Food Safety Testing Market Share, Size, Trends, Industry Analysis Report, By Test (Genetically Modified Organism (GMO) Testing, Residues & Contamination Testing, Microbiological Testing, Allergen Testing, Chemical & Nutritional Testing, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM1923

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

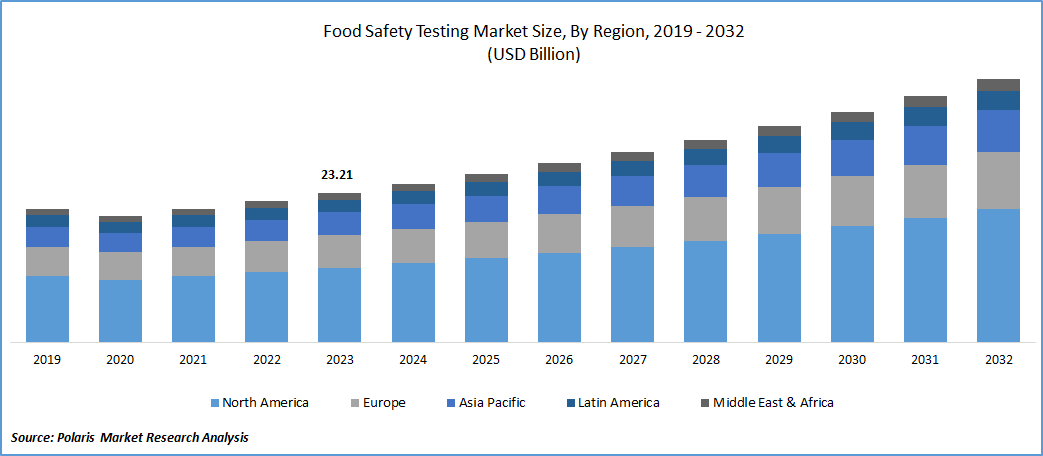

Food Safety Testing Market size was valued at USD 23.21 billion in 2023. The market is anticipated to grow from USD 24.62 billion in 2024 to USD 40.91 billion by 2032, exhibiting a CAGR of 7.3% during the forecast period

Food Safety Testing Market Overview

The market is experiencing significant growth driven by an increased incidence of food-borne illnesses, heightened consumer awareness of food safety, the enforcement of stringent regulations, and a growing demand for convenient packaged food. Moving forward, food safety testing providers are poised for substantial expansion, benefitting from technological advancements in testing methodologies. Ensuring the quality and safety of our food is imperative, making food safety testing essential.

This sector plays a vital role in preserving public health by identifying and eliminating hazardous pollutants, foodborne pathogens, and viruses. The market is expected to witness substantial growth due to increasing public apprehension about food contamination and foodborne illnesses, coupled with advancements in testing methodologies. According to estimates from the Centers for Disease Control and Prevention (CDC), approximately 1 in 6 Americans, equivalent to 48 million individuals annually, experience foodborne illnesses. These conditions result in approximately 3,000 fatalities each year, with 128,000 individuals requiring hospitalization. Consequently, the rising incidence of foodborne illnesses in the American population is anticipated to propel the food safety testing market.

To Understand More About this Research: Request a Free Sample Report

Foodborne illnesses primarily result from the consumption of contaminated, spoiled, or deteriorating food items, serving as breeding grounds for various microorganisms such as bacteria, fungi, parasites, and viruses, among others. Additionally, the escalating incidence of foodborne illnesses is attributed to several other contaminants, including heavy metals, mycotoxins, and chemicals. This surge in incidents is driving a significant increase in demand for food testing kits, machinery, and systems, thereby boosting the market for food safety equipment.

For instance, in May 2022, Bureau Veritas, based in Reno, Nevada, a company specializing in certification services, laboratory testing, and inspection, announced the establishment of its third U.S. microbiological laboratory. This facility will conduct microbiology indicator analyses and rapid pathogen testing for the agri-food industry.

Food Safety Testing Market Dynamics

Market Drivers

The Increasing Occurrences of Foodborne Illnesses Bolstering the Growth of the Food Safety Testing Market

Foodborne illnesses are typically infectious or toxic, resulting from the ingestion of bacteria, viruses, parasites, or chemical substances through contaminated food or water. Pathogens associated with foodborne illnesses, such as Salmonella, E. coli, and Campylobacter, can cause severe diarrhea and debilitating infections, including meningitis, affecting millions of people annually with occasional severe and fatal outcomes. Symptoms include fever, headache, nausea, vomiting, abdominal pain, and diarrhea. Listeria infection may lead to miscarriage in pregnant women or the death of newborns, while chemical contamination can cause acute poisoning or result in long-term diseases like cancer. Foodborne diseases have the potential for long-lasting disability and death. Examples of unsafe foods include uncooked animal products, fruits, and vegetables contaminated with feces, and raw shellfish containing marine biotoxins.

Therefore, the anticipated increase in the prevalence of foodborne diseases worldwide is expected to lead to a substantial rise in the demand for food safety testing in the coming years.

Market Restraints

High Cost Likely to Hamper the Growth of the Market

The process of food safety testing demands specialized equipment and expertise, both of which pose financial challenges for businesses, especially smaller ones. Some enterprises encounter difficulties in establishing comprehensive food safety measures due to a lack of resources to invest in costly testing equipment or to hire trained personnel. Consequently, they may opt for less thorough testing or none at all, potentially jeopardizing consumer safety. Additionally, the expenses incurred in testing are often transferred to consumers, resulting in elevated food prices. The exorbitant costs associated with food safety testing equipment and services act as a constraint on market growth, particularly in developing countries with constrained resources.

Report Segmentation

The market is primarily segmented based on test, application, and region.

|

By Test |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Food Safety Testing Market Segmental Analysis

By Test Analysis

The Microbiological Testing segment held the largest revenue share in 2023 . The market is expected to expand as it plays a crucial role in identifying microorganisms in food using biological, chemical, molecular, and biochemical methods, providing precise insights into their composition. As an illustration, SGS inaugurated a new food analysis facility in Mexico in July 2022. The Naucalpan laboratory's support with quality control and regulatory compliance is poised to benefit businesses and contribute to the advancement of the Mexican food industry.

The residues & contamination testing segment is poised to experience the fastest CAGR. This surge is attributed to thorough safety and quality assessments aimed at detecting the excessive use of chemicals like pesticides and herbicides, along with the increased use of antimicrobial drugs and additives. The segment's growth is expected to be driven by a heightened demand for contamination checks in meat, poultry, and meat products.

By Application Analysis

The Meat, Poultry, & Seafood Products segment accounted for the highest market share during the forecast period. Globally, an increasing number of individuals are consuming processed poultry and meat products in various settings, including homes, restaurants, fast-food establishments, and other locations. For example, worldwide meat consumption is projected to reach between 460 and 570 billion tons by the year 2050, as per The World Counts. Consequently, ensuring optimal product quality during meat processing is crucial to mitigate the risks associated with foodborne microorganisms.

The requirements for meat quality testing are continuously evolving to ensure that food producers release only the highest-grade products into the market. As an illustration, Tyson Foods initiated a recall of over 8.9 billion pounds of ready-to-eat chicken products in July of this year due to potential Listeria monocytogenes contamination. The substantial quantity involved in the recall underscores the extensive pathogen testing needs in the processed meat sector, thereby contributing to the growth of the food safety testing market.

The processed food segment focused on processed food applications is poised for the most rapid CAGR. The expanding exploration of processed food product lines is propelled by the rising consumer demand for diverse food options. Implementing advanced quality control techniques becomes imperative to uphold the quality and safety of each ingredient throughout all processing stages, ensuring the proper packaging and storage of finished products. As a result, the adoption of food safety testing is anticipated to fuel market expansion. For instance, the FSSAI oversees processed foods as a distinct product category, issuing testing guidelines covering aspects such as nutritional information, pollutants, and microbiological safety.

Food Safety Testing Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2023

By providing distinct product lines and advanced food safety testing services, market players have solidified their presence in North America, employing state-of-the-art manufacturing and marketing strategies. The increasing disposable income in Canada is expected to further contribute to additional regional market growth for food safety testing. According to the Mississippi State Department of Health, shigellosis, salmonellosis, and campylobacteriosis stand out as the three most prevalent foodborne diseases in the state. In light of these factors, several businesses have initiated the provision of high-quality food safety testing services, leading to an upsurge in market demand.

The Asia Pacific region is poised for rapid growth with a CAGR. This market expansion is attributed to the implementation of stringent rules and regulations concerning food safety. Governments have instituted various regulations targeting regulators, consumers, and producers. The regional surge is primarily propelled by the escalating demand for processed food items in rapidly emerging nations like China, Indonesia, India, and Thailand. Additionally, there has been an increase in cases of poisoning outbreaks resulting from the consumption of contaminated meat, as well as a growth in instances of food degradation, encompassing contamination, pesticides, and artificial flavoring. For instance, the South Korean government has enforced a complete ban on food and beverage packaging made from recycled materials that do not fully comply with national standards.

Competitive Landscape

The Food Safety Testing market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AsureQuality Limited

- Bureau Veritas

- Eurofins Scientific SE

- Intertek Group PLC

- Merieux Nutrisciences

- NSF International

- SGS S.A.

- TUV SUD

- UL LLC

Recent Developments

- In July 2022, SGS inaugurated a fresh food analysis facility in Mexico. This new laboratory in Naucalpan is designed to aid the Mexican food industry by providing support for quality control and ensuring regulatory compliance.

- In May 2022, Bureau Veritas, a company specializing in laboratory testing, inspection, and certification services, declared the establishment of its third microbiology laboratory in the United States, located in Reno, Nevada. This facility is set to perform swift pathogen testing and microbiology indicator analyses, primarily catering to the agri-food sector.

- In April 2022, Mérieux NutriSciences, a prominent figure in global food safety, quality, and sustainability, completed the acquisition of Hortec Pty Ltd (Hortec) in South Africa and Laboratorios Bromatológicos Araba SA (Aralab) in Spain. These strategic acquisitions are aligned with Mérieux NutriSciences' objectives, enabling entry into the South African pesticide market and enhancing its geographical footprint in Spain.

- March 2024: Queen's University and MOBILion Systems announced their partnership to develop new test techniques and instruments to enhance food safety. This partnership aims at improvement in existing technologies for identifying contaminants quickly.

- February 2024: The Indian government inaugurated a new microbiology lab in Assam. Additionally, 17 food safety on wheels (FSW) vehicles were announced.

Report Coverage

The Food Safety Testing market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive test, application and futuristic growth opportunities.

Food Safety Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 24.62 billion |

|

Revenue Forecast in 2032 |

USD 40.91 billion |

|

CAGR |

7.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Test, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The key companies in Food Safety Testing Market are include AsureQuality Limited, Bureau Veritas, Eurofins Scientific SE, Intertek Group PLC

Food Safety Testing Market exhibiting a CAGR of 7.3% during the forecast period

Food Safety Testing Market report covering key segments are test, application, and region

The key driving factors in Food Safety Testing Market are The increasing occurrences of foodborne illnesses

Food Safety Testing Market Size Worth $ 40.91 Billion By 2032