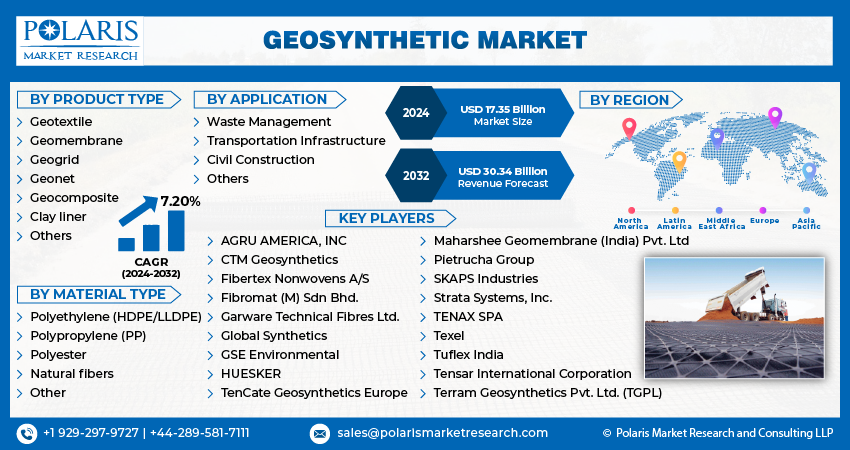

Geosynthetic Market Share, Size, Trends, Industry Analysis Report, By Product Type (Geotextile, Geomembrane, Geogrid, Geonet, Geocomposite, Clay liner, Others); By Material Type; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3953

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

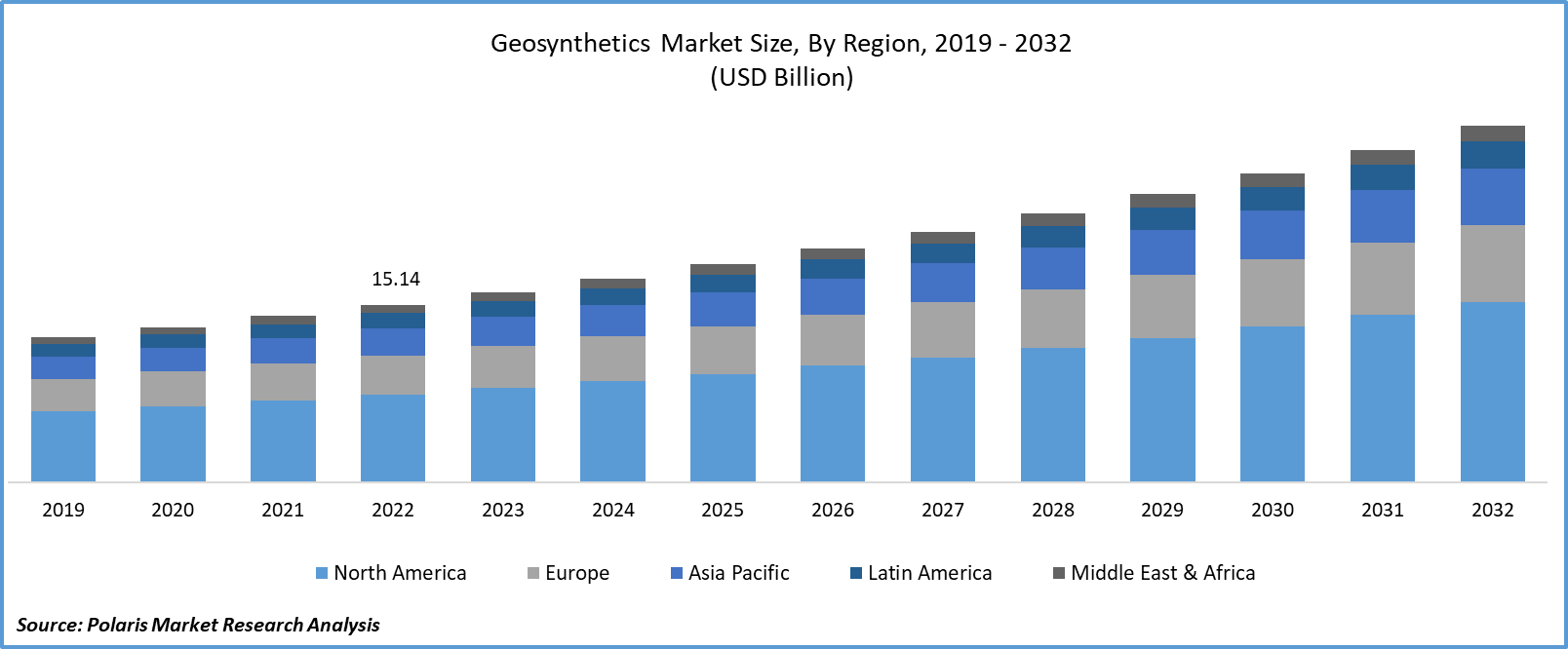

The global geosynthetic market is projected to witness robust growth. It was valued at USD 16.2 billion in 2023 and is projected to grow to USD 30.34 billion By 2032 exhibiting a CAGR of 7.20% in the forecast period 2024 - 2032

Geosynthetics refer to artificial polymeric (plastic) products that provide solutions for various geotechnical problems during construction projects. They are available in different forms, such as strips, three-dimensional structures, or planar. They are designed to perform specific functions such as stabilization, separation, reinforcement, drainage, filtration, containment of liquids, and erosion control. Some products are even designed to provide multiple functions. These have become increasingly popular in civil engineering due to their ability to improve and enhance various construction works. They are made of different polymers and are particularly useful in erosion control, landfills, separation, and filtration. As a result, the global demand for geosynthetics is expected to grow in line with the increase in construction activities.

There are nine main types of geosynthetics in the geosynthetic market. They include geogrids, geocells, geotextiles, geopipes, geonets, geofoam, geocomposites, geomembranes, and geosynthetic clay liners. Each of these geosynthetic types differs in the way it’s designed and created. Geogrids are plastics that consist of integrally connected ribs that are linked by bonding, extrusion, or interlacing. They’re made using polymeric materials like polypropylene, high-density polyethylene, or other durable polymers. Geopipes are polymeric pipes that are used in the construction sector to facilitate the drainage of liquids and gases.

Geofoam, also referred to as expanded polystyrene, is a durable, light weight material that’s created via polymeric expansion of polystyrene. It’s used in a wide range of applications as an alternative to soil backfill. Correctly designed and applied geosynthetics offer a wide range of benefits. They facilitate fast and straightforward installation using well-proven techniques. Besides, they’re highly resistant to biodegradation and chemical contaminants. Furthermore, geosynthetics can be customized to meet the requirements in terms of size and composition.

To Understand More About this Research: Request a Free Sample Report

For instance, in November 2022, A product called Secutex Green was developed by Naue Greenline using renewable raw materials. Nonwovens made from this material are commonly used for separation, filtration, and fastening in various applications, and it has proven to be highly effective in landscaping and gardening.

Geosynthetic materials have recently gained popularity in the fields of railroad, drainage systems, and road construction due to their exceptional tensile strength and the ability to enhance subsurface drainage. The primary functions of geosynthetics include drainage, filtration, separation, environmental protection, fluid barrier provision, and reinforcement.

Geotextiles are widely used in the construction of infrastructure such as waste landfills, tunnels, dams, ponds, roads, or railways. During installation, geotextiles can suffer damages, which can lead to changes in their hydraulic, physical, and mechanical properties. It is important to consider these changes while designing infrastructure with geotextiles. To evaluate damages during installation, tests or laboratory tests should be conducted. Similarly, geogrids can also be damaged during exposure to low temperatures and UV light, which can affect their market demand during installation. The extent of damage may vary with the temperature at the site during installation, which can further hinder the growth of the geogrids market. However, the damages that occur during the installation process can be evaluated by conducting laboratory tests or field tests.

The market report provides a thorough analysis of the geosynthetic market, covering all the major aspects stakeholders need to know. It sheds light on the key developments and trends that are anticipated to drive the geosynthetic industry demand over the forecast period. Besides, it maps the qualitative impact of various key factors on market segments and geographies. Furthermore, it examines the key steps taken by industry participants to strengthen their presence in the industry.

Growth Drivers

Increase Investment in Waste Management

The rapid growth of the world's population and urbanization has led to a significant increase in the generation of both liquid and solid waste. With a heightened global awareness of environmental issues and increased investment in waste management, there is a growing demand for effective waste and water management solutions. Geosynthetics, which are synthetic materials designed for use in civil engineering and environmental applications, are playing a crucial role in addressing these challenges.

One of the primary applications of geosynthetics is in landfill management. They are used to cover landfills, serving as protective barriers. These geosynthetic liners act as impermeable layers, preventing the migration of fluids into landfills and, as a result, reducing the formation of leachate. Leachate is the liquid that forms as water percolates through waste materials in landfills and can become contaminated with various pollutants. By using geosynthetics to control leachate formation, landfill operators can significantly reduce the environmental impact and the associated costs of leachate treatment after landfill closure.

Geosynthetics are not limited to landfill applications; they are also instrumental in various water management activities. Concerns over water contamination are driving the adoption of geosynthetic liner systems in waste treatment lagoons at wastewater treatment plants. These liner systems act as protective barriers to prevent the seepage of contaminants into the surrounding soil and groundwater, thus safeguarding precious water resources. As a result, the demand for geosynthetics is expected to increase in the coming years.

Report Segmentation

The market is primarily segmented based on product type, material type, application, and region.

|

By Product Type |

By Material Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

The Geotextiles Segment Accounted for the Largest Market During the Forecast Period

The geotextiles segment accounted for the largest market during the forecast period due to their superior functionality and practical benefits compared to other substances. Geotextiles are fabrics made of absorbent, long-lasting, and non-biodegradable fibers and are widely used in geotechnical engineering, major construction, hydrogeology, building, paving, and environmental science. They are also used for managing erosion and drainage, as well as for soil reinforcement stabilization, dams, asphalt replacements, and other applications.

Geomembranes are expected to experience a steady growth in profits during the forecast period. This is due to the increasing awareness of their use as floater coverings for reservoirs. It helps regulate evaporation, reduce Volatile Organic Components (VOC) emissions, and minimize the need for draining and maintenance.

By Application Analysis

Waste Management Segment Held the Fastest Market Share in 2022

In 2022, the waste management segment held the fastest market share. Proper waste management is crucial to maintaining a healthy and clean environment, especially with the increasing urbanization, population growth, and industrialization. Geosynthetics are widely used in waste management for various purposes such as drainage, filtration, separation, barriers, and reinforcement. Geotextiles play an important role in preventing polluted liquids and gases from leaking into aquifers, freshwater, rivers, and other aquatic resources. It is essential to collect, transport, treat, recycle, and dispose of industrial, residential, and commercial waste properly. Waste management initiatives are necessary and will continue to grow in importance in the years to come.

Regional Insights

North America Region Held the Largest Market Share in 2022

In 2022, the North American region held the largest geosynthetic market share. The mining industry in the U.S. has experienced a surge in demand for significant metals like copper, silver, zinc, bauxite, and gold. It has led to an expansion of the industry and an increase in regional market demand. The electronics, automobile, and construction industries are the primary drivers behind the growing demand for metal, which has led to an increase in mineral exploration by mining companies. The demand for geotextiles is also expected to rise due to infrastructure projects and rapid industrialization. Additionally, technological advancements and intensive research and development activities have resulted in the development of materials that require less maintenance and have further driven regional industry demand.

Europe is projected to be the fastest region in the geosynthetics market, owing to the rising awareness towards environment-friendly infrastructure. The growing demand for residential buildings may further boost infrastructure development in the European region. The increasing awareness of rising carbon emissions and environmental concerns has led to a surge in demand for green infrastructure. In Germany, strict laws have been imposed regarding practices in industrial waste management and municipal sectors, which may, in turn, promote the demand for geomembranes.

Key Market Players & Competitive Insights

The Geosynthetic market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AGRU AMERICA, INC

- CTM Geosynthetics

- Fibertex Nonwovens A/S

- Fibromat (M) Sdn Bhd.

- Garware Technical Fibres Ltd.

- Global Synthetics

- GSE Environmental

- HUESKER

- TenCate Geosynthetics Europe

- Maharshee Geomembrane (India) Pvt. Ltd

- Pietrucha Group

- SKAPS Industries

- Strata Systems, Inc.

- TENAX SPA

- Tensar International Corporation

- Terram Geosynthetics Pvt. Ltd. (TGPL)

- Texel

- Tuflex India

Recent Developments

- In March 2022, to market apraglutide in Japan, Asahi Kasei signed an exclusive license with VectivBio for the next-gen GLP-2 analog peptide.

- In August 2021, The International Geosynthetics Society (IGS) launched a new website. The website offers interactive resources and member-only features to enhance networking opportunities.

Geosynthetic Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.35 billion |

|

Revenue Forecast in 2032 |

USD 30.34 billion |

|

CAGR |

7.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Material Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Delve into the intricacies of geosynthetic market in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.