Global Geriatric Medicines Market Size, Share, Trends, Industry Analysis Report: By Therapeutics (Analgesics; Statins, Antidiabetic; Proton Pump Inhibitors, Anticoagulant, Antipsychotic, and Others), Condition, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 117

- Format: PDF

- Report ID: PM1338

- Base Year: 2024

- Historical Data: 2020-2023

Geriatric Medicines Market Overview

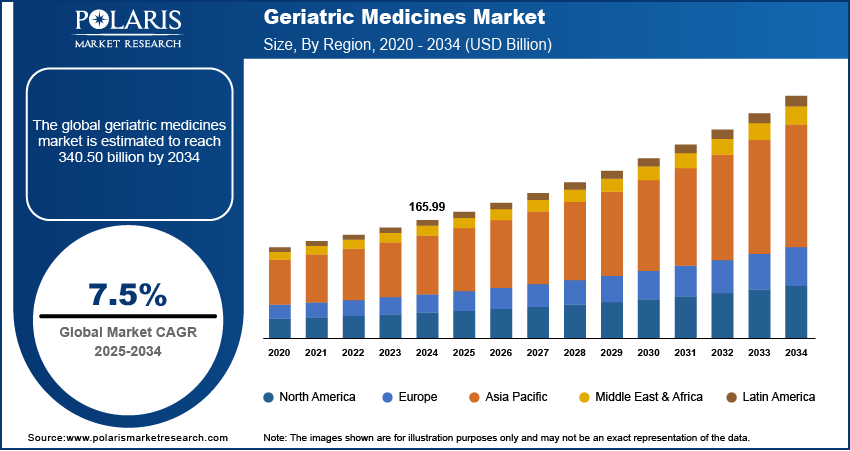

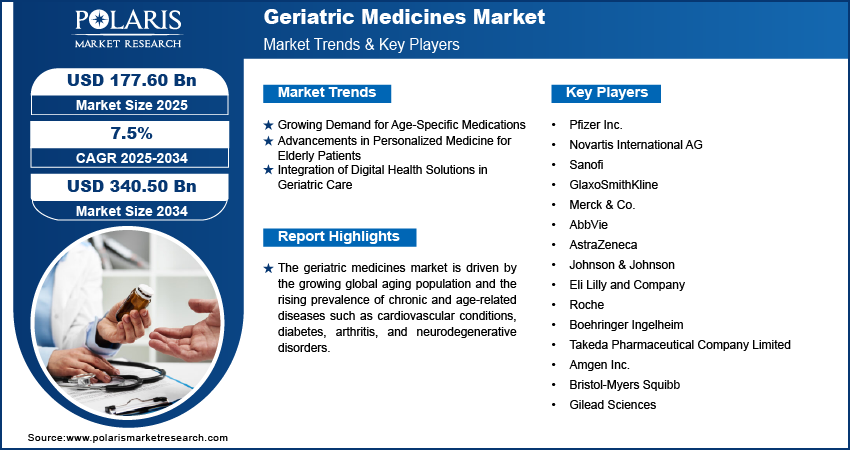

The geriatric medicines market size was valued at USD 165.99 billion in 2024. The market is projected to grow from USD 177.60 billion in 2025 to USD 340.50 billion by 2034, exhibiting a CAGR of 7.5% during the forecast period.

The geriatric medicines market refers to the sector focused on the development, production, and distribution of pharmaceutical products specifically designed to meet the healthcare needs of the aging population. With the global population of elderly individuals growing, the demand for medicines addressing age-related diseases and conditions, such as cardiovascular diseases, diabetes, and neurological disorders, is increasing. Key drivers of this market include the rising prevalence of chronic diseases in older adults, advancements in medical research, and the growing emphasis on improving the quality of life for seniors. Additionally, trends such as personalized medicine and the increasing adoption of telemedicine are shaping the market's future. The expanding geriatric population and advancements in healthcare technology continue to drive geriatric medicines market growth.

To Understand More About this Research: Request a Free Sample Report

Geriatric Medicines Market Dynamics

Growing Demand for Age-Specific Medications

As the global population ages, there is an increasing need for medications tailored specifically to address the health concerns of older adults. The World Health Organization (WHO) 2024 reports that by 2050, the number of people aged 60 years and older is expected to increase more than 2 times, reaching 2.1 billion globally. This demographic shift has led to a rise in the prevalence of chronic conditions such as hypertension, diabetes, and dementia. In response, pharmaceutical companies are focusing on developing medications that address these age-related diseases, with a growing emphasis on formulations that minimize side effects and enhance efficacy in older populations. For example, medications for cardiovascular diseases are being increasingly modified to better cater to the unique physiological conditions of older adults.

Advancements in Personalized Medicine for Elderly Patients

Personalized medicine, which involves tailoring treatments based on individual genetic profiles, is gaining traction in the geriatric medicines market. This approach is particularly relevant for older adults, who often experience a range of complex health conditions. According to a study by the National Institute on Aging (NIA), personalized medicine has the potential to improve the management of age-related diseases by offering more precise and individualized treatment plans. The use of biomarkers and genetic information is helping to identify the most effective treatments for elderly patients, improving outcomes and reducing adverse effects. With the rise of genomics and precision health technologies, personalized medicine is expected to play a significant role in optimizing geriatric care.

Integration of Digital Health Solutions in Geriatric Care

The integration of digital health technologies, including telemedicine and health monitoring apps, is a prominent geriatric medicines market trend. Older adults are increasingly using digital platforms to manage their health, from remote consultations with healthcare providers to tracking chronic conditions such as diabetes or heart disease through wearable devices. A study published by the Journal of Medical Internet Research in 2022 highlights that telemedicine usage among older adults has risen significantly, especially during the COVID-19 pandemic, which accelerated the adoption of digital healthcare solutions. These technologies are helping to bridge the gap in access to healthcare services for seniors, particularly in rural areas, while also providing better medication management and chronic disease monitoring, thereby improving patient adherence to prescribed treatments.

Geriatric Medicines Market Segment Insights

Geriatric Medicines Market Assessment by Therapeutics

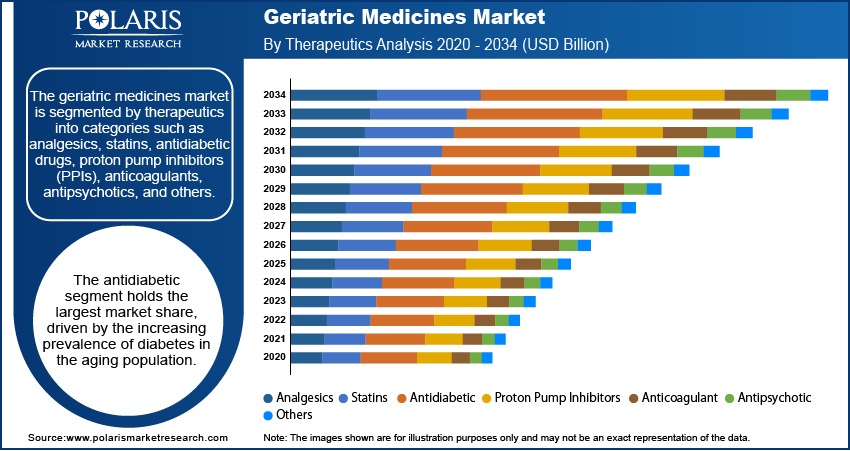

The geriatric medicines market is segmented by therapeutics into categories such as analgesics, statins, antidiabetic, proton pump inhibitors (PPIs), anticoagulants, antipsychotics, and others. Among these, the antidiabetic segment holds the largest market share, driven by the increasing prevalence of diabetes in the aging population. According to the International Diabetes Federation, approximately 10% of adults aged 60-79 are living with diabetes, contributing to the growing demand for effective antidiabetic treatments. The rising adoption of newer therapies, including GLP-1 receptor agonists and SGLT-2 inhibitors, is expected to sustain this segment's dominance. Furthermore, the anticoagulant segment is registering notable growth, fueled by an increase in cardiovascular diseases and the aging population's susceptibility to conditions such as atrial fibrillation. This trend is supported by the ongoing development of novel oral anticoagulants (NOACs), which offer advantages over traditional options, improving patient adherence and safety.

In addition to the dominant antidiabetic and anticoagulant segments, analgesics, particularly those used for managing pain in conditions such as osteoarthritis and musculoskeletal disorders, are also experiencing steady growth due to the high incidence of chronic pain among older adults. Statins, commonly prescribed for managing cholesterol levels and reducing cardiovascular risks, continue to maintain a significant market share as cardiovascular diseases remain a major health concern in the geriatric population. While antipsychotics are growing in importance due to the rise in dementia and psychiatric disorders in older adults, their growth rate is moderate compared to other segments, owing to concerns over adverse effects and the increasing preference for non-pharmacological treatments. Overall, the geriatric therapeutics market is shaped by a combination of chronic disease prevalence, advancements in drug therapies, and increasing healthcare access for older populations.

Geriatric Medicines Market Evaluation by Condition

The geriatric medicines market segmentation, based on condition, includes cardiovascular diseases; neurological disorders; cancer, diabetes and metabolic disorders; respiratory diseases; and others. Among these, cardiovascular diseases hold the largest market share, driven by the high prevalence of hypertension, coronary artery disease, and other heart-related conditions in the elderly population. With the global aging demographic, cardiovascular diseases remain a major concern, leading to a steady demand for medications such as statins, antihypertensives, and anticoagulants. This segment's growth is further supported by innovations in treatment options, including novel oral anticoagulants and new classes of antihypertensive drugs, which are improving patient outcomes. The neurological disorders segment, encompassing conditions such as dementia, Alzheimer's disease, and Parkinson's disease, is registering the highest growth. This is attributed to the increasing incidence of cognitive decline in the aging population, with a significant rise in Alzheimer's diagnoses as life expectancy increases. The development of new therapies, including disease-modifying treatments for Alzheimer's, is driving this growth.

Other segments, such as cancer, diabetes and metabolic disorders, also contribute significantly to the geriatric medicines market. The cancer segment is expanding due to advancements in oncology treatments, including targeted therapies and immunotherapies, which offer more effective and less invasive options for older patients. Similarly, diabetes and metabolic disorders continue to be a major focus due to the rising prevalence of type 2 diabetes in the elderly. The market for diabetes medications, particularly for novel antidiabetic drugs, is growing rapidly as more targeted therapies emerge. Respiratory diseases, including chronic obstructive pulmonary disease (COPD), also represent a key segment, though growth is relatively steady compared to other conditions. With the aging population increasingly facing multiple chronic conditions, the demand for medications that address these overlapping health issues is rising.

Geriatric Medicines Market Assessment by Distribution Channel

The geriatric medicines market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies hold the largest geriatric medicines market share due to the significant volume of prescriptions provided in clinical settings, where older patients with chronic conditions often require ongoing treatment. These settings are typically the first point of contact for elderly patients with complex health needs, such as cardiovascular diseases, diabetes, and neurological disorders. As hospitals continue to serve as central hubs for elderly care, the demand for medicines prescribed within these facilities remains strong. Additionally, hospital pharmacies offer a comprehensive range of specialty drugs that cater specifically to geriatric patients, further consolidating their dominance in the market.

Online pharmacies are registering the highest growth, fueled by the increasing trend of digitalization in healthcare and the growing comfort among elderly consumers with e-commerce platforms. The convenience of home delivery services, especially for long-term medications and chronic disease management, is driving the expansion of this segment. As telemedicine and online health consultations become more widely accepted, the role of online pharmacies is expected to strengthen further. Moreover, the retail pharmacy segment continues to experience steady growth, driven by the widespread availability of over-the-counter medications and prescription refills. However, the growth rate of online pharmacies is notably higher due to the increased adoption of digital health solutions and changing consumer behaviors.

Geriatric Medicines Market Regional Insights

By region, the study provides geriatric medicines market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the high prevalence of chronic diseases, an aging population, and advanced healthcare infrastructure. The US, in particular, has a significant proportion of elderly individuals, with nearly 16% of the population aged 65 or older, which drives demand for geriatric medicines. The region's robust healthcare system, increased access to innovative treatments, and strong pharmaceutical research and development further support market growth. Additionally, the presence of major pharmaceutical companies and healthcare providers in North America facilitates the availability of a wide range of geriatric medications. Other regions, such as Europe and Asia Pacific, are also growing rapidly, with Europe benefiting from an aging population and advanced healthcare systems, while Asia Pacific is expanding due to rising healthcare access and the increasing geriatric population in countries such as China and India.

Europe is one of the key regions in the geriatric medicines market, driven by a rapidly aging population and a well-established healthcare infrastructure. European population is experiencing significant growth in the elderly demographic, with over 20% of people aged 65 and older, particularly in countries such as Germany, Italy, and France. This trend is increasing the demand for medications related to chronic conditions, such as cardiovascular diseases, diabetes, and neurological disorders. The European market is supported by advanced healthcare policies, widespread access to healthcare services, and strong government healthcare funding. Additionally, ongoing research and development in the region are driving the availability of specialized treatments for elderly patients, particularly in terms of personalized medicine and innovative therapies for age-related diseases.

Asia Pacific is experiencing rapid growth in the geriatric medicines market, primarily due to the increasing aging population, especially in countries such as China, Japan, and India. By 2050, Asia is expected to account for over half of the global elderly population. As a result, the demand for medications catering to age-related conditions, such as hypertension, diabetes, and cancer, is rising. However, healthcare access varies significantly across the region, with developed countries such as Japan and South Korea offering advanced healthcare solutions while emerging economies including India and China are making strides to improve healthcare systems. The market in this region is also influenced by the increasing adoption of digital health technologies, including telemedicine and online pharmacies, which help expand access to geriatric medicines in both urban and rural areas. The growth potential in Asia Pacific is significant due to the large and diverse population, rising healthcare investments, and improving healthcare infrastructure.

Geriatric Medicines Market – Key Market Players and Competitive Insights:

Key players in the geriatric medicines market include pharmaceutical companies such as Pfizer Inc., Novartis International AG, Sanofi, GlaxoSmithKline, Merck & Co., AbbVie, AstraZeneca, Johnson & Johnson, Eli Lilly and Company, and Roche. Additionally, companies such as Boehringer Ingelheim, Takeda Pharmaceutical Company Limited, Amgen Inc., Bristol-Myers Squibb, and Gilead Sciences are also actively involved in developing and marketing geriatric medicines. These companies are investing in research and development for age-related diseases, particularly in the fields of cardiovascular health, diabetes, neurological disorders, and cancer treatment. Many of these players have established strong distribution networks and partnerships with healthcare providers to enhance their market presence.

The competitive landscape of the geriatric medicines market is shaped by the continuous innovation of pharmaceutical products and the growing demand for specialized treatments for elderly patients. Companies are increasingly focusing on developing medications that address the unique needs of older adults, such as reducing side effects and improving patient adherence. There is also significant competition in the area of personalized medicine and biologics, which cater to the specific needs of geriatric populations. Furthermore, as healthcare systems globally focus on improving elderly care, pharmaceutical companies are expanding their portfolios to include a wider range of therapeutic areas that specifically target age-related conditions. The development of newer formulations and drug delivery systems is also an important strategy for companies to differentiate themselves.

In addition to innovation, pricing strategies, and distribution channels, companies are also focusing on collaborations and partnerships with healthcare providers and organizations to gain a competitive edge. Some pharmaceutical firms are partnering with digital health companies to incorporate telemedicine and monitoring solutions into their offerings, providing more comprehensive care to elderly patients. Moreover, the market is witnessing the emergence of biosimilars, which are driving competition in therapeutic areas such as oncology and diabetes. As the market for geriatric medicines continues to grow, these companies are likely to further prioritize research and development, strategic alliances, and expanding access to medicines in emerging markets.

One major player in the geriatric medicines market is Pfizer Inc., a global pharmaceutical company known for its wide range of medications, including those aimed at treating age-related conditions such as cardiovascular diseases and cancer. Pfizer has focused on developing drugs that cater to the elderly population, particularly in the areas of immunotherapy and vaccines. Another key player is Sanofi, a French multinational pharmaceutical company that produces various medications targeting conditions prevalent among older adults, such as diabetes and cardiovascular diseases. Sanofi is also investing in biologics and vaccines that address age-related health concerns.

Key Companies in Geriatric Medicines Market

- Pfizer Inc.

- Novartis International AG

- Sanofi

- GlaxoSmithKline

- Merck & Co.

- AbbVie

- AstraZeneca

- Johnson & Johnson

- Eli Lilly and Company

- Roche

- Boehringer Ingelheim

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Bristol-Myers Squibb

- Gilead Sciences

Geriatric Medicines Industry Developments

- October 2024: Pfizer announced its collaboration with a biotech company to enhance its portfolio of treatments for Alzheimer's disease. This partnership is expected to strengthen Pfizer’s presence in the geriatric market, particularly as demand for neurological disease treatments rises.

- July 2024: Sanofi reported a significant advancement in its research on a new diabetes medication designed to provide better control for elderly patients. This move reflects the company's ongoing efforts to expand its presence in the geriatric medicines market, particularly as the global elderly population grows.

Geriatric Medicines Market Segmentation

By Therapeutics Outlook

- Analgesics

- Statins

- Antidiabetic

- Proton Pump Inhibitors (PPIs)

- Anticoagulant

- Antipsychotic

- Others

By Condition Outlook

- Cardiovascular Diseases

- Neurological Disorders

- Cancer

- Diabetes & Metabolic Disorders

- Respiratory Diseases

- Others

By Distribution Channel Outlook

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Geriatric Medicines Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 165.99 billion |

|

Market Size Value in 2025 |

USD 177.60 billion |

|

Revenue Forecast in 2034 |

USD 340.50 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The geriatric medicines market has been segmented into detailed segments of therapeutics, condition, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the geriatric medicines market focuses on expanding therapeutic portfolios to address the increasing prevalence of chronic and age-related conditions. Companies are prioritizing research and development of targeted therapies and personalized medicine to improve treatment outcomes for older adults. Strategic partnerships and collaborations with healthcare providers and digital health platforms are being leveraged to enhance access and distribution. Additionally, manufacturers are increasingly focusing on emerging markets with aging populations, such as Asia Pacific, while also investing in education and awareness programs to promote adherence to geriatric treatments. Innovative drug delivery systems tailored for older patients are also being developed to improve usability and compliance.

FAQ's

? The geriatric medicines market size was valued at USD 165.99 billion in 2024 and is projected to grow to USD 340.50 billion by 2034.

? The market is projected to register a CAGR of 7.5% during the forecast period, 2025-2034.

? North America had the largest share of the market.

? The geriatric medicines market key players include pharmaceutical companies such as Pfizer Inc., Novartis International AG, Sanofi, GlaxoSmithKline, Merck & Co., AbbVie, AstraZeneca, Johnson & Johnson, Eli Lilly and Company, and Roche.

? The antidiabetic segment accounted for the largest market share.

? The cardiovascular diseases segment accounted for the largest share of the market.

? Geriatric medicines, also known as geriatric pharmacotherapy, refer to a specialized branch of medicine focused on the development, use, and management of pharmaceutical treatments designed specifically for elderly individuals. This area addresses the unique physiological changes and health challenges associated with aging, including chronic conditions such as cardiovascular diseases, diabetes, arthritis, neurological disorders, and respiratory diseases. Geriatric medicines aim to optimize treatment outcomes while minimizing adverse effects, considering the complexities of multiple co-existing conditions (polypharmacy) often seen in older patients. These medications are essential for improving the quality of life and maintaining the health and functionality of the aging population.

? A few key trends in the geriatric medicines market are described below: Growing Focus on Personalized Medicine: Increasing emphasis on tailoring treatments to individual patient needs using genetic and biomarker data to improve efficacy and reduce side effects. Advancements in Drug Formulations: Development of age-appropriate formulations, such as extended-release tablets and easy-to-administer dosage forms, to enhance compliance among elderly patients. Integration of Digital Health Technologies: Rising adoption of telemedicine, wearable devices, and online pharmacies to improve access to geriatric care and medication management. Increase in Chronic Disease Prevalence: Higher demand for medications addressing conditions like cardiovascular diseases, diabetes, neurological disorders, and arthritis due to the aging global population.

? A new company entering the geriatric medicines industry could focus on developing innovative therapies for underserved areas, such as neurodegenerative diseases, including Alzheimer’s and Parkinson’s, where demand for effective treatments is high. Investing in personalized medicine and leveraging genetic research to create targeted therapies can provide a competitive edge. The company could also prioritize the development of user-friendly drug delivery systems tailored for older adults, such as dissolvable tablets or patches. Collaborating with digital health platforms to integrate telemedicine and remote monitoring solutions into treatment plans can further differentiate its offerings. Expanding access in emerging markets with aging populations, such as Asia Pacific and Latin America, by offering cost-effective solutions could also position the company favorably.

? Companies manufacturing, distributing, or purchasing geriatric medicines and related products, and other consulting firms must buy the report.