Glaucoma Market Share, Size, Trends, Industry Analysis Report, By Drug Class; By Distribution Channel (Hospital pharmacy, Retail pharmacy, and Online pharmacy); By Disease Type; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM1366

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

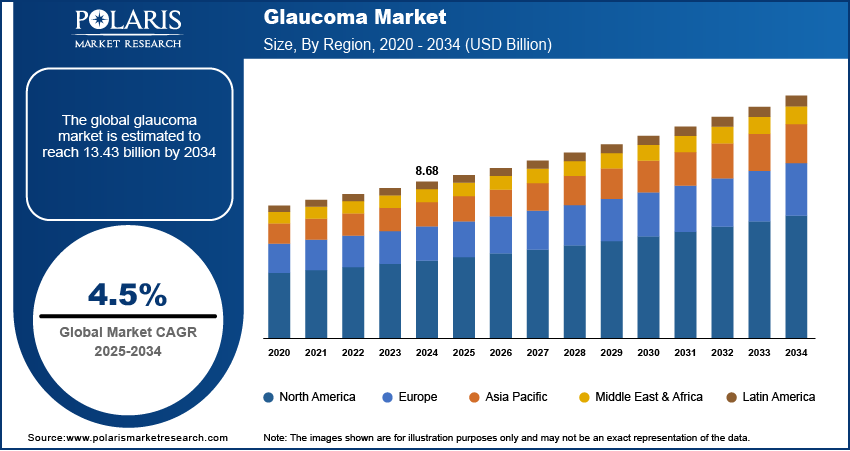

The global glaucoma market was valued at USD 6,678.0 million in 2022 and is expected to grow at a CAGR of 3.2% during the forecast period.Increasing incidence rates and growing preferences for cutting-edge therapeutic strategies are key market expansion drivers. According to the World Glaucoma Association, the disease will affect 79.6 million people worldwide in 2020. In 2040, there will be 111.8 million people in the world.

To Understand More About this Research: Request a Free Sample Report

One of the most prevalent ocular conditions seen in secondary and primary care settings, glaucoma is the third most common cause of blindness in the general population. According to the Bright Focus Foundation, in the United States, glaucoma affects 3 million people, 2.7 million of whom are over 40.

Over 40s in America: 3.3 million people are blind or have limited eyesight. Globally, the disease affects over 80 million individuals as of 2020, and by 2040, that figure is projected to rise to about 111 million. The pool of older adults is growing, and the diagnostic tools are improving, helping the industry expand.

One of the key driving forces behind the positive outlook for the glaucoma market is the ongoing technological improvements in the ophthalmology sector. The desire for cutting-edge surgical techniques will drive industry expansion. The popularity of optometrists will also increase as a result of developments in medical imaging, optical coherence tomography (OCT), micro-invasive glaucoma surgery (MIGS), selective laser trabeculoplasty (SLT), and progression analysis software. The market size will also increase by incorporating laser therapies as first-line therapies and medications to treat glaucoma.

Due to the implementation of preventive lockdowns in various economies, the COVID-19 pandemic negatively affected the sales of glaucoma treatments. In addition, due to a lack of healthcare infrastructure, COVID-19 patients were given priority, and all available resources were mobilized.

Additionally, many ophthalmology clinics were turned into COVID-19 wards, which limited the ability to follow up with the patients. Further, the market demand has decreased due to fewer patients visiting clinical settings since older persons fear contracting an illness. However, telemedicine platforms during the epidemic enabled patients to access care promptly, which fueled industry expansion generally.

Industry Dynamics

Growth Drivers

Many pipeline treatments for the disease are currently being developed, which is the key factor boosting the market growth over the forecast period. The Department of Medicinal Chemistry and the Institute for Therapeutics Discovery & Development (ITDD) at the University of Minnesota, College of Pharmacy, worked together to develop a novel medicine for the treatment of glaucoma.

The group created the medication QLS-101, a brand-new prodrug of the KATP connection opener levcromakalim intended to decrease the patients' episcleral vascular resistance. QLS-101 was granted a Qlaris Bio license in 2019 and has started its phase I/II clinical trials.

Further, in April 2022, Skye Bioscience appointed CMAX Clinical Research to conduct a Phase I trial for SBI-100 Ophthalmic Emulsion. CMAX, one of the world's most prominent trial operators focusing on early-phase trials, will assist Skye with subject recruitment and administering the trial medication to healthy volunteers. Thus, the launches of products and clinical trial products boost the glaucoma market growth over the forecast period.

Report Segmentation

The market is primarily segmented based on drug class, distribution channel, disease type, and region.

|

By Drug Class |

By Distribution Channel |

By Disease Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Prostaglandin Analogs Segment Held the Largest Share in 2022

Segmental demand will increase due to the widespread use of prostaglandin analogs to treat the disease, which has various benefits, including only one daily dose effectiveness. Furthermore, the segment is projected to experience a tremendous increase due to the rising demand for prostaglandin medicines used in combination therapy.

Because it effectively lowers intraocular pressure (IOP) and has fewer side effects than other treatments, the prostaglandin analogs sector held the largest market share for the medicines. Further divisions of the prostaglandins section include latanoprost, bimatoprost, travoprost, and others. In some rare circumstances, combination medications are another emerging therapy for treating complex and quickly developing glaucoma.

The utilization of this medication class among glaucoma patients has changed due to increased research on prostaglandin analogs. The pharmacological class offers greater efficacy and fewer side effects than other therapeutic goods and treatment choices. Improvements in glaucoma devices, however, might hurt this pattern.

Open-Angle Segment Industry Accounted for the Highest Market Share in 2022

The open-angle disease type segment dominated the market and is anticipated to hold that position during the projected period. The disorder's high prevalence explains this compared to the other kinds of glaucoma.

Most therapeutic medications on the market are designed to treat open-angle type, making it the category's dominant subcategory. Additionally, increasing hypotensive drugs to lower intraocular pressure is a factor in segmental growth overall.

The Hospital Is Expected to Hold a Significant Revenue Share in 2022

Hospital pharmacies are anticipated to be the market segment with the biggest share throughout the forecast period. The significant growth is attributable to the wide availability of items for various treatment modalities.

Patients’ preference for hospital pharmacies while purchasing prescription goods aids income generation. Additionally, providing insurance coverage and payment rules for prescription purchases made in hospital settings will improve market projections.

North America Dominated the Market in 2022

Some key reasons for North America's dominance in this industry include its well-developed hospital diagnosis infrastructure and effective treatment framework. Since the condition progresses gradually, effective diagnostic tools enable its prompt discovery. The rising FDA approvals and drug launches for the treatment in the region are bolstering the growth.

In September 2020, the two glaucoma treatments introduced by Micro Labs USA were dorzolamide 2% and dorzolamide-timolol. Micro Labs USA plans to release new ophthalmic products in stages of FDA evaluation and development to meet the expanding demand.

Further, in July 2019, Allergan Plc reported that the New Drug Application (NDA) for Bimatoprost Sustained-Release had been approved by the US Food and Drug Administration (FDA). Bimatoprost SR would be the first-ever prolonged, reversible implant for treating individuals with primary open-angle glaucoma or ophthalmic hypertension.

According to estimates, the favorable reimbursement scenario in Europe will promote the use of glaucoma treatments. Glaucoma therapies are now part of the list of authorized, subsidized therapeutic goods available to UK citizens under the National Health Services (NHS).

In contrast, Asia Pacific is anticipated to develop at the greatest rate in the market because of the region's growing elderly population, which is particularly prevalent in nations like China and Japan. Public spending is smaller in Asia, and most medical procedures require out-of-pocket costs.

The eye care industry needs to be developed more effectively, particularly in the Asia Pacific region's poorer nations. The largest markets are Japan and South Korea, but China will grow at the highest rate due to rising healthcare costs and accelerated economic expansion. Additionally, the availability of potent generics, particularly in countries like India, will cause the anti-glaucoma medicine volume to increase. However, compared to growing regions of Asia Pacific, Japan will have the greatest development in the surgical industry.

Competitive Insight

Some of the major players operating in the global market include Allergan PLC, Aristo Pharmaceuticals Pvt. Ltd., Aerie Pharmaceuticals Company, Akorn operating company LLC, Bausch & Lomb Incorporated, Cipla Incorporation, Fera Pharmaceuticals, LLC, Inotek Pharmaceuticals, Merck KGaA, Novartis AG, Pfizer Incorporation, Santen Pharmaceutical Co., Ltd., Teva Pharmaceutical Industries Ltd., and Valeant Pharmaceuticals International, Inc.

Recent Developments

- In June 2022, the FDA approved the revised New Drug Application (NDA) for STN1011700/DE-117 (omidenepag isopropyl), which is used to treat glaucoma, according to a statement from Santen Pharmaceutical Co., Ltd., and UBE Corporation.

- In March 2021, The US Food and Drug Administration approved Teva Pharmaceuticals USA, Inc. to market the first generic version of AZOPT (brinzolamide ophthalmic solution) 1%, a medication used to treat open-angle glaucoma and high intraocular pressure. This has extended the company's product portfolio.

Glaucoma Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6,905.0 million |

|

Revenue forecast in 2032 |

USD 9,154.4 million |

|

CAGR |

3.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Drug Class, By Distribution Channel, By Disease Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Allergan PLC, Aristo Pharmaceuticals Pvt. Ltd., Aerie Pharmaceuticals Company, Akorn operating company LLC, Bausch & Lomb Incorporated, Cipla Incorporation, Fera Pharmaceuticals, LLC, Inotek Pharmaceuticals, Merck KGaA, Novartis AG, Pfizer Incorporation, Santen Pharmaceutical Co., Ltd., Teva Pharmaceutical Industries Ltd., and Valeant Pharmaceuticals International, Inc. |

FAQ's

The Glaucoma Market report covering key are drug class, distribution channel, disease type, and region.

Glaucoma Market Size Worth $ 9,154.4 Million By 2032.

The global glaucoma market expected to grow at a CAGR of 3.2% during the forecast period.

North America is Glaucoma Market.

key driving factors in Glaucoma Market are Increasing Collaboration And Partnerships Among The Industry’s Key Players.