Frozen Dessert Market Share, Size, Trends, Industry Analysis Report, By Product (Ice Cream, Frozen Yogurt, Confectionery & Candies, Others); By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM2471

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

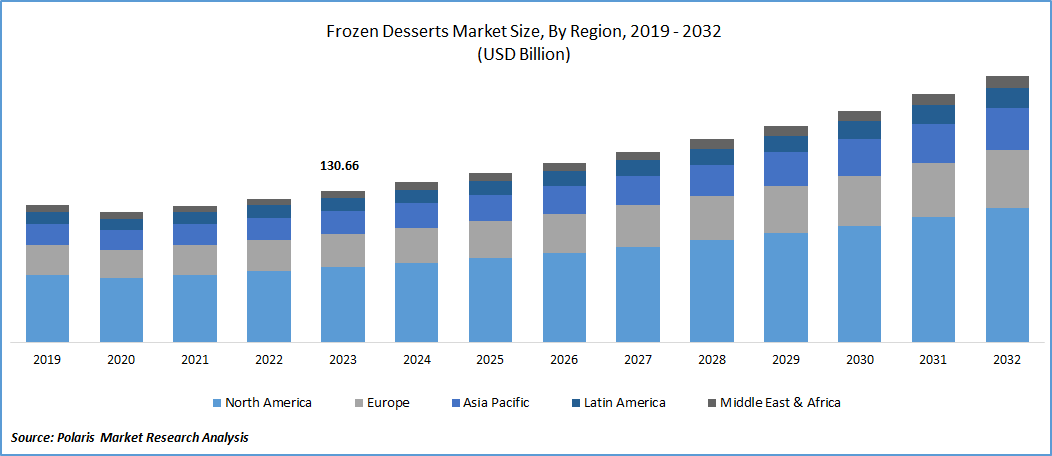

The global Frozen Dessert market was valued at USD 130.66 billion in 2023 and is expected to grow at a CAGR of 6.6% during the forecast period.

The growing market is propelled by a rising global demand for frozen dessert products, fueled by shifts in consumer preferences and health consciousness. Additionally, the market is driven by an increase in disposable income and the introduction of diverse dessert products to accommodate a wide range of consumer preferences.

Frozen desserts primarily consist of milk compounds, vegetable fats, flavors, and dry fruits. The increasing trend of consuming frozen desserts after meals as effective digestive products is propelling the dessert market's growth. Climate change is expected to contribute to a heightened global demand for frozen desserts like ice cream and frozen yogurt. The demand for ice creams alone is estimated to rise by up to 50% on hot days and decline by 20% in adverse weather conditions. Consumers associate ice cream consumption with cooling down their body temperature in hot climates, contributing to the market's expansion.

To Understand More About this Research: Request a Free Sample Report

Growing health consciousness is impeding the market's expansion, with a significant portion of consumers opting for healthier alternatives such as low-calorie options, vegan choices, and dairy-free products. The World Health Organization (WHO) reports that over 400 million people worldwide are currently living with diabetes, a number projected to surpass 600 million within the next two decades. This rising diabetic population has intensified the demand for sugar-free products in the dessert industry, catering to the specific needs of health-conscious consumers.

Furthermore, numerous companies are seeking to broaden their product range within the frozen dessert segment, driven by the rising popularity of frozen desserts in the Frozen Dessert market.

For example, Coca-Cola, a prominent carbonated beverage giant, extended its business by introducing frozen desserts in India. The company also declared an investment of ₹11,000 crores to establish an agriculture-focused ecosystem, food processing units, and sourcing initiatives, enabling the introduction of a diverse range of fruit-based products and desserts to the market.

Industry Dynamics

Growth Drivers

-

Increasing incidence of spinal degeneration is expected to drive market expansion.

The increasing preference for various ice cream varieties is fueled by a growing demand for smaller snack-sized portions. There is a rising trend of enjoying ice cream immediately, particularly at home events and gatherings. Takeout ice cream is also experiencing significant demand. Furthermore, health-conscious consumers favor artisanal ice cream, appreciated for its natural flavors, organic ingredients, and nutritional elements such as nuts and fruit.

The rise in health consciousness among a broader population segment, appreciating the quality and origin of ingredients, coupled with a preference for exotic flavors, is driving an increased demand for high-quality "premium" ice cream. Higher urbanization levels are also contributing to elevated ice cream consumption, evident from a surge in retail sales. Furthermore, the significant end-user role of establishments, particularly fast-food chain restaurants, is also fueling an uptick in consumption.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- The Ice Cream segment held the largest revenue share in 2022

The popularity of ice cream is soaring across all generations, driven by factors such as diverse flavors, shapes, fat contents, textures, and sweetness. Health-conscious consumers are increasingly favoring sugar-free and handcrafted ice creams. While taste and nutritional value remain crucial, factors like price, brand, and ambiance also significantly impact consumer choices in this market. A survey indicates that 36% of Brazilians opt for more affordable ice creams, showing a preference for private label options.

Frozen yogurt is expected to experience rapid growth in the forecast period due to numerous health benefits associated with the product. Comprising yogurt, and occasionally other dairy and non-dairy ingredients, frozen yogurt is a frozen dessert. Positioned as a healthier alternative to ice cream, frozen yogurt is gaining popularity among consumers, leading to its status as the fastest-growing product in the market.

By Distribution Channel Analysis

- The Supermarket/Hypermarket segment accounted for the highest market share during the forecast period

It is driven by the consistent rise in demand for desserts as part of daily grocery purchases, highlighting the increasing preference for desserts in everyday food consumption.

The increasing inclination towards purchasing items from specialty stores has led to the establishment of numerous cafes and bakery shops specializing in frozen dessert products. Recent developments have prompted these establishments to incorporate nutritious desserts into their menus, expanding their range of offerings. Additionally, various online delivery services are introducing creative solutions to deliver frozen desserts to customers' locations while maintaining freshness from the source points. This has contributed to a rise in the online purchasing of frozen desserts.

Regional Insights

- North America dominated the largest market in 2022

Changes in lifestyle, along with a growing focus on health, are propelling the expansion of this market. Frozen yogurt, encompassing a myriad of flavors and boasting over 400 brands, stands out as the most sought-after product in this segment. In line with this, the USDA has initiated multiple projects to encourage yogurt and related product consumption in the region. Given its calcium-rich composition, low-fat yogurt is being actively promoted by organizations for its health and nutritional benefits.

The frozen desserts market in the Asia Pacific is set to become the fastest-growing regional market during the forecast period. Urban population growth, evolving lifestyles, rising disposable income, and variable weather conditions are pivotal factors propelling market expansion in the region. The heightened demand for frozen desserts has resulted in a notable surge in the number of retail ice cream and frozen dessert stores in China. With an increasing preference for healthy, low-fat foods, frozen desserts are projected to gain traction in the Chinese market, fueled by a growing consumer spending capacity. The convergence of increasing consumer income, swift development of manufacturing capacity, a trend towards premiumization, and growing consumer adoption of premium products is expected to meet the surging demand for frozen desserts in China.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Archer Daniels Midland Company

- Arla Foods amba

- Conagra Brands Inc.

- Dairy Queen

- Daiya Foods Inc.

- Danone SA

- DD IP Holder LLC

- Ferrero

- General Mills Inc.

- Halo Top Creamery

- Kellogg Company

- London Dairy Co. Ltd

- Nestlé S.A.

- The Hain Celestial Group

- Unilever

Recent Developments

In October 2022, Hindustan Unilever's Kwality Walls introduced a Gulab Jamun flavored ice cream in India for the festive season, combining the exotic taste of mithai with fruits and nuts.

- In March 2022, Vadilal Enterprises unveiled new flavors for its Gourmet Natural ice cream line and launched a creative advertising campaign featuring the iconic Gulab Jamun Uncle, now recognized as Vadilal Ice Cream Uncle.

- In January 2022, Oreo Frozen Desserts were introduced by Mondelēz International, Inc., featuring a range of treats such as bars, cones, sandwiches, and Oreo trays. The bars and cones are enriched with Oreo pieces and coated with crushed Oreo wafer pieces, while the sandwiches boast two large Oreo wafers.

Frozen Desserts Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 138.01 billion |

|

Revenue forecast in 2032 |

USD 229.50 billion |

|

CAGR |

6.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Frozen Desserts market size is expected to reach USD 229.50 billion by 2032

the top market players in Frozen Desserts Market are Archer Daniels Midland Company, Arla Foods amba, Conagra Brands Inc

North America is the region that contribute notably towards the Frozen Desserts Market

The Frozen Desserts Market expected to grow at a CAGR of 6.6% during the forecast period.

Frozen Desserts Market report covering key segments are product, distribution channel, and region