Glass Bonding Adhesives Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Polyurethane, Modified Silanes, Silicone, Acrylate, and Others), End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 119

- Format: PDF

- Report ID: PM1617

- Base Year: 2024

- Historical Data: 2020-2023

Glass Bonding Adhesives Market Overview

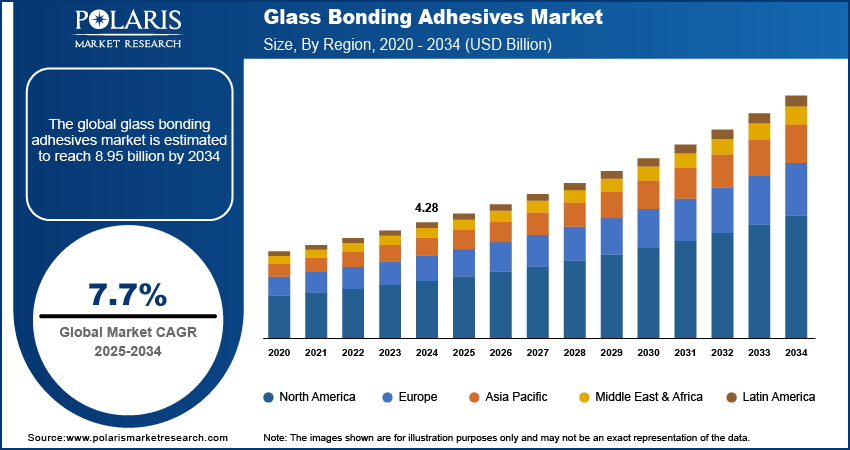

The global glass bonding adhesives market size was valued at USD 4.28 billion in 2024. The market is projected to grow from USD 4.60 billion in 2025 to USD 8.95 billion by 2034, exhibiting a CAGR of 7.7% during 2025–2034.

The global glass bonding adhesives market focuses on adhesives designed for high-strength bonding applications involving glass materials. The market is positively influenced by the growing demand for advanced bonding solutions in the automotive, electronics, and construction sectors. The increasing preference for lightweight, durable, and aesthetically appealing glass structures in these industries is a primary factor driving market growth. Additionally, glass bonding adhesives market trends such as the rising demand for UV-curable adhesives, which offer quick curing times and enhanced performance, are expected to positively impact the market during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Glass Bonding Adhesives Market Dynamics

Shift Toward UV-Curable Adhesives

One prominent glass bonding adhesives market trend is the shift toward UV-curable adhesives. These adhesives, which cure upon exposure to ultraviolet light, offer several advantages over traditional adhesives, including faster processing times, superior bond strength, and minimal waste generation. The rapid curing process of UV adhesives, typically under 10 seconds, is particularly valuable in industries such as electronics and automotive, where high production efficiency is essential. The enhanced strength and transparency of UV adhesives also make them suitable for applications in consumer electronics, where aesthetics and durability are prioritized.

Growing Focus on Eco-Friendly and Low-VOC Adhesives

There is a significant shift toward environmentally sustainable and low-VOC (Volatile Organic Compounds) adhesives, driven by stringent environmental regulations and growing awareness about environmental health. Industries are increasingly adopting low-VOC and solvent-free adhesives to meet regulatory standards, particularly in Europe and North America. According to the European Chemicals Agency, VOC reduction requirements have led to a 20% increase in the adoption of water-based adhesives over solvent-based alternatives. These eco-friendly adhesives reduce harmful emissions, aligning with corporate sustainability goals and improving workplace safety. As regulatory bodies continue to implement stricter guidelines, manufacturers are investing in R&D to produce more sustainable products. Thus, rising focus on eco-friendly and low-VOC adhesives boosts the glass bonding adhesives market expansion.

Rising Adoption in Automotive and Construction Industries

The demand for glass bonding adhesives is rising notably in the automotive and construction sectors, driven by the preference for lightweight, resilient, and transparent materials. In automotive applications, these adhesives are used for bonding glass components such as windshields and side windows, essential for vehicle durability and safety. The construction industry, especially in architectural glass applications, benefits from the high strength and weather resistance of advanced adhesives. The automotive sector’s shift toward electric vehicles (EVs) has increased demand for adhesives that provide durability while maintaining vehicle weight. A study by the US Department of Energy found that lightweight materials can improve EV fuel efficiency by up to 6%. As a result, both industries are increasingly reliant on specialized bonding adhesives that can meet performance and regulatory standards.

Glass Bonding Adhesives Market Segment Insights

Glass Bonding Adhesives Market Outlook – by Product Type-Based Insights

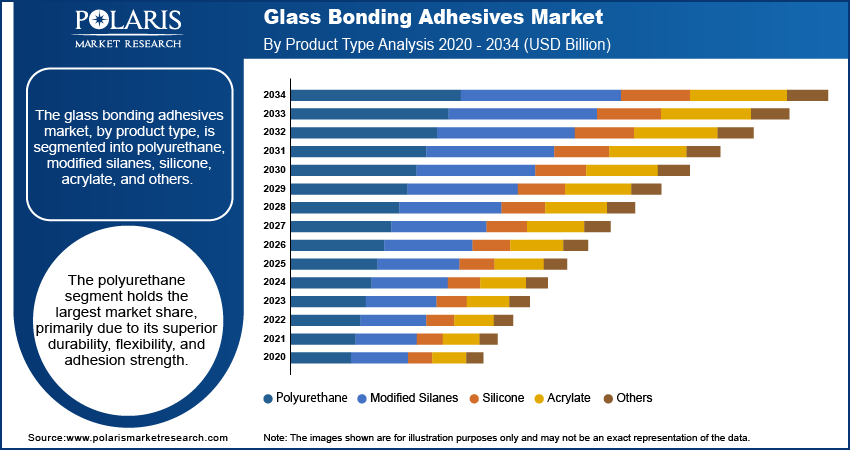

The glass bonding adhesives market, by product type, is segmented into polyurethane, modified silanes, silicone, acrylate, and others. The polyurethane segment holds the largest market share, primarily due to its superior durability, flexibility, and adhesion strength. These adhesives are widely used in automotive and construction applications, where strong bonding and resistance to environmental stress are essential. Polyurethane’s ability to withstand temperature fluctuations and resist moisture makes it particularly advantageous for outdoor applications, supporting its dominance in these segments. Moreover, the material's high tensile strength and versatility in bonding various substrates have driven its widespread adoption, securing a strong foothold across multiple end-use industries.

The modified silanes segment is experiencing the highest growth rate within the market. Their unique hybrid formulation combines the flexibility of silicones with the adhesion strength of polyurethane, making them suitable for applications that require robust, long-lasting bonds. Modified silanes are particularly valued in high-performance applications where low emissions and minimal environmental impact are desired, aligning with rising regulatory requirements for low-VOC materials. Additionally, their superior adhesion to nonporous surfaces such as glass and metals, along with enhanced weather resistance, supports their increasing use in construction and transportation, fueling the segment’s rapid expansion.

Glass Bonding Adhesives Market Assessment – by End-Use Industry-Based Insights

The glass bonding adhesives market, by end-use industry, is segmented into automotive, aerospace, furniture, construction, electronics, medical, and others. The automotive industry holds the largest share of the glass bonding adhesives market revenue, driven by the extensive use of glass adhesives in vehicle assembly and maintenance. These adhesives are essential for bonding windshields, windows, and other glass components, ensuring structural integrity and occupant safety. As the automotive sector is increasingly prioritizing lightweight materials to improve fuel efficiency and reduce emissions, glass bonding adhesives have become a critical component. The transition toward electric vehicles (EVs) has also amplified demand, as these adhesives contribute to the overall weight reduction and thermal stability required for EV batteries and structural components. These applications underscore the automotive sector’s strong influence on the market’s size and demand patterns.

The electronics segment is projected to register the highest growth rate, owing to rising demand for compact and durable devices that incorporate glass. With the proliferation of smartphones, tablets, and wearable devices, glass bonding adhesives are indispensable for assembling displays and other glass-embedded components. Their use in electronics ensures device durability, water resistance, and impact protection, which are critical qualities in consumer electronics. Moreover, the increasing adoption of glass bonding adhesives in advanced manufacturing processes, such as automated optical bonding for screens, further fuels growth in this segment. The electronics sector's ongoing innovations and the demand for high-performance adhesives tailored for compact, high-value devices are propelling the segment expansion.

Glass Bonding Adhesives Market Regional Insights

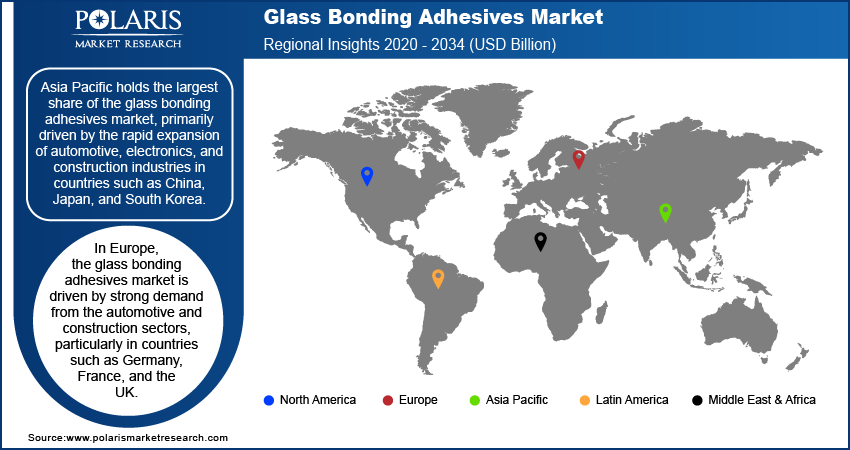

By region, the study provides glass bonding adhesives market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the glass bonding adhesives market, primarily driven by the rapid expansion of automotive, electronics, and construction industries in countries such as China, Japan, and South Korea. High demand for consumer electronics, increasing production of EVs, and rising infrastructure development fuel the need for advanced glass bonding solutions across various applications. Furthermore, supportive government policies and investments in manufacturing capabilities in the region have encouraged the growth of local production, meeting domestic and international demands. The region's focus on technological advancements and sustainable materials has spurred significant growth in adhesive applications, solidifying Asia Pacific’s leading position in the global market.

In Europe, the glass bonding adhesives market development is driven by strong demand from the automotive and construction sectors, particularly in countries such as Germany, France, and the UK. With Europe being a hub for luxury and EV manufacturing, the need for high-performance adhesives has grown as manufacturers seek materials that provide durability, safety, and aesthetic appeal in glass components. Additionally, stringent environmental regulations promoting low-VOC and sustainable adhesives are prompting increased adoption of eco-friendly products. The region's commitment to sustainability aligns with adhesive innovations that reduce emissions and improve product longevity, bolstering the growth in these industries.

Glass Bonding Adhesives Market – Key Players and Competitive Insights

Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Sika AG, and Dow Inc. are among the key players in the glass bonding adhesives market. The players offer diverse product portfolios across the automotive, electronics, and construction sectors. Other notable companies include Arkema S.A., Permabond LLC, DELO Industrial Adhesives, Avery Dennison Corporation, and Ashland Global Holdings Inc. They focus on specialized applications and advanced formulations. Additionally, Huntsman Corporation, Illinois Tool Works Inc., Saint-Gobain, Dymax Corporation, and Master Bond Inc. actively contribute to market developments through adhesive innovations targeting specific end-use requirements.

The competitive landscape is characterized by a mix of multinational corporations and specialized regional players, with larger companies leveraging economies of scale and global distribution networks to maintain market presence. Many players focus on product differentiation through technological advancements, such as low-VOC and high-strength adhesives, catering to regulatory standards and consumer demands for sustainable solutions. Regional companies, particularly in Asia Pacific, are emphasizing localized production and R&D efforts to stay competitive against global brands, capitalizing on demand in electronics and automotive markets.

The glass bonding adhesives market insights reveal that competition centers on innovation, with companies continuously enhancing adhesive performance, such as improving durability, curing speed, and environmental impact. Strategic partnerships and mergers and acquisitions are also common, allowing companies to expand their market reach and product offerings. For example, Henkel has strengthened its position in the automotive sector through partnerships focused on sustainable adhesive solutions, while Dow and Sika are investing in adhesives tailored for high-performance applications in both construction and electronics. As companies increasingly invest in sustainable and eco-friendly formulations, competitive advantage is shifting toward those capable of meeting regulatory demands and evolving consumer expectations.

Henkel AG & Co. KGaA is a significant player in the glass bonding adhesives market. The company is known for its extensive range of adhesives used in sectors such as automotive, electronics, and construction. Henkel actively develops environmentally friendly solutions and has made advancements in adhesive technologies that align with regulatory demands for sustainable products.

3M Company is another major participant, with a diverse product lineup that includes glass bonding adhesives for automotive, aerospace, and electronics applications. The company is well-regarded for its focus on innovation, particularly in developing fast-curing and high-durability adhesives that meet the specific requirements of high-tech industries.

Key Companies in Glass Bonding Adhesives Market

- Henkel AG & Co. KGaA

- 3M Company

- H.B. Fuller Company

- Sika AG

- Dow Inc.

- Arkema S.A.

- Permabond LLC

- DELO Industrial Adhesives

- Avery Dennison Corporation

- Ashland Global Holdings Inc.

- Huntsman Corporation

- Illinois Tool Works Inc.

- Saint-Gobain

- Dymax Corporation

- Master Bond Inc.

Glass Bonding Adhesives Industry Developments

- In November 2024, Henkel announced a partnership with Packsize to focus on expanding its eco-friendly adhesive solutions in the automotive sector.

- In July 2023, 3M introduced a new adhesive formulation aimed at improving performance and bonding strength in electronic devices, responding to the demand for reliable adhesive solutions in consumer electronics.

Glass Bonding Adhesives Market Segmentation

By Product Type Outlook

- Polyurethane

- Modified Silanes

- Silicone

- Acrylate

- Others

By End-Use Industry Outlook

- Automotive

- Aerospace

- Furniture

- Construction

- Electronics

- Medical

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Glass Bonding Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.28 billion |

|

Market Size Value in 2025 |

USD 4.60 billion |

|

Revenue Forecast by 2034 |

USD 8.95 billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.28 billion in 2024 and is projected to grow to USD 8.95 billion by 2034.

The global market is projected to register a CAGR of 7.7% during 2024–2034.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the glass bonding adhesives market are Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Sika AG, and Dow Inc. The players offer diverse product portfolios across the automotive, electronics, and construction sectors. Other notable companies include Arkema S.A., Permabond LLC, DELO Industrial Adhesives, Avery Dennison Corporation, and Ashland Global Holdings Inc

The polyurethane segment accounted for the largest share of the global market in 2024

The automotive segment accounted for the largest share of the global market in 2024.

Glass bonding adhesives are specialized adhesives designed to create strong, durable bonds between glass and other materials, such as metals, plastics, or ceramics. These adhesives are used in a variety of industries, including automotive, construction, electronics, and medical, to secure glass components in applications such as windows, windshields, displays, and other glass-related products. The adhesives are formulated to offer high adhesion strength, weather resistance, durability, and, in some cases, optical clarity.

A few key trends in the glass bonding adhesives market are described below: Shift Toward UV-Curable Adhesives: Increasing demand for fast-curing and high-performance adhesives that reduce processing time and energy consumption. Rising Adoption of Eco-Friendly Solutions: Growing focus on low-VOC, solvent-free, and water-based adhesives to meet environmental regulations and sustainability goals. Innovation in Adhesive Formulations: Development of advanced adhesives that offer superior durability, impact resistance, and weathering performance, particularly in the automotive and construction sectors. Increased Use in Electronics: The rising demand for glass bonding adhesives in consumer electronics, especially in displays, smartphones, and wearable devices, is driven by the need for compact and durable components.

A new company entering the glass bonding adhesives market must focus on developing eco-friendly and sustainable adhesive solutions, such as low-VOC or water-based products, to align with increasing environmental regulations and consumer preferences for greener options. Additionally, investing in innovative formulations that offer faster curing times and superior durability, particularly for the automotive and electronics sectors, could differentiate the company. Targeting niche applications, such as advanced bonding for electric vehicles or electronics displays, would also help carve out a specialized market position.

Companies manufacturing, distributing, or purchasing glass bonding adhesives and related products and other consulting firms must buy the report.