Folic Acid Market Size, Share, Trends, Industry Analysis Report

: By Form Type (Tablets, Soft Gels, Lozenges, and Others), Source Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1618

- Base Year: 2024

- Historical Data: 2020-2023

Folic Acid Market Overview

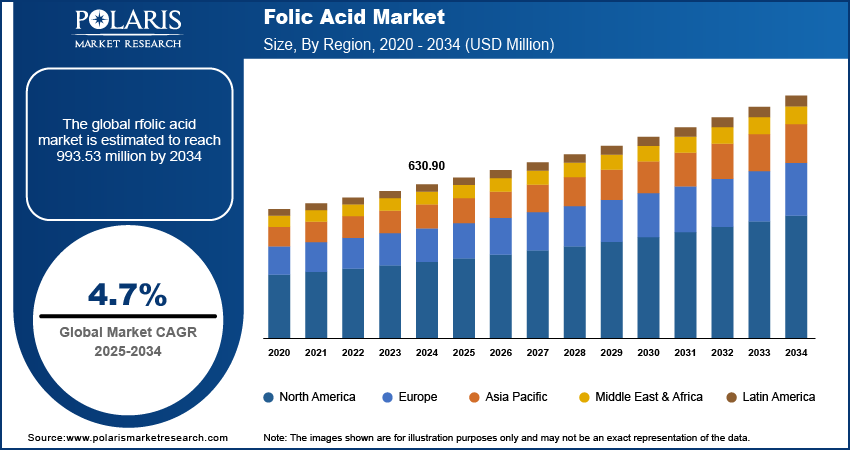

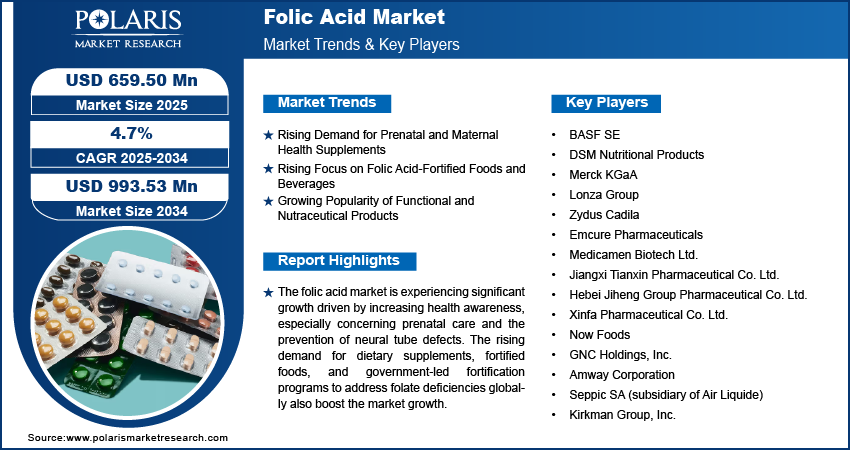

The global folic acid market size was valued at USD 630.90 million in 2024. The market is projected to grow from USD 659.50 million in 2025 to USD 993.53 million by 2034, exhibiting a CAGR of 4.7% during 2025–2034.

The global folic acid market, a segment of the vitamin and supplement industry, focuses on the production and distribution of folic acid. Folic acid is a B vitamin essential for DNA synthesis, cell division, and growth. A primary driver of market growth is the increasing awareness of folic acid's role in preventing neural tube defects in newborns, leading to its inclusion in prenatal and maternal health products. Additionally, the folic acid market demand is rising due to folic acid's use in fortified foods and beverages to address vitamin deficiencies. Other significant factors influencing the market include aging populations, increasing focus on dietary supplements for overall health, and regulatory support for folic acid fortification in various regions.

To Understand More About this Research: Request a Free Sample Report

Folic Acid Market Drivers and Trends

Rising Demand for Prenatal and Maternal Health Supplements

One of the major trends in the folic acid market is the increased demand for prenatal and maternal health supplements, driven by folic acid’s critical role in reducing the risk of neural tube defects in newborns. The Centers for Disease Control and Prevention (CDC) recommends that women of childbearing age consume 400 micrograms of folic acid daily to support fetal health. This emphasis has led to the increased incorporation of folic acid into prenatal vitamins, which are now a key segment within the broader supplement market. The CDC found that neural tube defect rates decreased by nearly 35% in countries with folic acid fortification programs. Such initiatives underscore the necessity for accessible folic acid supplements, fueling demand in both developed and developing markets.

Rising Focus on Folic Acid-Fortified Foods and Beverages

The fortification of foods and beverages with folic acid has become increasingly common, serving as a preventive public health measure to address nutritional deficiencies. Governments and regulatory bodies, particularly in North America and Europe, have mandated or encouraged the fortification of staple foods such as bread and cereal to ensure wider access to essential vitamins. In the US, the Food and Drug Administration (FDA) has mandated the addition of folic acid to certain grain products since 1998, contributing to a significant reduction in folate deficiency. The World Health Organization (WHO) notes that around 80 countries now have mandatory folic acid fortification policies, which continues to drive demand for folic acid in the food industry. This trend aligns with a growing consumer preference for fortified foods over traditional supplements, especially in regions where supplementation compliance remains a challenge.

Growing Popularity of Functional and Nutraceutical Products

The functional foods and nutraceuticals market, which includes folic acid, has seen significant growth due to a heightened consumer focus on preventive health and nutrition. Folic acid is frequently included in nutraceuticals targeting cardiovascular health, cognitive function, and immune support, owing to its role in cell division and red blood cell formation. According to a report by the International Food Information Council (IFIC), over 60% of consumers globally prioritize health benefits when choosing foods and beverages, underscoring the appeal of functional products. This trend has led companies to invest in innovative folic acid-infused nutraceuticals, appealing to consumers looking for convenient, multifunctional health solutions that integrate seamlessly into their diets. Thus, the rising popularity of functional and nutraceutical products drives the folic acid market expansion.

Folic Acid Market Segment Insights

Folic Acid Market Outlook – by Form Type-Based Insights

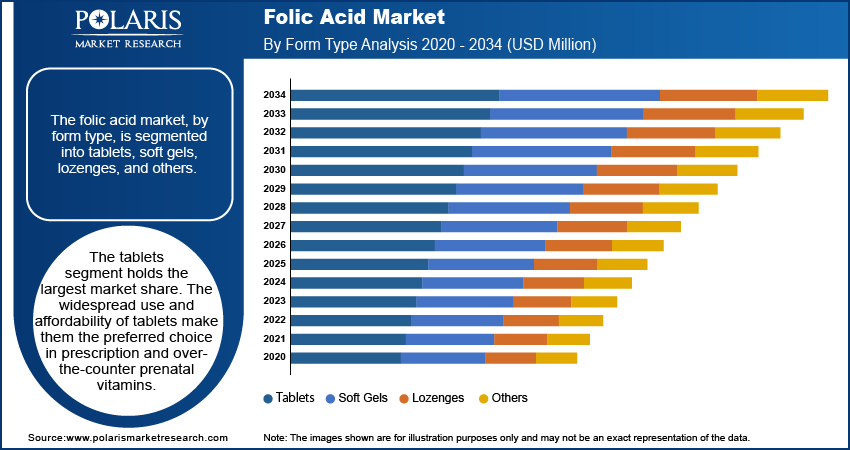

The folic acid market, by form type, is segmented into tablets, soft gels, lozenges, and others. The tablets segment holds the largest market share. The widespread use and affordability of tablets make them the preferred choice in prescription and over-the-counter prenatal vitamins. Their stable shelf life, cost-effectiveness, and ease of mass production further enhance their availability, particularly in regions where healthcare initiatives prioritize accessibility to essential supplements. Tablets are also highly customizable in dosage, allowing manufacturers to cater to specific dietary requirements and medical guidance, reinforcing their demand in the healthcare and wellness sectors.

The soft gels segment is experiencing the fastest growth due to its enhanced bioavailability and ease of consumption, especially among those who prefer alternatives to traditional tablets. The higher absorption rate associated with soft gels makes them an appealing option in nutraceutical and functional product applications, where immediate and effective delivery of nutrients is a priority. Increasing consumer demand for innovative supplement formats that offer convenience without compromising efficacy is anticipated to support the expansion of the soft gel segment. As a result, manufacturers are investing in soft gel production technologies to meet the growing interest, indicating that this segment may continue to capture the largest folic acid market share in the coming years.

Folic Acid Market Assessment – by Source Type-Based Insights

The folic acid market, by source type, is segmented into plants and animals. The plant segment holds a larger market share. This dominance is driven by the rising trend toward plant-derived vitamins, appealing to the increasing population of vegan and vegetarian consumers, as well as those seeking allergen-free and ethically sourced options. Plant-based folic acid is widely utilized in dietary supplements, fortified foods, and pharmaceuticals, where its compatibility with clean-label products is highly valued. The growth of plant-based supplements aligns with broader shifts in consumer behavior, emphasizing natural and sustainable sources, which continue to support the expansion of this segment across various regions.

The animals’ segment is experiencing significant growth due to its applications in specialized medical and pharmaceutical formulations where rapid and effective bioavailability is prioritized. Animal-sourced folic acid often finds use in clinical settings and targeted health products, appealing to consumers seeking nutrient forms known for quick absorption. Additionally, the demand for premium-grade supplements, particularly in regions with advanced healthcare systems, is fueling investments in animal-based folic acid production to meet the needs of specific consumer groups. Despite the dominance of plant-based sources, this segment’s high growth trajectory reflects a sustained demand for diverse sourcing options tailored to a range of health, dietary, and ethical preferences.

Folic Acid Market Evaluation – by Application-Based Insights:

The folic acid market, by application, is segmented into food & beverages, pharmaceuticals, nutraceuticals, and others. The pharmaceuticals segment holds the largest market share. This dominance is driven by the extensive use of folic acid in prescription prenatal vitamins and other medical formulations, where its role in preventing neural tube defects and supporting general health is widely recognized. Regulatory mandates on folic acid fortification in staple foods further reinforce its importance in healthcare and underscore its high demand in this sector. Pharmaceuticals benefit from robust public health campaigns that emphasize folic acid’s preventative health benefits, making it a staple ingredient in prenatal and general health supplements.

The nutraceutical segment is experiencing the highest growth rate, reflecting increasing consumer interest in preventive health solutions and functional products that offer convenient ways to meet nutritional needs. Folic acid's inclusion in fortified foods, beverages, and dietary supplements that address various health concerns such as immune support, cardiovascular health, and cognitive function has become a major trend within this application category. As consumers seek alternative health products that integrate easily into daily routines, nutraceutical manufacturers are leveraging the growth potential of folic acid by developing innovative and multifunctional offerings. This trend is expected to continue, supported by expanding health awareness and consumer preference for functional foods and supplements.

Folic Acid Market Regional Insights

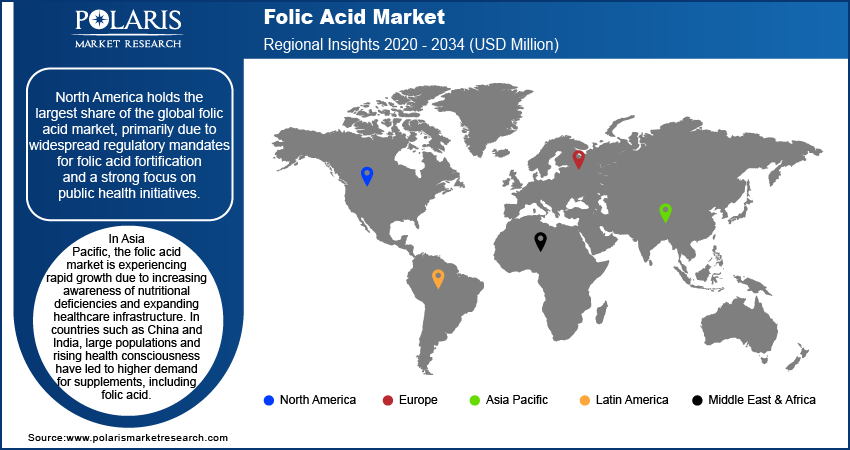

By region, the study provides folic acid market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global folic acid market revenue, primarily due to widespread regulatory mandates for folic acid fortification and a strong focus on public health initiatives. In the US the Food and Drug Administration (FDA) has mandated folic acid fortification in grain products since the late 1990s, leading to significant reductions in folate deficiency and neural tube defects. This established regulatory support, combined with high awareness of prenatal health, has driven consistent demand for folic acid across the region. Additionally, a mature market for dietary supplements and fortified foods contributes to North America’s leading position. Other regions, such as Europe and Asia Pacific, are experiencing growing demand for folic acid driven by increasing health awareness and government-led fortification programs. However, North America remains the dominant market due to its advanced healthcare infrastructure and established consumer awareness.

In Europe, the folic acid market expansion is driven by increasing health awareness and government initiatives promoting folic acid fortification. While mandatory fortification is not as widespread in Europe as in North America, a few countries, including the UK and Ireland, have implemented policies to address folic acid deficiency, particularly for maternal and child health. Consumer demand for dietary supplements and fortified foods is also on the rise in Europe, supported by the region’s aging population and their interest in preventive healthcare solutions. Additionally, Europe’s strong emphasis on natural and plant-based products is pushing demand for folic acid from sustainable sources, shaping market offerings to align with consumer preferences.

In Asia Pacific, the folic acid market is experiencing rapid growth due to increasing awareness of nutritional deficiencies and expanding healthcare infrastructure. In countries such as China and India, large populations and rising health consciousness have led to higher demand for supplements, including folic acid. Government-led initiatives and fortification programs are also emerging, particularly in response to concerns about prenatal health and folate deficiency. The Asia Pacific market growth is further fueled by the expanding nutraceutical sector, as well as a growing middle-class population willing to invest in preventive health products. This region is expected to be a significant contributor to global market expansion in the coming years.

Folic Acid Market – Key Players and Competitive Insights

BASF SE, DSM Nutritional Products, Merck KGaA, and Lonza Group are a few key players in the global folic acid market. Each player is recognized for their expansive product portfolios in the vitamin and supplement space. Other significant companies are Zydus Cadila, Emcure Pharmaceuticals, and Medicamen Biotech Ltd., which provide extensive pharmaceutical and nutraceutical solutions involving folic acid. Companies such as Jiangxi Tianxin Pharmaceutical Co. Ltd., Hebei Jiheng Group Pharmaceutical Co. Ltd., and Xinfa Pharmaceutical Co. Ltd. are also active, catering to both local and international markets. Additionally, manufacturers such as Now Foods; GNC Holdings, Inc.; and Amway Corporation play crucial roles in providing folic acid supplements in consumer markets. Seppic SA (a subsidiary of Air Liquide) and Kirkman Group, Inc. further enhance global availability, particularly in specialty supplements and formulations.

The competitive landscape in the folic acid market reflects a mix of established pharmaceutical manufacturers and specialized nutraceutical companies that cater to diverse applications, from fortified foods to prenatal care. Many of these companies focus on broadening their distribution networks and enhancing product quality to meet regulatory standards and consumer preferences in various regions. For example, BASF SE and DSM Nutritional Products invest heavily in R&D to develop sustainable and bioavailable folic acid solutions, aligning with the growing consumer preference for clean-label products. Meanwhile, companies such as Zydus Cadila and Emcure Pharmaceuticals prioritize pharmaceutical-grade folic acid formulations, catering to healthcare providers and medical institutions that require precise, high-quality supplements.

In response to increasing demand for diverse product formats, several companies are expanding their portfolios to include soft gels, tablets, and fortified foods. For instance, GNC Holdings, Inc. and Now Foods focus on consumer-friendly formulations that appeal to those seeking easy-to-consume products. The rising trend toward plant-based and non-GMO ingredients has also pushed companies such as Amway and Kirkman Group to introduce plant-derived folic acid products. Competitive strategies are largely centered on product differentiation and regional expansion, with major players leveraging partnerships and acquisitions to strengthen their foothold in emerging markets, particularly in Asia Pacific, where the folic acid market demand is growing rapidly due to expanding healthcare infrastructure and rising health awareness.

BASF SE is a prominent player in the folic acid market, offering a range of nutritional products across various sectors, including pharmaceuticals, food, and dietary supplements. The company emphasizes product quality and sustainability, investing in innovations aimed at enhancing the bioavailability of vitamins and supplements.

DSM Nutritional Products is another key company active in the folic acid market, supplying high-quality folic acid for fortified foods, pharmaceuticals, and consumer health products. Known for its research-driven approach, DSM focuses on products that can improve vitamin stability and effectiveness.

Key Companies in Folic Acid Market

- BASF SE

- DSM Nutritional Products

- Merck KGaA

- Lonza Group

- Zydus Cadila

- Medicamen Biotech Ltd.

- Jiangxi Tianxin Pharmaceutical Co. Ltd.

- Hebei Jiheng Group Pharmaceutical Co. Ltd.

- Xinfa Pharmaceutical Co. Ltd.

- Now Foods

- GNC Holdings, Inc.

- Amway Corporation

- Seppic SA (subsidiary of Air Liquide)

- Kirkman Group, Inc.

Folic Acid Industry Developments

- In September 2023, DSM released a report highlighting advancements in their precision nutrition solutions, which include new forms of folic acid designed for better nutrient absorption. This innovation aims to cater to evolving consumer needs for efficient and convenient supplementation, reflecting DSM’s dedication to continuous product improvement in the health and nutrition sectors.

- In November 2024, BASF SE announced a partnership with Acies Bio to explore natural, sustainable production methods for vitamins, including folic acid, aligning with the industry’s shift toward clean-label products.

Folic Acid Market Segmentation

By Form Type Outlook

- Tablets

- Soft Gels

- Lozenges

- Others

By Source Type Outlook

- Plants

- Animals

By Application Outlook

- Food & Beverages

- Pharmaceutical

- Nutraceuticals

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Folic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 630.90 million |

|

Market Size Value in 2025 |

USD 659.50 million |

|

Revenue Forecast by 2034 |

USD 993.53 million |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 630.90 million in 2024 and is projected to grow to USD 993.53 million by 2034.

The global market is projected to register a CAGR of 4.7% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the global folic acid market are BASF SE, DSM Nutritional Products, Merck KGaA, and Lonza Group, each recognized for their expansive product portfolios in the vitamin and supplement space. Other significant companies are Zydus Cadila, Emcure Pharmaceuticals, and Medicamen Biotech Ltd., which provide extensive pharmaceutical and nutraceutical solutions involving folic acid.

The tablets segment accounted for the largest share of the global market in 2024.

The plants segment accounted for a larger share of the global market in 2024.

Folic acid is a water-soluble B-vitamin (Vitamin B9) that is essential for the production and maintenance of new cells in the body. It plays a crucial role in DNA synthesis, cell division, and proper cell function, making it particularly important during periods of rapid growth, such as pregnancy and infancy. Folic acid is commonly found in fortified foods, dietary supplements, and certain natural food sources such as leafy greens, legumes, and citrus fruits. In prenatal care, folic acid is recommended to reduce the risk of neural tube defects in developing fetuses, which is one of its most significant health benefits.

A few key trends in the folic acid market are described below: Increasing Demand for Plant-Based Folic Acid: Rising consumer preference for natural, plant-based, and non-GMO products is driving the demand for plant-derived folic acid. Focus on Bioavailability: Companies are working on improving the bioavailability of folic acid to ensure better absorption and effectiveness, particularly in supplements and fortified foods. Rising Health Awareness: Growing awareness of the importance of folic acid in preventing neural tube defects, particularly among pregnant women, is boosting the folic acid market demand. Expanding Fortification Programs: Governments in various regions are implementing or expanding folic acid fortification programs in staple foods to combat folate deficiencies.

A new company entering the folic acid market must focus on innovation in product formulations and delivery formats, such as developing plant-based or bioavailable folic acid supplements that cater to the growing demand for natural and sustainable products. It could also capitalize on the rising trend of personalized nutrition by offering tailored folic acid solutions based on individual health needs. Additionally, targeting emerging markets with affordable and accessible folic acid products, alongside leveraging digital marketing and e-commerce platforms, could help build a strong customer base

Companies manufacturing, distributing, or purchasing folic acid and related products and other consulting firms must buy the report.