Fracking Chemicals Market Size, Share, Trends, Industry Analysis Report: By Product, Well Type (Vertical Well and Horizontal Well), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1504

- Base Year: 2024

- Historical Data: 2020-2023

Fracking Chemicals Market Overview

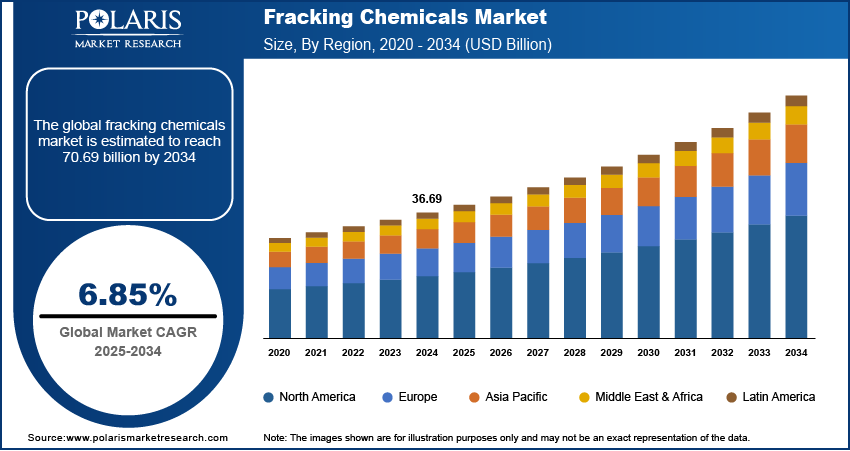

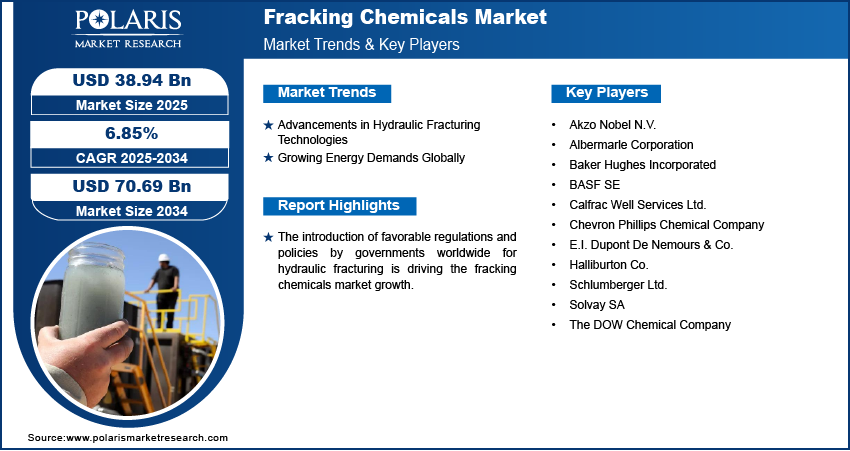

The global fracking chemicals market size was valued at USD 36.69 billion in 2024. The market is projected to grow from USD 38.94 billion in 2025 to USD 70.69 billion by 2034, at a CAGR of 6.85% from 2025 to 2034

Fracking, also known as hydraulic fracturing, is the process of injecting water, sand, and chemicals underground at extremely high pressures to fracture rock layers and release trapped oil or gas. Fracking chemicals are a complex mixture added to the fracking fluid to reduce friction, prevent corrosion, and improve extraction efficiency. These chemicals can be water-based, foam-based, or oil-based, depending on the formulation. Common fracking chemicals include ethylene glycol, hydrochloric acid, sodium hydroxide, ammonium persulfate, choline chloride, and magnesium peroxide.

The growing use of horizontal drilling and the rising adoption of natural gas as a fuel are some of the key factors fueling the fracking chemicals market growth. Horizontal wells facilitate easier access to gas and oil reserves, resulting in more efficient extraction processes. This shift is driving the demand for fracking fluids and chemicals that work effectively in challenging drilling environments. Additionally, rapid industrialization, population growth, and urbanization are driving the need for energy sources, supporting market expansion.

The discovery of new oilfields and advancements in offshore drilling techniques have increased the demand for fracking chemicals and fluids. Ongoing improvements in drilling technology continue to enhance the efficiency of hydraulic fracturing operations. Additionally, supportive regulatory policies have accelerated the fracking chemicals market development.

To Understand More About this Research: Request a Free Sample Report

Fracking Chemicals Market Dynamics

Advancements in Hydraulic Fracturing Technologies

Leading market companies continually invest in research and development to improve operational efficiency, maximize production output, and enhance fracking fluid formulations. Advanced fracking chemicals offer benefits such as improved environmental compatibility, higher fracture conductivity, and reduced water consumption. Additionally, innovations in nanotechnology, polymer chemistry, and surfactant design enable the development of customized fracking chemicals tailored to specific geological formations and reservoir conditions. These advancements are driving the fracking chemicals market demand by improving the effectiveness, sustainability, and safety of hydraulic fracturing operations.

Rising Energy Demand Globally

Developed nations and populations tend to use more energy-intensive products and services, leading to higher energy consumption. Unconventional sources, including tight sandstone, coalbed methane, and shale formations, are becoming increasingly important as conventional oil and gas supplies deplete. Hydraulic fracturing is a key method for removing hydrocarbons from these unconventional sources. Fracking chemicals play a crucial role in hydraulic fracturing by enhancing well productivity, facilitating fluid flow, and minimizing formation damage. As a result, the rising demand for energy worldwide is boosting the fracking chemicals market revenue.

Fracking Chemicals Market Segment Insights

Fracking Chemicals Market Outlook by Product Insights

The fracking chemicals market segmentation, based on product, includes oil-based fluids, water-based fluids, foam-based fluids, and synthetic-based fluids. The water-based fluids segment dominated the market with a revenue share of 70% in 2024. This dominance can be attributed to several factors, including their ease of handling, environmental compatibility, and cost-effectiveness. In addition, water-based fluid compositions are being increasingly adopted due to the growing emphasis on reducing the environmental impact of fracking operations.

The oil-based fluids segment is expected to register a significant CAGR of 6.9% from 2025 to 2034, driven by their ability to transport proppants and enhance well output effectively. Further, technological developments in oil-based fluid compositions that improve performance and reduce environmental concerns are contributing to the segment’s robust growth.

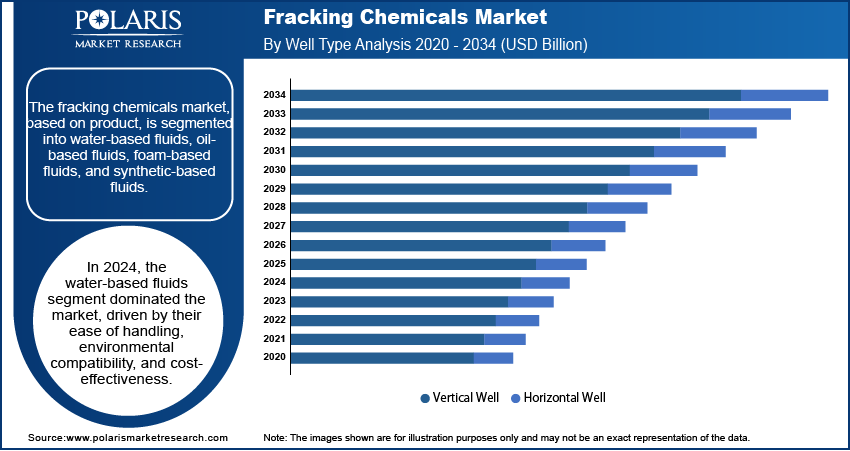

Fracking Chemicals Market Evaluation by Well Type Insights

Based on well type, the fracking chemicals market is segmented into vertical well and horizontal wells. In 2024, the horizontal well segment led the market with an 85.1% revenue share. The dominance of horizontal well in the market can primarily be attributed to their significantly higher production rates compared to vertical well. This well type facilitates higher hydrocarbon recovery by exposing the reservoir to a larger volume of fracturing fluids. Rising demand for fracking chemicals and fluids designed for horizontal well also contributes to the segment’s leading share.

The vertical well segment is expected to register a robust CAGR of 6.5% during the forecast period, driven by their established technology and lower initial investment costs than horizontal drilling. The demand for fracking chemicals and fluids in this segment is supported by ongoing research and development focused on new vertical well projects, as well as the continued need for enhanced hydrocarbon recovery methods.

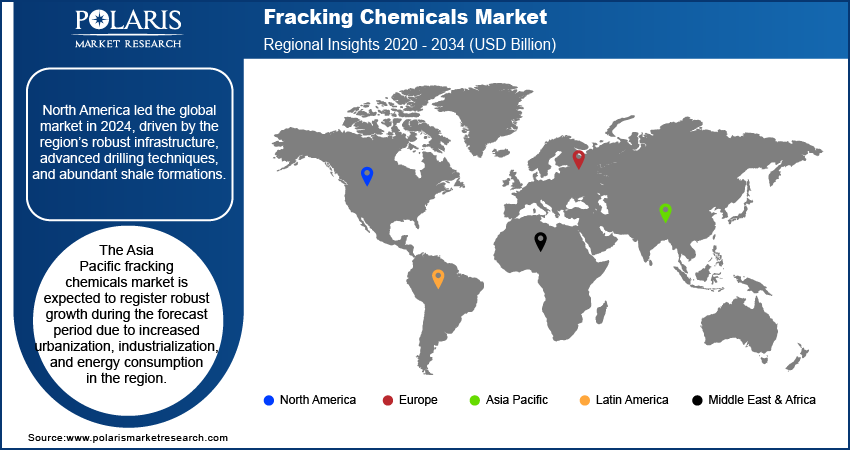

Fracking Chemicals Market Outlook Regional Analysis

By region, the report provides the fracking chemicals market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America led the global market with a 60.8% revenue share in 2024, driven by the region's robust infrastructure, advanced drilling techniques, and abundant shale formations. North America benefits from a long history of oil and gas production and exploration, which has fostered a skilled workforce and a well-established supply network. The region's robust economic growth and emphasis on energy independence also contribute to its leading market share. Furthermore, favorable regulatory policies for the development and application of innovative fracking chemicals and fluids and the presence of major oil and gas companies boosts the regional market dominance.

The Asia Pacific fracking chemicals market is projected to register a robust CAGR of 3.1% during the forecast period due to rising energy consumption, urbanization, and industrialization in the region. The demand for specialized chemicals and fluids is also being driven by the exploration of new shale and tight oil reserves, which are boosting exploration and production activity in the region.

Fracking Chemicals Market – Key Players and Competitive Insights

The leading market players are introducing new, innovative products to cater to the evolving consumer needs. Also, they are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their market presence. To expand and survive in a highly competitive market, market participants must offer innovative and cost-effective solutions.

In recent years, the market for fracking chemicals has witnessed several innovation breakthroughs, with the top market participants providing solutions that help meet sustainability goals. The fracking chemicals market report offers a market assessment of all the leading players, including Halliburton Co., BASF SE, Akzo Nobel N.V., Chevron Phillips Chemical Company, Baker Hughes Incorporated, The DOW Chemical Company, Calfrac Well Services Ltd., E.I. Dupont De Nemours & Co., Albermarle Corporation, and Schlumberger Ltd.

List Of Fracking Chemicals Market Key Players

- Akzo Nobel N.V.

- Albermarle Corporation

- Baker Hughes Incorporated

- BASF SE

- Calfrac Well Services Ltd.

- Chevron Phillips Chemical Company

- E.I. Dupont De Nemours & Co.

- Halliburton Co.

- Schlumberger Ltd.

- Solvay SA

- The DOW Chemical Company

Fracking Chemicals Industry Developments

In July 2024, the Ohio House of Representatives passed the Ohio House Bill 562 (HB 562). The new bill mandates that companies willing to do hydraulic fracturing within the state disclose the chemicals present in the fluids used during operations. HB 562 aims to improve openness and public safety.

In January 2024, the Pennsylvania Department of Environmental Protection (DEP) announced new fracking regulations. The regulation requires companies to make their chemical usage for hydraulic fracturing and drilling publicly available.

Fracking Chemicals Market Segmentation

By Product Outlook

- Oil-Based Fluids

- Water-Based Fluids

- Foam-Based Fluids

- Synthetic-Based Fluids

By Well Type Outlook

- Vertical Well

- Horizontal Well

By Application Outlook

- Breakers

- Cross-Linkers

- Clay Control Agent

- Friction Reducer

- Gelling Agent

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fracking Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 36.69 billion |

|

Market Size Value in 2025 |

USD 38.94 billion |

|

Revenue Forecast by 2034 |

USD 70.69 billion |

|

CAGR |

6.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The market was valued at USD 36.69 billion in 2024 and is projected to grow to USD 70.69 billion in 2034.

• The market is projected to register a CAGR of 6.85% from 2025 to 2034.

• North America held the largest share of the global market revenue in 2024.

• Halliburton Co., BASF SE, Akzo Nobel N.V., Chevron Phillips Chemical Company, Baker Hughes Incorporated, The DOW Chemical Company, Calfrac Well Services Ltd., E.I. Dupont De Nemours & Co., Albermarle Corporation, and Schlumberger Ltd. are some of the key players in the market.

• The water-based fluid segment led the market in 2024.

• The horizontal well segment held the largest market share in 2024.