Fruit and Vegetable Processing Market Share, Size, Trends, Industry Analysis Report

By Product (Fresh, Fresh-cut, Canned, Frozen, Dried & Dehydrated, Convenience); By Equipment; By Mode of Operation; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2507

- Base Year: 2024

- Historical Data: 2020-2023

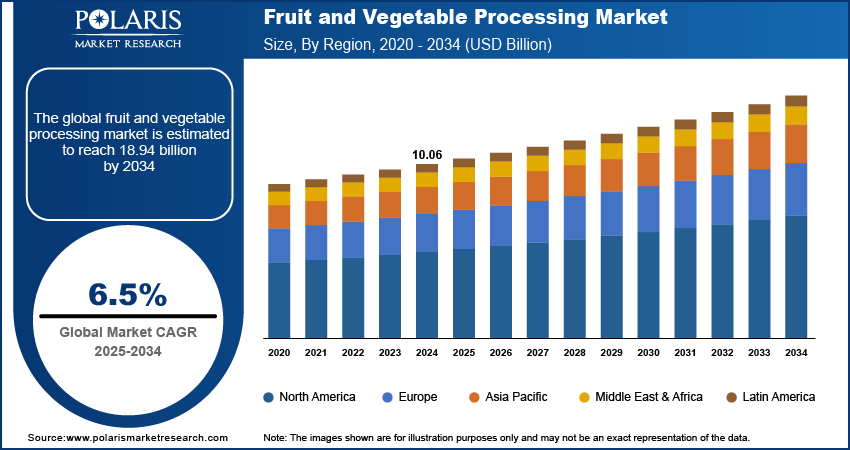

The global fruit and vegetable processing market was valued at USD 10.06 billion in 2024 and is expected to grow at a CAGR 6.5% during the forecast period. Processing fruits and vegetables, such as freezing, canning, drying, and preparing juices, jams, and jellies, improves the shelf life of fruits and vegetables. The processing of these commodities includes preparing the raw material for cleaning, trimming, and peeling, followed by cooking, canning, or freezing.

Key Insights

- The canned food segment accounted for the largest revenue share in 2024. This is due to the long shelf-life and cost-effectiveness, which are crucial for consumers as well as retailers for changing seasonal supply.

- The fillers segment is expected to witness rapid growth during the forecast period, driven by the filling systems that are an essential part of fruit and vegetable processing.

- The North American region dominated the market in 2024. This is due to the rise in demand for processed vegetables and fruits in developed countries.

- Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the change in the diet patterns of consumers.

Industry Dynamics

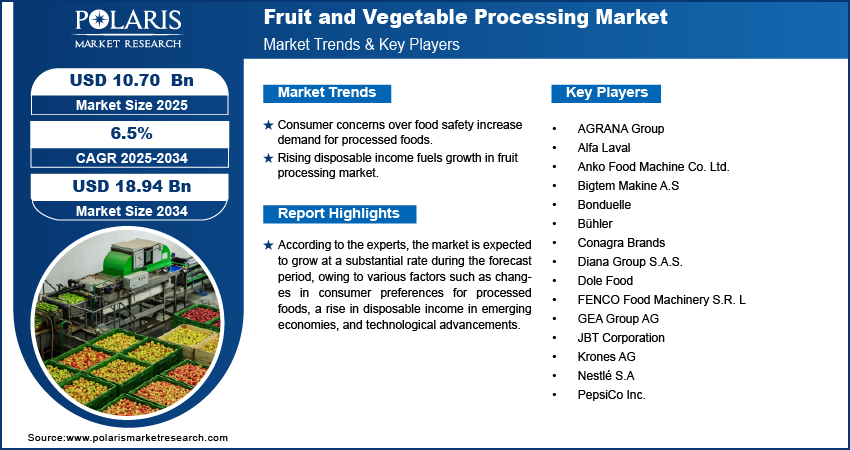

- Rise in consumer concerns over the safety of food products and demand for quality food items has boosted the shift toward processed foods.

- The rise in disposable income of consumers has contributed to the growth of the fruit and vegetable processing market due to the increased spending on various processed foods and related machinery.

- Increased operational costs from energy processing and strict food safety regulations pressure profits for small and medium-sized manufacturers.

- The rise in demand from consumers for organic, natural, and clean label products have created new avenue for health-focused and value-added fruit and vegetable offerings.

Market Statistics

- 2024 Market Size: USD 10.06 billion

- 2034 Projected Market Size: USD 18.94 billion

- CAGR (2025-2034): 6.5%

- North America: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

AI Impact on Fruit and Vegetable Processing Market

- AI vision systems automatically sort production by size, defects, and ripeness with accuracy.

- Algorithms of AI analyze sensor data to predict failures before they happen, which minimizes maintenance cost and downtime.

- These models are expected to forecast demand for optimization of inventory through data analysis to maximize extraction from raw production.

- It is also expected to boost R&D by analyzing consumer data to inform their preference for the production of new textures, flavors, and healthy formulations of products that consumers prefer.

According to the experts, the market is expected to grow at a substantial rate during the forecast period, owing to various factors such as changes in consumer preferences for processed foods, a rise in disposable income in emerging economies, and technological advancements.

It is imperative to have such processing machinery to avoid the risk of food contamination and ensure superior quality of food and flexible packaging during commercial manufacturing. All these factors have contributed to the growth of the market for fruit and vegetable processing.

Customers have become more health-conscious, and also, they have a higher preference for safety and quality. Therefore, these factors have additionally boosted the manufacturers to evaluate the safety parameters of each food product to maintain their product values in the industry.

Furthermore, with the introduction of high-end technologies and growth in demand for food processing machines from emerging economies such as Brazil, India, China, and South Africa, owing to changes in lifestyle patterns of consumers, the industry is expected to grow at a faster pace during the forecast period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Demand for processed quality food items and a rise in consumer concerns over the safety of food products are the primary drivers of the industry for fruit and vegetable processing. The major factors driving the industry are the change in preference toward processed foods. Processed foods are those that are altered in some way or another during their preparation before final consumption. Consumers are moving towards various processed foods, which are readily available in the market and require little preparation due to their changing lifestyle patterns.

Further, the rise in disposable income of consumers is another factor adding to the growth of the fruit and vegetable processing market. Consumer spending on various processed foods and related machinery has been increasing over the past few years, owing to an increase in disposable income and improved financial stability.

People are more likely to spend on these products, owing to time constraints and the ability to spend on various items such as slicers & dicers, mixers, and other extruding machines. Moreover, high living standards and willingness to spend money are some factors that contribute to the growth of the fruit and vegetable processing market.

Food processing is meant to manufacture high-quality food with enhanced taste and increased shelf life. In addition, they are used for different packaging types of fruits and vegetables. The customers demand the latest technology and offer high processing capacity with international hygiene & quality standards.

Change in food habits and preferences has led to an increase in demand for processed food items across the globe. Moreover, the growth of the food processing industry is expected to provide lucrative opportunities for new players to enter the industry with innovative products which offer higher output and better results.

Report Segmentation

The market is primarily segmented based on product, equipment, mode of operation, and region.

|

By Product |

By Equipment |

By Mode of Operation |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Product Analysis

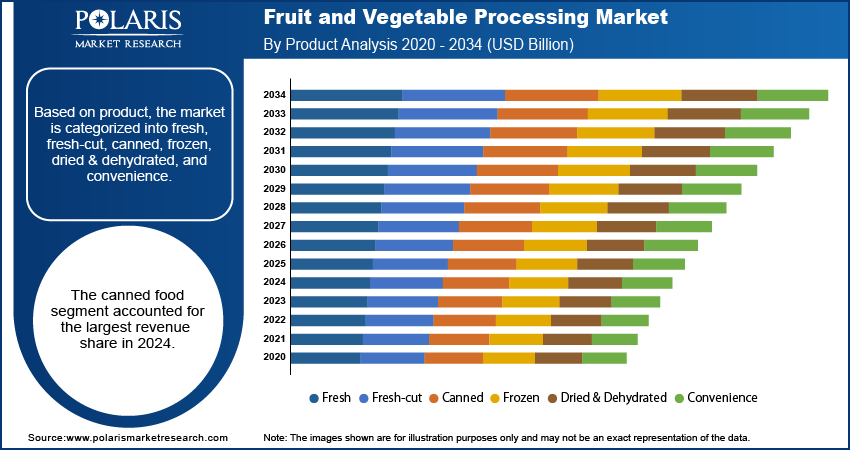

Based on product, the market is categorized into fresh, fresh-cut, canned, frozen, dried & dehydrated, and convenience. The canned food segment accounted for the largest revenue share in 2024. The canned segment consists of marginally processed agricultural products. The long shelf-life and cost-effictiveness are crucial for consumers as well as retailers for changing seasonal supply. Moreover, the rise in innovations for canned and packaging techniques have improved quality of products and their nutritional contents, boosting its appeal to the consumers.

The vegetables and fruits are frozen and packaged to avoid wastage or damage through bacterial contaminants during transportation. Several government initiatives and policies have been formed to increase the consumption of fruits and vegetables, increasing the demand for fresh fruits and vegetables. This expansion is further supported by the rise in cunsumer shift towards healthier and less processed food. Advances in cold logistics and packaging technologies are essential for wide distribution while monitoring freshness and safety of these goods.

Equipment Analysis

Based on equipment, the market has been segmented into pre-processing, peeling, & slicing, washing, fillers, seasoning system, packaging and handling, and others. The fillers segment is estimated to be the fastest-growing segment during the forecast period. This is because the filling systems are one of the foremost parts of fruit and vegetable processing, and the processed food items are filled into pouches, bottles, containers, and so on., based on the product category.

Mode of Operation Analysis

Based on the mode of operation, the fruit and vegetable processing market is sub-segmented into automatic and semi-automatic segments. The automatic segment accounted for the largest share in 2024. This is due to the increased traction and availability of processed food through various e-commerce platforms and established retail stores. Moreover, the growth in consistent output, strict hygiene standards, and high-volume for the automation of lines that deliver effective results rather than semi-automatic alternatives further support the expansion opportunities. Investments in Industry 4.0 and smart factories have also boosted the adoption of fully automated solutions for optimization of production and minimize labor costs.

Regional Analysis

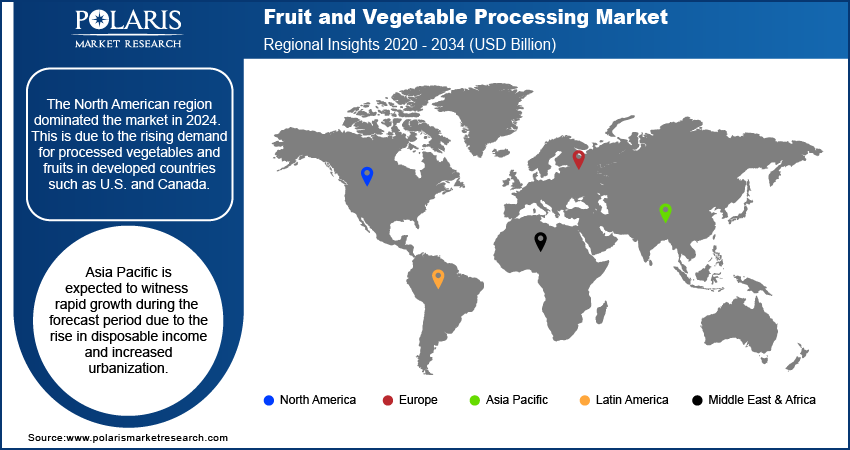

North America Fruit and Vegetable Processing Market Assessment

The North American region dominated the market in 2024. This is due to the rising demand for processed vegetables and fruits in developed countries such as U.S. and Canada. Moreover, increasing standard of living and rapid lifestyle change also accounts for the growth of the market in the North American region. This shift is further driven by the advances and developed retail infrastructure, which provides accessibility to a vast variety of processed products fo consumers. Furthermore, the rise in consumer awareness for food safety and strong preference for ready meals and convenience boost the rapid demand in North America region.

Asia Pacific Fruit and Vegetable Processing Market Insights

Asia Pacific is expected to witness rapid growth during the forecast period due to the rise in disposable income and increased urbanization. This shift in the economy has led to a change in the diet patterns of consumers, which has also boosted the robust demand for ready meals and packaged food with long shelf lives. Moreover, the availability of raw materials from agricultural output provides advantages for processing units. Government initiatives for post-harvesting loss and food processing infrastructure are further boosting the expansion opportunities.

India is expected to witness the fastest growth during the forecast period driven by the large consumer base and strong government push for investments and modernization of food processing units with policies like Make in India.

Key Players & Competitive Analysis Report

The competitive landscape of the fruit and vegetable processing industry includes strategic investments in automation and sustainable value chains to state the consumer demand for convenience and quality. Vendor strategies center on prospects for expansion in developing markets, where changing dietary habits yields unexplored demand and opportunity. Competitive intelligence from industry leaders suggests that technology advancement in processing equipment (for example, AI for sorting) is the most important competitive differentiator. Furthermore, large companies leverage joint ventures, mergers and acquisitions to strengthen their regional footprint and boost access to innovative technology.

Some of the major players operating in the global market include AGRANA Group, Alfa Laval, Anko Food Machine Co. Ltd., Bigtem Makine A.S, Bonduelle, Bühler, Conagra Brands, Diana Group S.A.S., Dole Food, FENCO Food Machinery S.R. L, GEA Group AG, JBT Corporation, Krones AG, Nestlé S.A, PepsiCo Inc.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the industry. The companies are also introducing new innovative products to cater to the growing consumer demands.

Industry Developments

July 2024: the Consumer Brands Association launched a website as a one-stop resource dedicated to providing fact-based information and dispelling myths on food processing and safety.

December 2021: Nestle India obtained approval under the Government of India production linked scheme (PLI) for the food processing sector under the eligible categories, i.e., ready-to-eat/ready-to-cook and processed fruits & vegetables. Under this scheme, Nestle India Limited received approval for its proposal for fruits and vegetable processing.

January 2021: DIL Deutsches Institut für Lebensmitteltechnik e. V. research institute (Germany) partnered with Bühler to develop new production technologies for focusing on healthy and sustainable food products.

Fruit and Vegetable Processing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.06 billion |

| Market size value in 2025 | USD 10.70 billion |

|

Revenue forecast in 2034 |

USD 18.94 billion |

|

CAGR |

6.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Equipment, By Mode of Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AGRANA Group, Alfa Laval, Anko Food Machine Co. Ltd., Bigtem Makine A.S, Bonduelle, Bühler, Conagra Brands, Diana Group S.A.S., Dole Food, FENCO Food Machinery S.R. L, GEA Group AG, JBT Corporation, Krones AG, Nestlé S.A, PepsiCo Inc. |

FAQ's

• The global market size was valued at USD 10.06 billion in 2024 and is projected to grow to USD 18.94 billion by 2034.

• The global market is projected to register a CAGR of 6.5% during the forecast period.

• North America dominated the global market share in 2024.

• A few of the key players in the market are AGRANA Group, Alfa Laval, Anko Food Machine Co. Ltd., Bigtem Makine A.S, Bonduelle, Bühler, Conagra Brands, Diana Group S.A.S., Dole Food, FENCO Food Machinery S.R. L, GEA Group AG, JBT Corporation, Krones AG, and Nestlé S.A, PepsiCo Inc.

• The canned food segment accounted for the largest revenue share in 2024.

• The fillers segment is expected to witness rapid growth during the forecast period.