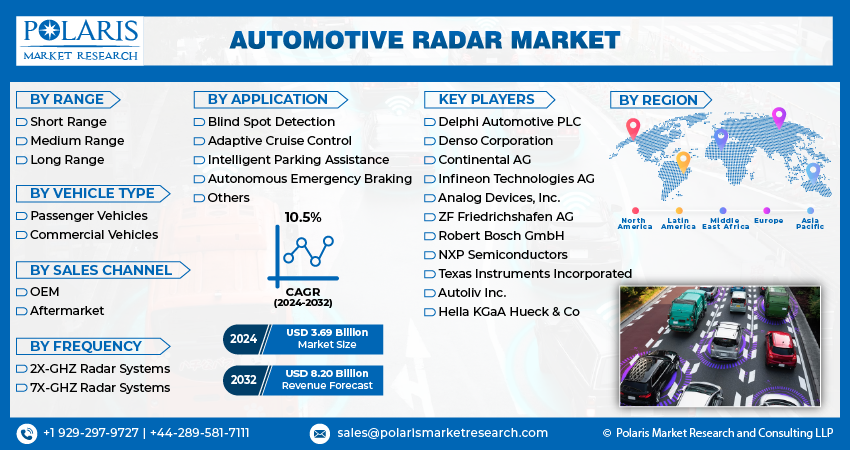

Automotive Radar Market Share, Size, Trends, Industry Analysis Report, By Range (Short Range, Medium Range and Long Range); By Vehicle Type; By Sales Channel; By Frequency; By Application, By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1293

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global automotive radar market was valued at USD 3.34 billion in 2023 and is expected to grow at a CAGR of 10.5% during the forecast period. Automotive radars are used for locating objects on the road and sensing distances between vehicles in real-time to enhance driving efficiency and road safety. The automotive radar, which consists of a receiver and a transmitter, enables sending and receiving of waves to detect object distances, speeds, and directions. Automotive radars are used for applications such as collision detection, warning and mitigation, collision avoidance, blind spot monitoring and detection, lane change assistance, lane departure warning system, rear cross-traffic alerts, and vulnerable road user detection, among others.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Automotive Radar Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Know more about this report: Request for sample pages

Vehicles increasingly use surround sensing technologies for parking-assistance systems, collision-warning, and adaptive-cruise-control (ACC) systems. Higher frequency radar systems with a 77 GHz to 81 GHz frequency range (79 GHz band) are used in vehicles for pedestrian detection and emergency braking systems. The growing popularity of autonomous vehicles and self-driving cars is expected to provide numerous growth opportunities for the market.

Some major automakers have revised their plans for autonomous cars due to the pandemic's negative impact on automotive sales. High-level autonomous driving depends on the radar since it offers critical information on aspects like motion prediction, object tracking, and object identification, among others. The substantial revenue losses brought on by the pandemic and the ensuing scarcity of semiconductors (because of the unexpectedly quick recovery in Q4 2020) will, however, put a short- to medium-term hold on the development of AVs.

For instance, Volvo had previously planned to release a Level 4 AV by 2024. The corporation hopes to build a Level 3 model by 2024 instead of the earlier target date of 2027 for Level 4. The debut of Ford's autonomous commercial vehicle service was also postponed until 2022, owing to Q2 revenue losses in 2020. As a result, the pandemic will cause financing for autonomous cars to be delayed in the near to medium future. This would therefore affect the demand in the automobile sector.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The major driving factors of the automotive radar market include the growing automotive industry and increasing demand for high-end luxury vehicles. The introduction of government regulations for road and vehicular safety supports the growth of the market. Automotive radar systems are being used in driver assistance systems owing to increasing cases of road accidents.

The growing traffic and increasing need to improve road safety have accelerated the adoption of automotive radars. The growing demand for autonomous vehicles and self-driving vehicles encourages vehicle manufacturers to integrate advanced radar systems in vehicles. The increasing demand for technologically advanced vehicles from countries such as China, the U.S., and Western Europe also increases the demand for the automotive radar industry.

Report Segmentation

The market is primarily segmented based on range, vehicle type, sales channel, frequency, application, and region.

|

By Range |

By Vehicle Type |

By Sales Channel |

By Frequency |

By Application |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Medium Range Segment Accounted for the Highest Market Share in 2022

Medium-range radar has the highest market share in 2022 and is predicted to increase significantly throughout the forecast period. These technologies are integrated with safety systems to give features like park assist, cross-traffic warning, and lane change assist, among others. The domination of this market can be ascribed to cost reduction and the increased requirement to expand functionality by utilizing more than two radars.

Long-range radars, on the other hand, are largely employed for adaptive cruise control (ACC). As a result, higher adoption of ACC features in smaller and mid-range vehicles is expected to support category growth.

Passenger Vehicles Segment is Projected to Grow at the Fastest Rate over the Forecast Period

The passenger vehicles market is predicted to develop faster than the commercial vehicle market. The increased awareness of vehicle safety among mid-priced car owners is the key element driving the segment's rise. Furthermore, renowned luxury automobile manufacturers such as Mercedes-Benz and BMW saw a large boost in unit sales. The market is predicted to grow throughout the forecast period as more passenger cars are outfitted with radar-based safety systems.

Furthermore, the expanding logistics business and brisk e-commerce have boosted sales of commercial cars. Growing customer expectations for vehicle autonomy in commercial vehicles are also likely to drive market growth.

Adaptive Cruise Control Held the Greatest Market Share in 2022

Adaptive Cruise Control held the greatest market share in 2022 because to the early acceptance of this function in passenger cars in countries such as Germany and the United States. Furthermore, the FCWS segment is expected to increase at a rapid CAGR throughout the projection period. The good outlook of this category is attributable to the increased adoption of vehicles in countries such as China and India as a result of the increasing incidence of traffic incidents.

On the other hand, the Automatic Emergency Braking segment is expected to develop at one of the quickest CAGRs throughout the projection period. Favorable government measures, such as the licensing of radar frequencies and increasing investment by automakers in the development of low-cost radar-based safety systems, are likely to drive growth in the forecast period.

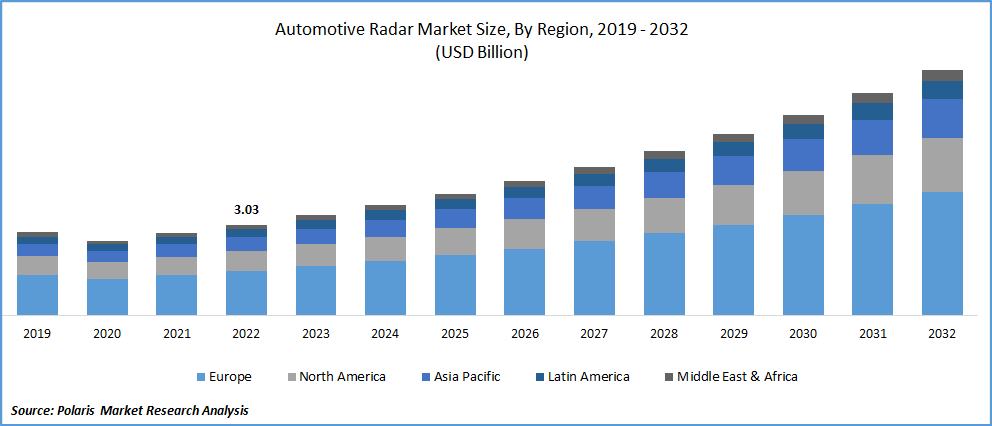

Europe Dominated the Global Market in 2022

Europe dominated the worldwide market in terms of value and is predicted to develop a CAGR over the forecast period. This can be linked to the European Commission's increased stringency of automobile safety standards (EC). German automakers produce over 70% of luxury vehicles. Furthermore, the country's automobile sector invests around one-third of its sales on R&D research. As a result, the German automotive radar sector is predicted to account for the highest proportion.

The Asia Pacific area is likely to emerge as the fastest developing region due to the low-cost benefits associated with car manufacturing. Because of increased disposable income, the Asia Pacific area has seen a spike in automotive sales in recent years. The increased awareness of car safety systems and their advantages is one of the reasons driving the growth of the market. The South American market is expanding due to strong support for the use of the 79 GHz band for vehicle short-range radar.

Competitive Insight

Some of the major players operating in the global market include Delphi Automotive PLC, Denso Corporation, Continental AG, Infineon Technologies AG, Analog Devices, Inc, ZF Friedrichshafen AG, Robert Bosch GmbH, NXP Semiconductors, Texas Instruments Incorporated, Autoliv Inc., and Hella KGaA Hueck & Co. among others.

Recent Developments

- In July 2021, Continental is incorporating AEye's long-range LiDAR technology into its full sensor stack solution to produce the first full-stack automotive-grade system for automated and autonomous driving applications ranging from Level 2+ to Level 4.

- In April 2021, Continental introduced the sixth generation of surround radar and long-range radar at Auto Shanghai 2021. Both sensors use the same hardware and software platform, which reduces complexity and, as a result, costs.

Automotive Radar Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.69 billion |

|

Revenue forecast in 2032 |

USD 8.20 billion |

|

CAGR |

10.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Range, By Vehicle Type, By Sales Channel, By Frequency, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Delphi Automotive PLC, Denso Corporation, Continental AG, Infineon Technologies AG, Analog Devices, Inc, ZF Friedrichshafen AG, Robert Bosch GmbH, NXP Semiconductors, Texas Instruments Incorporated, Autoliv Inc., and Hella KGaA Hueck & Co. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Automotive Radar Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports:

Actinic Keratosis Treatment Market Size, Share 2024 Report

Magnetic Beads Market Size, Share 2024 Report

Collagen And Gelatin Market Size, Share 2024 Report

Reverse Osmosis (RO) Membrane Market Size, Share 2024 Report

FAQ's

Key companies in automotive radar market are Delphi Automotive PLC, Denso Corporation, Continental AG, Infineon Technologies AG, Analog Devices, Inc, ZF Friedrichshafen AG, Robert Bosch GmbH, NXP Semiconductors, Texas Instruments Incorporated.

The global automotive radar market expected to grow at a CAGR of 10.5% during the forecast period.

The automotive radar market report covering key segments are range, vehicle type, sales channel, frequency, application, and region.

The global automotive radar market size is expected to reach USD 8.20 Billion by 2032.