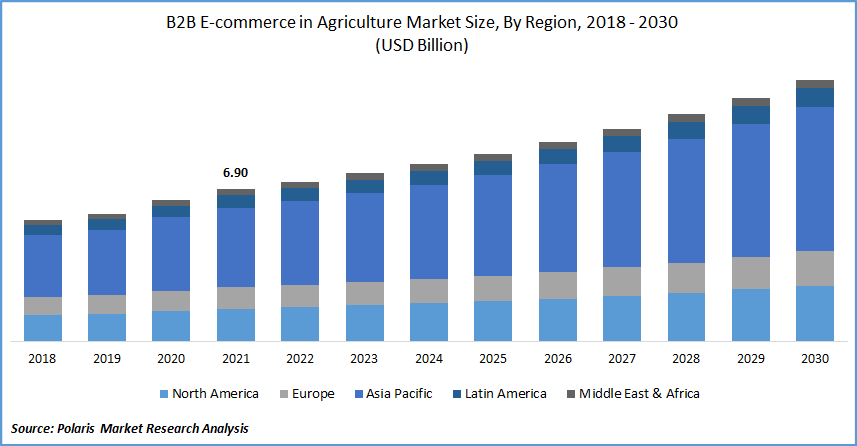

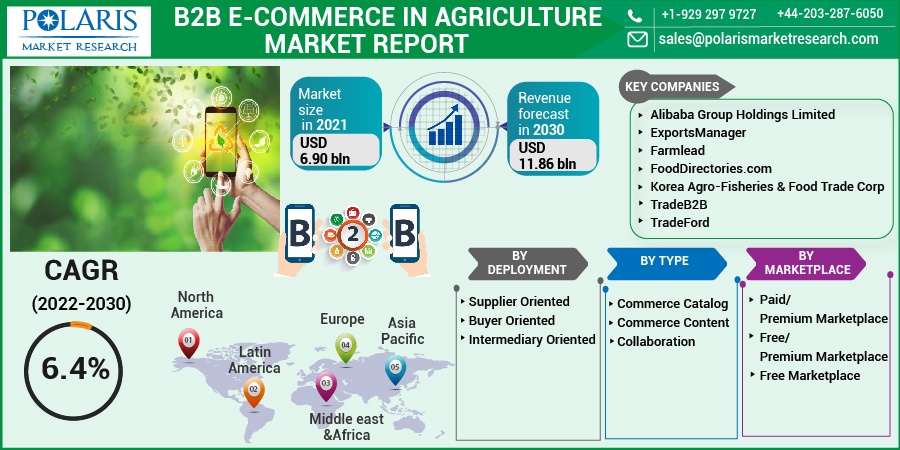

The global B2B e-commerce in the agriculture market was valued at USD 6.90 billion in 2021 and is expected to grow at a CAGR of 6.4% during the forecast period. Factors such as increased penetration of the internet along with the growing usage of mobile phones and the benefits of these platforms are driving the B2B e-commerce in agriculture market growth during the forecast period.

Know more about this report: Request for sample pages

Farmers can use B2B platform to connect with a variety of shops to advertise their crops and purchase supplies like fertilizers, insecticides, heavy equipment, and crop protection products, among other things. The platform lowers supply-chain costs by eliminating middlemen, and it's a good platform for the agriculture industry for selling spices, grains, veggies, exotic fruits, and organic products.

B2B e-commerce reduces transaction expenses while reducing transaction lead time. It also lessens competition by making agriculture products more transparent. Farmers can also use B2B e-commerce platforms to expand their network and interact with a variety of enterprises. Further, consumers are becoming more aware of the benefits of using the internet to promote agriculture practices, which is fueling the expansion of B2B E-commerce in the agriculture market.

As per the World Bank, individuals using the internet in 2020 was 60% in the world. B2B e-commerce systems' increased usability, as well as simple online payment choices, are fueling industry expansion. Additionally, enhanced transparency and expanding networking opportunities provided by B2B commerce platforms assist industry growth. Due to the extensive usage of mobile phones, farmers and buyers have become connected.

Eatfromfarms offers an innovative e-platform via which consumers quickly place orders for their items. It allows both customers and sellers to communicate directly, as well as simple and speedy purchase and delivery processes.

Though not all farmers and buyers have internet access, the vast majority of them do have a phone, and the platform is attempting to make the communication process more efficient by leveraging mobile phones. However, rapid changes in technologies, logistics costs, urbanization rates, and accessing the international market are among the major factors that are restraining the B2B e-commerce in agriculture market growth.

Industry Dynamics

Growth Drivers

In the last decade, the adoption of the internet and mobile phones has gained traction, which has led to an increase in the adoption of mobile applications for purchasing agriculture products in the world. Along with this, major players in the industry are focusing on the development of advanced solutions for the B2B e-commerce of agriculture. For instance, in May 2022, nurture. farm, India's premier agritech firm for agriculture ecosystem solutions, has announced a collaboration agreement with the platform “Nurture”, with Dubai based pesticide company “AgFarm”.

On the nurture. retail platform, a total of 40+ AgFarm items will be available for sale to begin with. Herbicides, insecticides, and fungicides are among them, and they can be used on a wide range of crops. Along with launching creative and patented products, the partnership will also offer products to the 70,000 retailers that use the nurture. retail app at extremely low prices.

Further, in June 2020, OURFARM, a new agriculture business-to-business (B2B) e-commerce platform, is poised to transform the agribusiness distribution network by allowing farmers to connect directly to business owners and increase their income by removing middlemen costs and improving logistical support for producers to fulfill direct orders to businesses.

OURFARM takes advantage of AirAsia's comprehensive ecosystem, which includes freight, logistics, and payment services, as well as a large database of businesses and consumers. Furthermore, the platform provides farmers with the opportunity to receive free training on digitalizing their business through RedBeat Academy's e-commerce courses. Thus, the advancement and development of the solution for leveraging farmers and eliminating middlemen are the factors that drive the industry growth during the forecast period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on deployment, type, marketplace, and region.

|

By Deployment |

By Type |

By Marketplace |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Deployment

The supplier oriented segment is expected to be the most significant revenue contributor in the global industry. They provide a diverse range of products and services to a group of clients while also assisting them with their businesses.

Furthermore, customer communities, tailored products, and direct consumer interactions hold significant promise. Suppliers can access new forms of advertising and distribution channels through supplier oriented marketplaces. Without the use of intermediaries, products can be sold straight to customers.

Geographic Overview

North America accounted for the largest revenue share in 2021 of the global B2B e-commerce for the agriculture industry. The growing number of mobile devices and high internet penetration in this region is projected to fuel industry expansion. For instance, as per the World Bank, in North America, around 92% of individuals were using the internet in 2020.

The increasing use of B2B e-commerce in rural areas to supply farmers with transparent agriculture trading platforms is further driving the adoption. During the projection period, increased demand for B2B e-commerce platforms from countries such as Canada and Mexico will present growth possibilities. This is rapidly changing, as e-commerce solutions that try to overcome hurdles such as customer preferences and logistics push online groceries.

The high CAGR of the industry over the projection period is due to increased per capita expenditure on internet retailing, as well as rising government launches of agriculture applications and initiatives to benefit farmers. Another reason fueling the growth of the worldwide e-commerce of agriculture products industry is the simple availability of raw materials, inputs, and improved technologies to cultivate crops. However, over the projection period, lack of knowledge and internet accessibility in rural areas are the primary factors limiting the growth of the global industry.

Moreover, Asia Pacific is expected to witness a high CAGR over the forecast period. Because of the growing agriculture industry and technological improvements, there has been an increase in demand for B2B e-commerce platforms in the Asia Pacific emerging economies. Global companies are extending their operations in this region to expand their consumer base and geographical reach.

Organizations that use the internet to connect farmers and purchasers are gathering momentum in emerging economies, and a few have built online platforms for agriculture to sell organic e-commerce store markets straight to customers. As per the World Bank, the number of individuals using the internet in 2020 was around 69%. These initiatives are paving the road for efficient industry linkages for farmers by eliminating middlemen from the distribution network and gaining higher prices for farmers.

Competitive Insight

Some of the major players operating in the global market include Alibaba Group Holdings Limited, ExportsManager, Farmlead, FoodDirectories.com, Korea Agro-Fisheries & Food Trade Corp, TradeB2B, and TradeFord, among others.

B2B E-commerce in Agriculture Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 6.90 billion |

|

Revenue forecast in 2030 |

USD 11.86 billion |

|

CAGR |

6.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Deployment, By Type, By Marketplace, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Alibaba Group Holdings Limited, ExportsManager, Farmlead, FoodDirectories.com, Korea Agro-Fisheries & Food Trade Corp, TradeB2B, and TradeFord |