Gas Sensor Market Size, Share, Trends, Industry Analysis Report: By Product, Type (Wired and Wireless), Technology, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM2721

- Base Year: 2024

- Historical Data: 2020-2023

Gas Sensor Market Overview

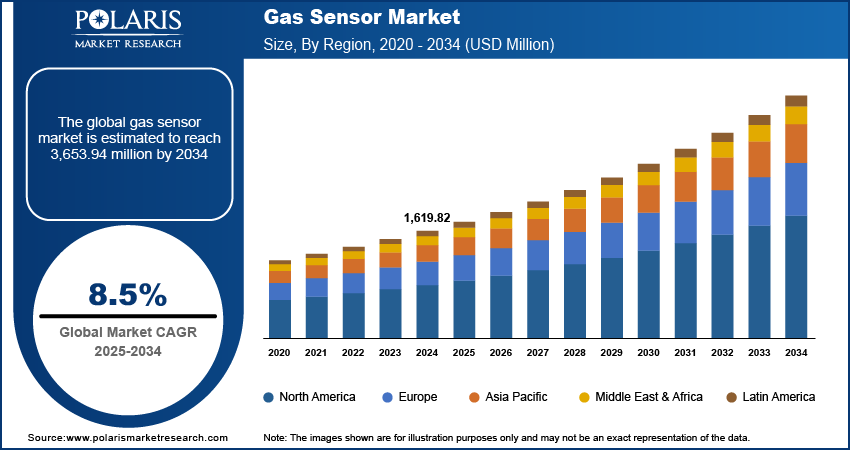

The global gas sensor market size was valued at USD 1,619.82 million in 2024. The market is projected to grow from USD 1,754.91 million in 2025 to USD 3,653.94 million by 2034, exhibiting a CAGR of 8.5% during 2025–2034.

Gas sensors detect and measure the concentration of various gases in the environment. These sensors work by oxidizing the gas at a catalytic surface, which generates heat and changes resistance, signaling the presence of gas. They play an essential role in ensuring safety across multiple sectors, including industrial, residential, and manufacturing. There are several types of gas sensors, each designed to detect specific gases or groups of gases. Electrochemical sensors are common for detecting toxic gases such as carbon monoxide and hydrogen sulfide. Similarly, catalytic sensors are widely used for detecting combustible gases like methane or propane.

The rising industrialization worldwide is propelling the gas sensor market growth. According to data published in the International Yearbook of Industrial Statistics 2023, a 2.3% growth was registered in industrial sectors globally in 2023. Industries use various gases in production processes, leading to a higher risk of leaks, contamination, and hazardous emissions. This drives industries to install gas sensors for real-time monitoring and early detection of toxic or combustible gases to ensure workplace safety and regulatory compliance. Furthermore, growing automation and the adoption of smart technologies in industries drive the need for advanced gas sensors that provide accurate data and integrate with industrial systems.

To Understand More About this Research: Request a Free Sample Report

The gas sensor market demand is driven by the implementation of stringent government regulations to reduce car emissions. These regulations set strict limits on pollutants such as carbon monoxide, nitrogen oxides, and hydrocarbons, forcing automotive manufacturers to integrate gas sensors that ensure regulatory compliance by optimizing engine performance, improving fuel efficiency, and reducing harmful emissions. Therefore, as governments introduce stricter emission norms and testing procedures, automotive companies invest in high-precision gas sensors to meet standards and avoid penalties, thereby expanding the overall market.

Gas Sensor Market Dynamics

Increasing Investment in Smart Cities Worldwide

Governments worldwide are making significant investments in smart city projects. For instance, the Government of India allocated USD 19,030 million to develop 100 smart cities across the country. Smart city projects widely integrate gas sensors into traffic systems, industrial zones, and residential areas to detect air pollution, hazardous gas leaks, and overall air quality. Governments and private real estate investors in these cities deploy gas sensors in buildings, transportation networks, and waste management systems to ensure a healthier and safer environment. Additionally, gas sensors in smart cities help city administrators make informed decisions, enforce regulations, and improve city planning by providing real-time data. Hence, as investment in smart cities expands, the gas sensors market demand continues to rise.

Rising Number of Hospitals Globally

Hospitals use various gases such as oxygen, nitrogen, and anesthetic agents, making precise monitoring essential for patient safety and operational efficiency. Gas sensors help detect gas leaks, ensure proper ventilation, and maintain clean air in critical areas, including operating rooms and intensive care units. Regulatory authorities are enforcing stringent guidelines for hospital air quality, pushing healthcare providers to invest in advanced gas detection systems. Thus, the rising number of hospitals is propelling the gas sensor market revenue.

Gas Sensor Market Segment Insights

Gas Sensor Market Evaluation by Product Insights

Based on product, the gas sensor market is divided into oxygen/lambda sensors, carbon dioxide sensors, carbon monoxide sensors, NOx sensors, methyl mercaptan sensors, and others. The carbon dioxide sensors segment dominated the gas sensor market in 2024 due to the increasing demand for air quality monitoring in residential, commercial, and industrial spaces. Governments worldwide are implementing stricter regulations on indoor air quality, pushing businesses and homeowners to install monitoring sensors that detect CO₂ buildup and ensure proper ventilation. The rapid expansion of smart buildings and HVAC systems further accelerates carbon dioxide gas sensors adoption. Additionally, healthcare facilities and laboratories require precise CO₂ sensors to maintain safe environments for patients and researchers. Furthermore, industries are increasingly investing in CO₂ sensors with rising concerns over greenhouse gas emissions and global warming, contributing to the segment's dominant position.

Gas Sensor Market Assessment by Type Insights

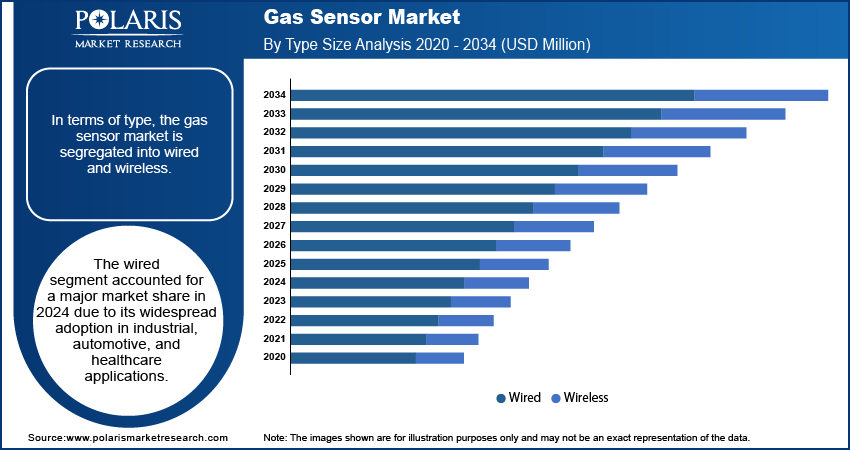

In terms of type, the gas sensor market is segregated into wired and wireless. The wired segment accounted for a major market share in 2024 due to its widespread adoption in industrial, automotive, and healthcare applications. Manufacturing facilities, oil refineries, and chemical plants rely on wired sensors for continuous and stable monitoring of hazardous gases in high-risk environments. Automakers are integrating wired sensors into vehicles to meet stringent emission regulations and improve engine efficiency. Hospitals and laboratories use these sensors for precise gas detection in critical areas such as operating rooms and intensive care units. The reliability, accuracy, and uninterrupted data transmission of wired sensors have made them the preferred choice in industries where safety and regulatory compliance remain top priorities.

Gas Sensor Market Regional Analysis

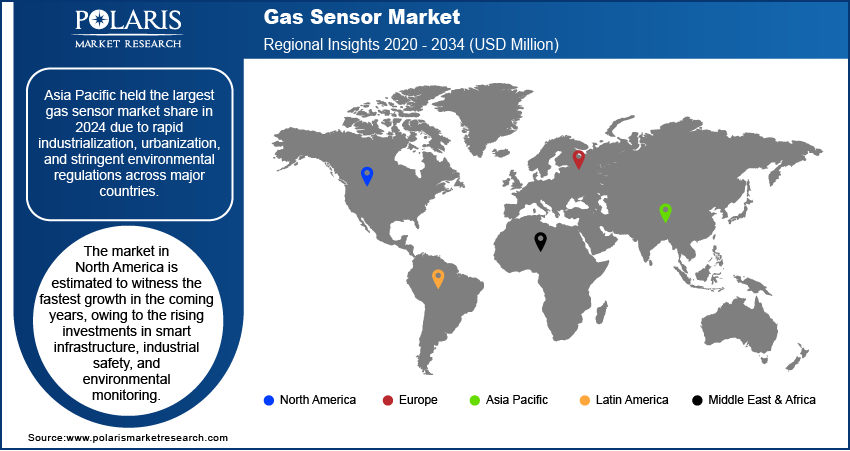

By region, the report provides the gas sensor market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest gas sensor market share in 2024 due to rapid industrialization, urbanization, and stringent environmental regulations across major countries. Countries such as China, India, and Japan, with their robust manufacturing activities, are witnessing an increasing demand for gas sensors in industries such as oil & gas, chemicals, and automotive. Governments in the region are implementing strict policies to curb air pollution, driving demand for gas sensors in industrial plants, commercial buildings, and residential areas. The rise in automotive production, particularly in China, and the push for cleaner emissions have further fueled the adoption of gas sensors in the region. For instance, according to CEIC, China Motor Vehicle Production was reported at 30,160,966.000 units in Dec 2023, an increase from the previous number of 27,020,615.000 units in Dec 2022.

The North America gas sensor market is estimated to witness the fastest growth in the coming years, owing to the rising investments in smart infrastructure, industrial safety, and environmental monitoring. The US leads this growth due to stringent regulations from agencies such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA). Increasing concerns over greenhouse gas emissions and workplace hazards are pushing industries to adopt advanced gas sensors. The expansion of smart cities, along with the growing demand for wireless and IoT-enabled monitoring systems, further propels the regional market growth.

Gas Sensor Market – Key Players and Competitive Insights

Key market players are investing heavily in research and development in order to expand their offerings, which will help the gas sensor market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The gas sensor market is fragmented, with the presence of numerous global and regional market players. Major players in the market include ABB Ltd.; AlphaSense Inc.; City Technology Ltd.; Dynament; Figaro Engineering Inc.; FLIR Systems, Inc.; GfG Gas Detection UK Ltd.; Infineon Technologies AG; Membrapor; Nemoto & Co. Ltd.; Robert Bosch LLC; Siemens; and Yokogawa Electric Corporation.

FLIR Systems, Inc. is a prominent company in the field of thermal imaging and sensing technologies. Founded in 1978, the company initially focused on developing high-performance, low-cost infrared imaging systems for airborne applications. Over the years, FLIR expanded its expertise beyond aviation, venturing into various sectors, including government, defense, industrial, and commercial markets. The company’s innovative approach has led to the creation of advanced thermal imaging cameras and sensor systems that enhance perception and awareness across multiple applications. FLIR’s gas sensors utilize advanced infrared technology to identify harmful gases such as carbon monoxide, methane (CH4), and other volatile organic compounds (VOCs).

Infineon Technologies AG is a global semiconductor manufacturer based in Neubiberg, Germany. The company specializes in designing, developing, and manufacturing a wide array of semiconductor products that cater to various sectors, including automotive, industrial power control, and security applications. Infineon boasts a significant presence worldwide, with numerous research and development centers and manufacturing facilities across Europe, Asia, and the Americas. Infineon’s product portfolio includes application-specific integrated circuits (ASICs), microcontrollers, power semiconductors, sensors, and interfaces. Among its innovative offerings are advanced gas sensors that play a vital role in safety and environmental monitoring. These sensors utilize various technologies to detect specific gases such as carbon dioxide, methane, and volatile organic compounds.

List of Key Companies in Gas Sensor Market

- ABB Ltd.

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- FLIR Systems, Inc.

- GfG Gas Detection UK Ltd.

- Infineon Technologies AG

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- Yokogawa Electric Corporation

Gas Sensor Industry Developments

October 2024: Flyability, a company specializing in confined space drone inspections, announced the launch of a new flammable gas sensor for its flagship drone, the Elios 3. The sensor was created in partnership with NevadaNano, a global company in advanced gas detection technology.

August 2024: CO2Meter, a major manufacturer of gas detection safety and analytical solutions, announced the release of its new Gaslab industrial gas detection safety series. The company stated that the new series is designed to monitor a broad range of gas types and concentrations across multiple industries.

March 2024: Winsen, a supplier of sensing solutions, launched a new gas sensor, MH-Z1542B-R32, for refrigerant gas leakage detection.

Gas Sensor Market Segmentation

By Product Outlook (Volume, Million Units; Revenue, USD Million; 2020–2034)

- Oxygen/Lambda Sensors

- Carbon Dioxide Sensors

- Carbon Monoxide Sensors

- NOx Sensors

- Methyl Mercaptan Sensors

- Others

By Type Outlook (Volume, Million Units; Revenue, USD Million; 2020–2034)

- Wired

- Wireless

By Technology Outlook (Volume, Million Units; Revenue, USD Million; 2020–2034)

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

By End Use Outlook (Volume, Million Units; Revenue, USD Million; 2020–2034)

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

By Regional Outlook (Volume, Million Units; Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gas Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,619.82 million |

|

Revenue Forecast in 2025 |

USD 1,754.91 million |

|

Revenue Forecast by 2034 |

USD 3,653.94 million |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Million Units, Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global gas sensor market size was valued at USD 1,619.82 million in 2024 and is projected to grow to USD 3,653.94 million by 2034.

• The global market is projected to register a CAGR of 8.5 % during the forecast period.

• Asia Pacific had the largest share of the global market in 2024.

• Some of the key players in the market are ABB Ltd.; AlphaSense Inc.; City Technology Ltd.; Dynament; Figaro Engineering Inc.; FLIR Systems, Inc.; GfG Gas Detection UK Ltd.; Infineon Technologies AG; Membrapor; Nemoto & Co. Ltd.; Robert Bosch LLC; Siemens; and Yokogawa Electric Corporation.

• The wired segment dominated the gas sensor market in 2024.