Full Dentures Market Share, Size, Trends, Industry Analysis Report, By Materials (Metal Dentures, Acrylic Dentures, Ceramic Dentures, Porcelain Dentures, Others); By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4052

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

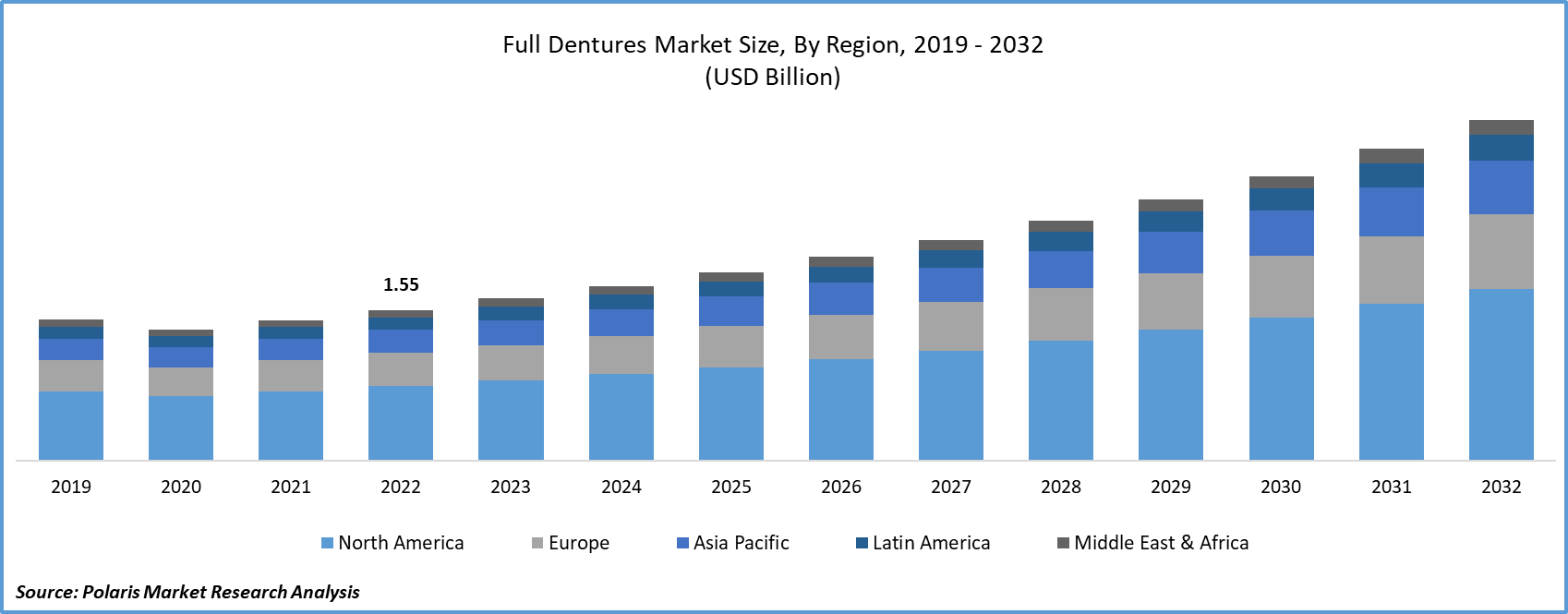

The global full dentures market size and share was valued at USD 1.66 billion in 2023 and is expected to grow at a CAGR of 8.70% during the forecast period.

A full denture also referred to as a complete denture, occupies the entire oral cavity instead of a specific section, serving as a removable solution to replace all missing teeth in cases where an individual has lost their entire set of teeth, typically crafted from acrylic material. Anticipated growth in the full dentures market is expected during the forecast period, driven by the projected rise in the number of edentulous individuals due to increasing life expectancy, thus leading to an increased demand for dental prostheses like dentures in the years ahead. The demand for meticulously crafted removable dental prostheses is set to rise as the baby boomer generation continues to age.

Full dentures can either be traditional or instant. Rendered after the teeth have been separated and the gum tissue has commenced healing a traditional denture is equipped for positioning in the mouth about 8 to 12 weeks after the teeth have been separated. The full dentures market demand is on the rise as unlike traditional dentures, instant dentures are rendered in advance and can be situated as soon as teeth are separated.

The denture advancement procedure takes a couple of weeks and numerous appointments. The steps involve making a sequence of impressions of the jaw and taking estimations of how the jaw connects and how much expanse in between them. The second step is making models, wax forms, and plastic motifs in precise shape and position of the denture then to be made. This is followed by casting a final denture and ultimately making adaptations as required.

To Understand More About this Research: Request a Free Sample Report

The dental care sector experienced a notable disruption in the early stages of the COVID-19 pandemic, with dental care providers temporarily closing to adhere to social distancing guidelines.

- For instance, In March 2020, the American Dental Association (ADA) released guidelines advising the postponement of elective dental procedures, including oral examinations, routine dental cleanings, radiography, cosmetic dental treatments, and a range of orthodontic procedures. The American Dental Association's Health Policy Institute (HPI) reported that dental services came to a halt during the pandemic.

Technological progress in denture manufacturing has facilitated greater patient acceptance and utilization of full dentures, with CAD/CAM technology playing a pivotal role in the development of both complete and partial dentures, promising substantial potential for denture design. This automation attributed to CAD/CAM technology is particularly advantageous for dental laboratories without extensive infrastructure, marking a significant transformation in the dental technology sector with the integration of CAD/CAM in the automated design of dental prosthetics.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the full dentures market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Industry Dynamics

Growth Drivers

- The increasing elderly population is expected to drive market growth.

The escalating burden of the aging demographic has led to a global surge in the demand for dentures. As the elderly population continues to grow, there is an expected increase in the need for addressing acute and chronic oral health conditions, subsequently driving greater demand for artificial teeth. Moreover, the rising prevalence of periodontal diseases among adults is poised to bolster full dentures market expansion further. As an illustration, the World Health Organization (WHO) reports that severe periodontal diseases affect approximately 19% of the global adult population, translating to over 1 billion cases worldwide. Consequently, these factors are expected to drive market growth.

Report Segmentation

The market is primarily segmented based on material, end-use, and region.

|

By Material |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

- The Ceramic Dentures segment held the largest revenue share in 2022

The present market for ceramic full dentures is experiencing consistent expansion, with this trajectory projected to persist in the forthcoming years. Factors like the growing awareness of aesthetic dental solutions and the increasing emphasis on enhanced oral health chiefly propel the surge in demand for ceramic full dentures. Ceramic full dentures provide patients with a robust and lifelike choice, thereby enhancing their acceptance.

The ceramic full dentures market is poised for a promising future, with a favorable projection for substantial expansion. The rising occurrence of complete tooth loss (edentulism) and the global aging population are pivotal factors propelling the need for ceramic full dentures. Furthermore, ongoing advancements in dental technology and techniques are adding momentum to the market's growth.

By End-Use Analysis

- The Dental Clinics segment accounted for the highest market share during the forecast period

In 2022, dental clinics took the lead, primarily due to the substantial presence of dentists practicing within these facilities. Furthermore, the proliferation of dental and orthodontic clinics in Europe and the United States has contributed to a significant uptick in the volume of procedures performed, factors that are expected to propel market growth.

As reported by the U.S. Census Bureau, roughly 85% of dentists were affiliated with dental offices or private practices.

The specialized dental hospitals segment is expected to record a higher CAGR from 2023 to 2030. The growing utilization of advanced digital technologies, such as 3D printing in dental laboratories for the creation of personalized products, along with the increasing prevalence of such dental laboratories in various global regions, will play a pivotal role in driving substantial growth within this segment throughout the forecast period.

Regional Insights

- Europe dominated the largest market in 2022

By the increasing expenditure on dental services, Europe asserted its dominance in the global market by leading in revenue generation, and this region is poised to maintain its significant market share throughout the study period. For instance, the National Health Service (NHS) in England allocates approximately USD 4.8 billion annually to dental care services, encompassing both primary and secondary care. Moreover, the NHS in England provides dental services to over 1 million patients every week.

The escalating awareness regarding dental services, diverse dental product offerings in the region, and the emergence of new applications are expected to propel the growth of this segment during the study period. Additionally, the substantial growth potential within the European dentures market is attracting investments from manufacturing companies, leading to the implementation of various strategic partnerships and acquisitions. Furthermore, the technological advancements introduced by major market players have contributed to increased demand for dental care products across various age groups.

North America will benefit from escalated healthcare expenditure, a robust healthcare infrastructure, and a sizable population affected by edentulism. Notably, data from the National Center for Biotechnology Information (NCBI) reveals that professional dental services in the United States rank fifth in terms of expenses, following after-hospital care, personal healthcare services, nursing home care, physician's services, and pharmaceuticals.

The Asia Pacific market is poised to demonstrate the highest CAGR, primarily due to the growing awareness of the numerous benefits associated with dentures. Furthermore, factors like an expanding elderly population, an increased prevalence of periodontal diseases, rising disposable income, and greater utilization of dental services are expected to drive the Asia Pacific market.

Illustratively, the Asia-Pacific Report on Population Ageing 2022 reveals that Asia is home to approximately 670 million individuals aged 60 years or older, a number projected to reach 1.3 billion by 2050. This escalating demand for dentures in the aging population, often linked to complete or partial tooth loss, is leading to heightened adoption of these products in countries like Japan, India, and China.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- 3M

- Align Technology, Inc.

- BEGO GmbH and Co. K.G.

- Brasseler USA

- Coltene Holdings AG

- D.B. Orthodontics

- Dentsply Sirona

- Envista

- G.C. Corporation

- Geistlich Pharma AG

- Henry Schein, Inc.

- Institut Straumann AG

- Ivoclar Vivadent

- J. Morita Corp

- Keystone Dental, Inc.

- Kuraray Co., Ltd.

- Mitsui Chemicals Inc.

- Nakanishi Inc.

- OSSTEM Implant Co

- Septodont Holding

- The Yoshida Dental Mfg Co. Ltd.

- Ultradent Products, Inc.

- VOCO GmbH

- Young Innovations Inc.

- Zimmer Biomet

Recent Developments

- In February 2023, Stratasys Reveals Cutting-Edge 3D Printing Technology for Full-Color Dentures in a Single Print.

- In February 2023, vhf camfacture AG proudly attained certification as an Ivoclar Authorized Milling Partner for the Ivotion Denture System, enabling the company to produce monolithic full dentures.

Full Dentures Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.79 billion |

|

Revenue Forecast in 2032 |

USD 3.50 billion |

|

CAGR |

8.70% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Material, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

We provide our clients the option to personalize the full dentures market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

Gain profound insights into the 2024 full dentures market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Delivery Robots Market Size, Share 2024 Research Report

Subdural Electrodes Market Size, Share 2024 Research Report

Corticosteroids Market Size, Share 2024 Research Report

Cumene Market Size, Share 2024 Research Report

Ophthalmic Drugs Market Size, Share 2024 Research Report