Geotextile Market Size, Share, Trends, Industry Analysis Report: By Technology (Woven, Nonwoven, and Knitted), Material, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 117

- Format: PDF

- Report ID: PM1486

- Base Year: 2024

- Historical Data: 2020-2023

Geotextile Market Overview

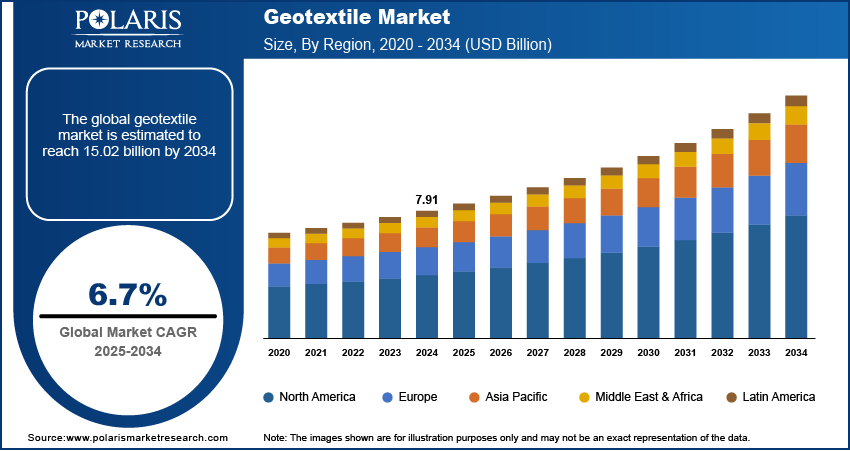

The global geotextile market size was valued at USD 7.91 billion in 2024. The market is projected to grow from USD 8.35 billion in 2025 to USD 15.02 billion by 2034. It is projected to exhibit a CAGR of 6.7% from 2025 to 2034.

Geotextiles are knitted, woven, or nonwoven materials made of natural or synthetic fibers. These textiles are available in different textures and strengths. They are widely used in building, construction, and landscaping to enhance soil characteristics, control erosion, and aid drainage.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for infrastructural developments, rising applications in drainage systems across various regions, and intensified efforts to reduce soil erosion are the key factors driving the geotextile market growth. The growing use of geotextiles as an alternative to granular soil filters, owing to their superior permeability and filtration properties, further supports the development of the market.

Advancements in technology, which are leading to the production of high-performance geotextiles with enhanced properties, are expected to drive the geotextile market expansion in the coming years. The increasing government regulations in the construction industry are anticipated to create lucrative market opportunities during the forecast period.

Geotextile Market Dynamics

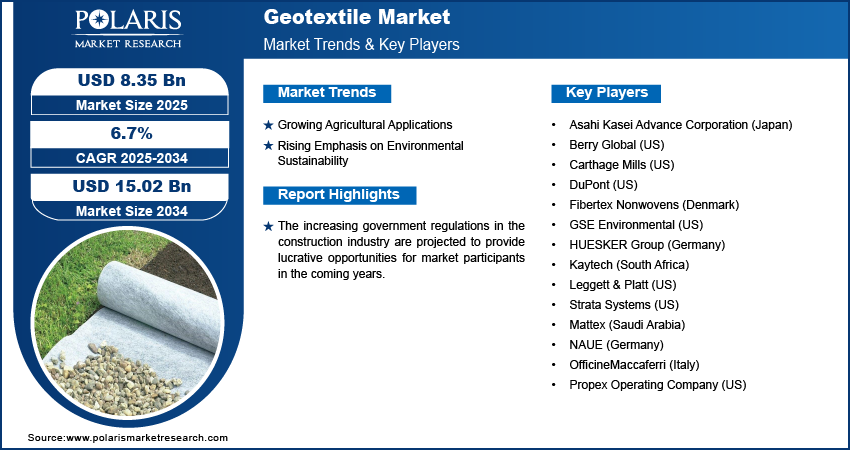

Growing Agricultural Applications

The agricultural sector is increasingly adopting geotextiles for several applications. They are being used to control soil erosion on human-disturbed lands and prevent weeds from growing into fields and gardens. Their use in improving slope stability and vegetation management also adds value to agriculture. With rising food demand globally, geotextiles are becoming a critical tool in sustainable agriculture, impacting the geotextile market growth favorably.

Rising Emphasis on Environmental Sustainability

With shifting global preferences toward sustainable development, geotextiles are gaining traction owing to their eco-friendly properties. Many geotextiles are made using biodegradable or recyclable materials, which aligns with green standards and reduces their environmental impact. Also, the ability of geotextiles to replace conventional soil stabilization methods with more sustainable alternatives has made them a key component in environmentally conscious land management and construction practices. Thus, the growing emphasis on environmental sustainability propels the geotextile market revenue.

Geotextile Market Segment Insights

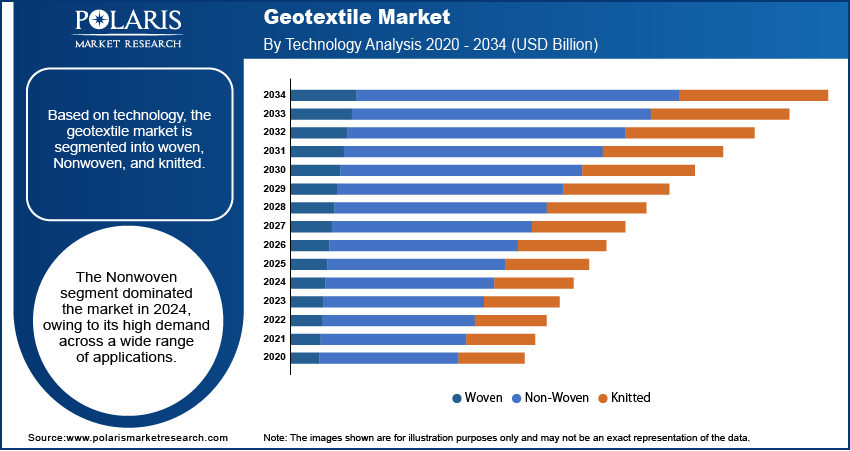

Geotextile Market Outlook Based on Technology

The geotextile market, based on technology, is segmented into woven, Nonwoven, and knitted. The Nonwoven segment led the market with the largest share of 67.9% in 2024. The ability of Nonwoven geotextiles to offer a combination of through-plane and in-plane permeability, along with adequate puncture resistance and tear strength to resist aggregate penetration under cyclic loads, has driven high demand across various applications. The use of these textiles in pooling water management, drainage systems, and the rail industry significantly enhances the lifespan of these structures. Also, Nonwoven geotextiles can last for several decades, which reduces the need for frequent maintenance of these systems.

Geotextile Market Evaluation Based on Material

The geotextile market, based on material, is segmented into natural and synthetic. The synthetic segment dominated the market with a revenue share of 94.2% in 2024. Polypropylene, polyester, and polyethylene are a few common synthetic materials used to produce geotextiles. Synthetic geotextiles offer excellent water flow rates and aren’t affected by microbial processes or chemical reactions. Also, they can be extruded in the form of slit films, tapes, multifilaments, and monofilaments. All of these properties make them ideal for a wide range of applications, including soil filtration, pipe wrapping, and erosion protection.

Geotextile Market Regional Analysis

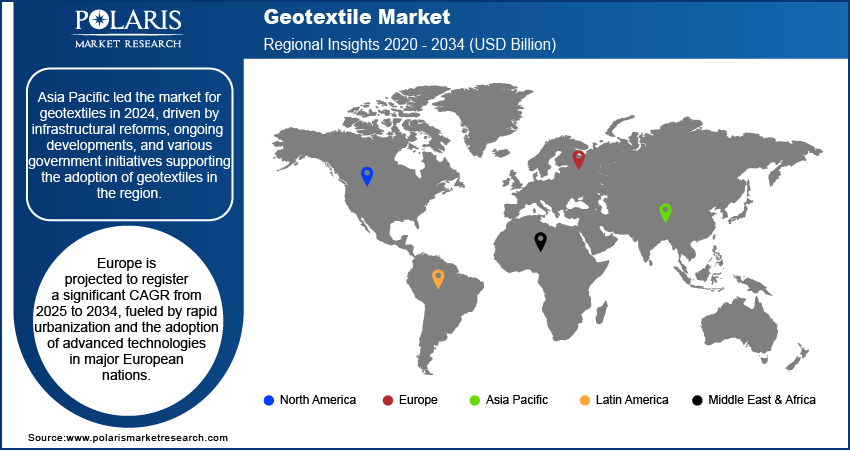

By region, the market report offers geotextile market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of 57.2% in 2024. The market growth in Asia Pacific is primarily fueled by infrastructural reforms, ongoing developments, and various government initiatives supporting the adoption of geotextiles. Besides, rising foreign investments in emerging economies such as India and China support the market development in the region.

The Europe geotextile market is projected to register a significant CAGR from 2025 to 2034. Rapid urbanization and the adoption of advanced technologies in major European nations are expected to drive the demand for geotextiles owing to increased infrastructure projects and the need for durable construction materials. In addition, the presence of stringent regulations for managing municipal waste creates a strong demand for geotextiles in waste management systems, impacting the regional market demand favorably.

Geotextile Market – Key Players and Competitive Insights

The geotextiles market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives and focusing on strategic developments such as partnerships and collaborations to introduce new geotextiles that cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly geotextiles that comply with stringent government regulations. The geotextile market research report offers a market assessment of all the leading players, including Asahi Kasei Advance Corporation (Japan), Berry Global (US), Carthage Mills (US), DuPont (US), Fibertex Nonwovens (Denmark), GSE Environmental (US), HUESKER Group (Germany), Kaytech (South Africa), Leggett & Platt (US), Strata Systems (US), Mattex (Saudi Arabia), NAUE (Germany), OfficineMaccaferri (Italy), and Propex Operating Company (US).

List of Key Players in Geotextile Market

- Asahi Kasei Advance Corporation (Japan)

- Berry Global (US)

- Carthage Mills (US)

- DuPont (US)

- Fibertex Nonwovens (Denmark)

- GSE Environmental (US)

- HUESKER Group (Germany)

- Kaytech (South Africa)

- Leggett & Platt (US)

- Strata Systems (US)

- Mattex (Saudi Arabia)

- NAUE (Germany)

- OfficineMaccaferri (Italy)

- Propex Operating Company (US)

Geotextile Industry Developments

February 2024: HUESKER Group announced the establishment of a new subsidiary in South Africa. The company stated that the new subsidiary aims to strengthen its commitment to South Africa by expanding existing business relationships and targeting new customers.

October 2022: Owens Corning announced an investment of USD 24.5 million in the expansion of its nonwoven geotextile production in Arkansas. According to Owens Corning, the strategic move will help it better serve the long-term growth of its customers.

Geotextile Market Segmentation

By Technology Outlook

- Woven

- Nonwoven

- Knitted

By Material Outlook

- Natural

- Jute

- Others

- Synthetic

- Polypropylene

- Polyester

- Polyethylene

By Application Outlook

- Agriculture

- Drainage

- Erosion Control

- Railways

- Roadways

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Geotextile Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.91 billion |

|

Market Size Value in 2025 |

USD 8.35 billion |

|

Revenue Forecast by 2034 |

USD 15.02 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 7.91 billion in 2024 and is projected to grow to USD 15.02 billion by 2034.

The market is projected to register a CAGR of 6.7% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Asahi Kasei Advance Corporation (Japan), Berry Global (US), Carthage Mills (US), DuPont (US), Fibertex Nonwovens (Denmark), GSE Environmental (US), HUESKER Group (Germany), Kaytech (South Africa), Leggett & Platt (US), Strata Systems (US), Mattex (Saudi Arabia), NAUE (Germany), OfficineMaccaferri (Italy), and Propex Operating Company (US).

The Nonwoven segment accounted for the largest market share in 2024.

The synthetic segment dominated the market for geotextiles in 2024.