Food Certification Market Share, Size, Trends, Industry Analysis Report, By Type (ISO 22000, Halal, Kosher, SQF, IFS, Free-from certifications, BRC, and Others); By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3808

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

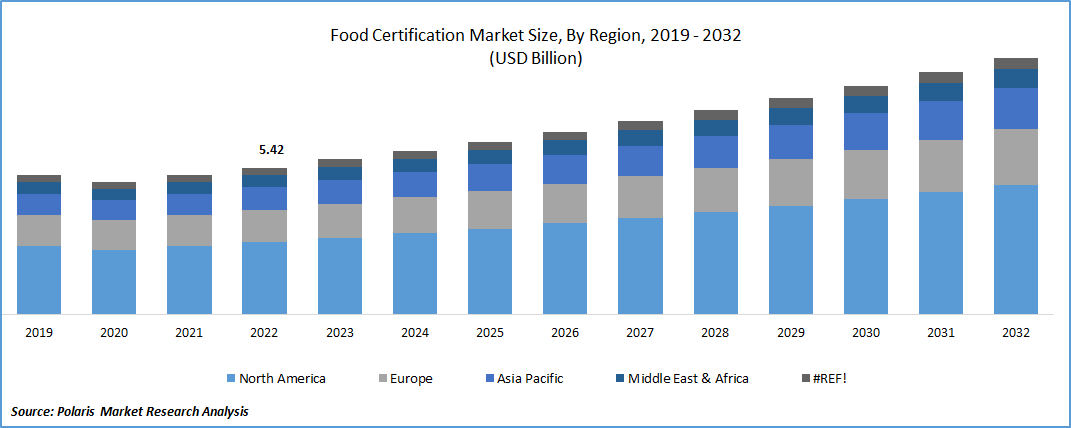

The global food certification market was valued at USD 5.42 billion in 2022 and is expected to grow at a CAGR of 5.8% during the forecast period.

Veganism has become more and more popular in recent years across many countries worldwide. This led participation of various organizations, private companies and well as government.

- For example, in April 2023, the China Vegan Society has launched a certification programme and revealed the names of the first group of vegan-friendly candidates who were accepted. It is a cooperative effort between the Beijing Soybean Foods Association and the China Biodiversity Conservation and Green Development Foundation (CBCGDF). It is alleged to be compliant with global requirements for vegan certification.

To Understand More About this Research: Request a Free Sample Report

Vegan food certification provides a trusted and recognizable standard for verifying the vegan status of all kind of food products. This is likely to spur the development in the food certification market throughout the world.

Food certification and application play a crucial role in ensuring the safety, quality, and transparency of food products. It provides assurance to consumers that the food they purchase meets specific standards for safety, quality, and authenticity. Food certification helps food businesses comply with local and international regulations and standards. food certification is important for ensuring consumer protection, maintaining quality standards, complying with regulations, accessing new markets, building brand reputation, managing risks, driving continuous improvement, and promoting sustainability in the food industry.

The COVID-19 pandemic has disrupted global supply chains, affecting the availability of raw materials and ingredients necessary for food production. This disruption has put strain on food businesses to meet certification standards consistently. In addition to this, many food businesses, especially smaller ones, have faced financial challenges during the pandemic due to reduced demand, supply chain disruptions, and closures. Investing in certification processes might become more challenging for some companies during these difficult economic times. However, with heightened concerns about public health and food safety during the pandemic, there has been a surge in demand for certified food products. As a result, the COVID-19 has played positive as well as negative impact on the global market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Increasing Consumer Awareness

Increased concern about the food safety is one of the foremost factors likely to fuel the market’s growth globally. Various people are suffering from many problems due to lack of safety of food. For example, according to World Health Organization’s estimate published in May 2022, about 600 million people worldwide—nearly 1 in 10—get sick after eating tainted food, and 420 000 people pass away each year, losing 33 million years of healthy life. As a result, consumers are increasingly seeking high-quality food products that are authentic and produced using sustainable and ethical practices. Food certification provides assurance that the products meet specific safety standards, helping to protect consumers from foodborne illnesses and hazards. Increasing awareness of food safety issues and a desire for transparency drive the demand for certified food products.

Augmented contribution of the various market players by executing several strategies like partnership, collaboration, merger, and acquisition is helping the market to expand. For example, in May 2023, SGS, the top testing, inspection, and certification service provider in the world, and Eezytrace, a cutting-edge software programme that supports data-driven risk management and aids in digitising self-check processes in the food service sector teamed up to transform food service industry management of food safety. Companies have made a commitment to helping food businesses worldwide improve food safety management. Such collaborations allow companies to share knowledge, expertise, and best practices in food safety and certification. These strategies also enable companies to have a stronger collective voice in influencing certification standards and regulations. This apparently improves the market’s expansion globally.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Free from certifications segment is dominating the market in 2022

In fiscal year 2022, the free from certifications segment held the largest share. The food service industry, including restaurants, hotels, and catering services, has witnessed a significant rise in customer requests for allergen-free options. Free from certifications enable food service establishments to meet these demands by providing certified allergen-free meals and ingredients, enhancing customer satisfaction and loyalty. Moreover, there is a growing global emphasis on health and wellness, with consumers actively seeking out foods that align with their dietary preferences and restrictions. This segment helps consumers identify suitable products that meet their specific dietary requirements, enabling them to make informed choices that support their health and wellness goals.

Furthermore, free from certifications promote transparency and build consumer trust. These certifications offer clear and specific claims about the absence of allergens, allowing consumers to make informed choices. By opting for certified products, consumers feel more confident about the safety and suitability of the food they consume.

By Application Analysis

Meat, poultry, and seafood products segment is dominating the global market

In 2022, the meat, poultry, and seafood products segment held the largest global share. Primarily, these products are highly perishable and can be susceptible to various safety risks, including contamination by pathogens such as Salmonella, E. coli, and Listeria. Food certification programs provide assurance that these products have undergone rigorous safety checks, ensuring that they meet specific hygiene and quality standards.

Given the critical nature of food safety in this segment, certification plays a vital role in building consumer trust and mitigating risks associated with these products. These products are subject to stringent regulatory requirements and standards in most countries. Certification programs ensure that companies in this sector comply with these regulations, including those related to processing, handling, labelling, and traceability. Meeting these requirements is essential for market access, both domestically and in international trade.

In addition to above aspects, certification programs often incorporate animal welfare standards and guidelines, addressing consumer concerns about ethical treatment and humane practices. Companies that obtain certification in this aspect can demonstrate their commitment to animal welfare, appealing to a segment of consumers who prioritize these values.

Regional Insights

North America is accounting the largest share in the global market in 2022

The region is home to a robust and diverse food industry that encompasses various sectors, including agriculture, food processing, and foodservice. The region is known for its advanced food production practices, technological advancements, and sophisticated supply chain management. The industry's focus on food safety, quality, and meeting regulatory requirements drives the demand for food certification to demonstrate compliance and enhance market competitiveness.

- For instance, the Food Safety and Inspection Service (FSIS) of the U.S. Department of Agriculture (USDA) revealed its main accomplishments for 2022 that will further safeguard public health via food safety, expand and improve market opportunities, advance racial justice, equity, and opportunity. About 7.6 million food safety and food defence procedures were carried out by the inspection staff of the Food Safety and Inspection Services at 6,800 facilities under USDA regulation.

Asia Pacific is one of the fastest growing regions expected to expand with high CAGR during the assessment years. Government support from various Asian countries is prominent factors responsible for the growth of market with rapid pace. For instance, in March 2022, the Delhi government offered food safety training and certification (FOSTAC) to all city-based food sector operators in order to improve the city's rating in the national food safety rankings produced by the Food Safety and Standards Authority of India (FSSAI). This factor is responsible for the development in the region with a considerable growth rate.

Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share

The global food certification market involves:

- AsureQuality

- Bureau Veritas

- Control Union Certifications Germany gmbh

- DEKRA

- Eurofins Scientific

- Intertek Group Plc

- Lloyd's Register Group Services Limited

- NSF International

- SGS SA

- TÜV NORD GROUP

Recent Developments

- In March 2023, the first beneficiaries of the China Vegan Food Standard Certification, country’s 1st vegan certification, were announced at an online conference hosted by the China Vegan Society and the China Biodiversity Conservation and Green Development Foundation (CBCGDF).

Food Certification Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5.72 billion |

|

Revenue forecast in 2032 |

USD 9.48 billion |

|

CAGR |

5.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in food certification market are AsureQuality, Bureau Veritas, Intertek Group Plc.

The global food certification market is expected to grow at a CAGR of 5.8% during the forecast period.

The food certification market report covering key segments are type, application, and region.

key driving factors in industrial food certification market are Stringent Food Safety Regulations

The global food certification market size is expected to reach USD 9.48 billion by 2032.