Forage Market Share, Size, Trends, Industry Analysis Report, By Crop Type (Cereals, Legumes, and Grasses); By Product Type; By Animal Type; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3513

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

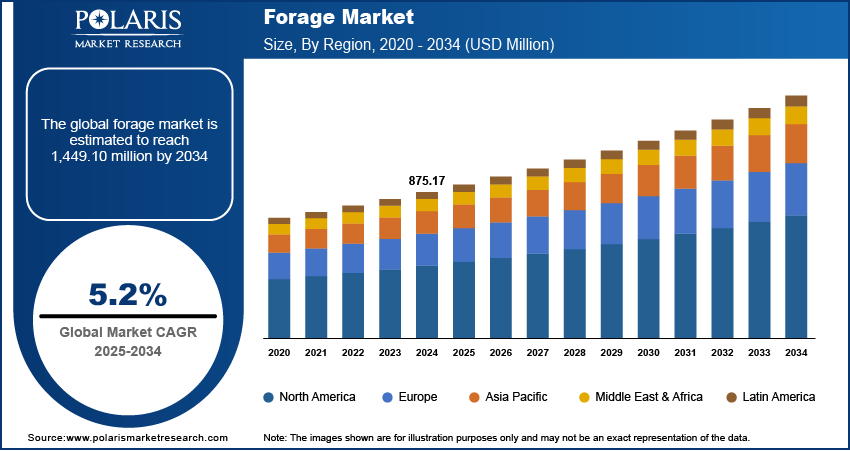

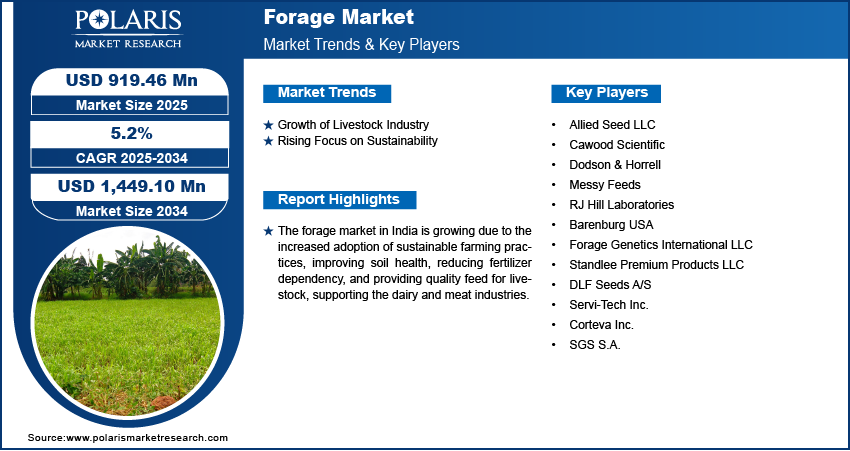

The global forage market size was valued at USD 810.85 million in 2023. The forage industry is projected to USD 1,261.13 million by 2032, exhibiting a CAGR of 5.0% during 2023- 2032.

Growing awareness among individuals about the numerous health benefits of consuming animal meat products such as milk and meat and high focus on the health of livestock, along with the rising preference for the products among farmers as it provides adequate nutrition to animals, which are the major factors boosting the market growth at a rapid pace.

To Understand More About this Research: Request a Free Sample Report

Additionally, the rising adoption of improved processing methods for increasing the product’s shelf life and innovations in the forage production capabilities, which enhance the production of fortified animal feed while reducing the waste product volume, are also likely to create huge growth opportunities for the market in the near future. For instance, in March 2023, York restaurant announced the launch of a unique and new menu, foraged and fresh ingredients, to create environment-friendly flavors. Forage consists of a ‘waste-less’ ethos that uses excess cuts of fruits, vegetables, & supplement foods in flavor rubs, dressings, and many other applications.

Moreover, high advances in breeding techniques have led to the rapid development of forage crops with improved yield, quality, and resistance to pests and diseases, which has helped farmers to increase productivity and maximizes their profitability coupled with the introduction of precision agriculture technologies such as GPS mapping and sensors, help farmers to optimize forage production by monitoring soil conditions, moisture levels, and nutrient requirements.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the forage market. The rapid emergence of the deadly coronavirus globally has resulted in temporary closures of restaurants, hotels, and several other food service establishments due to lockdowns and other stringent government measures. The pandemic has also disrupted global supply chains due to issues with transportation, labor shortages, and other logistical challenges that negatively influenced the market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rapidly increasing prevalence of several types of chronic illnesses in livestock and widespread modernization across the globe, which results in changing consumer preferences and a rise in the demand for high-quality organic and natural forage, are among the key factors driving the market growth globally. Rising consumer focus on health in livestock and awareness regarding the negative impacts of low-quality forage products on both health and the environment is generating significant growth potential for the market.

Furthermore, the emergence of several new technologies and improvements in forage seed genetics and an increasing number of government favorable reimbursement policies or programs, including subsidies and tax rebates, coupled with the rise in investments in the R&D sector to develop more enhanced and improved products or manufacturing techniques, are some other factors influencing the demand and growth of the market.

Report Segmentation

The market is primarily segmented based on crop type, product type, animal type, and region.

|

By Crop Type |

By Product Type |

By Animal Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Legumes Segment Accounted for the Largest Market Share in 2022

The legumes segment accounted for the largest market share in 2022 and will likely retain its market position throughout the forecast period. The growth of the segment market can be highly attributed to the high volume of protein, fiber, and several other essential nutrients, which further contain nitrogen-fixing bacteria that can improve soil fertility. In addition, these crops are gaining significant popularity among farmers as they can be easily grown in various climates and are relatively inexpensive compared to other feed options available in the market, thereby propelling the segment market.

The grasses segment is anticipated to grow at the fastest growth rate over the coming years on account of growing innovations in the production techniques for grass, such as improved seed varieties and precision agriculture practices, which increased the productivity and efficiency of the grasses. The continuously increasing demand and adoption of grasses as a major source of forage for livestock, including cattle, sheep, and goats, is further fueling the demand and growth of the market.

The Stored Forage Segment Held A Significant Market Revenue Share in 2022

The stored forage segment held the maximum market share in terms of revenue in 2022, which is mainly driven by rising demand for animal feed and the need to ensure a consistent supply of forage throughout the year due to the rising global population and increased consumption of animal protein all over the world. The rapid development of enhanced storage technology like bale wrappers and silage bags, which allows farmers to store forage for longer while maintaining product quality, is driving the segment market growth.

The fresh storage segment is projected to exhibit a significant growth rate over the anticipated period, mainly due to its increasing prevalence among consumers globally due to numerous nutritional benefits like a large number of proteins, vitamins, and minerals availability, which makes it an essential part of a balanced diet for livestock. With the rising health and environmental concerns, farmers are increasingly looking to purchase fresh storage from organic or sustainable sources, fueling the demand for products.

The Poultry Segment is Expected to Grow the Most Over the Projected Period

The poultry segment is projected to grow throughout the forecast period, which is highly attributable to the rising need and demand for the product, proper maintenance and nutrition to fresh and healthy meat, and the growing protein consumption among consumers globally. In addition, many consumers are becoming more health-conscious and opting for natural and organic products with higher nutritional values, pushing the market growth forward.

The cattle segment led the industry market with substantial revenue share, which is largely accelerated by increasing adoption of the foraged seeds in the cattle feed, which increases the quality and freshness of milk & meat products along with the exponential growth of the global livestock industry, particularly the dairy and beef sectors.

North American Region Dominated the Global Market in 2022

North America garnered the largest share in 2022, which is mainly attributed to the continuous rise in the consumption of dairy products and high preferences towards organic feed, along with the surging production of alfalfa in countries like the US and Canada due to reduction of land available for the feeding animals. Moreover, the rapid expansion in Oregon, where the forage grass is produced due to the growing demand for forage seed and favorable policies introduced by governments, contribute significantly to the market growth.

The Asia Pacific region is likely to be the fastest growing region with a healthy CAGR over the next coming years, owing to increased forage demand in the region due to high production of chicken and other meat products and a shift in consumer preferences for dairy products due to its several health benefits and growing consumer awareness regarding the health and environmental concerns associated with chemical or pesticide-based products.

Competitive Insight

Some of the major players operating in the global market include Allied Seed, Cawood Scientific, Dairy Land Laboratories, CVAS Forage Lab, Eurofins Scientific, Intertek Testing Laboratories, Dodson & Horrell, Messy Feeds, RJ Hill Laboratories, Barenburg USA, Cargill Incorporated, Forage Genetics International, Standlee Premium Products, DLF Seeds, Servi-Tech Inc., Corteva Inc., and SGS S.A.

Recent Developments

- In July 2021, Wilbur-Ellis Nutrition announced that the company has successfully acquired the forage pellets business of Ametza, a leading manufacturer and seller of forage pellets for livestock and companion animal markets through the major retailers of the U.S. With this acquisition, the company will expand its current forage manufacturing operations and will leverage the company’s capabilities both domestically and internationally.

- In November 2022, Altech, an animal nutrition and health company, announced the launch of Egalis, a new range of high-quality silage inoculants which helps maximize nutrient quality retention and reduce dry matter loss. It controls and drives forage fermentation using highly efficient homolactic bacteria and elements which inhibit fungal growth.

Forage Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 810.85 million |

|

Revenue forecast in 2032 |

USD 1,261.13 million |

|

CAGR |

5.0% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Crop Type, By Product Type, By Animal Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Allied Seed LLC, Cawood Scientific, Dairy Land Laboratories, CVAS Forage Lab, Eurofins Scientific, Intertek Testing Laboratories, Dodson & Horrell, Messy Feeds, RJ Hill Laboratories, Barenburg USA, Cargill Incorporated, Forage Genetics International LLC, Standlee Premium Products LLC, DLF Seeds A/S, Servi-Tech Inc., Corteva Inc., and SGS S.A. |

FAQ's

The global forage market size is expected to reach USD 1,261.13 million by 2032.

Top market players in the Forage Market are Allied Seed, Cawood Scientific, Dairy Land Laboratories, CVAS Forage Lab, Eurofins Scientific, Intertek Testing Laboratories.

North American contribute notably towards the global Forage Market.

The global forage market expected to grow at a CAGR of 5.0% during the forecast period.

The Forage Market report covering key are type, product type, animal type, and region.