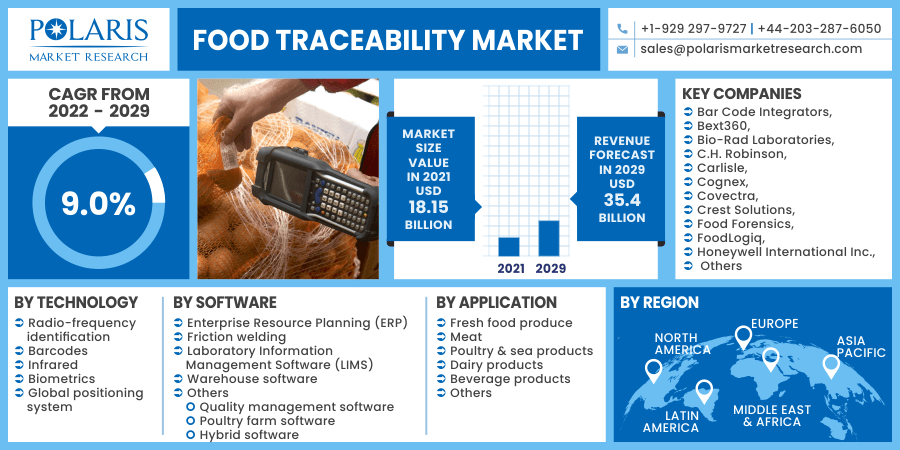

Food Traceability Market Share, Size, Trends, Industry Analysis Report, By Technology (Radio-frequency Identification, Barcodes, Infrared, Biometrics, Global Positioning System); By Software; By Application; By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 120

- Format: PDF

- Report ID: PM2144

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Outlook

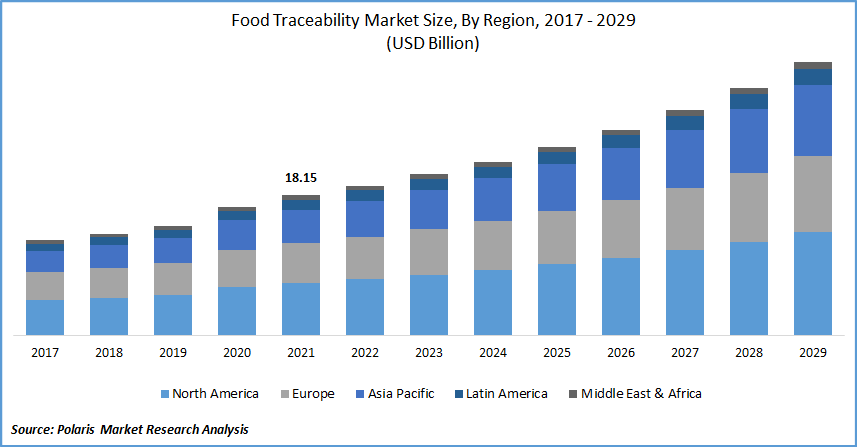

The global food traceability market was valued at USD 18.15 billion in 2021 and is expected to grow at a CAGR of 9.0% during the forecast period. One of the primary factors expected to drive the market's growth is customer worries about meal safety. Food-borne infections and adulteration occurrences are also expected to fuel demand for this traceability industry in the forecast period, resulting in major health-related difficulties.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, as per the WHO, every year, an estimated 600 million individuals – about one in every ten people across the globe, become ill after having contaminated meals, which results in a loss of around 33 Mn healthy man-days. Each year, low- and middle-income nations lose USD 110 billion in productivity and medical costs as a result of hazardous consumables.

Furthermore, the rise in regulatory organizations' initiatives to promote safety across countries and the expansion of legislative framework is expected to fuel the growth of the food traceability market. In addition, a surge in the number of traces contamination and product recall is expected to stimulate the development of the food traceability market over the forecast period.

Additionally, in the forecast period, significant technical improvements in traceability and government support for implementing consumable traceability systems are expected to provide a variety of new possibilities for this traceability industry. Advanced technology-based solutions such as barcodes and RFID are available for tracking a product and its contents. The technology provides data collection, storage, and exchange of traceability attributes on inputs, freshness, pathogen infestation tracking, and environmental variable assessment, in addition to product traceability.

However, there are some problems with implementing these technologies, such as ensuring the privacy and security of data contained on RFID tags against illegal access and modification. Consumers are concerned about privacy invasion because they believe they could be monitored if they purchase RFID-enabled devices, another hazard posed by RFID. As a result, consumer and manufacturer concerns about data sharing impede the progress of the food traceability business.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market has witnessed major players' initiatives such as partnerships, product launches, mergers and acquisitions, geographical expansion, and the rising trend of automation and intelligence decisions. For instance, In March 2021, Honeywell International Inc. has agreed to buy a controlling position in Fiplex Communications INC, a Miami-based firm that creates in-building communication systems. Due to the acquisition, Honeywell's in-building connection and communication solutions will expand. Honeywell wireless technologies will use Fiplex's products as a foundation for innovation.

Further, in February 2021, Fusionware announced the acquisition of its platform operations by AgTech.io, LLC, owned and managed by C9 Capital, LLC. Fusionware is the platform that connects the dots from beginning to end, giving their country's growers and consumers comprehensive traceability.

Fusionware is the cloud-based produce supply chain firm, assisting growers in connecting every stage of the supply chain – from seed to shelf. Fusionware can trace a seed-based commodity back to the parent generation of the seed and the grocery store shelf. To do this, Fusionware employs a patented cloud-based technology that provides real-time data access to key stakeholders throughout the supply chain. Thus, major players' acquisitions and advancements are the factors that are boosting the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on technology, software, application, and region.

|

By Technology |

By Software |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Technology

Based on the technology segment, the Radio frequency identification technology (RFID) segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. Food traceability refers to the control and tracing of consumable goods as they travel to their final destination, whether a customer or a store. This process uses technology to track the actual address of the meal, ensuring that a tainted or rejected meal is not mixed in with a perfectly good meal.

Radio-frequency Identification Technology (RFID) is used to track real-time information by utilizing a tag that identifies and tracks consumables using radio waves. RFID technology is beneficial since it tracks data and complex characteristics like temperature, air pressure, and moisture. It also has an advantage over its competitors. It does not need user-initiated, line-of-sight activities, and it can simultaneously read and write hundreds of tags, lowering labor and expenses. RFID enables businesses to capture data with the fewest possible errors.

Geographic Overview

In terms of geography, North America had the largest revenue share in 2021. Due to the obvious significant need for traceability in growing countries. Individual market affecting factors and changes in regulation in the domestic market are also discussed in the country portion of the food traceability market study, which impacts the market's current and future trends. Consumption quantities, manufacturing sites and volumes, import-export analysis, price trend analysis, cost of raw materials, and downstream and upstream value chain evaluation are primary markers utilized to anticipate the market scenario for different countries.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. Rapid population growth with surging consumables demand, food safety among consumers is driving the driving revenue growth in the region. Due to the region's large population and spending power, consumers are looking for high-quality, safe meals to eat. The demand for these traceability services is expanding as the population's consumption habits change due to increased awareness about healthy F&B. The millennial generation is driving demand for clean and safe F&B, propelling the food traceability industry once again.

Competitive Insight

Some of the major players operating in the global market include Bar Code Integrators, Bext360, Bio-Rad Laboratories, C.H. Robinson, Carlisle, Cognex, Covectra, Crest Solutions, Food Forensics, FoodLogiq, Honeywell International Inc., Merit-Trax, OPTEL GROUP, rfxcel, Safe Traces, SGS SA, Source Trace, TE-Food, Trace One, Traceall Global, and Zebra Technologies.

Food Traceability Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 18.15 billion |

|

Revenue forecast in 2029 |

USD 35.48 billion |

|

CAGR |

9.0% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Technology, By Software, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Bar Code Integrators, Bext360, Bio-Rad Laboratories, C.H. Robinson, Carlisle, Cognex, Covectra, Crest Solutions, Food Forensics, FoodLogiq, Honeywell International Inc., Merit-Trax, OPTEL GROUP, rfxcel, Safe Traces, SGS SA, Source Trace, TE-Food, Trace One, Traceall Global, and Zebra Technologies. |