Geospatial Analytics Market Size, Share, Trends, Industry Analysis Report: By Component (Software and Services), Type, Application, Technology, Data Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM2320

- Base Year: 2024

- Historical Data: 2020-2023

Geospatial Analytics Market Overview

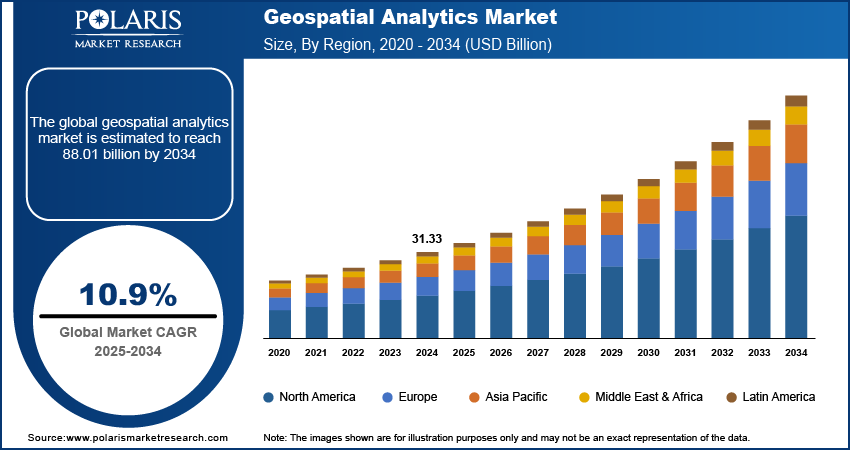

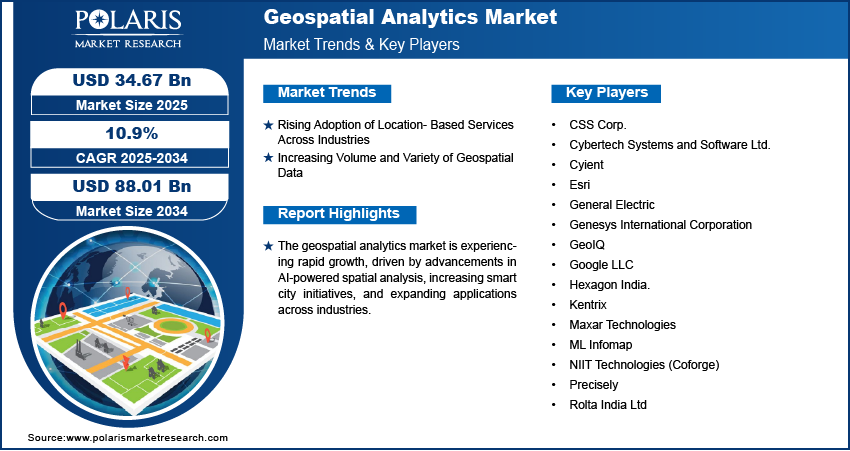

The global geospatial analytics market was valued at USD 31.33 billion in 2024. The market is expected to grow from USD 34.67 billion in 2025 to USD 88.01 billion by 2034, at a CAGR of 10.9% from 2025 to 2034.

Geospatial data refers to information associated with specific geographic locations, enabling spatial analysis and decision-making across various industries. The geospatial data market is experiencing substantial growth, driven by technological advancements in spatial data processing. Innovations in artificial intelligence (AI), machine learning (ML), and cloud computing have significantly enhanced the accuracy, efficiency, and accessibility of geospatial analytics. For instance, in December 2024, AWS announced four innovations for Amazon SageMaker AI to help customers get quickly started with popular models. These updates aim to enhance training efficiency, reduce costs, and support preferred tools for developing generative AI models. Technological advancements also enable real-time data processing, improved remote sensing capabilities, and automated geospatial mapping, allowing industries such as agriculture, defense, and urban planning to derive deeper insights. As a result, businesses and governments are increasingly integrating geospatial data into their operations to optimize resource allocation, infrastructure planning, and disaster management.

To Understand More About this Research: Request a Free Sample Report

Rising investment in smart cities and urban planning is another key factor driving the geospatial analytics market development. Governments and private entities worldwide are leveraging geospatial technologies to develop intelligent urban infrastructure, improve traffic management, and enhance public services. Moreover, geospatial data plays a crucial role in addressing challenges related to climate change, energy efficiency, and resource management within smart city ecosystems. The growing emphasis on digital transformation and data-driven decision-making further strengthens the adoption of geospatial solutions, making them integral to modern urban planning and governance strategies.

Geospatial Analytics Market Dynamics

Rising Adoption of Location-Based Services Across Industries

Industries such as retail, transportation, and telecommunications utilize location-based services (LBS) for real-time navigation, targeted marketing, and network optimization as businesses increasingly leverage spatial data to enhance decision-making and operational efficiency. The integration of geospatial analytics with mobile applications, IoT devices, and GPS technologies enables organizations to deliver personalized services, optimize supply chains, and enhance customer engagement. For instance, in November 2024, Trimble introduced the WM-FieldForm, a control system for precise land forming that connects with selected tractors. It features an intuitive design with an airplane and simple plane options, allowing users to import external designs for enhanced versatility. Additionally, sectors such as emergency response and public safety rely on location intelligence to improve disaster preparedness and resource allocation. Therefore, as businesses and governments continue to prioritize spatial insights, the demand for advanced geospatial analytics solutions is expected to grow.

Increasing Volume and Variety of Geospatial Data

The expansion of high-resolution imagery, real-time geospatial feeds, and unstructured location data has created a need for advanced analytics solutions capable of processing and interpreting complex datasets. For instance, in 2024, Niantic announced the development of a large geospatial model (LGM), leveraging AI-driven analysis of user-generated scans to enhance 3D mapping and real-world interactions. AI-driven geospatial analytics enables automated pattern recognition, predictive modeling, and real-time mapping, allowing industries to extract meaningful insights from vast geospatial datasets. Therefore, as organizations aim to enhance operational efficiency and strategic planning, the ability to harness, analyze, and visualize large-scale spatial data has become essential, thereby driving the geospatial analytics market expansion.

Geospatial Analytics Market Segment Insights

Geospatial Analytics Market Assessment by Data Type Outlook

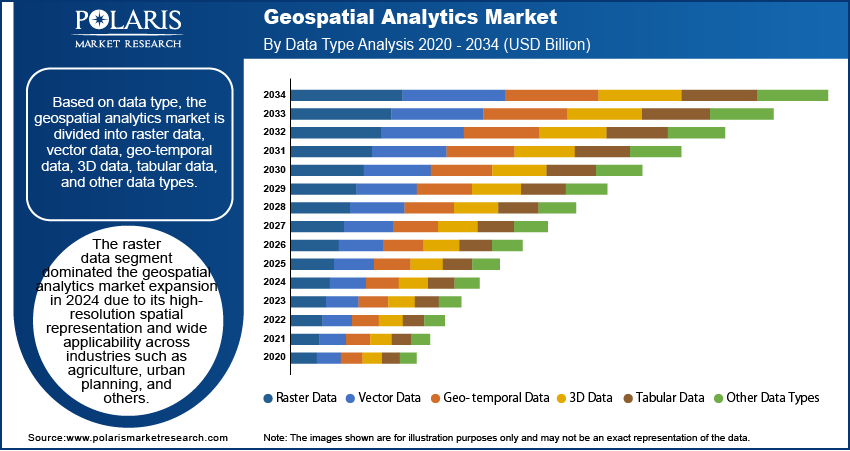

The global geospatial analytics market assessment, based on data type, includes raster data, vector data, geo-temporal data, 3D data, tabular data, and other data types. The raster data segment dominated the geospatial analytics market in 2024 due to its high-resolution spatial representation and wide applicability across industries like agriculture and urban planning. Raster data, derived from satellite imagery, aerial photography, and remote sensing, enables detailed spatial analysis by capturing continuous geographic phenomena such as elevation, temperature, and land cover. This data format is extensively used in urban planning, environmental monitoring, and disaster management, where high-precision imagery and terrain modeling are essential. Advancements in remote sensing technologies and cloud-based geospatial platforms have improved the accessibility and processing efficiency of raster data, further solidifying the segment’s dominance in the global market.

Geospatial Analytics Market Evaluation by Technology Outlook

The global geospatial analytics market evaluation, based on technology, includes sensors & scanning, global navigation satellite system (GNSS), GIS & earth observation, and ML & advanced analytics. The ML & advanced analytics segment is expected to witness the fastest geospatial analytics market growth during the forecast period driven by the increasing need for automated data processing, predictive modeling, and real-time decision-making. Machine learning algorithms enable the rapid analysis of vast geospatial datasets, identifying patterns and insights that traditional methods struggle to detect. Industries such as defense, agriculture, and logistics are leveraging AI-powered geospatial analytics for applications such as crop health monitoring, predictive maintenance, and route optimization. Additionally, the integration of ML with big data analytics and cloud computing is improving scalability and accuracy, thereby accelerating the segment’s growth in the global market.

Geospatial Analytics Market Regional Analysis

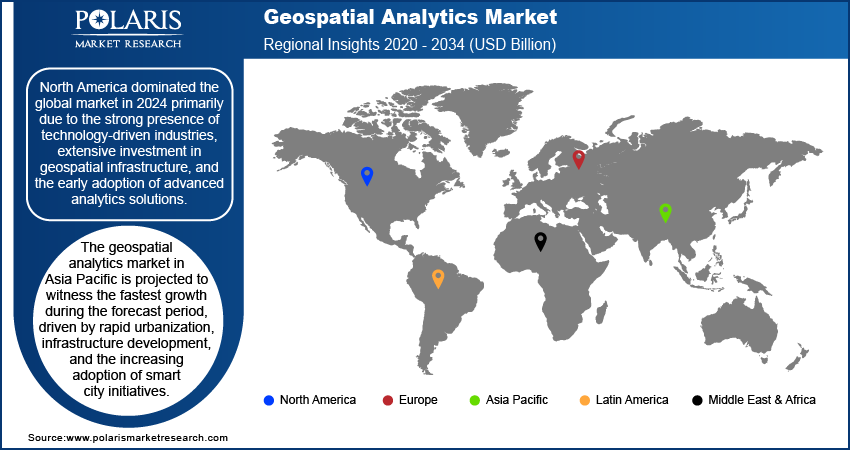

By region, the report provides the geospatial analytics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the geospatial analytics market revenue in 2024 primarily due to the strong presence of technology-driven industries, extensive investment in geospatial infrastructure, and the early adoption of advanced analytics solutions. For instance, the October 2024 FGDS report outlines the NSDI's mission through 2035 to provide timely, reliable, and interoperable geospatial data and services. The goal is to deliver on-demand knowledge and actionable insights that aid decision-making and address challenges at all levels, benefiting everyone. The region’s well-established defense, transportation, and smart city initiatives have fueled demand for geospatial data-driven insights. Moreover, government agencies and private enterprises are actively integrating geospatial analytics into urban planning, environmental monitoring, and emergency response efforts. The presence of leading geospatial technology providers in North America, combined with favorable regulatory support and advancements in AI-driven analytics, further contributes to the regional market dominance.

The Asia Pacific geospatial analytics market is projected to witness the fastest growth during the forecast period driven by rapid urbanization, infrastructure development, and the increasing adoption of smart city initiatives. Countries in the region are investing heavily in geospatial technologies to improve disaster resilience, optimize land use, and improve public services. For instance, in October 2024, Oracle announced a USD 6.5 billion investment to open a public cloud region in Malaysia, offering 150+ infrastructure and SaaS services. The expansion will provide Malaysian organizations access to advanced AI infrastructure, including OCI Generative AI and NVIDIA partnerships. The expansion of industries such as agriculture, construction, and transportation is also fueling demand for advanced geospatial analytics solutions. Additionally, the rising availability of high-resolution satellite imagery and the integration of AI and cloud computing in geospatial applications are accelerating the regional market expansion.

List of Key Companies in Geospatial Analytics Market

- CSS Corp.

- Cybertech Systems and Software Ltd.

- Cyient

- Esri

- General Electric

- Genesys International Corporation

- GeoIQ

- Google LLC

- Hexagon India.

- Kentrix

- Maxar Technologies

- ML Infomap

- NIIT Technologies (Coforge)

- Precisely

- Rolta India Ltd

Geospatial Analytics Market – Key Players and Competitive Insights

The competitive landscape comprises global leaders and regional players aiming to capture geospatial analytics market share through technological innovation, strategic collaborations, and geographic expansion. Established companies such as Esri, Hexagon AB, Trimble Inc., and Maxar Technologies leverage advanced R&D capabilities and extensive distribution networks to offer cutting-edge geospatial solutions, such as GIS software, AI-driven spatial analytics, and high-resolution satellite imagery. Geospatial analytics market trends indicate a growing demand for AI-integrated geospatial analytics, real-time mapping solutions, and cloud-based GIS platforms, reflecting advancements in data processing, machine learning, and spatial intelligence. The geospatial analytics market is expected to witness significant growth, driven by increasing applications in urban planning, disaster management, defense, and smart city initiatives.

Regional players capitalize on localized requirements by providing cost-effective, scalable, and application-specific geospatial solutions, particularly in fast-growing regions such as Asia Pacific, which is projected to expand at the highest CAGR. Competitive strategies include mergers and acquisitions, partnerships with government agencies and technology firms, and the development of next-generation geospatial platforms to meet the rising demand for precise and actionable spatial intelligence. These advancements highlight the pivotal role of technological evolution, market adaptability, and regional investments in shaping the future of the geospatial analytics industry. A few key major players are CSS Corp; Cybertech Systems and Software Ltd; Cyient; Esri; General Electric; Genesys International Corporation; GeoIQ; Google LLC; Hexagon India; Kentrix; Maxar Technologies; ML Infomap; NIIT Technologies (Coforge); Precisely; and Rolta India Ltd.

CyberTech Systems and Software Ltd., founded in 1995, is a provider of geospatial analytics and IT solutions, primarily serving clients in the US. The company specializes in Enterprise Cloud Transformation, offering cloud-based SAP solutions and Esri ArcGIS Enterprise platforms, which enhance customer experiences and operational efficiency. CyberTech's expertise in spatial analytics integrates geographic data with enterprise information, enabling organizations to leverage real-time insights for improved decision-making. With a commitment to innovation, CyberTech has evolved into a leader in geospatial technologies, focusing on developing cloud-native SaaS products through its subsidiary, Spatialitics LLC. The company’s strategic partnerships with industry giants such as ESRI and SAP further solidify its position as a trusted partner in digital transformation initiatives across various sectors such as government, healthcare, and retail. CyberTech's dedication to quality and customer satisfaction has earned it a strong reputation globally.

Google LLC, a subsidiary of Alphabet Inc., is an American multinational corporation renowned for its diverse range of services, particularly in online advertising and search engine technology. Founded in 1998, Google has evolved into a dominant force in the tech industry, offering products such as Google Search, Google Maps, and Google Cloud. The company is recognized for its innovations in geospatial analytics, leveraging vast datasets to enhance location-based services and provide insights for businesses and consumers alike. Google Earth and Google Maps exemplify its capabilities in geospatial technology, enabling users to visualize and analyze geographic data effectively. Google continues to shape the future of digital interaction and data utilization across various sectors with a global presence and a commitment to artificial intelligence, making it an integral player in the realm of geospatial analytics.

Geospatial Analytics Industry Developments

January 2024: Deloitte launched a Geospatial and AI Platform for Scenario Planning, utilizing Google Earth and Vertex AI. The platform helps clients address sustainability challenges by improving disaster response, urban planning, and land use insights, while supporting sustainable investments.

October 2024: Ghent University in Belgium launched an international research center aimed at addressing geospatial problems by enhancing the spatial reasoning and analytical capabilities of artificial intelligence (AI) models.

Geospatial Analytics Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Surface & Field Analytics

- Network & Location Analytics

- Geo-Visualization

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Surveying

- Medicine & Public Safety

- Military Intelligence

- Disaster Risk Reduction & Management

- Marketing Management

- Climate Change Adaption (CCA)

- Urban Planning

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Sensors & Scanning

- Global Navigation Satellite System (GNSS)

- GIS & Earth Observation

- ML & Advanced Analytics

By Data Type Outlook (Revenue, USD Billion, 2020– 2034)

- Raster Data

- Vector Data

- Geo-Temporal Data

- 3D Data

- Tabular Data

- Other Data Types

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Geospatial Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 31.33 billion |

|

Market Size Value in 2025 |

USD 34.67 billion |

|

Revenue Forecast by 2034 |

USD 88.01 billion |

|

CAGR |

10.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global geospatial analytics market size was valued at USD 31.33 billion in 2024 and is projected to grow to USD 88.01 billion by 2034.

• The global market is projected to register a CAGR of 10.9% during the forecast period.

• North America dominated the geospatial analytics market revenue in 2024.

• Some of the key players in the market are CSS Corp; Cybertech Systems and Software Ltd; Cyient; Esri; General Electric; Genesys International Corporation; GeoIQ; Google LLC; Hexagon India; Kentrix; Maxar Technologies; ML Infomap; NIIT Technologies (Coforge); Precisely; and Rolta India Ltd.

• The raster data segment dominated the geospatial analytics market expansion in 2024.