Fresh Food Packaging Market Size, Share, Trends, Industry Analysis Report

By Material, By Pack Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM2357

- Base Year: 2024

- Historical Data: 2020-2023

Overview

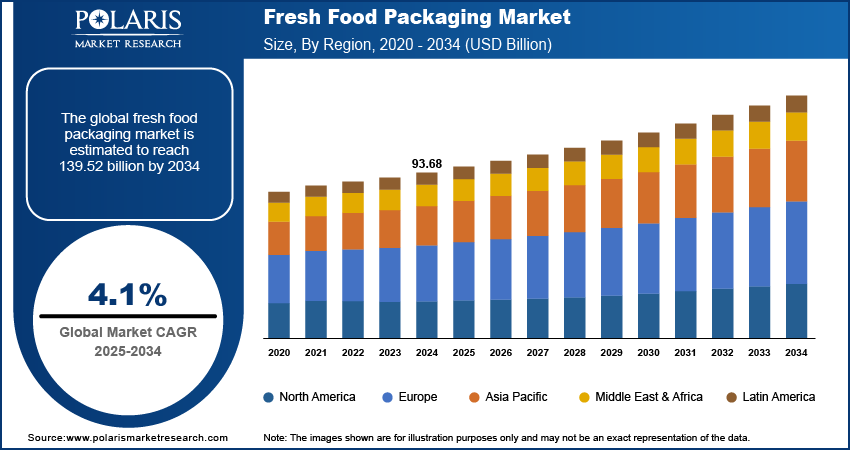

The global fresh food packaging market size was valued at USD 93.68 billion in 2024, growing at a CAGR of 4.1% from 2025 to 2034. Key factors driving demand for fresh food packaging include the rapid growth of e-commerce sector coupled with increasing focus on food safety and quality.

Key Insights

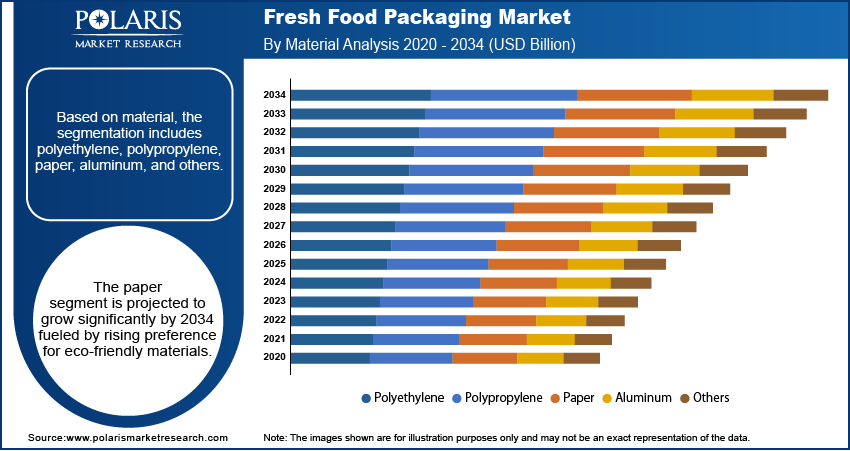

- The segment of polyethylene dominated the market in 2024.

- The paper segment is expected to expand at a fast rate in the coming years due to growing adoption of recyclable materials.

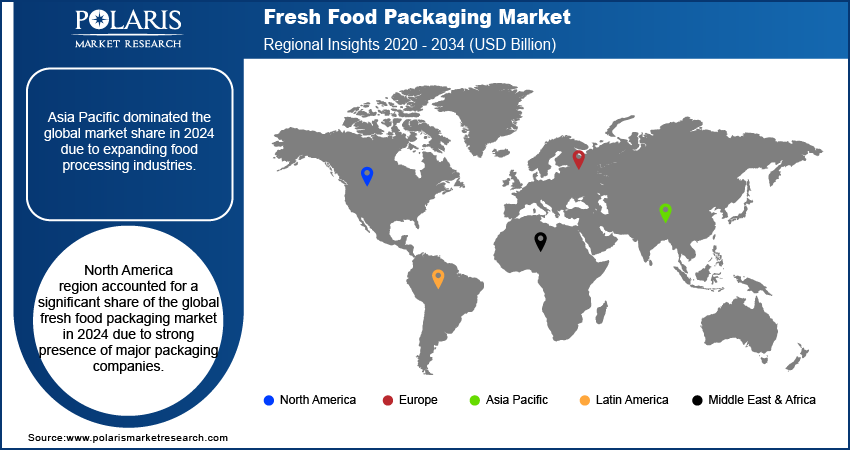

- Asia Pacific fresh food packaging market held the largest share in 2024.

- China and Japan drive regional growth with growing investments in advanced packaging manufacturing.

- North America market is expected to grow at a rapid rate from 2025-2034 owing to innovations in green packaging.

- The U.S. fresh food packaging market is fueled by rising packaged food consumption.

Industry Dynamics

- Rapid growth of the e-commerce sector worldwide boosts the adoption of fresh food packaging in rising demand for secure delivery solutions.

- Increasing focus on food safety and quality creates the need for fresh food packaging as consumers prefer hygienic storage options.

- Adoption of smart and active packaging solutions is expected to create new opportunities during the forecast period.

- The fluctuations in raw material prices is anticipated to limit market growth.

Market Statistics

- 2024 Market Size: USD 93.68 Billion

- 2034 Projected Market Size: USD 139.52 Billion

- CAGR (2025–2034): 4.1%

- Asia Pacific: Largest Market Share

Fresh food packaging refers to the technology and material employed to ensure perishable foods' safety, taste, and freshness during handling and storage and transportation. It provides for shelf life and contamination avoidance for fruits and vegetables, dairy, meat, and seafood products. Market expansion is driven by the growing focus on sustainable solutions and improved food safety levels.

Rising urban life is propelling the demand for ready-to-eat, on-the-go, and fresh-packaged foods, driving the demand for effective packaging solutions. The urban population, as per the United Nations, made up 57% of the world's population and is estimated to grow to 68% by 2050. This growth in city residence necessitates robust and clean packaging to preserve food freshness and safety.

Increasing green awareness among consumers and plastic usage legislation are driving the use of sustainable fresh food packaging. Companies are turning towards biodegradable packaging, recyclable, and compostable pack products to minimize its effects on the planet, driving innovation and market expansion.

Drivers & Opportunities

E-commerce Industry Growth: Rising e-commerce orders within online food purchasing are driving the demand for fresh food packaging to ensure freshness on delivery. The International Energy Agency predicted that the e-commerce market is expected to grow from USD 28 trillion in 2024 to USD 36 trillion in 2026. This growth is generating huge demand for packaging, preserving freshness and avoiding contamination during shipping.

Increasing Role of Food Quality and Safety: Increasing consumer concern toward purity and cleanliness is fueling demand for premium fresh food packaging solutions. Manufacturers and governments are focusing on contamination-free handling and longer shelf life to achieve safety requirements fueling growth and innovation in green packaging materials.

Segmental Insights

Material Analysis

By material, the market is classified as polyethylene, polypropylene, paper, aluminum, and others. The polyethylene segment led the market in 2024 due to its strength, elasticity and resistance to moisture, hence ideal for packaging perishable foods.

The paper segment is expected to record the fastest growth through 2034, led by the growing demand for recyclable and biodegradable materials. Saica Group partnered with Mondelez International in June 2024 to launch a recyclable paper-based packaging suitable for multipack chocolate, biscuit, and confectionery products.

Pack Type Analysis

Based on pack type, the market is divided into converted roll stock, gusseted bags, flexible paper, corrugated box, boxboard, and others. Converted roll stock accounted for the largest market share in 2024 due to its adaptability, superior sealing strength, and fitness for automated filling systems of food processing units.

The gusseted bags segment is forecast to grow at a fast rate until 2034, fueled by increasing use in frozen and ready-to-eat food packaging and its capability for delivering extended shelf life and effective storage space.

Application Analysis

By application, the market is categorized into meat products, vegetables, seafood, fruits, and others. Meat products dominated the market in 2024, driven by the demand for clean, temperature-resistant and vacuum-sealed packaging remaining high in retail and foodservice channels.

Seafood segment is expected to witness the highest growth by 2034 as a result of the rising demand for ready-to-cook and frozen seafood products. Also, improved cold-chain logistics and sustainable flexible packaging innovations are fueling this segment’s development.

Regional Analysis

Asia Pacific dominated the fresh food packaging market in 2024, driven by expanding food retail networks and rapid growth of food sector. Increasing demand for packaged fruits, vegetables, and dairy items in growing economies is offering significant opportunities for packagers.

India Fresh Food Packaging Market Insights

Expanding food and beverage industry in India is propelling demand for fresh food packaging to provide product safety, quality, and better shelf life. As per DBT-BIRAC, the country’s food processing sector valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030. This rapid industry expansion is increasing the need for advanced and sustainable packaging solutions.

Europe Fresh Food Packaging Market Assessments

Europe is expected to hold a large share of the market in 2034 owing to strict environmental policies and wide acceptance of recyclable and compostable packaging solutions. Rising consumption of ready-to-eat and organic food products is contributing to consistent market expansion in the region.

North America Fresh Food Packaging Market Trends

North America is expected to show the highest growth, driven by robust demand for convenient and sustainable packaging formats in retail and food service channels. Increasing consumer concern about the safety of food and maintenance of shelf life is driving the use of innovative packaging materials.

U.S. Fresh Food Packaging Market Overview

Rapid innovation in packaging technology is boosting the U.S. fresh food packaging market through improved material design and sustainability. For instance, Nestle collaborated with U.S. IBM Research to develop AI-based sustainable packaging indicating the expanding influence of the country in the field of smart packaging solutions.

Key Players & Competitive Analysis

The fresh food packaging market is competitive with major companies such as Amcor plc, Sealed Air Corporation, Mondi Group, and WestRock Company. Firms emphasize product safety, shelf-life extension, and visual appeal to meet consumer demand. The competitive market is fueled by innovation in packaging and strategic collaborations.

A few major companies operating in the fresh food packaging industry include Amcor plc, Sealed Air Corporation, Mondi Group, International Paper Company, WestRock Company, Smurfit Kappa, Coveris, Silgan Holdings Inc., DS Smith Plc, Anchor Packaging LLC, DuPont, and TPN Food Packaging.

Key Players

- Amcor plc

- Anchor Packaging LLC

- Coveris

- DS Smith Plc

- DuPont

- International Paper Company

- Mondi Group

- Sealed Air Corporation

- Silgan Holdings Inc.

- Smurfit Kappa

- TPN Food Packaging

- WestRock Company

Fresh Food Packaging Industry Developments

October 2025: Siegwerk, Borouge and TPN Food Packaging introduced a fully recyclable mono-material polyethylene pouch for dry foods minimizing multi-material waste in food packaging.

July 2025: INEOS Styrolution introduced a 100% bio-based polystyrene for sustainable food packaging reducing carbon emissions while maintaining premium heat resistance and transparency.

Fresh Food Packaging Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Polyethylene

- Polypropylene

- Paper

- Aluminum

- Others

By Pack Type Outlook (Revenue, USD Billion, 2020–2034)

- Converted Roll Stock

- Gusseted Bags

- Flexible Paper

- Corrugated Box

- Boxboard

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Meat Products

- Vegetables

- Seafood

- Fruits

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fresh Food Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 93.68 Billion |

|

Market Size in 2025 |

USD 97.41 Billion |

|

Revenue Forecast by 2034 |

USD 139.52 Billion |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 93.68 billion in 2024 and is projected to grow to USD 139.52 billion by 2034.

The global market is projected to register a CAGR of 4.1% during the forecast period.

Asia Pacific dominated the market in 2024 driven by expanding food processing industries.

A few of the key players in the market are Amcor plc, Sealed Air Corporation, Mondi Group, International Paper Company, WestRock Company, Smurfit Kappa, Coveris, Silgan Holdings Inc., DS Smith Plc, Anchor Packaging LLC, DuPont, and TPN Food Packaging.

The meat products segment led the market in 2024 due to rising demand for safe and extended shelf-life packaging.

The gusseted bags segment is projected to witness the fastest growth during the forecast period driven by rising use in retail and food service packaging.