Gabapentin Market Size, Share, Trends, Industry Analysis Report: By Dosage (Capsule and Tablet), Type, Method, Application, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 119

- Format: PDF

- Report ID: PM3214

- Base Year: 2024

- Historical Data: 2020-2023

Gabapentin Market Overview

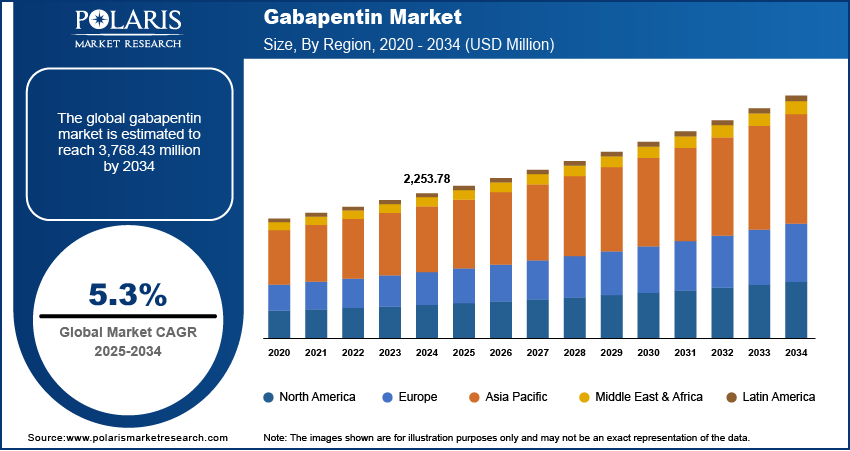

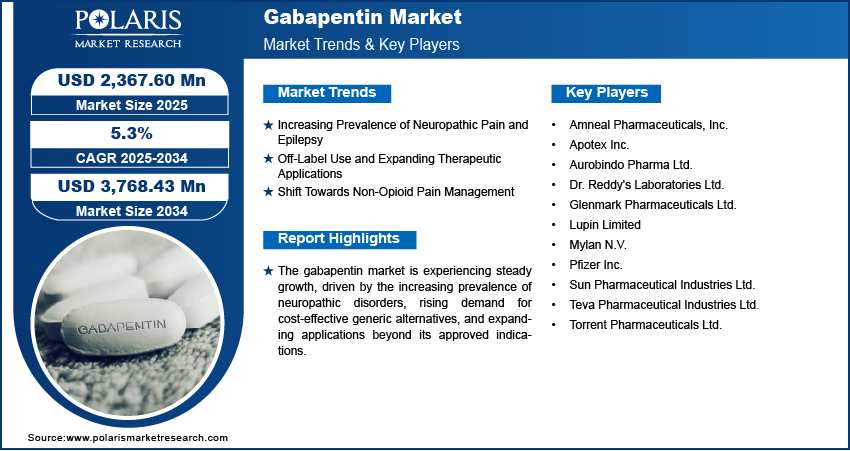

The gabapentin market size was valued at USD 2,253.78 million in 2024. The market is projected to grow from USD 2,367.60 million in 2025 to USD 3,768.43 million by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

The gabapentin market is driven by the increasing prevalence of neuropathic pain, epilepsy, and other neurological disorders. Gabapentin is widely used for pain management and seizure control, contributing to its growing demand. The market is also influenced by the rising geriatric population, as older adults are more susceptible to chronic pain conditions. For instance, according to a September 2023 report by the UNFPA, the elderly population in India was estimated to be 41 million people. This figure is projected to double, reaching over 20% of the total population by 2050.

The gabapentin market is experiencing significant growth, driven by the expansion of generic drug manufacturing and supportive regulatory policies that encourage cost-effective alternatives to branded medications. The rising prevalence of neurological disorders, including epilepsy and neuropathic pain, continues to fuel demand for gabapentin. Additionally, a key market trend is the increasing off-label use of gabapentin for various conditions such as anxiety, migraines, and bipolar disorder. Physicians are prescribing gabapentin beyond its approved indications due to its perceived efficacy and relatively low risk of abuse compared to opioids. Furthermore, ongoing research into gabapentin’s potential therapeutic benefits is expected to further expand its market scope. As healthcare providers seek alternative treatment options, the gabapentin market is poised for continued growth.

To Understand More About this Research: Request a Free Sample Report

Gabapentin Market Dynamics

Increasing Prevalence of Neuropathic Pain and Epilepsy

The gabapentin market is significantly influenced by the rising incidence of neuropathic pain and epilepsy. Gabapentin is widely prescribed for managing neuropathic pain associated with conditions such as diabetic neuropathy and postherpetic neuralgia. For instance, according to a March 2025 report by the DEA, ~USD 73.1 million in gabapentin prescriptions were dispensed in the US in 2024, making it the seventh most commonly prescribed medication nationally. This high prescription rate underscores the growing demand for effective treatments for these conditions.

Off-Label Use and Expanding Therapeutic Applications

Beyond its approved indications, gabapentin is frequently utilized off-label for various conditions, including anxiety disorders, insomnia, and fibromyalgia. A February 2024 report by the NIH stated that among 172,607 patients, a new off-label gabapentin prescription was associated with a decrease in opioid dosage for 67,016 patients. This shift reflects healthcare provider’s confidence in gabapentin's safety profile and therapeutic versatility, thereby broadening its market reach.

Shift Towards Non-Opioid Pain Management

Gabapentin, a well-established anticonvulsant, is gaining widespread adoption as an alternative for managing neuropathic pain, post-herpetic neuralgia, and other chronic pain conditions. Its non-addictive profile and favorable safety characteristics make it a preferred option in multimodal pain management strategies as healthcare providers and regulatory bodies increasingly focus on reducing opioid dependency due to concerns over addiction and adverse effects. Additionally, ongoing clinical research and updated pain management guidelines are promoting the use of gabapentin in both monotherapy and combination therapy approaches. For instance, In January 2025, the FDA approved Journavx (suzetrigine) 50mg tablets, the first non-opioid analgesic for moderate-to-severe acute pain in adults. It works by blocking sodium channels in the peripheral nervous system, inhibiting pain signals before they reach the brain. Thus, the rising demand for safer and more effective non-opioid analgesics is driving the gabapentin market expansion.

Gabapentin Market Segment Insights

Gabapentin Market Assessment – Dosage-Based Insights

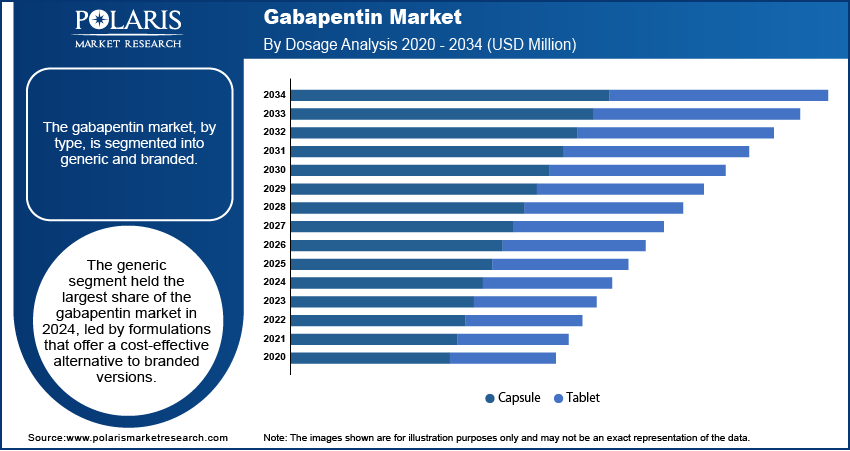

The gabapentin market, by dosage, is segmented into capsule and tablet. The capsule segment dominated the market in 2024, primarily due to its convenience and patient compliance. Capsules facilitate flexible dosing, which is essential for titrating the optimal dose in conditions such as epilepsy and neuropathic pain. Their ease of ingestion and ability to mask the drug's taste further enhance patient acceptability. The widespread use of capsules in various treatment regimens underscores their significance in the gabapentin market.

The tablet segment, while not as prevalent as capsules, serves as a crucial alternative, especially for patients who may have difficulty swallowing capsules. The tablet form allows for the controlled release of formulations, which can be beneficial in maintaining steady-state drug levels, thereby improving therapeutic outcomes. The availability of both capsules and tablets ensures that diverse patient needs and preferences are met, contributing to the overall growth and adaptability of the market.

Gabapentin Market Evaluation – Type-Based Insights

The gabapentin market, by type, is segmented into generic and branded. The generic segment held the largest share of the gabapentin market in 2024, led by formulations that offer a cost-effective alternative to branded versions. The widespread availability and affordability of generic gabapentin have made it a preferred choice among healthcare providers and patients, especially for long-term treatments like epilepsy and neuropathic pain. This preference is further supported by the therapeutic equivalence of generic drugs to their branded counterparts, ensuring similar efficacy and safety profiles.

The branded segment is expected to experience growth due to factors such as brand recognition and perceived quality. Pharmaceutical companies producing branded versions often invest in marketing and the development of innovative formulations, such as extended-release versions, to enhance patient adherence and therapeutic outcomes. These efforts contribute to the sustained demand for branded gabapentin in specific patient populations and clinical scenarios.

Gabapentin Market Outlook – Method-Based Insights

The gabapentin market, by method, is segmented into column-based, magnetic beads, reagent-based, and others. In the gabapentin market, the column-based segment is widely utilized for the purification and analysis of the drug during its manufacturing process. This technique employs chromatographic columns to separate gabapentin from impurities, ensuring high purity and quality in the final pharmaceutical product. The precision and reliability of column-based methods make them a standard choice in industrial applications, contributing to their significant adoption in the market.

The magnetic bead-based segment is gaining traction due to its efficiency and scalability in gabapentin production. These methods utilize magnetic beads coated with specific ligands to isolate gabapentin molecules from complex mixtures rapidly. The ease of automation and potential for the reuse of magnetic beads make this approach cost-effective and appealing for large-scale manufacturing. The growing interest in magnetic bead-based methods reflects an industry trend toward innovative and efficient purification technologies in pharmaceutical production.

Gabapentin Market Assessment – Application-Based Insights

The gabapentin market, by application, is segmented into neuropathic pain, epilepsy, restless legs syndrome, and others. In the gabapentin market, epilepsy represents the leading application segment, primarily due to gabapentin's established efficacy as an anticonvulsant essential for seizure management. The global prevalence of epilepsy, affecting approximately 50 million individuals, underscores the demand for effective treatments like gabapentin. Its role in reducing seizure frequency and severity has solidified its position as a cornerstone therapy in epilepsy management.

The neuropathic pain segment is experiencing significant growth within the market. Gabapentin is frequently prescribed for conditions such as postherpetic neuralgia and diabetic neuropathy, providing substantial pain relief for patients. The increasing incidence of these conditions, coupled with gabapentin's effectiveness in managing chronic neuropathic pain, contributes to its expanding use in this segment.

Gabapentin Market Evaluation – Distribution Channel-Based Insights

The gabapentin market, by distribution channel, is segmented into retail pharmacy, hospital pharmacy, and online pharmacy. In the gabapentin market, the hospital pharmacy segment held the largest share as it serves as the primary distribution channel, managing a substantial portion of gabapentin prescriptions. These pharmacies are integral to patient care, particularly for individuals with chronic conditions such as epilepsy and neuropathic pain, ensuring timely access to necessary medications. The trust established between patients and hospital pharmacies further reinforces their central role in the distribution of gabapentin.

The online pharmacy segment is experiencing notable growth in the gabapentin market, driven by the increasing adoption of digital health services and e-prescriptions. The convenience of home delivery and the ability to discreetly obtain medications appeal to a broad patient base. This trend reflects a broader shift towards digitalization in healthcare, with online pharmacies expanding their reach and accessibility for gabapentin distribution.

Gabapentin Market Regional Analysis

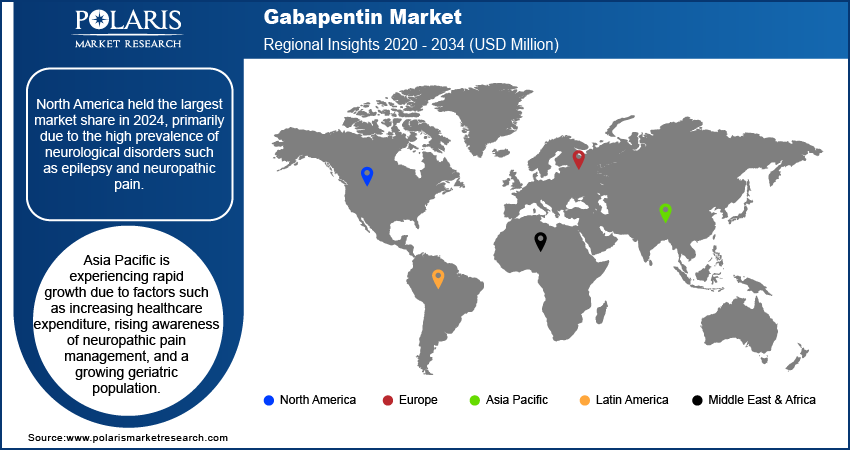

By region, the study provides the gabapentin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share of the gabapentin market, primarily due to the high prevalence of neurological disorders such as epilepsy and neuropathic pain. An April 2024 NCBI report revealed that in 2021, about 1.1% of US adults (roughly 2.87 million) had active epilepsy, while 0.6% (approximately 1.64 million) reported inactive epilepsy. The region's advanced healthcare infrastructure facilitates widespread access to gabapentin for managing these conditions. Additionally, the increasing off-label use of gabapentin for conditions such as anxiety and insomnia contributes to its demand. The presence of major pharmaceutical companies and favorable reimbursement policies further support the market growth in this region. Moreover, the availability of generic versions has made gabapentin more accessible, enhancing its adoption across North America.

The Europe gabapentin market is driven by an aging population and a high prevalence of neurological disorders such as epilepsy and neuropathic pain. Countries like Germany, the UK, and France are significant contributors to the market, with well-established healthcare systems ensuring patient access to gabapentin. The increasing incidence of conditions like diabetic neuropathy and postherpetic neuralgia further propels the demand for gabapentin in this region. Additionally, the availability of both branded and generic formulations provides patients with various treatment options, enhancing market growth.

The Asia Pacific gabapentin market is experiencing rapid growth due to factors such as increasing healthcare expenditure, rising awareness of neuropathic pain management, and a growing geriatric population. Countries such as China, Japan, and India are at the forefront of this expansion. The large patient pool, coupled with improving healthcare infrastructure, facilitates greater access to medications like gabapentin. Moreover, the presence of key generic manufacturers in this region contributes to the widespread availability and affordability of gabapentin, further driving market growth.

Gabapentin Market – Key Players and Competitive Insights

The competitive landscape of the gabapentin market features global and regional players competing through innovation and strategic alliances. Global players leverage R&D capabilities and technological advancements to deliver advanced solutions, meeting the demand for disruptive technologies. Market trends highlight rising technological adoption driven by economic growth and geopolitical shifts. Companies focus on strategic investments, mergers, and joint ventures to strengthen market positions. Regional players offer cost-effective solutions tailored to local needs. The market experiences ongoing technological transformation, with companies investing in supply chain management and sustainability strategies. Competitive intelligence and pricing insights are critical for identifying growth opportunities. The industry's growth is driven by technological innovation, market adaptability, and strategic regional investments, ensuring sustained competitiveness in a dynamic global market. A few major players are Amneal Pharmaceuticals, Inc.; Apotex Inc.; Aurobindo Pharma Ltd.; Dr. Reddy's Laboratories Ltd.; Glenmark Pharmaceuticals Ltd.; Lupin Limited; Mylan N.V.; Pfizer Inc.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; and Torrent Pharmaceuticals Ltd.

Amneal Pharmaceuticals, Inc. is a global biopharmaceutical company headquartered in Bridgewater, New Jersey, specializing in the development, manufacturing, and distribution of generic and specialty pharmaceutical products. Founded in 2002, Amneal operates through three key segments: Affordable Medicines, Specialty, and AvKARE. The Affordable Medicines segment focuses on producing a wide range of dosage forms, such as oral solids, injectables, nasal sprays, ophthalmics, and transdermal patches. The Specialty segment targets central nervous system and endocrine disorders with branded products such as Rytary for Parkinson’s disease and Unithroid for hypothyroidism. The AvKARE segment caters to governmental agencies like the Department of Defense and Veterans Affairs by distributing pharmaceuticals and medical supplies. Amneal in the generic drug market has over 280 marketed products and a robust pipeline of complex generics. Among its offerings is gabapentin, a widely used medication for managing neuropathic pain and seizures. Gabapentin is available in various formulations under Amneal’s generic portfolio, reflecting the company’s commitment to providing affordable medicines. Amneal combines innovation with scalability to address global healthcare needs while maintaining high-quality standards with manufacturing facilities across the United States, India, and Ireland.

Apotex Inc. is a Canadian-based global pharmaceutical company founded in 1974 and is recognized as the largest producer of generic drugs in Canada. Apotex has established itself as a leader in affordable medicine production, with operations spanning over 45 countries and exports to more than 100 territories. The company employs approximately 8,000 people worldwide and focuses on manufacturing high-quality generics, biosimilars, and active pharmaceutical ingredients (API). Apotex’s portfolio includes over 300 products addressing various health conditions such as diabetes, cancer, and cardiovascular diseases. Among its offerings, Apotex produces gabapentin under the brand name APO-GABAPENTIN. Gabapentin is an anticonvulsant medication primarily used for managing partial seizures and neuropathic pain. It works by modulating calcium channels in the nervous system to reduce excitatory neurotransmitter release, thereby alleviating pain and seizure activity. Apotex provides gabapentin in various formulations, including capsules and tablets, ensuring accessibility for patients globally. The company sticks to strict Good Manufacturing Practices (GMP) to maintain high product quality standards.

List of Key Companies in Gabapentin Market

- Amneal Pharmaceuticals, Inc.

- Apotex Inc.

- Aurobindo Pharma Ltd.

- Dr. Reddy's Laboratories Ltd.

- Glenmark Pharmaceuticals Ltd.

- Lupin Limited

- Mylan N.V.

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

Gabapentin Industry Developments

-

March 2024: Strides Pharma Science Limited (Strides) received approval from the United States Food & Drug Administration (USFDA) for Gabapentin Tablets USP in 600 mg and 800 mg strengths.

-

February 2023: Zydus Lifesciences, a subsidiary of Zydus Pharmaceuticals (USA) Inc., received tentative approval from the United States Food and Drug Administration (USFDA) for Gabapentin Tablets in 300 mg and 600 mg strengths, which are equivalents of the US Reference Listed Drug Gralise Tablets.

Gabapentin Market Segmentation

By Dosage Outlook (Revenue – USD Million, 2020–2034)

- Capsule

- Tablet

By Type Outlook (Revenue – USD Million, 2020–2034)

- Branded

- Generic

By Method Outlook (Revenue – USD Million, 2020–2034)

- Column-Based

- Magnetic Beads

- Reagent-Based

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Neuropathic Pain

- Epilepsy

- Restless Legs Syndrome

- Others

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gabapentin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,253.78 million |

|

Market Size Value in 2025 |

USD 2,367.60 million |

|

Revenue Forecast by 2034 |

USD 3,768.43 million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The gabapentin market has been segmented into detailed segments of dosage, type, method, application, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the gabapentin market focuses on expanding generic drug availability, strategic partnerships, and geographic expansion. Pharmaceutical companies invest in research and development to introduce cost-effective formulations and enhance drug efficacy. Increasing awareness of neuropathic pain management through targeted marketing campaigns drives demand. Companies also leverage online and hospital pharmacies to improve accessibility. Additionally, collaborations with healthcare providers and government initiatives support market penetration, particularly in emerging regions.

FAQ's

The gabapentin market size was valued at USD 2,253.78 million in 2024 and is projected to grow to USD 3,768.43 million by 2034.

The market is projected to register a CAGR of 5.3% during the forecast period.

North America held the largest share of the market in 2024.

The gabapentin market features several key players actively involved in the development, manufacturing, and distribution of gabapentin formulations. A few players are Amneal Pharmaceuticals, Inc.; Apotex Inc.; Aurobindo Pharma Ltd.; Dr. Reddy's Laboratories Ltd.; Glenmark Pharmaceuticals Ltd.; Lupin Limited; Mylan N.V.; Pfizer Inc.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; and Torrent Pharmaceuticals Ltd.

The capsule segment accounted for the largest share of the market in 2024.

The generic segment accounted for the largest share of the market in 2024.

Gabapentin is a prescription medication primarily used to treat neuropathic pain, epilepsy, and restless legs syndrome. It is an anticonvulsant that works by affecting nerve signaling in the brain to reduce seizure activity and nerve-related pain. Gabapentin is available in various formulations, including capsules, tablets, and oral solutions. It is also prescribed off-label for conditions such as anxiety and migraines. The drug is commonly marketed under brand names like Neurontin and is widely available in generic forms.

A few key trends in the market are described below: Rising Demand for Generic Gabapentin: Increased availability of cost-effective generic versions is driving market growth, particularly in emerging economies. Growing Prevalence of Neuropathic Pain and Epilepsy: The rising incidence of conditions such as diabetic neuropathy and postherpetic neuralgia is increasing the demand for gabapentin. Expanding Online and Retail Pharmacy Sales: The growth of e-commerce and retail pharmacy chains is improving patient access to gabapentin, boosting sales.

A new company entering the gabapentin market can focus on developing cost-effective generic formulations to compete in price-sensitive regions. Investing in research to enhance drug efficacy, such as extended-release formulations, can provide a competitive edge. Expanding distribution channels, including online and retail pharmacies, can improve accessibility and market reach. Compliance with evolving regulatory requirements and ensuring quality manufacturing standards will be crucial for long-term success. Additionally, targeting emerging markets with high demand for affordable neurological treatments and forming strategic partnerships with healthcare providers can drive growth and market penetration.

Companies manufacturing, distributing, or purchasing gabapentin and related products, and other consulting firms must buy the report.