Gastrointestinal Products Market Size, Share, Trends, Industry Analysis Report: By Devices, Disease, End User (Hospitals, Ambulatory Centers and Independent Diagnostic Centers, Clinics, and Other End Users), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5304

- Base Year: 2024

- Historical Data: 2020-2023

Gastrointestinal Products Market Overview

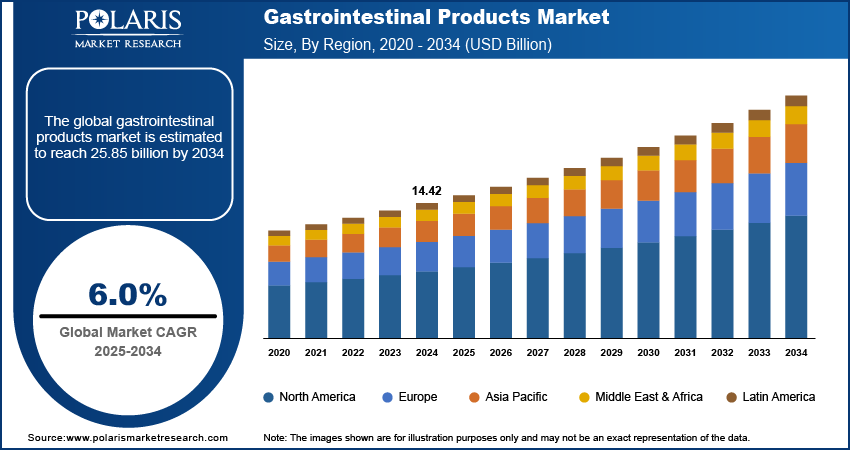

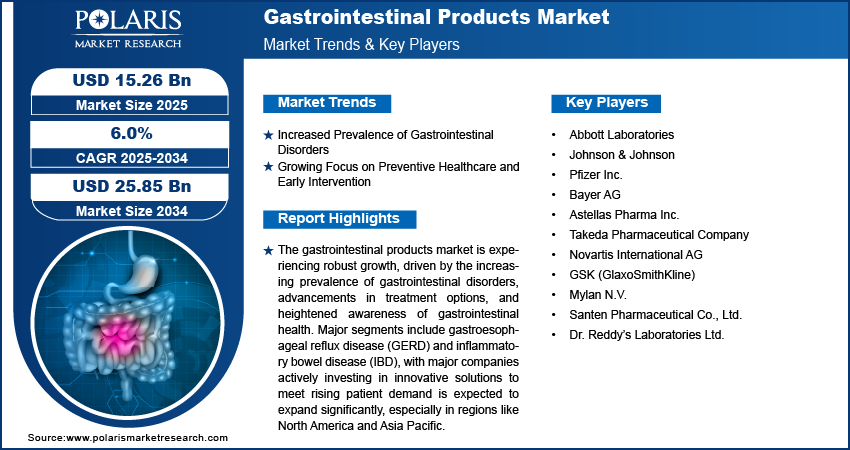

The gastrointestinal products market size was valued at USD 14.42 billion in 2024. The market is projected to grow from USD 15.26 billion in 2025 to USD 25.85 billion by 2034, exhibiting a CAGR of 6.0% during the forecast period.

Gastrointestinal products are medications and treatments designed to manage, prevent, or alleviate conditions affecting the digestive system, including acid reflux, ulcers, irritable bowel syndrome, and other gastrointestinal disorders. They encompass a range of solutions, from prescription drugs to over-the-counter remedies.

The market for gastrointestinal (GI) products is experiencing substantial growth, fuelled by an increasing prevalence of GI disorders such as acid reflux, irritable bowel syndrome, and Crohn's disease. Rising awareness about digestive health and a growing demand for accessible and effective treatments are key drivers of gastrointestinal products market expansion. Additionally, the aging population and changing dietary habits have led to a higher incidence of GI issues, prompting the need for a variety of prescription and over-the-counter options.

The gastrointestinal market comprises products such as medications, probiotics, antacids, laxatives, and biologics. Moreover, with the ongoing innovations in the sector, which is keenly focusing on enhancing treatment effectiveness while reducing potential side effects, the demand for gastrointestinal products is growing. A notable instance is of Azurity Pharmaceuticals, Inc., which, in September 2022, announced FDA approval for Konvomep (omeprazole and sodium bicarbonate for oral suspension) to treat active benign gastric ulcers and reduce the risk of upper gastrointestinal bleeding in critically ill patients. Moreover, companies are investing in research to develop targeted therapies. Regions such as North America and Asia Pacific are experiencing growth, driven by improvements in healthcare infrastructure and greater patient awareness.

To Understand More About this Research: Request a Free Sample Report

Gastrointestinal Products Market Dynamics

Increased Prevalence of Gastrointestinal Disorders

The rising prevalence of gastrointestinal disorders, including acid reflux, ulcers, and irritable bowel syndrome, is significantly driving the gastrointestinal products market growth. The demand for effective treatments and preventive solutions has increased as more individuals are experiencing these conditions. Moreover, the rising awareness of gastrointestinal health and the importance of early intervention has led more patients to seek medical advice and appropriate products. This rising consumer interest is driven by advancements in formulation technologies, which have improved the effectiveness and accessibility of treatments. In response, pharmaceutical companies are investing significantly in research and development to broaden their product offerings.

For instance, in June 2024, Akums Drugs and Pharmaceuticals launched Rabeprazole + Levosulpiride SR Capsules, approved by the Drug Controller General of India (DCGI), to provide enhanced relief for patients with gastrointestinal tract disorders, illustrating the industry’s response to this expanding market.

Growing Focus on Preventive Healthcare and Early Intervention

Increased awareness of gut health has led consumers to seek options to prevent digestive issues before they become serious. This shift toward preventive care is influenced by increased access to information and the availability of over-the-counter gastrointestinal products, including probiotics, antacids, and supplements, that promote digestive health. Improvements in formulation technology have enhanced the effectiveness and convenience of these products, thereby encouraging greater adoption of preventive measures. Furthermore, pharmaceutical companies are expanding their portfolios to meet the demand for proactive health management, which is expanding the gastrointestinal products market demand.

Gastrointestinal products are regulated by agencies such as the FDA, ensuring safety and efficacy in the US market. For instance, in August 2022, Abbott launched Similac Probiotic Tri-Blend for infants and children, combining three probiotics to support digestive health and boost immunity. This addresses the rising demand for preventive digestive care from infancy and caters to parental concerns over early gut health.

Gastrointestinal Products Market Segment Insights

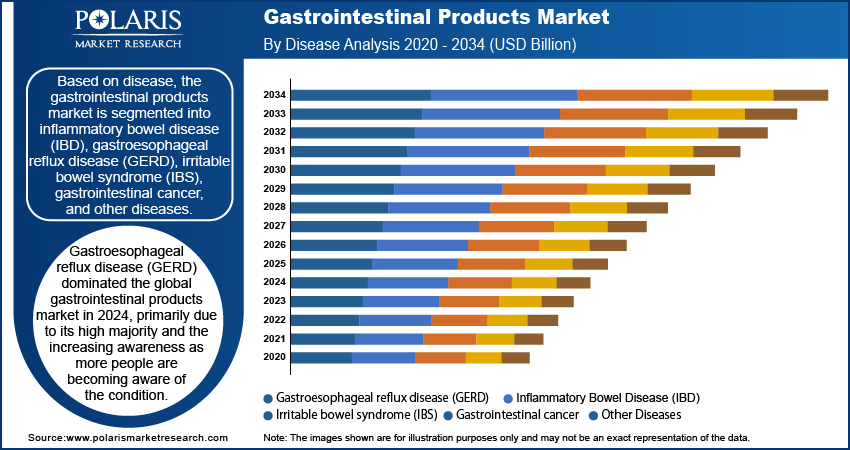

Gastrointestinal Products Market Assessment by Disease Outlook

The global gastrointestinal products market segmentation, based on disease, includes inflammatory bowel disease (IBD), gastroesophageal reflux disease (GERD), irritable bowel syndrome (IBS), gastrointestinal cancer, and other diseases. Gastroesophageal reflux disease (GERD) dominated the market primarily due to its high majority and the increasing awareness as more people are becoming aware of the condition. Factors contributing to GERD's dominance include lifestyle changes, such as poor dietary habits and obesity, which have led to a rise in reflux cases.

Advancements in treatment options, including over-the-counter medications and prescription therapies, have made it easier for patients to manage symptoms effectively. The growing emphasis on gastrointestinal health and the importance of seeking timely medical intervention is further driving the demand for GERD-related products. According to a report by the US FDA (Food and Drug Administration), Phathom Pharmaceuticals VOQUEZNA received FDA approval in May 2023. This medication is for adults experiencing heartburn associated with both erosive and non-erosive GERD. It represents a new class of acid blockers known as potassium-competitive acid blockers (PCABs).

Gastrointestinal Products Market Assessment by End User Outlook

The global gastrointestinal products market segmentation, based on end user, includes hospitals, ambulatory surgical centers and independent diagnostic centers, clinics, and other end users. The ambulatory surgical centers (ASCs) segment is anticipated to experience the fastest growth in the gastrointestinal products market due to a growing preference for outpatient procedures. Moreover, patients and healthcare providers are seeking efficient alternatives compared to traditional hospital settings. ASCs offer shorter wait times, lower costs, and the convenience of same-day discharge. These benefits make ASCs increasingly attractive to patients undergoing gastrointestinal procedures.

Advancements in minimally invasive surgical techniques have also improved the capabilities of ASCs, enabling them to perform complex gastrointestinal procedures that were once limited to hospitals. This shift is supported by a rising incidence of gastrointestinal disorders, leading to an increased demand for effective treatment options

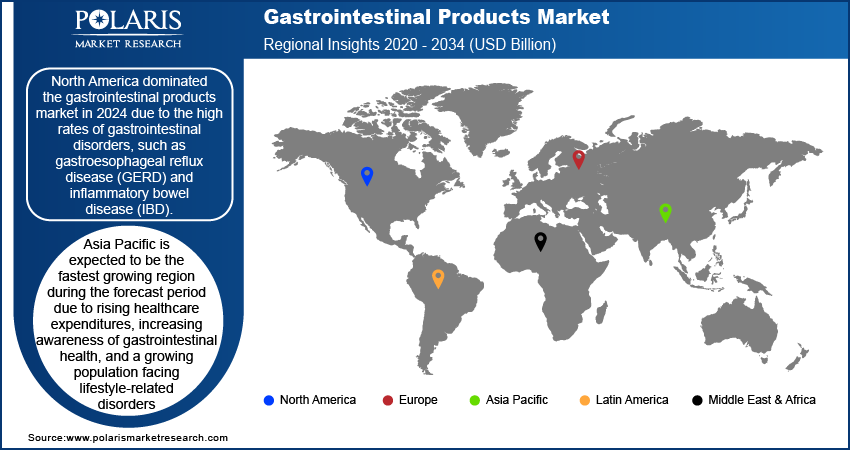

Gastrointestinal Products Market Regional Insights

By region, the study provides gastrointestinal products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to the high rates of gastrointestinal disorders, such as gastroesophageal reflux disease (GERD) and inflammatory bowel disease (IBD). Advanced healthcare infrastructure, coupled with a strong emphasis on research and development, facilitates the introduction of innovative gastrointestinal solutions tailored to meet patient needs.

For instance, in August 2023, Mirxes Corporation USA announced that its product GASTROClearTM, a PCR-based in vitro diagnostic test for the early detection of gastric cancer, received a device designation from the US Food and Drug Administration (FDA). This milestone highlights the ongoing commitment to enhancing diagnostic solutions within the region. Moreover, increased awareness of gastrointestinal health among the population, alongside the rising demand for preventive healthcare, further supports market expansion. These dynamics place North America at the forefront, accounting for a substantial gastrointestinal products market share of global revenue.

Asia Pacific is expected to be the fastest-growing region during the forecast period due to rising healthcare expenditures, increasing awareness of gastrointestinal health, and a growing population facing lifestyle-related disorders such as obesity and gastrointestinal diseases. Countries such as China and India are experiencing a surge in demand for innovative gastrointestinal treatments, driven by their large populations and improving healthcare infrastructure.

For instance, in August 2022, Bayer AG launched Iberogast, a product formulated with medicinal plants designed to quickly relieve multiple digestive symptoms, including abdominal pain, cramps, heaviness, bloating, flatulence, and nausea. This launch reflects the growing focus on effective gastrointestinal solutions tailored to the needs of consumers in Asia Pacific. Additionally, government initiatives aimed at enhancing healthcare access and promoting preventive care are fueling market expansion in this region.

Gastrointestinal Products Market – Key Players and Competitive Insights

The competitive landscape of the gastrointestinal products industry is characterized by a mix of global leaders and regional players aiming for market share through innovation, strategic partnerships, and geographic expansion. Major pharmaceutical companies such as Pfizer, Buyer AG, and others leverage their strong research and development capabilities, along with extensive distribution networks, to deliver advanced gastrointestinal solutions tailored to a variety of applications. These industry leaders focus on product innovation to improve the effectiveness and accessibility of treatments for conditions such as gastroesophageal reflux disease (GERD) and inflammatory bowel disease (IBD). Smaller regional companies are emerging with specialized gastrointestinal products designed to meet the unique needs of local markets. These firms often offer niche solutions that address specific digestive health concerns, helping to differentiate themselves from larger competitors.

Competitive strategies within this market include mergers and acquisitions, collaborations with healthcare providers, and the expansion of product portfolios to strengthen their presence in key geographic areas. This dynamic environment positions the gastrointestinal products market for continued growth and development as companies seek to enhance patient care and capitalize on emerging health trends. A few key major players are Abbott Laboratories; Johnson & Johnson; Pfizer Inc.; Bayer AG; Astellas Pharma Inc.; Takeda Pharmaceutical Company; Novartis International AG; GSK (GlaxoSmithKline); Mylan N.V.; Santen Pharmaceutical Co., Ltd.; Dr. Reddy’s Laboratories Ltd.

Dr. Reddy's Laboratories Ltd. is an Indian multinational pharmaceutical company headquartered in Hyderabad. Established in 1984, the company has made significant strides in developing medications that cater to various gastrointestinal disorders, including acid reflux, ulcers, and irritable bowel syndrome. Their product portfolio includes both prescription medications and over-the-counter solutions, addressing the needs of diverse patient populations. The company specializes in the pharmaceutical industry, manufacturing and marketing over 190 medications and 60 active pharmaceutical ingredients (APIs). Dr. Reddy's Laboratories has made investments in research and development, establishing facilities both in India and the United States to focus on innovative drug discovery, particularly in areas such as oncology and diabetes. The company has also engaged in strategic acquisitions to enhance its market position and broaden its product offerings.

Astellas Pharma Inc. is a prominent Japanese multinational pharmaceutical company, established on April 1, 2005, from the merger of Yamanouchi Pharmaceutical Co., Ltd. and Fujisawa Pharmaceutical Co., Ltd. Headquartered in Tokyo, Astellas focuses on innovative medicines across various therapeutic areas, including oncology, urology, immunology, cardiology, and infectious diseases. In May 2024, Astellas Pharma Inc. announced that Japan’s Ministry of Health, Labour, and Welfare (MHLW) approved VYLOY (zolbetuximab), a monoclonal antibody targeting claudin 18.2 (CLDN18.2) for patients with advanced or recurrent, unrespectable CLDN18.2-positive gastric cancer.

Key Companies in Gastrointestinal Products Market

- Abbott Laboratories

- Johnson & Johnson

- Pfizer Inc.

- Bayer AG

- Astellas Pharma Inc.

- Takeda Pharmaceutical Company

- Novartis International AG

- GSK (GlaxoSmithKline)

- Mylan N.V.

- Santen Pharmaceutical Co., Ltd.

- Dr. Reddy’s Laboratories Ltd.

Gastrointestinal Products Market Developments

March 2023: Polifarma Spa expanded its gastrointestinal portfolio through a long-term distribution agreement with Devintec Pharma Sagl, a Lugano-based company known for pioneering substance-based medical devices and the Gelsectan brand.

April 2023: Italian pharmaceutical innovator Azienda Farmaceutica Italiana partnered with TannerLAC, Inc. to distribute Hepilor, a medical device designed to protect the digestive system mucosa, throughout Latin America.

May 2022: Dr. Reddy’s Laboratories Ltd. announced a partnership with South Korea’s HK inno.N Corporation to supply and commercialize HK inno.N’s patented novel molecule, Tegoprazan, for treating gastrointestinal diseases in India and six key emerging markets.

Gastrointestinal Products Market Segmentation

By Devices Outlook (Revenue, USD Billion, 2020–2034)

- Endoscopy

- Colonoscopy

- Sigmoidoscopes

- Capsule endoscopy systems

- Other endoscopy devices/accessories

- Ablation system

- Radiofrequency Ablation system

- Microwave Ablation system

- Cryoablation system

- Other ablation system

- Motility testing

- Esophageal Manometry

- 4-hour pH impedance testing

- Anorectal Manometry

- Other Motility testing

- Biopsy Devices

- Needle Biopsy Devices

- Endoscopic mucosal resection (EMR) devices

- Endoscopic submucosal dissection (ESD) devices

- Other Biopsy accessory products

- Stenting Devices

- pH monitoring devices

- Other gastroenterology devices

By Disease Outlook (Revenue, USD Billion, 2020–2034)

- Inflammatory Bowel Disease (IBD)

- Gastroesophageal reflux disease (GERD)

- Irritable bowel syndrome (IBS)

- Gastrointestinal cancer

- Other diseases

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory surgical centres and Independent diagnostic centres

- Clinics

- Other end users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gastrointestinal Products Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.42 billion |

|

Market Size Value in 2025 |

USD 15.26 billion |

|

Revenue Forecast by 2034 |

USD 25.85 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global gastrointestinal products market size was valued at USD 14.42 billion in 2024 and is projected to grow to USD 25.85 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

North America dominated the gastrointestinal products market in 2024.

A few key players in the market are Abbott Laboratories; Johnson & Johnson; Pfizer Inc.; Bayer AG; Astellas Pharma Inc.; Takeda Pharmaceutical Company; Novartis International AG; GSK (GlaxoSmithKline); Mylan N.V.; Santen Pharmaceutical Co., Ltd.; Dr. Reddy’s Laboratories Ltd.

Gastroesophageal reflux disease (GERD) dominated the global gastrointestinal products market in 2024.

The ambulatory surgical centers (ASCs) segment is experiencing the fastest growth in the gastrointestinal products market.