Generative AI Market Size, Share, Trends, Industry Analysis Report: By Component (Software and Services), Technology, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM2992

- Base Year: 2024

- Historical Data: 2020-2023

Generative AI Market Overview

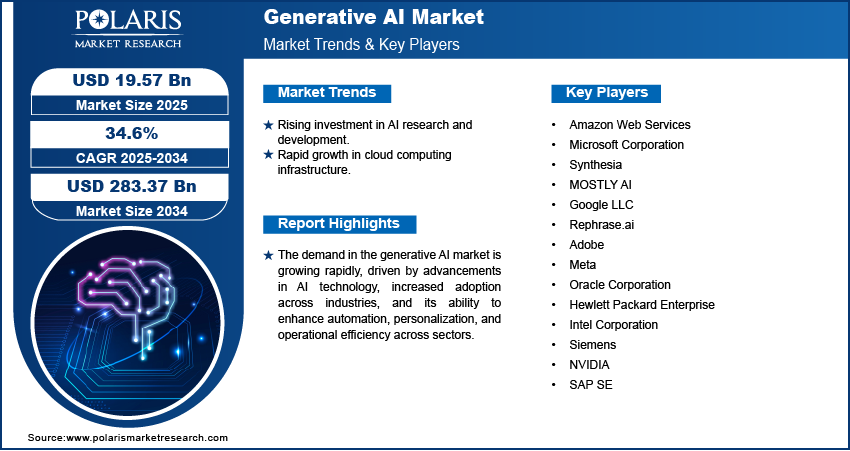

The global generative AI market size was valued at USD 14.59 billion in 2024. The market is projected to grow from USD 19.57 billion in 2025 to USD 283.37 billion by 2034, exhibiting a CAGR of 34.6% during the forecast period.

Generative AI refers to a subset of artificial intelligence that focuses on creating new data, such as text, images, audio, or video, by learning patterns and structures from existing datasets. This technology leverages advanced models such as Generative Adversarial Networks (GANs) and transformers to generate content, making it an essential tool for various applications. The global demand for generative AI is experiencing exponential growth, driven by its diverse use cases and transformative potential across industries.

To Understand More About this Research: Request a Free Sample Report

One of the key factors propelling the generative AI market revenue is its increasing utilization in tasks such as spam detection, data preprocessing, image compression, and noise reduction in visual data. Additionally, its growing adoption in medical imaging equipment and image classification has further solidified its significance in critical domains such as healthcare. Generative AI’s ability to enhance operational efficiency and foster innovation has made it indispensable for businesses seeking AI-driven solutions. For instance, in March 2023, Microsoft Corporation introduced Visual ChatGPT, an innovative model integrating multiple visual foundation models. This breakthrough allows users to interact with ChatGPT via graphical user interfaces, expanding the scope of AI-powered tools in creative and professional workflows.

Generative AI Market Dynamics

Rising Investment in AI Research and Development

Governments and organizations worldwide are allocating substantial funds to accelerate advancements in artificial intelligence, recognizing its transformative potential across industries. For instance, the EU has heavily invested in AI through initiatives such as Horizon Europe and the Digital Europe Programme, committing EUR 2.6 billion for 2021-2022 and an additional EUR 4 billion for generative AI development by 2027 through the AI Innovation Package. These investments are enhancing the capabilities of generative AI and also broadening its applications in areas such as data preprocessing, image compression, and medical imaging. As a result, rising investments in AI research and development are significantly driving generative AI market growth.

Rapid Growth in Cloud Computing Infrastructure

Cloud platforms provide the scalable computing power and storage necessary to train and deploy advanced generative AI models, enabling organizations to harness AI-driven solutions more effectively. The demand for generative AI continues to rise across various sectors, including healthcare, finance, and entertainment, as businesses increasingly adopt cloud-based services.

For instance, in October 2024, Oracle invested over $6.5 billion to establish a public cloud region in Malaysia, emphasizing the critical role of cloud infrastructure in enhancing AI innovation and digital transformation. This expansion of Oracle Cloud Infrastructure (OCI) in Asia Pacific highlights advancements in cloud computing are empowering organizations to deploy generative AI applications more efficiently, thereby driving generative AI market demand. The synergy between cloud computing and AI is expected to continue fueling the adoption and evolution of generative AI technologies globally.

Generative AI Market Segment Analysis

Generative AI Market Assessment by Component Outlook

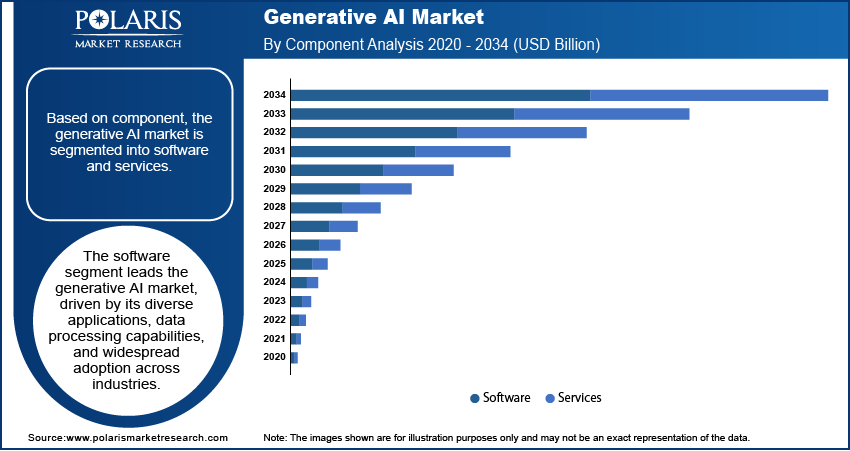

The global generative AI market segmentation, based on component, includes software and services. The software segment accounted for ∼ 59% of the generative AI market share in 2024 due to its diverse applications and ability to quickly process vast amounts of data. AI software is particularly valued for its capacity to synthesize data from various hardware systems and generate intelligent responses, making it essential across industries. It is increasingly used in applications such as smartphone assistants, ATMs, ad-serving software, and voice and image recognition, all of which are driving the demand for advanced AI solutions. The ability of AI software to improve operational efficiency, automate tasks, and deliver personalized experiences further propels its growth. This rapid surge in research and development of AI software such as NLP, ML & DL,etc, along with the integration of AI into everyday technology, solidifies the software segment's dominance in the market.

Generative AI Market Evaluation by Technology Outlook

The global generative AI market segmentation, based on technology, includes generative adversarial networks, transformers, variational auto-encoders, and diffusion networks. The diffusion networks segment is expected to register the highest CAGR of 39.1% during the forecast period due to the growing demand for image synthesis and generation across various industries. Diffusion networks, which employ advanced generative models to create high-quality images, are increasingly utilized in sectors such as healthcare, BFSI, automotive, transportation, defense, media & entertainment, and IT & telecommunication. These networks offer significant value by enhancing operational efficiency, enabling faster decision-making, and providing better customer experiences. For instance, in healthcare, diffusion networks generate medical images for analysis, improving diagnostic accuracy. The demand for diffusion networks is expected to surge as businesses and governments continue to recognize the benefits of this technology, making it one of the fastest-growing segments in the market.

Generative AI Market Regional Analysis

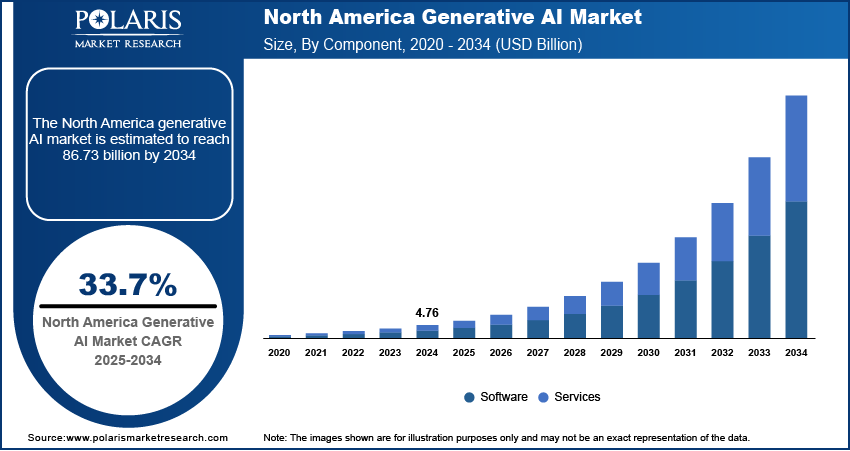

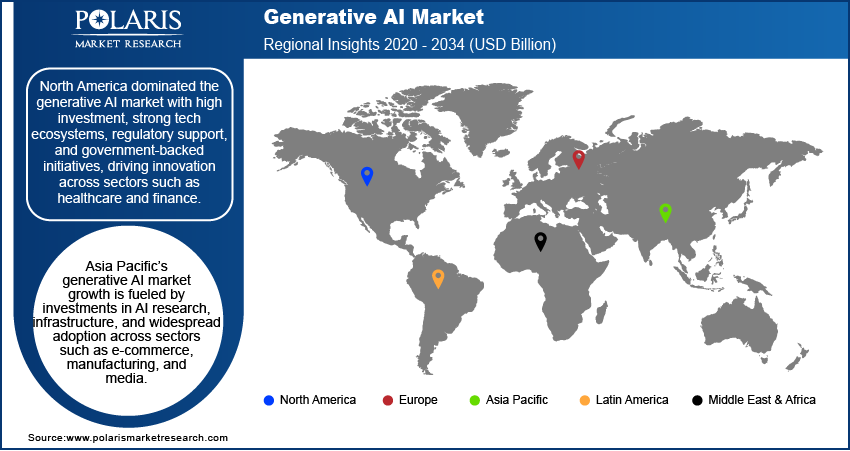

By region, the study provides generative AI market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market due to its high investment levels, a robust ecosystem of technology companies, and leading research institutions. The region’s rapid adoption of generative AI across sectors such as healthcare, finance, and entertainment reflect its growing recognition of AI’s potential to enhance productivity and foster innovation. North America’s commitment to developing AI technologies is supported by substantial funding and a thriving startup culture, particularly in the US. For instance, in 2022, the US government allocated $4.8 billion to AI research, focusing on smart health, data science, astronomical sciences, and materials research through NSF-led initiatives. Additionally, regulatory frameworks on data privacy and AI ethics are helping shape responsible AI adoption, further encouraging its growth. In Canada, government-backed initiatives are promoting AI research and innovation, creating an environment conducive to generative AI development. This combination of investment, talent, and regulatory support positions North America as a global leader in generative AI technology.

Asia Pacific is experiencing the fastest growth in the generative AI market, driven by substantial investments in AI research and infrastructure across major economies such as China, Japan, India, and South Korea. These countries are advancing in sectors such as autonomous systems, robotics, and digital transformation. The widespread adoption of generative AI in e-commerce, manufacturing, and media is further propelling growth as businesses seek automation and personalization. For instance, AWS's $8.3 billion investment in cloud infrastructure in Maharashtra by 2030 will boost India’s GDP by $15.3 billion, reinforcing the region's rapidly expanding AI capabilities.

Generative AI Market – Key Players and Competitive Analysis Report

The competitive landscape of the generative AI market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Amazon Web Services, Microsoft Corporation, and others in the market leverage their robust research and development capabilities along with extensive distribution networks to offer advanced generative AI solutions tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller regional firms are entering the market with specialized generative AI solutions targeting local market demands, often focusing on customized and cost-effective applications. A few competitive strategies in the generative AI industry include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence and cater to the growing demand for advanced grid solutions. Amazon Web Services, Microsoft Corporation, Synthesia, MOSTLY AI, Google LLC, Rephrase.ai, Adobe, Meta, Oracle Corporation, Hewlett Packard Enterprise, Intel Corporation, Siemens, NVIDIA, and SAP SE are among the key major players.

Adobe offers digital media and marketing solutions, including creative tools such as Photoshop and Premiere Pro, integrating generative AI for enhanced workflows and providing security solutions across sectors. In June 2023, Adobe partnered with Omnicom Group, leveraging joint generative AI capabilities to empower shared clients to craft on-brand content for improved marketing outcomes

Hewlett Packard Enterprise provides intelligent solutions across six segments, including HPC & AI, storage, intelligent edge, and financial services. It helps clients capture, analyze, and act on data from edge to cloud. In June 2023, Hewlett Packard Enterprise launched HPE GreenLake for Large Language Models, an AI cloud service enabling enterprises to privately train and deploy large-scale AI models using HPE's supercomputing platform and partnering with Aleph Alpha for field-proven LLM capabilities.

List of Key Companies in Generative AI Market

- Amazon Web Services

- Microsoft Corporation

- Synthesia

- MOSTLY AI

- Google LLC

- Rephrase.ai

- Adobe

- Meta

- Oracle Corporation

- Hewlett Packard Enterprise

- Intel Corporation

- Siemens

- NVIDIA

- SAP SE

Generative AI Market Developments

August 2023: Meta launched AudioCraft, a suite of generative AI music tools that challenges Google's MusicLM and enables users to create musical compositions from text inputs.

August 2023: NVIDIA and Dell Technologies partnered to develop comprehensive generative AI solutions, alleviating challenges in establishing AI-focused IT infrastructure.

July 2023: SAP advanced its Business AI vision with investments in Aleph Alpha, Anthropic, and Cohere. This enhanced its open ecosystem strategy alongside Sapphire Ventures' $1+ billion AI commitment.

Generative AI Market Segmentation

By Component Outlook (Revenue, USD Billion, 2021–2034)

- Software

- Services

By Technology Outlook (Revenue, USD Billion, 2021–2034)

- Generative Adversarial Networks

- Transformers

- Variational Auto-encoders

- Diffusion Networks

By End Use Outlook (Revenue, USD Billion, 2021–2034)

- Media & Entertainment

- BFSI

- IT & Telecommunication

- Healthcare

- Automotive & Transportation

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Generative AI Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.59 billion |

|

Market Size Value in 2025 |

USD 19.57 billion |

|

Revenue Forecast by 2034 |

USD 283.37 billion |

|

CAGR |

34.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global generative AI market size was valued at USD 14.59 billion in 2024 and is projected to grow to USD 283.37 billion by 2034.

• The global market is projected to register a CAGR of 34.6% during the forecast period.

• North America dominated the generative AI market in 2024.

• A few key players in the market are Amazon Web Services, Microsoft Corporation, Synthesia, MOSTLY AI, Google LLC, Rephrase.ai, Adobe, Meta, Oracle Corporation, Hewlett Packard Enterprise, Intel Corporation, Siemens, NVIDIA, and SAP SE.

• The software segment led the market share in 2024.

• The diffusion networks segment of the generative AI market is anticipated to register the highest growth rate during the forecast period.