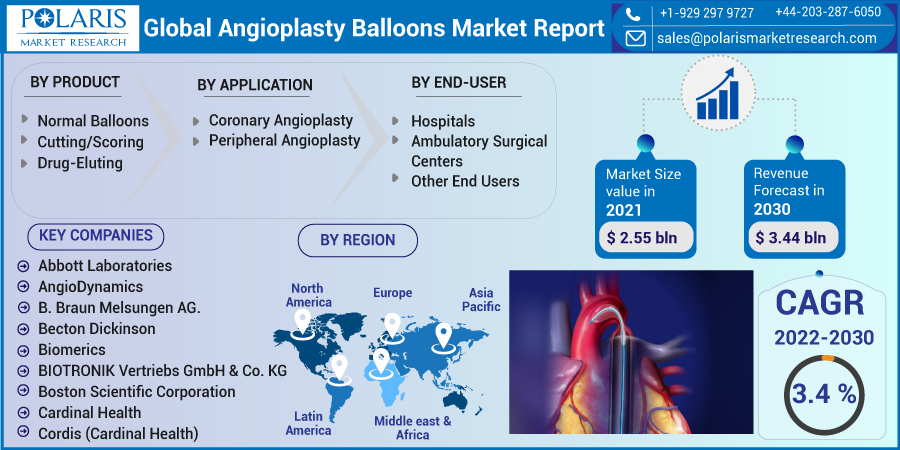

Angioplasty Balloons Market Share, Size, Trends, Industry Analysis Report, By Product Type (Normal Balloons, Cutting/Scoring Balloons, Drug-Eluting Balloons), By Application; By End-User; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM1111

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

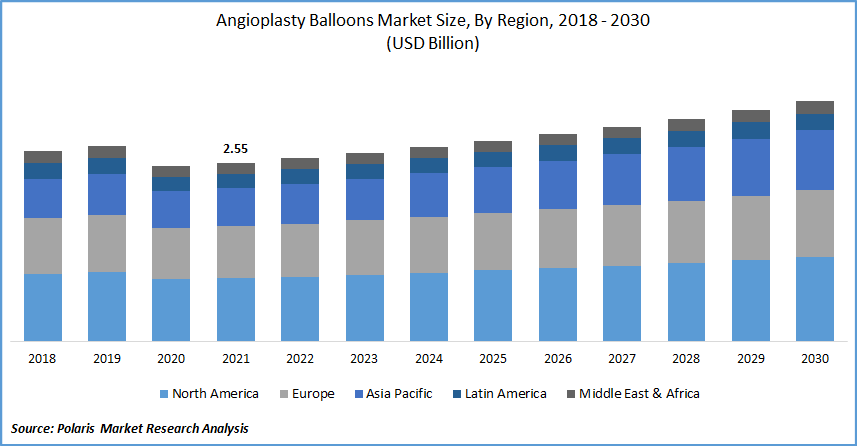

The global angioplasty balloons market was valued at USD 2.55 billion in 2021 and is expected to grow at a CAGR of 3.4% during the forecast period. The factors such as the rising number of cardiac diseases and the adoption of angioplasty balloons to treat coronary and peripheral artery illnesses are expected to boost the angioplasty balloons industry growth during the forecast period.

Know more about this report: Request for sample pages

Angioplasty balloons became the treatment of choice for individuals suffering from coronary and peripheral artery illnesses as the number of cases of artery disease rises. Coronary artery disease is a life-threatening condition caused by a lack of blood supply to the heart, resulting in cardiac arrest.

Angioplasty is a procedure that involves inserting a tiny balloon-tipped catheter into a blood vessel and inflating it at the blockage location to ensure open the restricted arteries. Furthermore, angioplasty balloons have a greater success rate than traditional angioplasty techniques, which is expected to drive market expansion.

Further, cardiac disorders are on the rise at an alarming rate, necessitating precise treatment options with high success rates. For instance, according to the World Health Organization (WHO), CVDs impacted the lives of around 17.9 million people across the globe, representing 32% of all deaths. Heart-related ailments and strokes accounted for most of the 85% of deaths.

Furthermore, a rising elderly population with heart disease and diabetes is predicted to drive up the demand for angioplasty catheters. However, the market is projected to be hampered by high costs and post-operative problems associated with angioplasty.

Industry Dynamics

Growth Drivers

Minimal invasive surgery has numerous advantages: less pain, swift recovery, smaller incisions, reduced hospital stay, and consequent medical costs. The rising geriatric population with the increasing prevalence of CVD will lead to the demand for minimally invasive treatment, which further propels the market's growth. As per the statistics published by Ageing Asia, the Vietnamese population aged 60 and above is projected to rise by 29,841,000 in 2050.

Similarly, the market is growing due to the increased frequency of lifestyle-related illnesses and the growing geriatric population. As per AgeingAsia.org, the geriatric population aged 60 and above in Myanmar was 5,443,000 in 2019 and is expected to rise to 62,253,000 in 2050. Thus, the growing geriatric population in emerging countries presents an increased demand for CVD treatment, augmenting the growth of the interventional cardiology market. Moreover, domestic and localized market players' new developments, product pipeline analysis, and initiatives for innovative treatment options have tremendously boosted the market growth.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on product type, application, end-user, and region.

|

By Product Type |

By Application |

By End-User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Product Type

The normal segment is expected to be the most significant revenue contributor. The segment is booming because of the inexpensive cost of these devices, supporting government regulations and approval processes, and favorable reimbursement policies.

Additionally, Low-cost Drug-eluting balloons (DEBs) and various advantages of DEBs over other types, as well as new product introductions, have all helped the segment's rise. In addition, due to key companies' significant investment in research & development, the cutting and scoring type sector is predicted to increase significantly throughout the projection period.

Geographic Overview

In terms of geography, North America had the largest revenue share. The primary drivers of the market across the globe include the presence of significant market players, rising healthcare expenditure, and a growing amount of percutaneous coronary interventions. According to the American Heart Association (AHA), heart-related ailments killed 1 out of every 7 people in the U.S. in 2018.

CHDs were the largest cause of mortality among cardiovascular diseases, accounting for 43.8% of deaths, followed by heart failure (9.0%), high blood pressure (9.4%), artery diseases (3.1%), and other cardiovascular diseases (17.9%). As a result, there is a growing desire for better treatment with innovative medical equipment, which is a primary driver of the market under consideration.

Furthermore, the region is a hotbed of technological breakthroughs and new product inventions for catheters and angioplasty balloons, which aids in the growth of the angioplasty balloons market. As a result, the market in the region is the largest in the world.

Moreover, Asia Pacific is expected to witness a high CAGR in the global angioplasty balloons market. This is due to the presence of the world's enormous population in this region, which includes a significant number of people suffering from heart disease. In India, Japan, and China, the cost of an angioplasty balloon has reduced by roughly 40% in the last decade, indicating that the angioplasty balloons market in Asia-Pacific is growing.

Competitive Insight

Some of the major players operating in the global angioplasty balloons market include Abbott Laboratories, AngioDynamics, B. Braun Melsungen AG., Becton Dickinson, Biomerics, BIOTRONIK Vertriebs GmbH & Co. KG, Boston Scientific Corporation, Cardinal Health, Cordis (Cardinal Health), CTK biotech, Inc, Hexacath, INFINITY Angioplasty Balloon, JOTEC GmbH, Koninklijke Philips N.V, Medtronic Plc, MicroPort Scientific Corporation, and Nipro Medical Corporation.

Angioplasty Balloons Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.55 Billion |

|

Revenue forecast in 2030 |

USD 3.44 Billion |

|

CAGR |

3.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Abbott Laboratories, AngioDynamics, B. Braun Melsungen AG., Becton Dickinson, Biomerics, BIOTRONIK Vertriebs GmbH & Co. KG, Boston Scientific Corporation, Cardinal Health, Cordis (Cardinal Health), CTK biotech, Inc, Hexacath, INFINITY Angioplasty Balloon, JOTEC GmbH, Koninklijke Philips N.V, Medtronic Plc, MicroPort Scientific Corporation, and Nipro Medical Corporation. |