Furniture Rental Service Market Share, Size, Trends, Industry Analysis Report, By Material (Wood, Metal, Plastic, Glass, and Others); By Product; By Application; By Region; Segment Forecast, 2024 – 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4349

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

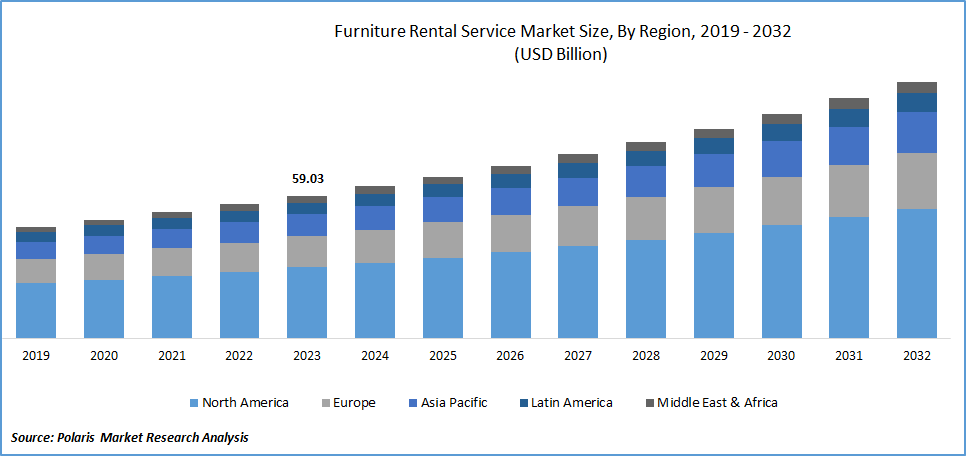

The global furniture rental service market was valued at USD 59.03 billion in 2023 and is expected to grow at a CAGR of 6.8% during the forecast period.

The exponential growth and upsurge in demand for various types of furniture on a rental basis, such as office tables and chairs, particularly from working professionals, due to emerging work-from-home trends coupled with the continuous change in people’s living culture and ideology and expansion of the rental economy all over the world, are among the leading factors driving its market growth. In addition, several established companies and new startups are investing heavily in their research & development activities to create new services and improve the existing ones to provide their customers with a more seamless and pleasant experience, which is likely to boost the market’s growth over the years.

- For instance, in March 2023, Cityfurnish, a leading online furniture rental platform based in India, announced that they had closed a USD 2.5 million financing round to support its growth, which was led by Northern Arc Capital and also included participation from Western Capital and UC Capital Inclusive.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces furniture rental service market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

To Understand More About this Research: Request a Free Sample Report

Furthermore, companies in the market are constantly focusing on bringing new innovations and advancements into their products, like customization options that allow customers to tailor furniture as per their specific needs and preferences easily. It involves several options, like selecting the fabric type, color, style, and even size of furniture, which leads companies and service providers to a broader customer base and helps them maximize their revenue.

However, a lack of people awareness about the availability of furniture rental services, especially in low-and-middle income countries, and the constantly increasing number of new market entrants and players with innovative strategies and services are likely to emerge as major challenges for companies in the market.

Industry Dynamics

Growth Drivers

Growing preference for flexible living arrangements and trend of interior decoration

The rapidly increasing preference for flexible as well as comfortable living arrangements, especially among the young population and individuals globally, can be achieved through furniture rental services as they offer customization options and a range of furniture products for customers with different needs and preferences, the primary factors fostering the market’s growth.

Besides this, there has been a significantly growing trend of renting furniture mainly among newly-wed couples & families because of its ability to provide an interior space & comfortable living, while allowing them to change spaces without the hassle of shifting heavy furniture.

3

The market is primarily segmented based on material, product, application, and region.

|

By Material |

By Product |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

Wood segment accounted for the largest market share in 2023

The wood segment accounted for the largest market share on account of its longer durability and low maintenance required as compared to other materials available in the market, coupled with the emerging trend among people towards adopting eco-friendly and sustainable furnishing items like wooden products.

The plastic segment is expected to register the highest growth rate during the projected period, which is mainly driven by its cost-effectiveness and lightweight, which makes it a highly suitable and preferable choice over wood and metal furnishing products. In addition, growing advancements in manufacturing technologies and techniques have led to greater versatility in plastic-based furniture designs and make them suitable for various types of preferences.

By Product Analysis

Bed segment held the significant market share in 2023

The bed segment held the majority of market revenue share in 2023, which is majorly driven by the rising popularity and prevalence of temporary living among individuals or couples, especially in high-income and developed countries, and the rise in the number of real estate professionals and home staging companies prefer furniture rental services over purchasing them.

As modern lifestyles have been emerging drastically in recent years, often involving adaptability and higher flexibility, the demand for renting beds is also increasing. They allow individuals to opt for a bed that matches their style without purchasing them or investing significant amounts into them.

The sofa & couch segment will also gain a substantial growth rate over the course of the study period because consumers are increasingly inclining towards the “try before they buy” trend that allows customers to test a sofa or couch and, after that, decide whether to buy it or not.

For instance, in July 2021, Sofology unveiled its new furniture rental service named “Loop” in partnership with the Fat Llama product rental marketplace. The new service offers customers access to sofas, footstools, and armchairs that all are made of sustainably sourced materials.

By Application Analysis

Residential segment is expected to witness highest growth during forecast period

The residential segment is expected to grow at the highest growth rate during the forecast period, mainly due to an increase in the number of people relocating from one location to another and the continuous emergence of work-from-home trends and classes worldwide that create demand for specific furniture. Additionally, renting furniture is becoming a more cost-effective and efficient solution than purchasing it, particularly for short-term needs. It is gaining more traction among individuals who often relocate and easily change residences without having the hassle of transporting and assembling their heavy furniture.

The commercial segment led the industry market with a significant share in 2023, which is majorly driven by a higher preference for furniture rental services among small offices and pantries for reducing their overall infrastructure costs. With the growing penetration for subscription-based furniture and availability of electronic appliances on a rental basis, the demand and need for furniture rental services is growing rapidly all over the world.

Regional Insights

North America region dominated the global market in 2023

The North America region dominated the global market. The regional market growth is mainly attributed to the region’s robust presence of some of the major service providers, higher awareness and preference for these services among individuals due to their benefits like flexibility and less investment required, and popularity among younger generations as they help meet their style preferences and needs.

The Asia Pacific will grow rapidly, owing to various developing and emerging economies in the region with a vast Gen-Z and millennial population who often change places and relocate for several purposes, including career, facilities, and family. Thus, the rising number of urban migrants and rapid rate of industrialization across the region will spur the demand for such services in the coming years. For instance, according to a recent report by Business Standard, India has a higher share of Gen Z and millennials as a percentage of the total population. In 2021, the percentage of Gen Z and millennials in the country stood at around 52%, which is higher than the global average of 47%.

Key Market Players & Competitive Insights

The furniture rental service market is moderately consolidated in nature, with several regional and global market companies competing in the market. Several key market players are implementing various business development strategies, including partnerships, collaborations, acquisitions and mergers, and new product launches, in order to expand their market presence and customer base all over the world.

Some of the major players operating in the global market include:

- Aaron’s LLC

- Apartment List

- Athoor

- Brook Furniture Rental

- CORT Business Services

- Fashion Furniture Rental

- Feather

- Fernish

- Fernished Inc.

- Furlenco

- Luxe Modern Rentals

- Rent-A-Center

- Rentomojo

- The Everset

Recent Developments

- In July 2021, Furlenco introduced the world’s 1st furniture subscription service, “ULNMTD,” which offers its customers all the furniture & appliances they want. It is available in two subscription plans, including premium and lite, that offer a choice of over 150 products.

- In June 2021, John Lewis announced the expansion of its furniture rental offering with the Fat Llama, which is the world’s largest product rental marketplace. With this expansion, customers will be able to rent out desks, sofas, dining & coffee tables.

Furniture Rental Service Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 62.85 billion |

|

Revenue forecast in 2032 |

USD 106.34 billion |

|

CAGR |

6.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the furniture rental service market report with a phone call or email, as and when needed.

FAQ's

The global furniture rental service market size is expected to reach USD 106.34 billion by 2032

Fashion Furniture Rental, Luxe Modern Rental, Apartment List, Aaron’s LLC, Brook Furniture Rental are the top market players in the market.

North America region contribute notably towards the global Furniture Rental Service Market.

The global furniture rental service market is expected to grow at a CAGR of 6.8% during the forecast period.

Material, product, application, and region are the key segments in the Furniture Rental Service Market.