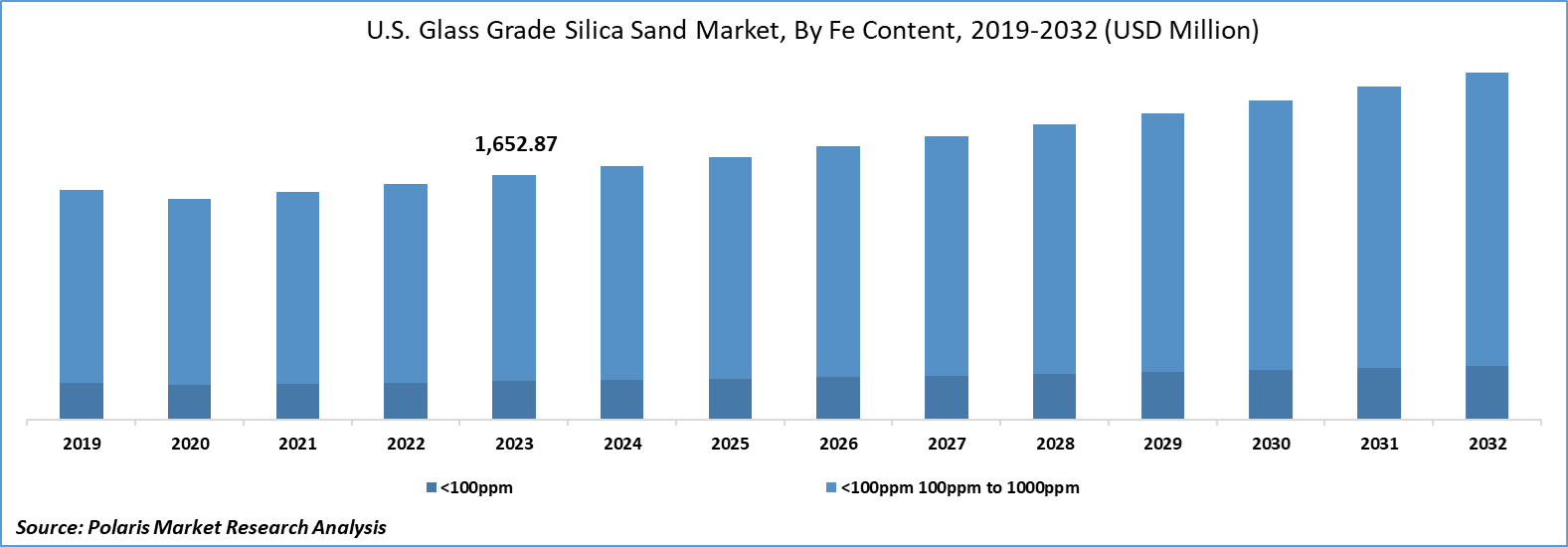

Glass Grade Silica Sand Market Share, Size, Trends, Industry Analysis Report, By Fe Content (<100ppm, 100ppm to 1000ppm); By Applications; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 117

- Format: PDF

- Report ID: PM4934

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Glass Grade Silica Sand Market size was valued at USD 5,817.33 million in 2023. The market is anticipated to grow from USD 6,033.16 million in 2024 to USD 8,272.60 million by 2032, exhibiting the CAGR of 4.0% during the forecast period

Glass Grade Silica Sand Market Overview

The glass-grade silica sand market is experiencing significant growth due to the rising demand from various end-use industries, including glass manufacturing and construction. Glass-grade silica sand is a high-purity form of silicon dioxide used in the production of glass products such as bottles, jars, windows, fiberglass, and solar panels. The increasing demand for glass products, particularly in the food and beverage industry, has resulted in higher consumption of glass grade silica sand, which has fueled the growth of the market. Technological advancements in the glass manufacturing process have also contributed significantly to the growth of the glass grade silica sand market. Modern glass production techniques necessitate high-quality raw materials, such as glass grade silica sand, which provides better optical clarity, durability, and thermal resistance.

To Understand More About this Research: Request a Free Sample Report

For instance, the adoption of CDE technology by Muadinoon Mining Company, headquartered in Saudi Arabia, improved its frac sand production operations in the Kingdom of Saudi Arabia in March 2022.

The COVID-19 pandemic negatively impacted the global glass grade silica sand market, leading to fluctuations in demand, supply chain disruptions, and changes in market dynamics. The primary result of the pandemic was the decrease in demand for glass products, particularly in the automotive and construction industries, which are among the largest consumers of glass grade silica sand.

With worldwide lockdowns and reduced consumer spending, the sales of new vehicles and construction projects were slowed down, which resulted in lower demand for glass components and, subsequently, glass grade silica sand. The silica sand mining and processing operations have been affected by these restrictions, leading to shortages and delays in deliveries.

Glass Grade Silica Sand Market Dynamics

Market Drivers

The Increasing Demand From the Solar Industry Drives Market Growth

The increasing demand from the solar industry is a significant driver of the glass grade silica sand market since silica sand is an essential component in the production of solar panels, specifically in the manufacturing of photovoltaic (PV) cells. PV cells are made from crystalline silicon, which is produced by melting and purifying silicon dioxide (SiO2), a key component of glass grade silica sand. Glass grade silica sand is particularly sought after due to its unique properties, such as high purity, uniform particle size distribution, and low iron content. These characteristics enable the production of high-efficiency PV cells that can convert sunlight into electricity more effectively. As the efficiency of PV cells continues to improve, the demand for even higher-grade raw materials like glass grade silica sand is expected to rise further.

The Significant Rise in the Glass Industry Fuels the Sales of Glass Grade Silica Sand

The growth in the glass industry is also driven by the increasing demand for glass packaging in the food and beverage sector, especially in emerging markets. The trend towards eco-friendly packaging has further accelerated the demand for glass products, as glass is a recyclable and environment-friendly material. Also, the expansion of the automotive and construction industries, which also rely heavily on glass products, has further fueled the demand for glass grade silica sand. To meet the growing demand for glass products, manufacturers are investing in new production facilities and expanding existing ones, which in turn requires more glass grade silica sand. For instance, in September 2020, AMI Silica Inc., a subsidiary of Athabasca Minerals Inc., signed a Term Sheet to undertake the Duvernay Silica Sand Project as a joint venture initiative. The primary objective of this initiative was to collaborate and operate one of the eco-friendly silica sand facilities in North America.

Market Restraints

The Increasing Emphasis on Alternative Materials is Causing a Decline in the Demand For Glass Grade Silica Sand

The increasing adoption of these alternative materials is reducing the demand for glass grade silica sand. This shift is particularly noticeable in regions where environmental regulations are becoming more stringent and consumers are becoming more environmentally conscious. The glass industry has become more productive, energy-efficient, and sustainable over the past few decades in response to market conditions. For instance, the European Union has established a comprehensive plan to reduce greenhouse gas emissions. The plan outlines a 30 percent reduction target by the year 2030, with a more ambitious 40 percent target set for 2040. The ultimate goal is to reach "net zero" emissions by 2050.

Report Segmentation

The market is primarily segmented based on fe content, applications, end-use, and region.

|

By Fe Content |

By Applications |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Glass Grade Silica Sand Market Segmental Analysis

By Fe Content Analysis

The 100ppm to 1000ppm segment has dominated the market. It is projected to grow with the fastest CAGR over the projected period, mainly driven by its significant advantages over lower-grade or higher-impurity sand. These benefits include high transparency, ensuring optimal clarity for applications such as solar glass and automotive windows, as well as improved strength, durability, and color consistency. Moreover, the low iron content enhances thermal insulation properties, making it particularly suitable for applications like solar panels. The versatility of silica sand with low Fe content enables its use across a wide range of industries, including electronics, architecture, and automotive. The strict control of iron content ensures that finished glass products meet stringent quality standards. At the same time, the availability of silica sand in varying grades allows manufacturers to tailor their selection based on specific requirements and budget considerations.

By Applications Analysis

The glass containers segment accounted for the largest market share owing to technological advancements in glass manufacturing techniques, leading to the production of lightweight yet durable containers that cater to evolving consumer preferences for eco-friendly packaging solutions. Additionally, stringent regulations promoting sustainability and the recyclability of packaging materials are driving manufacturers to opt for glass containers over plastic alternatives, further bolstering the demand for silica sand in this segment.

The flat glass segment is expected to grow at the fastest growth rate owing to its extensive applications in architectural glazing, windows, doors, and automotive windshields, among others. Additionally, technological advancements in the manufacturing processes of flat glass, such as the float glass method, further propel the demand for high-quality silica sand with specific particle size and purity requirements to ensure superior optical clarity and strength in the final product.

By End-User Analysis

The industrial segment dominated the market and is expected to grow at a healthy CAGR over the forecast period owing to the growing need for glass products across various industrial sectors, such as the construction industry, which is a major driving force behind this upswing, especially in developing countries where infrastructure development and urbanization are fuelling the demand for glass. Glass grade silica sand is an essential raw material used in the production of architectural glass, fiberglass, and other construction materials. The demand for this type of sand is expected to remain strong in the industrial sector due to the increasing construction activities worldwide, particularly in regions like Asia-Pacific and the Middle East.

Glass Grade Silica Sand Market Regional Insights

The North America Region Dominated the Global Market With the Largest Market Share

The rising demand for glass-grade silica sand in North America is closely tied to the flourishing glass industry, particularly driven by the automotive and construction sectors. The automotive and construction industries are significant consumers of flat glass, creating substantial demand for high-quality silica sand. The growth in these sectors, propelled by urbanization and increased investments in vehicles and real estate, plays a pivotal role in boosting the overall glass industry. For instance, in July 2022, the strategic agreement between Canadian Premium Sand and Hanwha was indicative of the growing importance of silica sand in emerging sectors. The collaboration focuses on manufacturing patterned solar glass in Manitoba, supporting Hanwha's solar energy growth strategy in North America. Initiatives like these, involving the use of high-purity, low-iron silica sand from local sources, contribute to the rise in the glass-grade silica sand market in North America.

The Europe region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the electronics sector, which stands out as a pivotal driver for the glass-grade silica sand market. Silica sand plays a crucial role in the manufacturing of electronic components, including semiconductors, optical fibers, and silicon wafers. As the global demand for electronic devices continues its upward trajectory fueled by technological advancements, consumer electronics, and telecommunication infrastructure development, the need for high-purity silica sand is witnessing a corresponding increase.

Competitive Landscape

The glass grade silica sand market is marked by intense competition, with players vying for market share through continual advancements in silica sand grades, strategic collaborations, and a commitment to innovation. Companies are actively investing in research and development to stay abreast of evolving industry needs and adhere to stringent quality standards. Overall, the competitive landscape of the glass grade silica sand market is complex and dynamic, with various players competing across different segments and geographies.

Some of the major players operating in the global market include:

- Athabasca Minerals Inc.

- Australian Silica Quartz Group Ltd.

- Covia Holdings LLC

- HRD Group of Companies

- Quarzwerke GmbH

- Radhey Shyam Group

- Sibelco

- SiO Silica, Inc.

- Strobel Quarzsand GmbH

- TOCHU CORPORATION

- Zillion Sawa Minerals Pvt, Ltd.

Recent Developments

- In April 2023, AMI Silica LLC, a subsidiary of Athabasca Minerals Inc., entered into a multi-year transload agreement for transporting its high-quality silica sand to the Grande Prairie region in Alberta.

- In March 2022, AMI Silica LLC completed the acquisition of a fully operational sand mine along with its facilities situated in Wisconsin, USA.

Report Coverage

The glass grade silica sand market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, Fe content, applications, end-user, and their futuristic growth opportunities.

Glass Grade Silica Sand Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6,033.16 million |

|

Revenue forecast in 2032 |

USD 8,272.60 million |

|

CAGR |

4.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Fe Content, By Applications, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Key players in the market are Covia Holdings LLC, HRD Group of Companies, Quarzwerke GmbH

North America contribute notably towards the global Glass Grade Silica Sand Market

Glass Grade Silica Sand Market exhibiting the CAGR of 4.0% during the forecast period.

The Glass Grade Silica Sand Market report covering key segments are fe content, applications, end-use, and region.