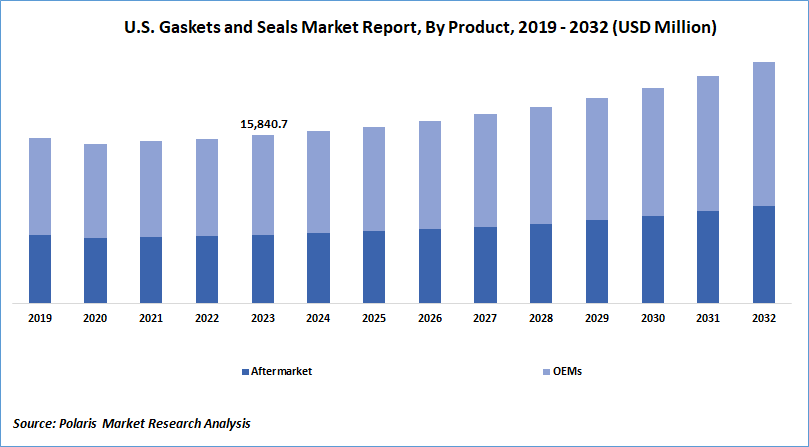

Gaskets and Seals Market Share, Size, Trends, Industry Analysis Report, By Material; By Sales Channel (Aftermarket, OEMs); By Product; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM1823

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Gaskets and Seals Market size was valued at USD 68,444.08 million in 2023. The market is anticipated to grow from USD 69,895.09 million in 2024 to USD 96,690.49 million by 2032, exhibiting a CAGR of 4.1% during the forecast period

Industry Trends

Rings are used for leakage or ingress prevention, protection against environmental contaminants and vibrations. Rubber is a prominent material used for the manufacturing of the product. Nitrile is used in applications involving oils, fuels, and solvents, whereas Viton is more appropriate for chemicals.

The automotive industry is a major contributor to the global market. Cork washers and compressed fiber seals are used in oil-bathed transmission systems. Geometrically shaped rings manufactured using steel, copper, and rubberized coating are used in engines to enable the passage of cylinder heads.

To Understand More About this Research:Request a Free Sample Report

Engine gaskets and seals offer internal leakage prevention of oil, fluids, coolants, and air while enabling maximum compression. Automotive seals and gaskets are manufactured using a wide range of materials such as rubber, plastic polymer, and stainless steel. The product also uses other materials such as multi-layered steel, copper, and composites for enhanced strength and flexibility.

Fiber washers are offered by market players in a broad range of thicknesses, hardness, and colors. Vegetable fiber gasket is treated cellulose fiber material, which is permeated with protein glue and a glycerin binder to provide greater strength, flexibility, resistance to heavy pressure, and compressibility. It resists a wide range of materials such as oils, water, alcohol, grease, air, gas, gasoline, and other solvents.

Vulcanized fiber washers are hard, lightweight, durable, and chemically pure cellulose products with high tear resistance and excellent electrical properties. These products also offer greater mechanical strength, high flatness, and resistance to heat and cold.

The growing automotive industry and increasing penetration of passenger and commercial vehicles drive the growth of this market. The rising demand for modernized vehicles and rising demand from the aerospace and defense sector support the growth of the market across the globe.

The introduction of strict industrial emission regulations has increased the demand for gaskets and seals from the industrial and manufacturing sectors. The increasing industrialization, rising demand for automobiles from emerging economies, and technological advancements have also accelerated the sale of gaskets and seals.

On the basis of material, the market is segmented into metal, plastic polymer, rubber, fiber, silicones, graphite, and others. Rubber gaskets and seals use a wide range of elastomers such as neoprene, nitrile, EPDM, and natural rubber. The demand for rubber gaskets and seals has increased in applications such as pipe gaskets, heat exchangers, and manways.

The product segment has been divided into is segmented into gaskets and seals. Gaskets have further been bifurcated into non-metallic, semi-metallic, metallic, whereas seals have been segmented into the molded, vehicle body, shaft, and others. In 2023, the seals segment accounted for the highest market share. However, the gaskets market segment is expected to grow at a significant rate during the forecast period. Gaskets are used to offer resistance against chemicals, weather, or pressure. Cork gaskets are increasingly being used owing to their high compression and flexibility in applications involving solvents and oil.

Key Takeaways

- Asia Pacific dominated the market in 2023 and contributed over 35% of Gaskets and Seals Market share in 2023

- By material category, the Rubber segment dominated the Gaskets and Seals Market share in 2023

- By sales channel category, the OEM segment is projected to grow with a significant CAGR over the Gaskets and Seals Market forecast period

What are the Market Drivers Driving the Demand for the Gaskets and Seals Market?

Increasing Demand for Gaskets and Seals in End-Use Industries

Seals and gaskets play a crucial role in preventing fluid or gas leakage between shafts and containers, finding applications across various sectors including aerospace, automotive, and wastewater treatment. With the global population expected to face water scarcity, the demand for centrifugal pumps in water and wastewater treatment plants is projected to rise, driven by modular designs and regulatory requirements like the Clean Water Act. Wastewater reuse initiatives, particularly in water-stressed regions like the Middle East, further fuel the demand for centrifugal pumps. Additionally, stringent environmental regulations, such as the EPA's Leak Detection and Repair regulations, are boosting the market for seals and gaskets, especially in industries like oil and gas. Despite a decline in global vehicle sales, gaskets and seals are finding new applications in electric vehicles, particularly in protecting battery packs against external environmental factors. This underscores a growing market for seals in electric vehicle components, highlighting opportunities in automotive sectors transitioning to electric propulsion.

Which Factor is Restraining the Demand for Electronic Shelf Label?

Presence of Alternatives

Despite advancements in sealing technology, the presence of alternatives like gland packing poses a challenge to industry growth. Gland packing, historically used for sealing in various applications including valves, pumps, and stationary tasks, offers advantages in corrosive environments and scenarios where mechanical seals may not perform optimally. Its versatility extends to applications like tank hatch and manhole cover sealing, globe and gate valves, reciprocating and rotating pumps, and even ship propeller shafts. Gland packing remains relevant where mechanical seals may fail due to corrosion or lack of rotational motion, offering cost-saving benefits and ease of maintenance, particularly in situations where expert manpower may be limited. Thus, while mechanical seals dominate certain sectors, gland packing continues to find utility in specific applications where its unique properties and operational benefits are advantageous.

Report Segmentation

The market is primarily segmented based on material, sales channel, product, end-use, and region.

|

By Material |

By Sales Channel |

By Product |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Material Insights

On the basis of Material, the Gaskets and Seals Market has been segmented into Metals, Plastic, Rubber, Fiber, Silicones, Graphite, and Other Materials. The rubber segment held the largest Gaskets and Seals Market share of around 25% in 2023 due to its capabilities, including tear rigidity, elasticity, and toughness. Furthermore, temperature resistance, electrical characteristics, and oil and chemical resistance are other qualities of rubber that are expected to fuel the demand over the forecast period.

Rubber gaskets and seals are physical polymers that are utilized to bridge the gap between two or more contact areas to prevent gas and liquid leaks and waste. These also protect against contaminants from atmospheric stimuli.

Moreover, these are critical machine elements that are extensively used in various industries, including mechanical devices, automotive, food & beverage packaging, as well as pharmaceuticals, in different forms, including cork, ring, O-rings, rotary seal, and lip seal.

By Sales Channel Insights

Based on component category analysis, the market has been segmented on the basis of microprocessors, batteries, transceiver, displays, others. The OEMs segment in the market is anticipated grow with a CAGR of 4.3% over the Gaskets and Seals Market forecast period. A massive increase in the use of gaskets and seals from manufacturing and aerospace industries has been registered, fueling the market growth of the OEM segment. The rising penetration of electric and hybrid vehicles and the introduction of government regulations regarding the use of clean and renewable energy resources further accelerate the market growth of gaskets and seals.

The OEM sector dominates the industry worldwide since OEMs are involved in the bulk manufacture of gaskets and seals. Furthermore, the expansion of the industrial sector in Asia Pacific as a result of increased federal measures to promote industrial progress is likely to fuel the OEM segment over the forecast period.

Regional Insights

Asia Pacific

Asia Pacific dominated the market and contributed over 35% of Gaskets and Seals Market share in 2023. The market for gaskets and seals is highly fragmented in the region, owing to emerging nations such as China, India, and Japan. The rising penetration of vehicles along with the increasing industrial automation is expected to propel the adoption of the gaskets and seals market in the near future.

The countries such as China, Thailand, India, Japan present across the region are the largest producers of the materials that are being used for the manufacturing of gaskets and seals metal manufacturers. Overall, Asia produced 1,374 Mt of crude steel in fiscal 2020, up by 1.5% as compared to 2019. Thailand is a leading producer of natural rubber, which offers domestic rubber gasket and seal manufacturers with an easily available supply. The market output is driven by product sales domestically and in the major export market.

A substantial proportion of motor vehicle manufacturing in Thailand is done by Japanese companies, which often import gaskets and seals from Japanese suppliers. China is also a crucial international supplier. The country’s regional neighbors such as China, Indonesia, Japan, and Malaysia are among the key external markets for Thai manufacturers.

North America

North America holds a significant market share in the gaskets and seals industry and is expected to grow at a substantial rate over the forecast period. The growing R&D investment coupled with the emerging automotive technologies and strong presence of gaskets and seals manufacturers including VICONE High Performance Rubber Inc., ACS Industries, Inc. Elastostar Rubber Corporation, Accro-Seal®, Qualiform Rubber Molding, ACE Rubber Products, across the region is likely to foster the growth of the market.

The demand for gaskets and seals is largely supported by the growing sales of automobiles and the rising production of both private and commercial vehicles. Over 13.4 million motor vehicles were produced in North America in fiscal 2020 and were also responsible for the enormous export of automobiles to other countries worldwide. Gaskets and seals are used in the vehicles to combine various systems and withstand extreme temperatures and high pressure.

The demand for gaskets and seals is expected to witness growth owing to the increasing demand for automation across the industrial verticals. The growing demand for machinery & equipment in manufacturing, automotive, and aerospace sectors is expected to drive gaskets and seals market. Furthermore, the growing use of gaskets and seals with adhesives to ensure additional safety is also likely to have a positive impact on the market growth.

The COVID-19 pandemic has however negatively impacted the demand for the product as several industries such as automotive, manufacturing, and aerospace saw a steep decline of around 15% - 20% which led to decline in the gaskets and seals demand in North America. Furthermore, the disruption in the supply chain due complete lockdown across the countries also had a negative impact on the demand across the value chain including raw materials.

However, increase in automotive production and sales in 2021 across the countries has led to a partial recovery of the demand for gaskets and seals in North America. In addition, as manufacturing has resumed across the countries, the demand for gaskets and seals is expected to witness growth in machinery manufacturing.

Competitive Landscape

The gaskets and seals market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant electronic shelf labels market share.

Some of the major players operating in the global market include:

- AB SKF

- Boyd Corporation

- Bruss Sealing System GmbH

- Dana Holding Corporation

- Datwyler

- Flowserve Corporation

- Freudenberg Sealing Technologies GmbH & Co. KG

- Garlock Sealing Technologies LLC

- Hutchinson SA

- James Walker

- Magnum Automotive Group LLC

- Parker Hannifin Corporation

- Smiths Group Plc

- Trelleborg Sealing Solutions AB

Recent Developments

- In September 2021, SKF has completed the acquisition of EFOLEX AB, a Gothenburg-based manufacturer of the Europafilter-branded industrial lubrication and oil filtration systems.

- In January 2022, SKF has completed the acquisition of Laser Cladding Venture (LCV), an additive manufacturing company based in Belgium. LCV is a niche engineering start-up specialized in various additive manufacturing technologies and processes, which can be applied to support SKF’s service and remanufacturing offering.

- In December 2021, John Crane announced the launch of John Crane Sense Turbo, a first-to-market dry gas seal digital diagnostics solution to monitor conditions at the heart of the compressor.

Report Coverage

The Gaskets and Seals Market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, component, display size, communication technology, store type, and futuristic growth opportunities.

Gaskets and Seals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 69,895.1 million |

|

Revenue Forecast in 2032 |

USD 96,690.5 million |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Component, By Display Size, By Communication Technology, By Store Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Gaskets and Seals Market Size Worth USD 96,690.5 Million By 2032.

The top market players in Gaskets and Seals Market include Hutchinson SA, Bruss Sealing System GmbH, Smiths Group Plc, Dana Holding Corporation.

Asia Pacific contribute notably towards the Gaskets and Seals Market.

Gaskets and Seals Market exhibiting a CAGR of 4.1% during the forecast period.

Gaskets and Seals Market report covering key segments are material, sales channel, product, end-use and region.