Gastric Button Market Share, Size, Trends, Industry Analysis Report

by Offerings (Products and Accessories), Application; Usage; End User; By Region, Segment Forecast, 2023-2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3857

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

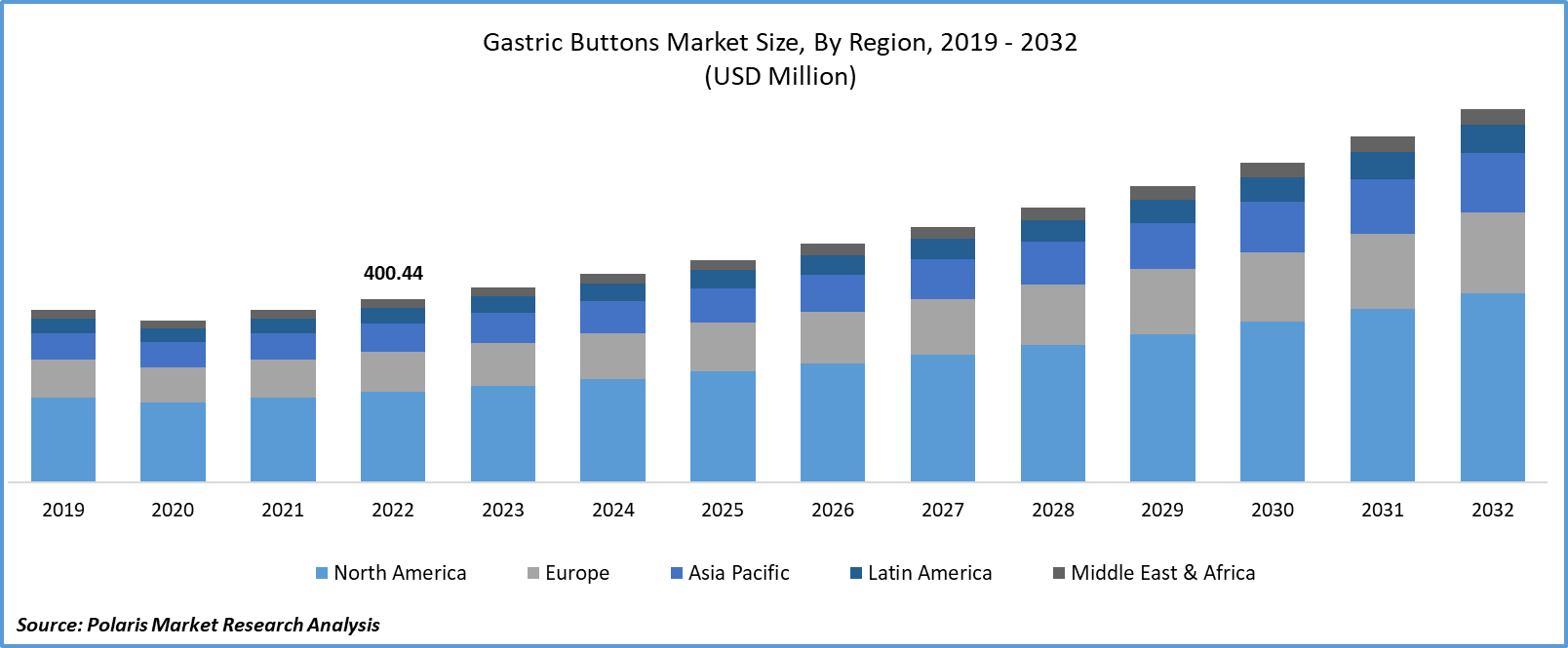

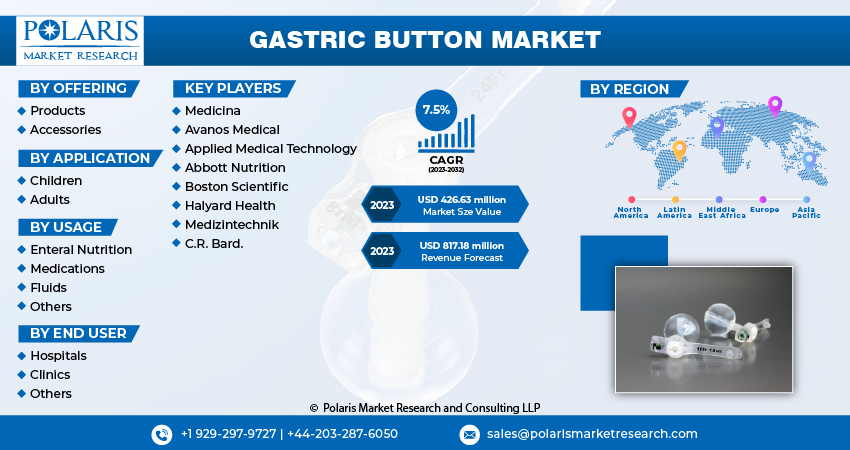

The global gastric button market was valued at USD 400.44 million in 2022 and is expected to grow at a CAGR of 7.5% during the forecast period.

The increasing prevalence of chronic diseases such as cancer and stroke, as well as neurological diseases such as dementia, seizures, and Alzheimer’s disease, are some of the key factors driving the market. Additionally, the rising aging population further propels market growth. Neurological disease manifests abnormalities in motor function rather than secretory function. Motor functions include skeletal muscle activity such as breathing, speaking, and swallowing.

To Understand More About this Research: Request a Free Sample Report

Thus, in such cases, the person is advised to utilize a gastrostomy tube to ensure adequate nutrition. The common neurological disorders that impact gastrointestinal mobility functions are stroke, multiple sclerosis, parkinsonism, and diabetic neuropathy. In the past few decades, the growth of neurological disorders has surged significantly. For instance, as per the study published in Neurological India, the number of stroke cases is high.

In the case of elderly patients, they suffer from disorders like dysphagia that make it challenging for them to chew or swallow food. As per studies, dysphagia is found to be the most common disorder faced by elderly patients. In such situations, a gastric button is highly recommended as a secure and efficient method of delivering nutrients to the stomach without going through the mouth or throat. This assists in ensuring that the patient gets the required nutrients to maintain their health and avoid the consequences of malnutrition.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

Rising geriatric population propels the demand of the market

The rising geriatric population creates a large patient pool to meet the demand for nutritional requirements. For instance, as per the Institut National D’Etudes Demographics report, the number of people older than 80 is witnessing a tripling from 157 million in 2022 to 459 million in 2050. Nasogastric tubes and percutaneous endoscopic gastrostomies are the two most common techniques used to feed older patients. Currently, a nasogastric tube (NGT) is recommended for cases that last less than 4 weeks, whereas a percutaneous endoscopic gastrostomy (PEG) is recommended for cases lasting more than 4 weeks. Overall, due to its convenience, long-term usage, lower risk of dislodgement, and flexibility for food and drug administration, the gastric button is highly preferred in geriatric populations.

Report Segmentation

The market is primarily segmented based on offering, usage, application, end-user, and region.

|

By Offering |

By Application |

By Usage |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering Analysis

The product segment is expected to witness fastest growth over the forecasted years

Gastric button products are an effective and reliable method of enteral feeding for patients who are unable to eat or swallow normally due to medical conditions like cancer, stroke, or other neurological disorders. Additionally, gastric button products are widely available in different designs to cater to different patients’ needs and preferences. Percutaneous Endoscopic Gastrostomy (PEG) tube, Radiologically Inserted Gastrostomy (RIG) tube, Gastrojejunostomy (GJ) tube, and low-profile or button tube are the different types of gastrostomy tubes available in the market.

By Application Analysis

Children segment accounted for the largest market share in 2022

Gastric buttons are used for both pediatric and adult patients, but they are mostly used for pediatric patients because of developmental differences. Children are less likely to develop the ability to eat and drink due to their age, making it more necessary to use the gastric button for their nutritional needs. Children are usually at a lower risk of complications than adults because of any displacement of the tube, which makes them a safer option to use. Moreover, the small size of the gastric tube makes it a more suitable option for children to use for nutritional requirements. As per the article published in 2018, pediatric patients with neurological conditions accounted for the largest group receiving the gastrostomy technique.

By Usage Analysis

Enteral Feeding segment is expected to hold the significant revenue share during the estimated period

Enteral nutrition is a technique that involves the intake of food throughout the gastrointestinal tract to meet a person’s nutritional requirements. The dominance of the segment is attributed to the advantages it offers compared to other segments. Eternal nutrition provides fewer complications with the capability to avoid CVL complications (the Central Venous Line) and maintain the gastrointestinal musical barrier. Moreover, enteral nutrition is free from septic or non-septic complications, making this technique safer and more convenient to use, which contributes to the overall growth of the segment.

On the other hand, enteral feeding has an advantage over intravenous feeding as it offers a less invasive procedure and is more affordable with fewer complications. Additionally, key players are also contributing to the growth of the enteral nutrition segment by developing innovative products. For instance, Witleaf launched the Brio-Enteral Nutrition Pump (EFP) in November 2021, which is a simple rotating peristaltic pump that aids in the delivery of enteral nutrition.

By End-User Analysis

The hospital segment held the largest market share in 2022

The insertion of a G-tube carries a risk of complications such as bleeding, infection, necrotizing fasciitis, or perforation of the gastrointestinal tract. Thus, to overcome the complication, prompt medical intervention is required to prevent further harm to patients. Hospitals are better equipped with medical facilities to manage these types of complications than outpatient settings. Moreover, a gastrostomy tube requires frequent adjustments, thereby making the process difficult to manage at home. As a result, gastrostomy tube insertion is typically performed in a hospital or other medical facility rather than at home or in an outpatient setting.

By Regional Analysis

The demand in North America is expected to witness significant growth during the forecast period

North America offers the highest prevalence of neurological conditions as well as cancer, making it the largest market for gastric buttons in the region. As per a Pan American Health Organization report published in 2021, the U.S. has the highest death rate due to neurological conditions, making them a serious problem for public health. Thus, the demand for gastric button technology is significantly higher compared to other countries.

As per the National Centre for Biotechnology Information report published in 2021, there are 160,000 to 200,000 percutaneous endoscopic gastrostomy (PEG) procedures conducted each year in the U.S. Therefore, with such a large patient pool, adoption of the gastric button technique in the U.S. is significantly high, thereby contributing to the overall market growth in the region.

On the other hand, the Asia-Pacific region is expected to witness the fastest growth, with a CAGR of 7.9% over the forecast period. The aging population in the region has significantly increased in the past few decades. For instance, as per the Asian Development and Poverty Report 2050, one in every four individuals in the region will be over the age of 60. As the region's population continues to age, the use of gastrostomy tubes and other enteral feeding methods will continue to grow.

Competitive Insight

The Gastric Buttons Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Medicina

- Avanos Medical

- Applied Medical Technology

- Abbott Nutrition

- Boston Scientific

- Halyard Health

- Medizintechnik

- C.R. Bard.

Recent Developments

- In March 2021, Applied Medical Technology expanded gastric jejunal feeding tubes. This expansion will help them to meet the increasing enteral nutrition demand of pediatric patients.

Gastric Buttons Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 426.63 million |

|

Revenue forecast in 2032 |

USD 817.18 million |

|

CAGR |

7.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Offering, By Application, By Usage, By End user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global gastric button market size is expected to reach USD 817.18 million by 2032.

Key players in the gastric button market are Medicina, Avanos Medical, Applied Medical Technology, Abbott Nutrition

North America contribute notably towards the global gastric button market.

The global gastric button market is expected to grow at a CAGR of 7.5% during the forecast period.

The gastric button market report covering key segments are offering, usage, application, end-user, and region.