Gene Therapy Market Size, Share, Trends, Industry Analysis Report: By Therapeutic Area (Autoimmune Disorders, Cardiovascular Diseases, Dermatological Disorders, Hematological Disorders, Metabolic Disorders, Muscle-Related Diseases, Oncological Disorders, and Others), Vector Type, Approach, Route of Administration, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Feb-2025

- Pages: 154

- Format: PDF

- Report ID: PM1084

- Base Year: 2024

- Historical Data: 2020-2023

Gene Therapy Market Overview

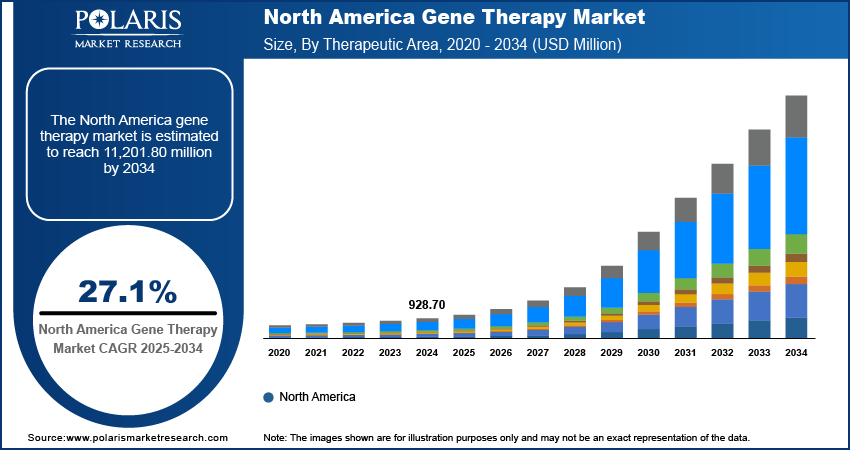

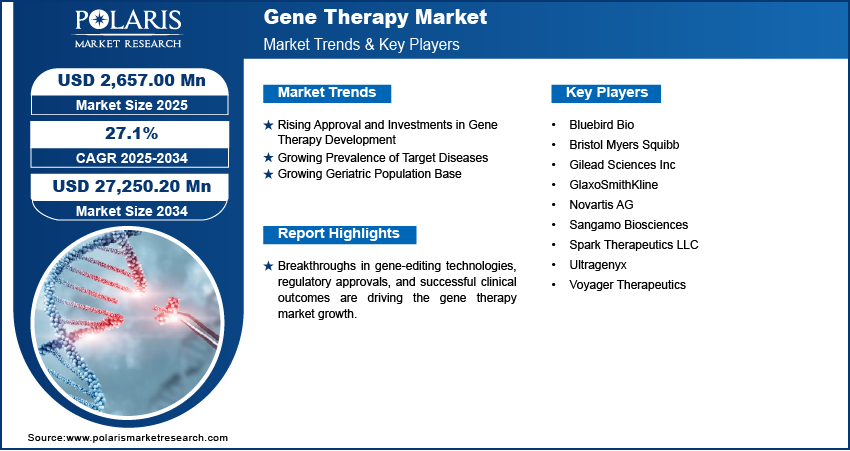

The global gene therapy market size was valued at USD 2,251.50 million in 2024. The market is projected to grow from USD 2,657.00 million in 2025 to USD 27,250.20 million by 2034, exhibiting a CAGR of 27.1% during 2025–2034.

Gene therapy refers to modifying a person's genes in order to treat certain diseases and conditions. It covers a wide range of aspects, from development, testing, and production to the marketing and distribution of gene-based therapies. Gene therapy encompasses the modification, addition, or alteration of genes to treat genetic disorders or improve specific biological processes. The gene therapy market demand is propelled by gene delivery technology advancements, strong research pipelines, and increasing regulatory approvals. Significant investors focus their funds on developing therapies for many other conditions, including cancer and central nervous system disorders. In spite of the increasing costs of development and stringent regulations, the overall market conditions have optimism for growth.

The prevalence of genetic disorders such as Duchenne muscular dystrophy (DMD), sickle cell disease, and cystic fibrosis is rising. The CDC reports that sickle cell disease affects approximately 100,000 Americans, and the incidence of cystic fibrosis is about 1 in 3,000 newborns in the US. Increased in these disease cases drives patients and healthcare providers to seek effective treatments. Gene therapy offers a promising solution by targeting and correcting defective genes, potentially providing a cure or significantly improving patient outcomes. Therefore, the demand for gene therapy is increasing with the rising incidence of genetic disorders such as Duchenne muscular dystrophy (DMD), sickle cell disease, and cystic fibrosis.

To Understand More About this Research: Request a Free Sample Report

The gene therapy market development is driven by rising regulatory support. The US FDA has approved multiple gene therapies, including Luxturna (2017), Zolgensma (2019), and Casgevy/Lovotibeglogene autotemcel (2023) for sickle cell disease. The European Medicines Agency (EMA) has also approved Skysona (bluebird bio) for cerebral adrenoleukodystrophy. Expedited pathways such as RMAT (Regenerative Medicine Advanced Therapy) and PRIME (Priority Medicines) in the EU facilitate faster approvals, enhancing investment attractiveness and accelerating commercialization of gene therapy, thereby propelling market growth.

Gene Therapy Market Dynamics

Rising Approval and Investments in Gene Therapy Development

The launch of Akcea Therapeutics’ Tegsedi, with the approval of Novartis’ Zolgensma, upheld the global gene therapy market with substantial growth. Big pharma companies are investing heavily in gene therapy. Roche acquired Spark Therapeutics for USD 4.3 billion, whereas Pfizer is actively developing multiple gene therapy programs. Biotech companies such as Bluebird Bio and Sarepta have secured significant funding to advance their product pipelines. Venture capital funding for gene therapy startups exceeded USD 3 billion in 2023, with major deals such as ElevateBio’s USD 401 million investment. The ongoing competitive strategies adopted by market participants, as well as the wide application portfolio of the therapy, in addition to its efficacy, is leading toward rapid gene therapy market growth.

Growing Prevalence of Target Diseases

Cardiovascular diseases have become the most dominant cause of mortality and morbidity in the world for the last three decades. According to a report published by the WHO (World Health Organization), cardiovascular diseases will cause ∼23.3 million deaths by 2030. The high presence of unmet medical needs pertaining to this disease and the subsequent rise observed in patient awareness levels across the globe is boosting the demand for gene therapy as it helps find the right medication to manage cardiovascular disorders. Therefore, the growing prevalence of target diseases such as cancer, cardiovascular diseases, and others is fueling the gene therapy market expansion.

Growing Geriatric Population Base

The global geriatric population base is on the rise. Estimates published by the WHO suggest that the global base of population pertaining to the age group 65 years and above is expected to rise from 7% in 2000 to 16% in 2050. Japan and China are two of the Asian countries with the most geriatric population, with Japan’s geriatric population growing at a very rapid pace. Estimates suggest that more than 20% of the population in Japan is over the age of 65 years. Geriatric population is highly prone to diseases, such as cardiovascular and cancer, and gene therapy is a widely used therapeutic to treat these diseases or conditions. Hence, the rising geriatric population across the world boosts the gene therapy market growth.

Gene Therapy Market Segment Analysis

Gene Therapy Market Assessment by Therapeutic Area Outlook

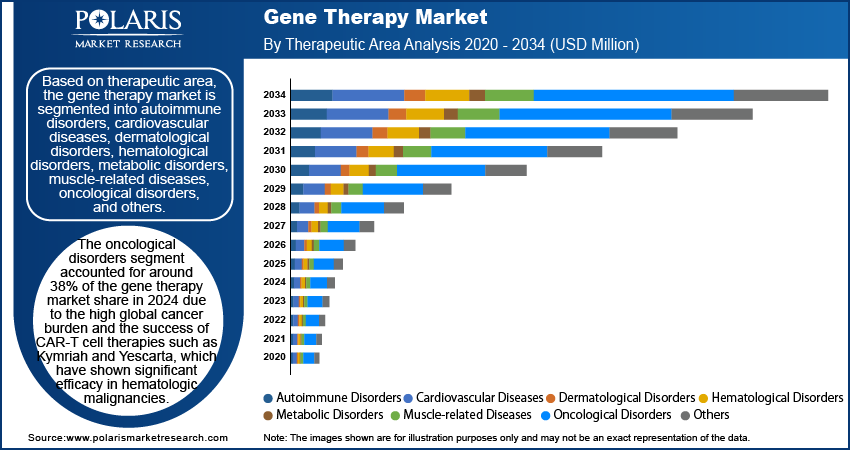

The global gene therapy market segmentation, based on therapeutic area, has been segmented into autoimmune disorders, cardiovascular diseases, dermatological disorders, hematological disorders, metabolic disorders, muscle-related diseases, oncological disorders, and others. The oncological disorders segment accounted for around 38% of the gene therapy market share in 2024 due to the high global cancer burden (19.3 million new cases in 2020, as per WHO) and the success of CAR-T cell therapies such as Kymriah and Yescarta, which have shown significant efficacy in hematologic malignancies. Advances in gene editing and viral vector delivery further enhance precision treatment, driving the adoption of gene therapies in oncology.

Gene Therapy Market Evaluation by Vector Type Outlook

The global gene therapy market segmentation, on the basis of vector type, includes viral vectors and non-viral vectors. The viral vectors segment is expected to register a higher CAGR of 27.3% during the forecast period due to their high transduction efficiency, stable gene expression, and ability to target specific cells, making them ideal for therapies such as Luxturna and Zolgensma. Researchers and biotech companies are widely using viral vectors such as adeno-associated viruses (AAVs), lentiviruses, and retroviruses owing to their strong transduction capabilities and long-lasting gene expression. Adeno-associated viruses (AAVs), in particular, gained popularity due to their low immunogenicity and ability to target non-dividing cells, making them ideal for treating inherited disorders. Increased funding for gene-based treatments, along with successful clinical trials and regulatory approvals, contributed to the viral vectors segment growth. Additionally, advancements in vector engineering reduced toxicity and improved delivery precision, further contributing to their growth.

Gene Therapy Market Regional Analysis

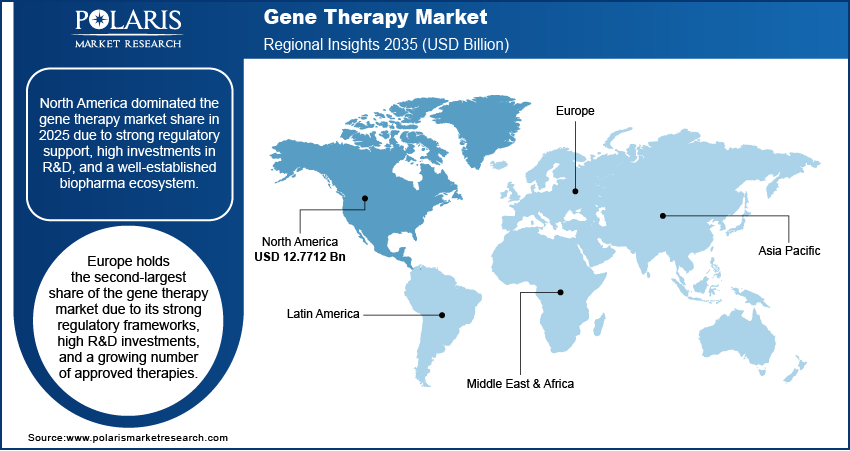

By region, the study provides gene therapy market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the gene therapy market revenue share in 2024 due to strong regulatory support, high investments in R&D, and a well-established biopharma ecosystem. The FDA has approved multiple gene therapies, including Luxturna, Zolgensma, and Casgevy, further accelerating commercialization and adoption. In 2023, the US accounted for over 65% of global gene therapy clinical trials, supported by NIH and private funding exceeding USD 10 billion. Major biotech hubs such as Boston and San Francisco house and prominent players such as Novartis, Bluebird Bio, and Sarepta are driving innovation in the market in North America. Additionally, the region benefits from advanced manufacturing infrastructure, reimbursement policies, and increasing patient access to gene therapies.

Europe holds the second largest share in the gene therapy market due to its strong regulatory frameworks, high R&D investments, and a growing number of approved therapies. The European Medicines Agency (EMA) has approved multiple gene therapies, including Skysona, Libmeldy, and Roctavian, supporting gene therapy market expansion. Countries such as Germany, France, and the UK lead in clinical trials, with government-backed initiatives such as Horizon Europe funding advanced therapies. Additionally, Europe has a well-established biopharma ecosystem, with companies such as Orchard Therapeutics and UniQure, which are driving innovation in the market. Expanding manufacturing capabilities, along with increasing adoption of value-based reimbursement models, further strengthen Europe's position in the market.

Gene Therapy Market – Key Players and Competitive Analysis Report

The competitive landscape of the gene therapy market is marked by a blend of global leaders and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players such as Abeona Therapeutic, Novartis AG, Spark Therapeutics LLC, Gilead Sciences Inc., Bristol Myers Squibb, Adverum Biotechnologies, Alnylam Pharmaceuticals, American Gene Technologies, Applied Genetic Technologies Corporation, Biogen, and Ultrageny dominate the market by leveraging their strong research and development (R&D) capabilities and vast distribution networks. These companies focus on product innovation to enhance efficiency, scalability, and reliability, addressing the growing demand for advanced automation solutions. Competitive strategies such as mergers and acquisitions, collaborations with tech firms, and expanding product portfolios are common approaches to enhance market positioning and meet the diverse demands of industries.

Sangamo Biosciences is a biotechnological company based in Brisbane that transforms advanced research into genomic therapeutics that improve patients' lives by employing novel technologies for gene therapy, genome editing, cell therapy, and gene therapy regulation. The company works on projects for uncommon diseases and develops genetic treatments for individuals suffering from severe illnesses using its in-depth scientific and patented zinc finger technology. Along with its novel technologies, Sangamo is conducting numerous clinical trials. Some of them are led by international pharmaceutical industry partners to assess the tolerability, efficacy, and safety of genomic therapies. The company believes in creating a fully owned genomic medicine platform, which would be financed through its partners with renowned biopharmaceutical companies.

Voyager Therapeutics is a gene therapy company dedicated to developing innovative treatments for severe central nervous system (CNS) disorders. The company estimates that over 200 million individuals worldwide suffer from brain diseases that can emerge at any stage of life. Believing in the transformative potential of gene therapy, Voyager is focused on advancing innovative solutions to address these critical neurological conditions. The company is actively developing proprietary AAV-based gene therapies, including TRACER capsid discovery technology, to enhance targeted and efficient gene delivery. Voyager collaborates with biopharmaceutical leaders and gene therapy experts to engineer novel capsids that enable the safe and reliable transfer of therapeutic gene payloads, with the goal of improving patient outcomes and changing lives.

List of Key Companies in Gene Therapy Market

- Bluebird Bio

- Bristol Myers Squibb

- Gilead Sciences Inc

- GlaxoSmithKline

- Novartis AG

- Sangamo Biosciences

- Spark Therapeutics LLC

- Ultragenyx

- Voyager Therapeutics

Gene Therapy Industry Development

In January 2023, Voyager entered a strategic collaboration with Neurocrine Biosciences to develop gene therapies targeting neurological diseases, including a GBA1 gene therapy program for Parkinson's disease.

In May 2022, Voyager Therapeutics announced an option agreement with Novartis to target specific access to next-generation TRACER AAV capsids for gene therapy programs.

In May 2022, Ultragenyx acquired the global rights of AAV gene therapy from Abeona therapeutics, which is used to treat Sanfilippo syndrome type A (MPS IIIA).

Gene Therapy Market Segmentation

By Type Therapeutic Area Outlook (Revenue, USD Million, 2020–2034)

- Autoimmune Disorders

- Cardiovascular Diseases

- Dermatological Disorders

- Hematological Disorders

- Metabolic Disorders

- Muscle-Related Diseases

- Oncological Disorders

- Others

By Vector Type Outlook (Revenue, USD Million, 2020–2034)

- Viral

- Non-Viral

By Approach Outlook (Revenue, USD Million, 2020–2034)

- Gene Augmentation

- Oncolytic Viral Therapy

- Immunotherapy

- Other Approaches

By Route of Administration Outlook (Revenue, USD Million, 2020–2034)

- Intraarticular

- Intracerebellar

- Intradermal

- Intramuscular

- Intratumoral

- Intravenous

- Intravesical

- Intravitreal

- Subretinal

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gene Therapy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,251.50 million |

|

Market Size Value in 2025 |

USD 2,657.00 million |

|

Revenue Forecast by 2034 |

USD 27,250.20 million |

|

CAGR |

27.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global gene therapy market size was valued at USD 2,251.50 million in 2024 and is projected to grow to USD 27,250.20 million by 2034.

• The global market is projected to register a CAGR of 27.1% during the forecast period.

• North America dominated the market in 2024.

• A few key players in the market are Voyager, Abeona Therapeutic, Novartis AG, Spark Therapeutics LLC, Gilead Sciences Inc., Bristol Myers Squibb, Adverum Biotechnologies, Alnylam Pharmaceuticals, American Gene Technologies, Applied Genetic Technologies Corporation, Biogen, and Ultragenyx.

• The oncological disorders segment led the market share in 2024.

• The viral segment is anticipated to register a higher growth rate during the forecast period.