Food Service Equipment Market Size, Share, Trends, Industry Analysis Report: By Equipment, Sales Channel (Online and Offline), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM1418

- Base Year: 2024

- Historical Data: 2020-2023

Food Service Equipment Market Overview

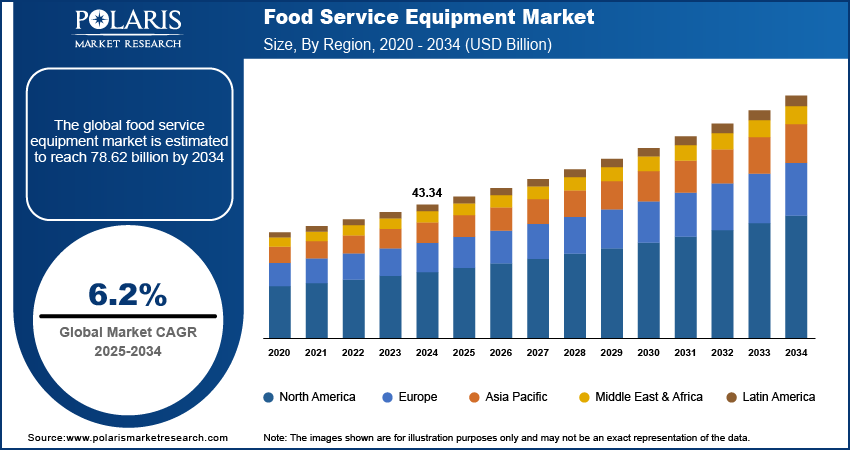

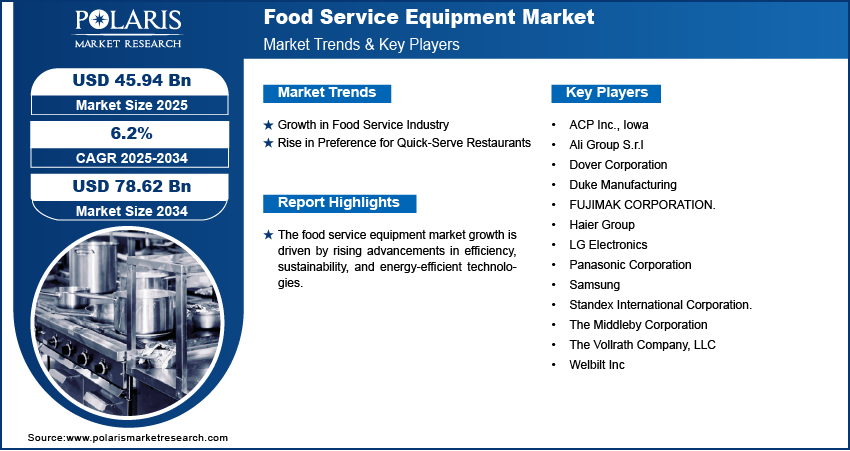

The food service equipment market size was valued at USD 43.34 billion in 2024. The market is projected to grow from USD 45.94 billion in 2025 to USD 78.62 billion by 2034, exhibiting a CAGR of 6.2% during the forecast period.

Food service equipment refers to the tools, devices, and machines used in commercial kitchens and other establishments to prepare and serve food. The equipment range from small appliances such as blenders and toasters to large commercial-grade equipment such as ovens, fryers, and refrigerators. The food service equipment market is experiencing steady growth, driven by the rising demand for efficient, energy-saving, and technologically advanced solutions in the hospitality and food service industries. The National Restaurant Association's 2020 State of the Restaurant Industry Report projected record industry sales of USD 899 billion, driven by off-premises growth, technology adoption, and eco-friendly practices. The report highlighted workforce challenges, evolving consumer preferences for healthy and locally sourced options, and opportunities in alcohol offerings. Key factors fueling the food service equipment market demand include the increasing number of restaurants, cafes, and fast-food chains and growing consumer preferences for dining out. Additionally, innovations in automation and smart kitchen technologies are reshaping commercial kitchen appliances, enhancing productivity and operational efficiency. The market also benefits from a heightened focus on food safety and hygiene, leading to the adoption of advanced storage, preparation, and cooking equipment.

To Understand More About this Research: Request a Free Sample Report

Food Service Equipment Market Drivers Analysis

Growth in Food Service Industry

Since restaurants, hotels, and catering services are expanding their operations, they require advanced and efficient equipment to enhance productivity, meet safety standards, and maintain food quality. This demand is further amplified by the rise of new food service concepts, including cloud kitchens and meal delivery services, which necessitate specialized and high-performance kitchen equipment to support their unique operational needs. In November 2024, Swiggy launched its Kitchen Equipment Procurement Services to help restaurant partners streamline their kitchen setup and improve operational efficiency. The service connects restaurants with reliable vendors offering premium equipment at exclusive prices tailored to their specific needs and size of operations. Therefore, the expansion of the food service industry, fueled by increased consumer spending on dining out and the proliferation of restaurants, is driving the food service equipment market growth.

Rise in Preference for Quick-Serve Restaurants

Quick-serve restaurants (QSRs) rely on efficient, high-capacity cooking, refrigeration, and food preparation equipment to ensure swift service and maintain food quality. Additionally, the need for automated and compact equipment that optimizes space and reduces operational costs aligns with the fast-paced nature of QSRs, driving further investments in specialized food service equipment. In September 2024, KFC India launched a Sign Language training program for all 17,000+ employees. The company also introduced India’s first interactive Sign Language kiosk, allowing consumers to learn to order food using Indian Sign Language, promoting inclusivity in the hospitality industry as part of its Kshamata initiative. Therefore, the growing consumer preference for QSRs, driven by busy lifestyles and the demand for fast, convenient meals, has positively influenced the food service equipment market development.

Food Service Equipment Market Segment Analysis

Food Service Equipment Market Assessment by Sales Channel Outlook

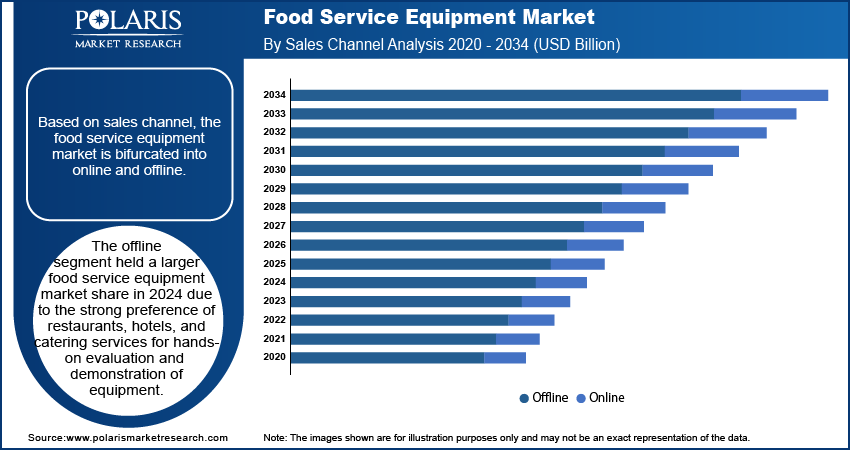

The global food service equipment market segmentation, based on sales channel, includes online and offline. The offline segment held a larger food service equipment market share in 2024 due to the strong preference of restaurants, hotels, and catering services for hands-on evaluation and demonstration of equipment. Offline channels allow potential buyers to physically assess the quality, durability, and functionality of food service equipment before making further investments. Additionally, these traditional sales channels offer the advantage of immediate access to maintenance and after-sales services, which are critical in the food service industry where equipment downtime adversely impacts operations. The long-established relationships between equipment vendors and restaurant owners further support the dominance of the offline segment in the market.

Food Service Equipment Market Evaluation by Equipment Outlook

The global food service equipment market segmentation, based on equipment, includes food preparation equipment, drink preparation equipment, cooking equipment, warming & holding equipment, refrigerators, and dishwashers. The food preparation equipment segment is expected to witness the highest growth rate due to the increasing demand for efficiency and consistency in food preparation. Foodservice businesses, particularly in quick-service restaurants (QSRs), look to streamline operations and meet the rising demand for high-volume, fast-food production, where the need for advanced food preparation equipment has surged. The rise in new foodservice concepts, such as cloud kitchens and meal delivery services, which prioritize speed and consistency, further accelerates this demand. Additionally, innovations in food processing technologies are making food preparation equipment more efficient, hygienic, and versatile, contributing to the growth of this segment.

Food Service Equipment Market Regional Insights

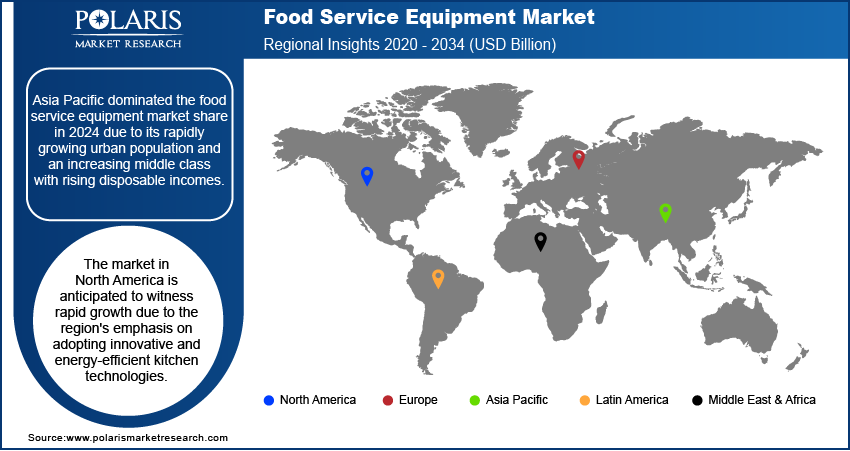

By region, the study provides food service equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the food service equipment market share in 2024 due to its rapidly growing urban population and the increasing disposable incomes of the rising middle-class population. The expansion of the hospitality and tourism sectors in countries such as China, India, and Japan has driven demand for commercial kitchens and modern food preparation solutions. Additionally, the proliferation of quick-service restaurants and international food chains in the region has created a robust market for advanced food service equipment. Government initiatives to support the food processing and hospitality industries further boost market growth. In November 2024, Australia addressed the critical issue of food waste, which costs the economy USD 36.6 billion each year. The Australian government introduced the National Food Waste Strategy, aiming for a 50% reduction in food waste by 2030. This initiative has encouraged food service operators to adopt sustainable practices, such as composting programs and enhanced waste management systems.

The North America food service equipment market is anticipated to witness the fastest growth due to the region's emphasis on adopting innovative and energy-efficient kitchen technologies. The increasing majority of food trucks, cloud kitchens, and fast-casual dining trends drive demand for versatile and compact food service equipment. Moreover, strict food safety regulations and a growing focus on sustainable practices encourage the adoption of advanced equipment. The region's strong base of established food service chains and continuous technological advancements in equipment manufacturing also contribute to the food service equipment market expansion across the region.

Food Service Equipment Market – Key Players and Competitive Analysis Report

The competitive landscape of the food service equipment market is shaped by a mix of global leaders and regional players aiming to capture major market share through innovation, strategic partnerships, and regional expansion. Major global players such as Rational AG, Welbilt Inc., Middleby Corporation, and Ali Group leverage their robust R&D capabilities and extensive distribution networks to offer advanced cooking, refrigeration, and food preparation solutions. Market trends indicate growing demand for energy-efficient, automated, and high-performance equipment, as well as innovations such as smart kitchen technology and sustainable solutions. According to the food service equipment market assessment, the market is expected to witness considerable growth, driven by the expansion of the hospitality industry, increasing consumer spending on dining out, and the rising preference for QSRs. Regional companies, particularly in emerging markets such as Asia Pacific, capitalize on local needs by offering cost-effective, tailored solutions, with this region anticipated to witness the fastest growth. Competitive strategies include mergers and acquisitions, collaborations with food service operators, and the development of specialized products to cater to the evolving needs of restaurants and catering services. These factors highlight the importance of technological innovation, market adaptability, and regional investments in propelling the food service equipment market expansion. A few key major market players are Welbilt Inc; The Middleby Corporation; Standex International Corporation; Dover Corporation; FUJIMAK CORPORATION; The Vollrath Company, LLC; Haier Group; Ali Group S.r.l; LG Electronics; Panasonic Corporation; Samsung; Duke Manufacturing; and ACP Inc., Iowa.

Panasonic Holdings Corporation is a multinational electrical, electronics, and appliance manufacturing company that operates in various industries, including electronics, devices, and industrial solutions. The company also has a few specialties, which include business solutions, industrial equipment, manufacturing, housing, artificial intelligence, engineering, virtual reality, internet of things, energy savings and environment, audio video solutions, productivity improvement, food service systems, facial recognition, supply chain management (SCM), security and disaster prevention, and digital transformation. The company’s diverse portfolio encompasses consumer electronics, such as televisions, cameras, audio equipment, and home appliances. The company’s food service equipment portfolio includes commercial microwaves, ovens, refrigeration units, dishwashers, and food warmers, designed to enhance efficiency, performance, and energy savings in professional kitchens and foodservice operations.

Standex International Corporation, founded in 1955 and headquartered in Salem, New Hampshire, is a diversified global industrial company that operates across multiple sectors, including food service equipment. The company is publicly traded on the New York Stock Exchange under the ticker symbol SXI. Standex's operations are organized into five primary segments: Electronics, Engraving, Scientific, Engineering Technologies, and Specialty Solutions. Within these segments, Standex provides a wide range of products and services tailored to commercial and industrial markets both domestically and internationally. In the food service equipment sector, Standex specializes in manufacturing refrigerated, heated, and dry merchandising display cases. These products are essential for retailers and food service providers looking to enhance product visibility and maintain optimal storage conditions. The company's Specialty Solutions segment is particularly noted for its innovative display solutions that cater to the needs of the food service industry, ensuring that products remain fresh while being attractively presented to consumers. This segment also includes custom fluid pump solutions and hydraulic cylinders, further showcasing Standex's commitment to providing comprehensive solutions across various applications. Standex International innovates and adapts to market demands, leveraging advanced technologies to improve product offerings. The company has established a strong reputation for quality and reliability, which is critical in the competitive landscape of food service equipment. Standex continues to focus on growth through strategic partnerships and a problem-solving approach that addresses the evolving needs of its customers, with a workforce of over 1,600 employees worldwide. Standex International Corporation remains well-positioned to meet the challenges of the global market while delivering value across its various business segments by maintaining a diverse portfolio and investing in research and development.

List of Key Companies in Food Service Equipment Market

- ACP Inc., Iowa

- Ali Group S.r.l

- Dover Corporation

- Duke Manufacturing

- FUJIMAK CORPORATION.

- Haier Group

- LG Electronics

- Panasonic Corporation

- Samsung

- Standex International Corporation.

- The Middleby Corporation

- The Vollrath Company, LLC

- Welbilt Inc

Food Service Equipment Industry Development

In May 2024, Samsung launched three new AI-powered refrigerators in India featuring its next-generation AI Inverter Compressor, offering up to 10% energy savings and a 20-year warranty. The models include innovative designs such as the 4-Door Flex French Door Bespoke Family Hub Refrigerator.

In June 2023, Coca-Cola showcased its foodservice-oriented beverage, equipment, digital, and sustainability innovations at the National Restaurant Association Show 2023.

In November 2022, Hatco Corporation acquired Food Warming Equipment Company, Inc. (FWE), a manufacturer of heated holding cabinets and cook & hold ovens. This acquisition enhances Hatco's product offerings and aligns with its commitment to customer service.

Food Service Equipment Market Segmentation

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Food Preparation Equipment

- Slicers & Peelers

- Mixers & Grinders

- Food Blenders

- Processors

- Others

- Drink Preparation Equipment

- Drink Blenders

- Juicers

- Ice Crushers

- Others

- Cooking Equipment

- Grills

- Fryers

- Toasters

- Others

- Warming & Holding Equipment

- Warmer

- Merchandizers

- Sauce Dispensers

- Refrigerators

- Dishwashers

By Sales Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Full-Service Restaurant (FSR)

- Quick Service Restaurant (QSR)

- Hotels & Pub Bar Clubs

- Others (General & Retail Stores)

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Food Service Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 43.34 billion |

|

Market Size Value in 2025 |

USD 45.94 billion |

|

Revenue Forecast by 2034 |

USD 78.62 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global food service equipment market size was valued at USD 43.34 billion in 2024 and is projected to grow to USD 78.62 billion by 2034.

• The global market is projected to register a CAGR of 6.2% during the forecast period.

• Asia Pacific dominated the market share in 2024.

• A few key players in the market are Welbilt Inc; The Middleby Corporation; Standex International Corporation; Dover Corporation; FUJIMAK CORPORATION; The Vollrath Company, LLC; Haier Group; Ali Group S.r.l; LG Electronics; Panasonic Corporation; Samsung; Duke Manufacturing; and ACP Inc., Iowa.

• The offline segment held a larger market share in 2024.

• The food preparation equipment segment is expected to witness the highest growth rate during 2025–2034