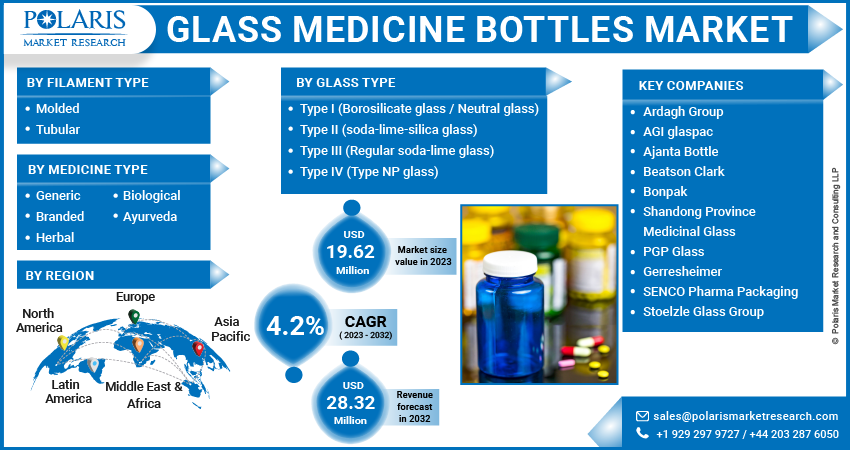

Glass Medicine Bottles Market Share, Size, Trends, Industry Analysis Report, By Glass Type (Type I (Borosilicate glass / Neutral glass), Type II (soda-lime-silica glass), Type III (Regular soda-lime glass), Type IV (Type NP glass)), By Filament Type, By Medicine Type, By Region; Segment Forecast, 2023-2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3603

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

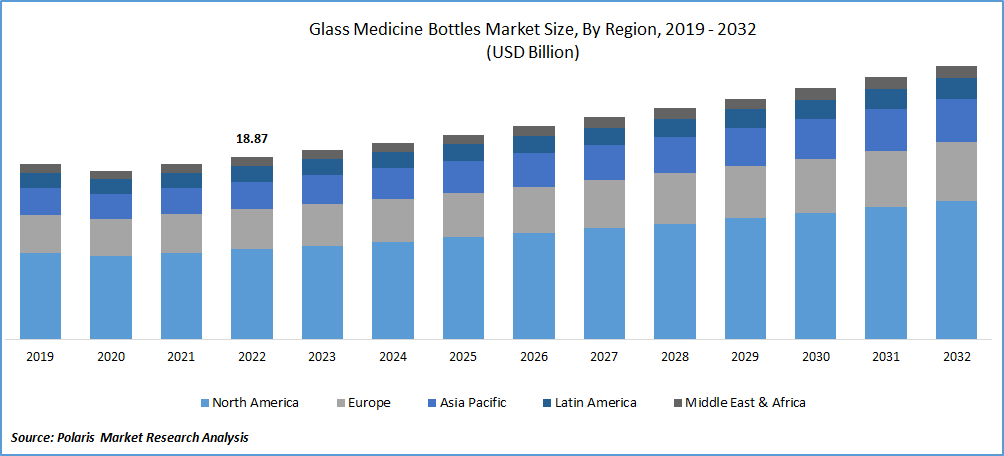

The global glass medicine bottles market was valued at USD 18.87 billion in 2022 and is expected to grow at a CAGR of 4.2% during the forecast period. Glass medicine bottles are widely used in the pharmaceutical industry for packaging various medications. These are commonly used for packaging oral medications such as tablets, capsules, and liquids. They provide a protective barrier against moisture, gases, and light, helping maintain the medications' stability and efficacy. The bottles also package herbal remedies, dietary supplements, and vitamins. The transparency of glass allows consumers to see the contents easily and ensures that the supplements are not exposed to external elements that could affect their efficacy. These are utilized in clinical trials and research studies for packaging investigational drugs or placebos. The use of glass ensures consistency, integrity, and proper storage of the trial medications.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 pandemic has led to a surge in demand for pharmaceutical products, including medications and vaccines. This increased demand for drugs has also increased the need for packaging materials, including glass medicine bottles. The pharmaceutical industry has been working to develop and distribute vaccines, antiviral medications, and other treatments, which require appropriate packaging solutions such as glass bottles. Similarly, the pandemic has heightened awareness of safety and hygiene measures, including in the pharmaceutical industry. Glass medicine bottles are considered a hygienic packaging solution as they are easy to clean, sterilize, and maintain the integrity of the medications. The emphasis on safety and hygiene has further emphasized the importance of glass medicine bottles in the pharmaceutical sector.

However, the global supply chain has been significantly impacted by the pandemic, with disruptions occurring at various stages, including manufacturing, transportation, and distribution. Glass medicine bottle manufacturers faced challenges in sourcing raw materials, maintaining production capacities, and ensuring timely delivery due to logistical issues and restrictions. These disruptions affected the availability of glass medicine bottles in some regions, causing temporary shortages.

For Specific Research Requirements, Request for a customized e Report

Industry Dynamics

Growth Drivers

The growing pharmaceutical sector is a prime factor escalating the global glass medicine bottles market growth. The industry is experiencing steady growth due to factors such as an aging population, the prevalence of chronic diseases, and advancements in medical treatments. As the demand for medications continues to rise, there is a corresponding need for appropriate packaging solutions, including glass medicine bottles. These are often preferred due to their ability to provide a barrier against external factors, meet regulatory requirements, and maintain the quality of pharmaceutical products. As a result, expanding pharmaceutical industry is augmenting the growth of the global market.

Product development in the pharmaceutical industry is another factor contributing to the market. It involves introducing new or improved features, designs, and technologies to enhance the packaging's functionality, safety, and aesthetics. Manufacturers continuously innovate to meet the evolving needs of the pharmaceutical industry, regulatory requirements, and consumer expectations for safe, functional, and sustainable packaging solutions.

For example, in October 2021, Gerresheimer specialized in producing pharmaceutical containers made of type II glass and is a market leader in specialty pharmaceutical packaging and solutions. Both conventional infusion bottles with higher contents and extremely compact injection bottles can be manufactured thanks to special internal surface treatment techniques. The market is witnessing a demand for medicine bottles in different sizes and configurations to cater to various medication types and dosage requirements. It is enhancing the overall growth of the market worldwide.

Report Segmentation

The market is primarily segmented based glass type, filament type, medicine type, and region.

|

By Glass Type |

By Filament Type |

By Medicine Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Type I segment held the largest share of the global market in 2022

In fiscal year 2022, the type I segment dominated the market. Its excellent chemical resistance makes it suitable for storing a wide range of medications. It helps prevent interactions between the medication and the container, ensuring the stability and integrity of the drug. This type of glass is highly durable and resistant to breakage. It is important to protect the medication during transportation, handling, and storage, reducing the risk of product loss or contamination. Exceptional benefits such as durability, transparency, visual inspection, low permeability to moisture, gases, and light, and many other factors are attributed to the segment's growing popularity.

Manufacturers are also focusing on product developments to leverage the ongoing benefits of borosilicate glass. For instance, in November 2021, Industry-leading drug makers quickly responded to the pandemic with Corning Incorporated's introduction of Corning Velocity Vials, specifically constructed Type I borosilicate vials externally covered with the company's unique technology.

Tubular filament glass is anticipated to expand with the fastest CAGR.

During the assessment years, the tubular filament type is projected to be one of the fastest-growing segments. It may provide increased durability and resistance to breakage, ensuring the safe transportation and storage of medications. The design may offer enhanced sealing mechanisms, such as improved caps or closures, to prevent leakage and maintain the medication's integrity. The unique design of the tubular segment type may help pharmaceutical companies differentiate their products and create a distinctive brand identity in the market. In addition to this, they also offer an attractive and visually appealing packaging solution, contributing to positive consumer perception of the product.

Generic medicine type was a major contributor to the market in 2022

In the fiscal year 2022, the generic medicine type segment is anticipated to account for the highest share as generic medicines are generally more affordable than branded medications. Hence, higher demand for generic drugs leads to a larger market share in volume. When patents for branded drugs expire, generic versions can enter the market, leading to increased competition. As a result, many consumers and healthcare providers opt for generic alternatives, leading to a higher demand for glass medicine bottles to package these generic medications.

In addition to this, governments often encourage the use of generic medicines through policies and incentives. For example, in May 2023, In India, the Union Health Ministry intended to request those private hospital physicians begin recommending affordable generic medications to their patients rather than pricy branded medications. These measures aim to reduce healthcare costs and promote competition in the pharmaceutical industry. Such support for generic drugs has further propelled the dominance of the generic medicine type segment.

North America region accounted for the largest share in 2022.

In the fiscal year 2022, North America is expected to lead the global market as the United States is home to a robust and advanced pharmaceutical industry. The region has many pharmaceutical companies involved in medication research, development, and production. The demand for glass medicine bottles is high to package these pharmaceutical products, driving market dominance. For example, in 2021, the U.S. accounted for the highest sales, resulting in $555 billion. Additionally, each year, the pharmaceutical sector in the USA spends about $60 billion on medication development. Hence, the robust pharmaceutical industry in the region is a foremost factor augmenting the growth of the market in the region.

Asia Pacific is the fastest-growing region globally during the forecast period. Increasing generic drug consumption is one of the prime factors helping the market grow rapidly. The consumption of generic drugs has been on the rise in Asia Pacific. For example, India exports more generic medications than any other country, representing a significant portion of all exports. Generic medicines are often more affordable and accessible than branded medications, making them the preferred choice for many consumers. The increased demand for generic drugs has led to a corresponding need for glass medicine bottles, driving market growth in the region.

Competitive Insight

The global players include Ardagh Group, AGI glaspac, Ajanta Bottle, Beatson Clark, Bonpak, Shandong Province Medicinal Glass, PGP Glass, Gerresheimer, SENCO Pharma Packaging, Stoelzle Glass Group.

Recent Developments

- In February 2023, Berry Global presented a package solution of child-resistant PET bottles & closures. Seven 28 mm neck PET bottle varieties were available, with sizes ranging from 20 ml to 1 liter in varied designs.

Glass Medicine Bottles Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 19.62 billion |

|

Revenue forecast in 2032 |

USD 28.32 billion |

|

CAGR |

4.2 % from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Segments covered |

By Glass Type, By Filament Type, By Medicine Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Ardagh Group, AGI glaspac, Ajanta Bottle, Beatson Clark, Bonpak, Shandong Province Medicinal Glass, PGP Glass, Gerresheimer, SENCO Pharma Packaging, Stoelzle Glass Group |

FAQ's

The global glass medicine bottles market size is expected to reach USD 28.32 billion by 2032.

top market players in the Glass Medicine Bottles Market are Ardagh Group, AGI glaspac, Ajanta Bottle, Beatson Clark, Bonpak, Shandong Province Medicinal Glass, PGP Glass, Gerresheimer.

North America contribute notably towards the global Glass Medicine Bottles Market.

The global glass medicine bottles market expected to grow at a CAGR of 4.2% during the forecast period.

The Glass Medicine Bottles Market report covering key are glass type, filament type, medicine type, and region.