Genetic Analysis Market Size, Share, Trends, Industry Analysis Report

: By Technology (Next Generation Sequencing (NGS), Array Technology, PCR-Based Testing, FISH, and Others), Type, Application, Product, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 116

- Format: PDF

- Report ID: PM3113

- Base Year: 2024

- Historical Data: 2020-2023

Genetic Analysis Market Overview

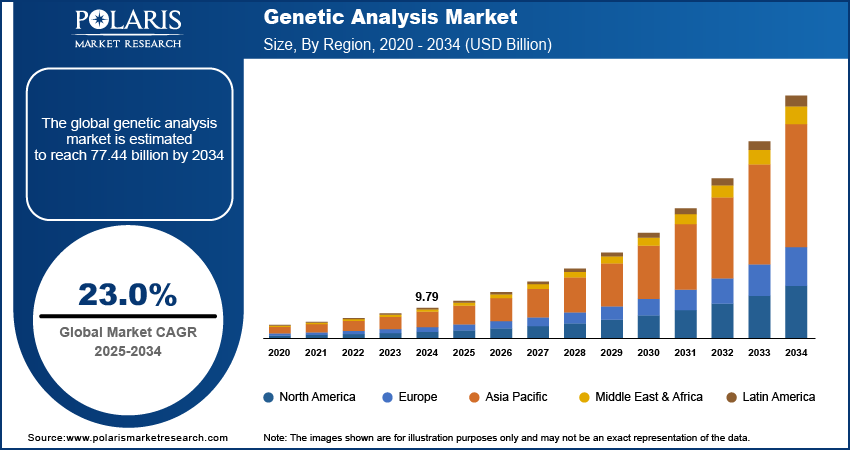

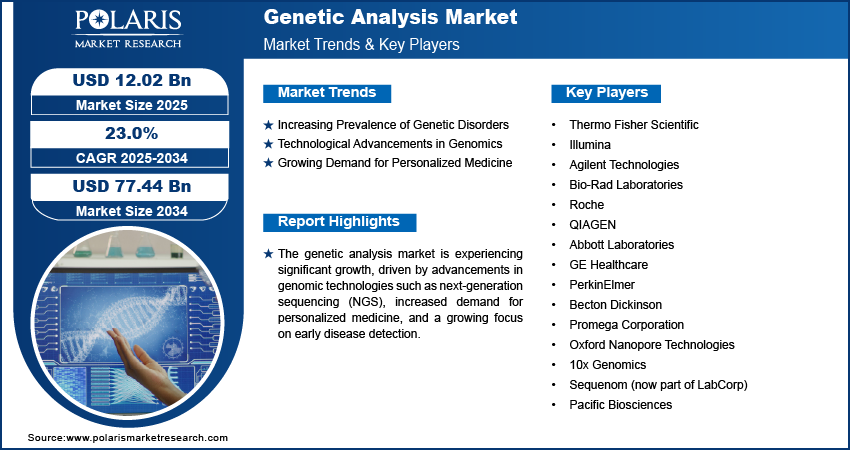

The genetic analysis market size was valued at USD 9.79 billion in 2024. The market is projected to grow from USD 12.02 billion in 2025 to USD 77.44 billion by 2034, exhibiting a CAGR of 23.0% during 2025–2034.

The genetic analysis market involves the study and interpretation of genetic material to understand genetic variation, inheritance patterns, and potential health risks. This market has expanded due to advancements in genomics, biotechnology, and precision medicine, driving demand for genetic testing in healthcare, agriculture, and forensic applications. Key drivers include the increasing prevalence of genetic disorders, growing awareness of personalized medicine, and technological improvements in gene sequencing and analysis. Additionally, trends such as the integration of artificial intelligence in genetic research and the development of direct-to-consumer genetic testing are contributing to genetic analysis market growth. The market is also influenced by regulatory developments and an increasing focus on early disease detection and prevention.

To Understand More About this Research: Request a Free Sample Report

Genetic Analysis Market Dynamics

Increasing Prevalence of Genetic Disorders

The rising incidence of genetic disorders is a major genetic analysis market driver. As genetic testing becomes more accessible, there is an increased focus on early detection and prevention of hereditary diseases. Conditions such as cystic fibrosis, sickle cell anemia, and Down syndrome have contributed to a greater demand for genetic analysis services. According to the Centers for Disease Control and Prevention (CDC), genetic disorders affect 1 in 100 live births in the United States alone. With this high prevalence, healthcare systems are increasingly relying on genetic testing to improve diagnostic accuracy, identify risks, and provide personalized treatment plans, all of which stimulate the market's growth.

Technological Advancements in Genomics

Technological innovations in genomics, particularly in next-generation sequencing (NGS), have significantly advanced the capabilities of genetic analysis. These advancements allow for faster, more accurate, and less costly genetic testing, leading to a broader adoption of these services. For instance, NGS technologies have reduced sequencing costs from billions of dollars to a few thousand dollars over the past decade. According to the National Human Genome Research Institute, the cost of sequencing a human genome has dropped from approximately $100 million in 2001 to under $1,000 today. This reduction in cost, coupled with enhanced precision and throughput, is a key factor driving the widespread use of genetic testing in clinical, research, and personal healthcare settings.

Growing Demand for Personalized Medicine

The growing shift towards personalized or precision medicine is another significant market driver. Personalized medicine tailors treatment plans based on an individual's genetic profile, offering more effective and targeted therapies. As healthcare providers recognize the value of genetic testing in predicting treatment responses, there is an increasing demand for genetic analysis to guide clinical decisions. In 2020, the National Institutes of Health (NIH) reported that over 4,000 drugs are now in development with a genetic or molecular profile in mind. This demand for tailored therapies is accelerating the adoption of genetic analysis in both clinical settings and research, further contributing to the genetic analysis market expansion.

Genetic Analysis Market Segment Insights

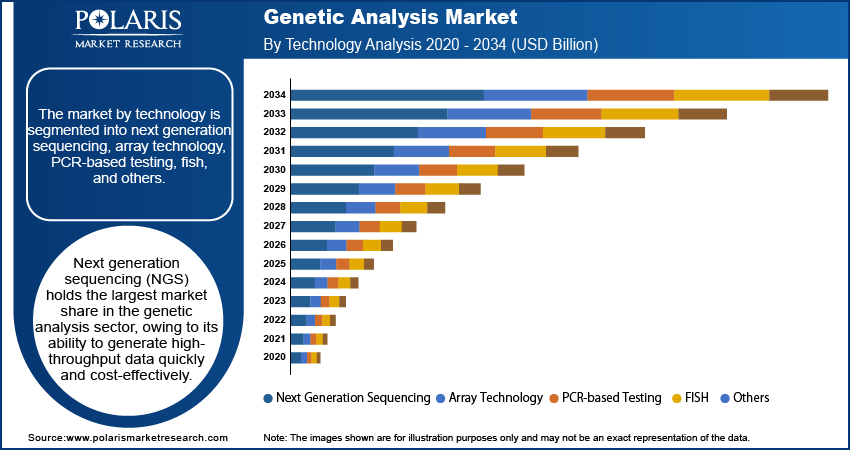

Genetic Analysis Market Assessment by Technology

The genetic analysis market, by technology, is segmented into next generation sequencing (NGS), array technology, PCR-based testing, FISH, and others. Next generation sequencing (NGS) holds the largest market share in the genetic analysis sector, owing to its ability to generate high-throughput data quickly and cost-effectively. NGS has revolutionized genomics by enabling the sequencing of entire genomes with precision, making it a preferred choice for clinical diagnostics, research, and personalized medicine. Its growing adoption is further supported by technological advancements that reduce sequencing costs and improve accuracy, allowing for broader applications in areas such as oncology, genetic disorders, and rare disease diagnostics.

NGS is also registering the highest growth rate among the technologies due to the increasing demand for genomic data, particularly in research and clinical applications that require extensive genetic analysis. Array technology and digital PCR-based testing also contribute significantly to the market, though at a comparatively slower pace. PCR-based testing is widely used for detecting specific genetic markers, and array technology is commonly employed in gene expression studies and disease research.

Genetic Analysis Market Evaluation by Product

The genetic analysis market segmentation, based on product, includes consumables, equipment, and software & services. The consumables segment holds the largest market share, driven by the continuous need for reagents, kits, and other consumable products required for genetic testing procedures. These consumables are essential in all stages of genetic analysis, from sample collection and preparation to sequencing and data analysis. The high demand for consumables is also fueled by the growing volume of genetic tests and the increasing frequency of genetic studies across various sectors such as healthcare, agriculture, and research. As more genetic tests are conducted, the demand for consumables continues to grow, contributing to the segment's dominant position in the market.

The software and services segment is also experiencing the fastest growth, driven by advancements in bioinformatics and data analytics. As genetic sequencing technologies, particularly NGS, generate large volumes of data, there is an increasing need for advanced software solutions that can efficiently process, analyze, and interpret these complex datasets. Additionally, the rise of cloud-based platforms and AI-driven solutions for genetic data analysis is propelling the growth of this segment. While the equipment segment, which includes sequencing instruments and related hardware, remains important, it is the software and services segment that is benefiting most from the growing complexity of genetic research and clinical diagnostics, thus registering the highest growth rate.

Genetic Analysis Market Assessment by End Use

The genetic analysis market, by end use, is segmented into hospitals & clinics, diagnostic laboratories, and others. The hospitals & clinics segment holds the largest market share, driven by the increasing adoption of genetic testing for clinical diagnostics and personalized treatment plans. Hospitals & clinics play a crucial role in providing genetic services for a wide range of conditions, including cancer, genetic disorders, and cardiovascular diseases. With the growing prevalence of chronic diseases and genetic disorders, these healthcare institutions are incorporating genetic testing into routine clinical workflows. The demand for genetic testing in hospitals and clinics is also supported by advancements in genomic medicine, which facilitate the development of targeted therapies and precision treatments for patients.

The diagnostic laboratories segment is also registering the fastest growth, as these facilities are becoming key providers of genetic testing services. The increasing demand for genetic testing, particularly for disease screening, prenatal testing, and cancer diagnostics, is driving this growth. Diagnostic laboratories are adopting advanced technologies such as NGS and PCR-based testing to meet the rising volume of tests. Moreover, the shift towards preventive healthcare and the focus on early disease detection are contributing to the growth of this segment. Laboratories are also benefitting from collaborations with hospitals, research institutions, and biotechnology companies, further driving the adoption of genetic analysis in diagnostics.

Genetic Analysis Market Regional Insights

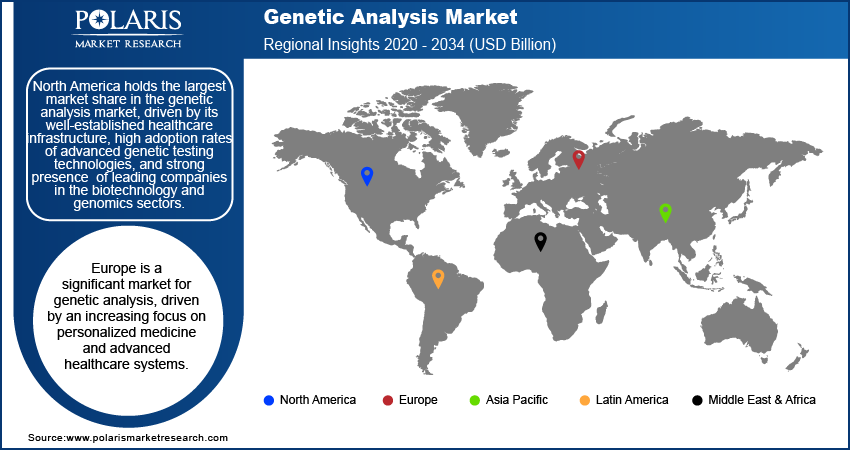

By region, the study provides genetic analysis market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by its well-established healthcare infrastructure, high adoption rates of advanced genetic testing technologies, and strong presence of leading companies in the biotechnology and genomics sectors. The region's dominance is further supported by significant investments in healthcare research, favorable reimbursement policies for genetic testing, and growing awareness about hyper personalized medicine and precision healthcare. The US, in particular, plays a pivotal role due to its advanced healthcare system, high levels of genetic research funding, and widespread integration of genetic analysis into clinical practices. Additionally, North America's emphasis on early disease detection and personalized treatments continues to drive the demand for genetic testing, further solidifying its leadership in the market.

Europe is a significant market for genetic analysis, driven by an increasing focus on personalized medicine and advanced healthcare systems. The region has been investing heavily in genomics research and biotechnology, with countries such as the UK, Germany, and France leading the adoption of genetic testing in clinical and research settings. The presence of well-established healthcare infrastructure, alongside supportive government initiatives and regulatory frameworks, fosters the growth of genetic analysis technologies. Moreover, the rising awareness of genetic disorders and preventive healthcare is encouraging the use of genetic testing in Europe. However, varying reimbursement policies across countries may affect the rate of adoption in some regions.

Asia Pacific is experiencing rapid growth in the genetic analysis market, driven by an expanding healthcare sector, rising disposable incomes, and increasing awareness of genetic diseases. Countries such as China, India, and Japan are major contributors to the market, with large populations and a growing demand for advanced diagnostic tools. In particular, China’s investment in genomics and biotechnology research, along with India’s expanding healthcare infrastructure, positions the region as a key growth area for genetic testing. The increasing prevalence of genetic disorders and the growing focus on precision medicine are also factors propelling the adoption of genetic analysis technologies in Asia Pacific. Despite these opportunities, challenges such as regulatory hurdles and affordability remain in some countries, potentially slowing market growth.

Genetic Analysis Market – Key Players and Competitive Insights

Key players in the genetic analysis market include Thermo Fisher Scientific, Illumina, Agilent Technologies, Bio-Rad Laboratories, Roche, QIAGEN, Abbott Laboratories, GE Healthcare, PerkinElmer, Becton Dickinson, Promega Corporation, Oxford Nanopore Technologies, 10x Genomics, Sequenom (now part of LabCorp), and Pacific Biosciences. These companies are actively involved in providing various genetic testing technologies, from sequencing platforms to diagnostic kits and software solutions. Thermo Fisher Scientific, for example, offers a wide range of products for genetic analysis, including reagents, consumables, and instruments. Illumina is well-known for its advanced sequencing technologies, while QIAGEN and Bio-Rad provide PCR-based testing solutions and reagents for genetic analysis. Other players such as Oxford Nanopore Technologies and Pacific Biosciences are recognized for their innovations in sequencing technology, specifically in real-time and long-read sequencing, respectively.

The competitive landscape is shaped by ongoing technological advancements and a focus on expanding product offerings to meet diverse genetic testing needs. Companies such as Thermo Fisher Scientific and Illumina are investing heavily in research and development to enhance sequencing technologies and make them more affordable and accessible. The demand for precision medicine and personalized treatment is fostering competition, particularly among companies specializing in diagnostics and clinical genetic testing. As a result, many of these companies are exploring strategic partnerships, acquisitions, and collaborations with healthcare providers, research institutions, and biotech firms to strengthen their positions in the market.

Companies are also adapting to the growing demand for software and services that complement genetic analysis. Players such as 10x Genomics and Promega Corporation are focusing on enhancing data analytics and bioinformatics tools to process large volumes of genetic data. The increasing integration of artificial intelligence in genetic analysis is shaping the direction of the market, with players investing in AI-driven software solutions to improve accuracy and efficiency in genetic testing. Competitive strategies also involve focusing on regional expansion, with companies targeting emerging markets in Asia Pacific and Latin America, where the demand for genetic analysis services is on the rise.

Thermo Fisher Scientific is a major genetic analysis market player. It provides a wide range of products and services that support genetic testing across various applications, including research, clinical diagnostics, and pharmaceutical development. The company’s offerings include instruments, reagents, and consumables for genetic sequencing, PCR-based testing, and gene expression analysis. Thermo Fisher continues to expand its presence in the market through strategic acquisitions and innovations, ensuring its position as a key provider of solutions for genetic analysis.

Illumina is another key player known for its advancements in next-generation sequencing (NGS) technology. The company develops and manufactures sequencing systems, reagents, and software solutions that enable high-throughput genomic analysis. Illumina’s products are widely used in research institutions, healthcare settings, and pharmaceutical companies.

List of Key Companies in Genetic Analysis Market

- Thermo Fisher Scientific

- Illumina

- Agilent Technologies

- Bio-Rad Laboratories

- Roche

- QIAGEN

- Abbott Laboratories

- GE Healthcare

- PerkinElmer

- Becton Dickinson

- Promega Corporation

- Oxford Nanopore Technologies

- 10x Genomics

- Sequenom (now part of LabCorp)

- Pacific Biosciences

Genetic Analysis Market Developments

- December 2024: Thermo Fisher Scientific announced the launch of a new sequencing platform designed to improve speed and accuracy in genetic testing, targeting the growing demand for personalized medicine.

- November 2024: Illumina unveiled a new partnership with a leading healthcare provider to integrate its sequencing technology into clinical diagnostics. This collaboration aims to make testing more accessible to healthcare providers globally, enhancing the ability to detect genetic diseases and improve patient treatment plans.

Genetic Analysis Market Segmentation

By Technology Outlook (Revenue-USD Billion, 2020–2034)

- Next Generation Sequencing (NGS)

- Array Technology

- PCR-Based Testing

- FISH

- Others

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Predictive Genetic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Disease Diagnostic Testing

- Pharmacogenomic Testing

- Others

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Cancer

- Genetic Diseases

- Cardiovascular Diseases

- Rare Diseases

- Infectious Diseases

- Others

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Consumables

- Equipment

- Software & Services

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Genetic Analysis Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.79 billion |

|

Market Size Value in 2025 |

USD 12.02 billion |

|

Revenue Forecast by 2034 |

USD 77.44 billion |

|

CAGR |

23.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The genetic analysis market has been segmented into detailed segments of technology, type, application, product, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the genetic analysis market focus on expanding product offerings and enhancing technological capabilities to meet the increasing demand for genetic testing. Companies are investing in research and development to improve the accuracy, speed, and cost-effectiveness of genetic analysis tools, with a particular emphasis on next-generation sequencing (NGS) and bioinformatics solutions. Strategic partnerships and collaborations with healthcare providers, research institutions, and biotech firms are also key to driving market expansion. Additionally, players are targeting emerging markets, particularly in Asia Pacific and Latin America, where the adoption of genetic testing is growing. Companies are increasingly emphasizing the integration of artificial intelligence and cloud-based platforms to improve data analysis and decision-making in genetic diagnostics

FAQ's

The genetic analysis market size was valued at USD 9.79 billion in 2024 and is projected to grow to USD 77.44 billion by 2034.

The market is projected to register a CAGR of 23.0% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the genetic analysis market include Thermo Fisher Scientific, Illumina, Agilent Technologies, Bio-Rad Laboratories, Roche, QIAGEN, Abbott Laboratories, GE Healthcare, PerkinElmer, Becton Dickinson, Promega Corporation, Oxford Nanopore Technologies, 10x Genomics, Sequenom (now part of LabCorp), and Pacific Biosciences.

The next generation sequencing (NGS) segment accounted for the larger share of the market in 2024.

The consumables segment accounted for the larger share of the market in 2024.

Genetic analysis is the process of examining and interpreting genetic material, such as DNA or RNA, to understand genetic variations, identify potential genetic disorders, and uncover insights related to inheritance patterns and disease susceptibility. This analysis involves various techniques like sequencing, polymerase chain reaction (PCR), and microarrays to detect mutations, variations, and other genetic markers. It is widely used in clinical diagnostics, research, personalized medicine, and forensics to help in disease diagnosis, treatment planning, and understanding of genetic conditions. The insights from genetic analysis play a key role in advancing precision medicine and tailoring medical treatments based on an individual's genetic makeup.

A few key trends in the market are described below: Advancements in Next-Generation Sequencing (NGS): Continuous improvements in NGS technology, offering faster, more accurate, and cost-effective genetic analysis. Integration of Artificial Intelligence: Use of AI and machine learning to analyze complex genetic data and improve diagnostic accuracy. Personalized Medicine: Growing emphasis on tailoring treatments based on an individual’s genetic profile for more effective healthcare. Direct-to-Consumer Genetic Testing: Increase in consumer-driven genetic tests for ancestry, health risks, and disease predispositions.

A new company entering the genetic analysis market could focus on developing advanced bioinformatics and data analytics solutions to complement genetic testing technologies, helping healthcare providers interpret complex genetic data more effectively. It could also target niche applications such as early disease detection, rare genetic disorders, or personalized cancer treatments, areas with growing demand. Investing in cost-effective, scalable next-generation sequencing platforms that offer faster results at lower costs could give the company a competitive edge. Additionally, focusing on partnerships with healthcare institutions and biotechnology firms for data sharing and collaboration could help expand market reach. Leveraging AI-driven solutions to automate and optimize genetic data analysis would also be a key differentiator.

Companies manufacturing, distributing, or purchasing genetic analysis and related products, and other consulting firms must buy the report.