Flow Diverters Market Size, Share, Trends, Industry Analysis Report

: By Flow Diverter Type [Pipeline Embolization Device (PED), Flow Modulation Device (FMD), Stent-Assisted Coiling (SAC), and Others], Application, Material, Delivery System, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1776

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

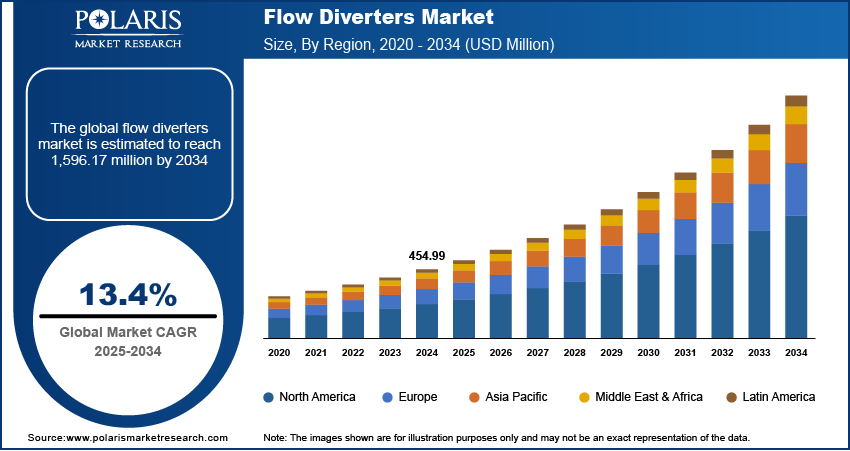

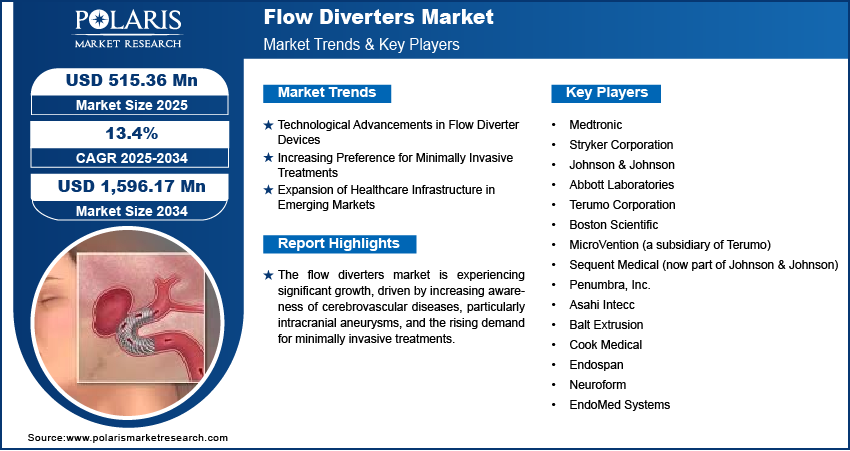

The global flow diverters market size was valued at USD 454.99 million in 2024, growing at a CAGR of 13.4% from 2025 to 2034. The market growth is primarily fueled by increased prevalence of neurological conditions, growing awareness of cerebrovascular disorders, and technological advancements in product design.

Key Insights

- The pipeline embolization device (PED) segment accounts for the largest market share. The proven efficacy of PED in the treatment of complex intracranial aneurysms has led to its widespread adoption.

- The arteriovenous malformations (AVMs) segment is witnessing the fastest growth. Increased awareness of the efficacy of flow diverters in the treatment of AVMs is driving the segment’s growth.

- The nitinol segment dominates the market, driven by its excellent flexibility, biocompatibility, and deployment ease.

- North America accounts for the largest market share. The regional market dominance is attributed to its advanced healthcare infrastructure and robust adoption of innovative medical technologies.

- Asia Pacific is registering the fastest growth, owing to the region’s rising burden of cerebrovascular diseases and rapid advancements in healthcare infrastructure.

Industry Dynamics

- Technological advancements in flow diverters, which have improved the safety and effectiveness of these devices, are contributing to the market growth.

- The growing preference for minimally invasive treatments has prompted healthcare providers to increasingly opt for flow diverters as a non-surgical treatment option for brain aneurysms, fueling market development.

- The increasing prevalence of intracranial aneurysms is expected to boost market adoption in the coming years.

- High procedure costs may present challenges to market expansion.

Market Statistics

2024 Market Size: USD 454.99 million

2034 Projected Market Size: USD 1,596.17 million

CAGR (2025-2034): 13.4%

North America: Largest Market in 2024

The flow diverters market involves the development and sale of medical devices used in the treatment of cerebrovascular diseases, particularly intracranial aneurysms. These devices are designed to redirect blood flow away from the aneurysm, promoting healing and reducing the risk of rupture.

The rising prevalence of neurological conditions, advancements in minimally invasive procedures, and increasing awareness of cerebrovascular disorders are a few of the key factors driving the flow diverters market growth. Additionally, technological innovations in device design and the expansion of healthcare infrastructure in emerging markets are contributing to market expansion. Trends such as the growing preference for non-invasive treatments and improvements in patient outcomes are expected to further fuel the demand for flow diverters.

Market Dynamics

Technological Advancements in Flow Diverter Devices

Modern flow diverters are becoming more effective and safer, incorporating features like finer mesh structures and improved biocompatibility, which reduce complications for patients. Recent innovations have focused on enhancing the accuracy of delivery systems and making the devices easier to deploy, even in complex anatomical cases. For instance, the development of braided stent technology and self-expanding flow diverters has been key in increasing the treatment success rate for aneurysms. Additionally, advancements in imaging techniques, such as 3D imaging and real-time monitoring, are making it easier for surgeons to plan and execute procedures with greater precision. These improvements not only reduce procedure time but also contribute to better patient outcomes, which boosts adoption rates. Thus, continuous technological advancements in device design and materials are driving the flow diverters market demand.

Increasing Preference for Minimally Invasive Treatments

With the rise of endovascular procedures, doctors are increasingly opting for flow diverters as a non-surgical treatment option for brain aneurysms. Compared to traditional surgical methods, such as craniotomy, flow diverters offer the advantage of reduced patient recovery time, lower risk of infection, and less postoperative pain. The global trend towards minimally invasive treatments is evident from the increasing number of hospitals adopting these techniques and the growing availability of skilled professionals trained in endovascular procedures. According to a study published in the Journal of NeuroInterventional Surgery, minimally invasive procedures have been shown to offer a better quality of life post-treatment for aneurysm patients, leading to an increase in the demand for flow diverters. Thus, the growing preference for minimally invasive procedures is significantly influencing the flow diverters market demand.

Expansion of Healthcare Infrastructure in Emerging Markets

As medical facilities in regions such as Asia Pacific, Latin America, and the Middle East improve their technological capabilities, the adoption of advanced medical devices like flow diverters is increasing. In these markets, the rising burden of cerebrovascular diseases and increasing healthcare awareness are contributing to the demand for advanced treatment options. For example, countries such as India and China are witnessing significant improvements in healthcare access and medical technology, with hospitals upgrading to advanced equipment for aneurysm treatments. As a result, the expansion of healthcare infrastructure in emerging markets is driving the flow diverters market revenue.

Segment Insights

Market Evaluation Based on Flow Diverter Type

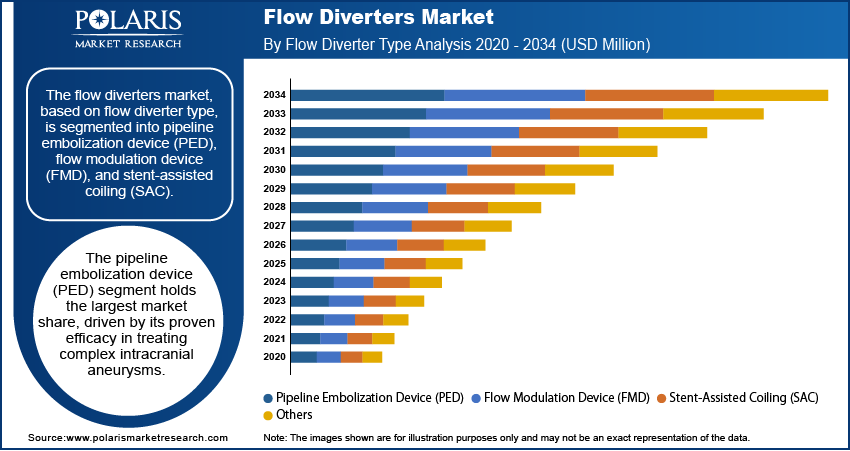

The flow diverters market, based on flow diverter type, is segmented into pipeline embolization device (PED), flow modulation device (FMD), and stent-assisted coiling (SAC), with the pipeline embolization device (PED) segment holding the largest market share. The PED is a self-expanding, stent-like device designed to redirect blood flow away from an aneurysm, and it has gained significant adoption due to its proven efficacy in treating complex intracranial aneurysms. This device is favored for its ability to treat large and wide-necked aneurysms that cannot be addressed through conventional methods. Its success rate and safety profile have driven its dominant position in the market, particularly in North America and Europe, where advanced healthcare infrastructure supports its widespread use.

Among the other segments, the flow modulation device (FMD) is registering the fastest growth due to increasing adoption in clinical practice as a less invasive alternative to PED. FMDs offer a similar treatment approach to that of PED, focusing on reducing the risk of device-related complications. Stent-assisted coiling (SAC) continues to be used in certain cases, as it involves the use of coils alongside stents to treat aneurysms, which can be more invasive and associated with higher complication rates. The others segment includes emerging technologies, but their contribution to market share remains limited compared to PED and FMD. As the medical community embraces newer, more efficient solutions, FMD is expected to see accelerated growth in the coming years.

Market Assessment Based on Application

The flow diverters market, by application, is segmented into intracranial aneurysms, arteriovenous malformations, carotid artery disease, and others. The intracranial aneurysms segment holds the largest market share, primarily due to the high prevalence of these conditions and the proven effectiveness of flow diverters in treating them. Intracranial aneurysms are a leading cause of stroke, and the increasing awareness and advancements in minimally invasive treatments have propelled the demand for flow diverters. This segment is well-established, with a significant number of procedures performed annually, particularly in developed regions where access to advanced healthcare facilities is widespread. The growing adoption of flow diverters, specifically PEDs, has solidified this segment's dominance in the market.

The arteriovenous malformations (AVMs) segment is experiencing the fastest growth, driven by the increased awareness of the efficacy of flow diverters in treating AVMs. AVMs, though less common than aneurysms, require specialized treatment options, and flow diverters are increasingly being used for cases that involve complex vascular structures. The use of flow diverters in this application has been supported by emerging clinical data demonstrating favorable outcomes. Other applications, such as carotid artery disease and additional cerebrovascular conditions, contribute to the market growth, but their share remains comparatively smaller due to the more specialized nature of treatments and a lower volume of cases.

Market Outlook Based on Material

The flow diverters market, by material, is segmented into nitinol, cobalt-chromium alloy, stainless steel, and others, with the nitinol segment holding the largest market share. Nitinol is a shape-memory alloy known for its superior flexibility, biocompatibility, and ease of deployment. Nitinol's unique properties, such as its ability to return to a pre-set shape when heated, make it an ideal material for flow diverters, particularly in challenging anatomical locations. These advantages have led to the widespread use of nitinol-based flow diverters in clinical practice, where they are favored for their ability to conform to vascular structures without causing damage or complications. The widespread adoption of nitinol in products like PED has solidified its dominant position in the market.

The cobalt-chromium alloy segment is witnessing the fastest growth, driven by its strength and radiopacity, which offer improved visibility during procedures. Cobalt-chromium alloys are particularly beneficial in applications where high radial force and resistance to fracture are necessary. These materials are being adopted in new flow diverter devices that require both durability and the ability to withstand mechanical stress in complex cases. Stainless steel and other materials, while still in use, contribute less significantly to the market as they are less favored due to their relatively lower flexibility and higher risk of complications in certain applications.

Market Outlook Based on Delivery System

The flow diverters market, by delivery system, is segmented into over-the-wire delivery system, catheter-based delivery system, and others, with the over-the-wire delivery system segment holding the largest market share. Over-the-wire (OTW) delivery system is preferred for its precision and control, allowing for the accurate placement of flow diverters in complex vascular anatomies. OTW delivery systems have been widely used in clinical settings for over a decade, particularly in procedures requiring high levels of control and maneuverability. The technology behind OTW systems provides enhanced safety during the deployment of flow diverters, leading to their continued dominance in the market for treating conditions like intracranial aneurysms. Their ability to work effectively in both routine and challenging clinical cases has sustained their popularity and market share.

The catheter-based delivery system segment is experiencing the fastest growth, primarily due to its ease of use and ability to minimize procedure time. Catheter-based systems offer greater flexibility and can be employed in a wider range of clinical scenarios, including those that involve smaller or more tortuous vessels. These systems are also associated with less trauma to the vascular structures, which contributes to faster patient recovery times and better overall outcomes. As the medical community shifts towards minimally invasive treatments, catheter-based delivery systems are becoming more favored, driving their rapid adoption and growth in the market. The others segment remains relatively small in comparison, as it includes niche technologies that are still being developed or are less commonly used in mainstream clinical practice.

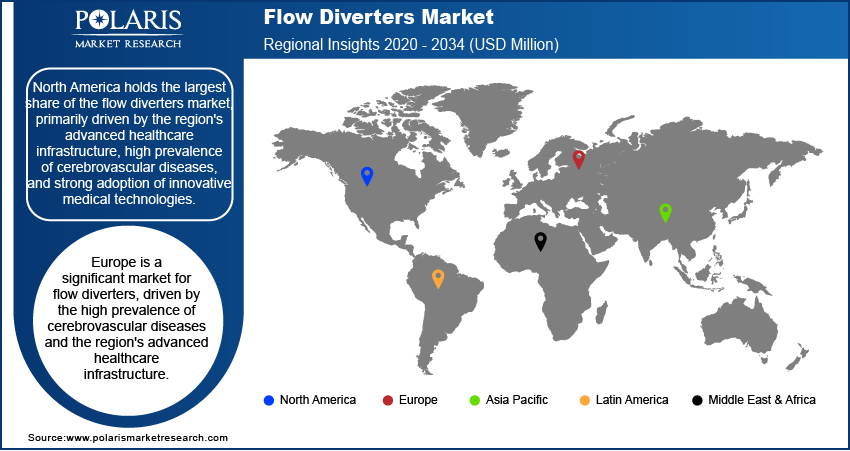

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the flow diverters market, primarily driven by the region's advanced healthcare infrastructure, high prevalence of cerebrovascular diseases, and strong adoption of innovative medical technologies. The US, in particular, is a key contributor to this dominance due to its well-established healthcare system, high demand for minimally invasive treatments, and extensive research and development in the medical device sector. Additionally, the region benefits from a high level of awareness regarding conditions like intracranial aneurysms, coupled with the presence of major market players and leading hospitals that support the adoption of flow diverters. Europe also contributes significantly to the market, while regions like Asia Pacific are witnessing rapid growth due to improving healthcare access and increasing investments in medical technologies.

Europe is a significant market for flow diverters, driven by the high prevalence of cerebrovascular diseases and the region's advanced healthcare infrastructure. Countries such as Germany, France, and the UK are key contributors to the market due to their well-established healthcare systems and the widespread use of minimally invasive procedures. The adoption of flow diverters in Europe has been supported by strong clinical evidence and a high rate of procedural success. Additionally, the region benefits from a robust regulatory environment that ensures the safety and effectiveness of medical devices, fostering patient trust and increasing adoption rates. As a result, Europe holds a substantial share of the global flow diverters market, with growing demand in both established and emerging European countries.

Asia Pacific is witnessing the fastest growth in the flow diverters market, driven by rapid advancements in healthcare infrastructure, increasing healthcare awareness, and a rising burden of cerebrovascular diseases. Countries such as China, Japan, India, and South Korea are expanding their medical capabilities, improving access to advanced treatments like flow diverters. The adoption of minimally invasive procedures is rising, particularly in urban areas where healthcare facilities are better equipped. The growing number of patients with intracranial aneurysms and other cerebrovascular conditions is pushing demand for advanced medical devices, making Asia Pacific a key growth area for the flow diverters market. Additionally, the expansion of health insurance coverage in emerging countries is contributing to the regional market growth.

Key Players and Competitive Insights

Key players in the flow diverters market include Medtronic; Stryker Corporation; Johnson & Johnson (via its subsidiary, Neurovascular); Abbott Laboratories; Terumo Corporation; Boston Scientific; MicroVention (a subsidiary of Terumo); Sequent Medical (now part of Johnson & Johnson); and Penumbra, Inc. Other notable companies are Asahi Intecc, Balt Extrusion, Cook Medical, Endospan, Neuroform, and EndoMed Systems. These companies are actively involved in the development, manufacturing, and distribution of flow diverters for cerebrovascular diseases. Many of these players focus on continuous product innovation and expanding their market reach, both in developed and emerging markets, to cater to the growing demand for minimally invasive treatments in neurology.

The competitive landscape in the flow diverters market is shaped by a few major factors: technological advancements, product differentiation, and expanding geographic presence. Companies such as Medtronic and Stryker are continually improving their devices to increase safety, efficacy, and ease of use for medical practitioners. For example, Medtronic’s pipeline embolization device (PED) has been one of the most successful products in the market due to its efficacy in treating complex aneurysms. Meanwhile, Terumo’s acquisition of MicroVention has strengthened its position in the market, allowing it to offer a wider range of neurovascular products, including advanced flow diverters. The ongoing push for innovation and the need for clinical evidence to support new product introductions are key areas where these companies compete.

Market players are also focusing on expanding their global footprint to tap into emerging markets, particularly in regions like Asia Pacific, where demand for advanced medical treatments is growing rapidly. Companies are increasing their investments in research and development to meet the evolving needs of patients and healthcare providers, ensuring that their devices offer improved outcomes with fewer complications. Collaboration with healthcare providers, as well as regulatory bodies, is also crucial for success in this market, with companies needing to navigate various regulatory requirements to ensure timely product approvals. The increasing focus on minimally invasive technologies and better patient outcomes continues to drive competitive strategies in the flow diverters market.

Medtronic is one of the prominent players in the flow diverters market, known for its wide range of medical devices and technologies. The company offers the pipeline embolization device (PED), which is commonly used for treating complex intracranial aneurysms. Medtronic has a strong presence in the neurovascular sector and is recognized for its ongoing efforts to enhance the design and functionality of its products.

Stryker Corporation is another key player in the market, providing a range of medical technologies, including neurovascular products. Stryker’s flow diverter offerings are designed to treat complex vascular conditions, including brain aneurysms. The company has been expanding its neurovascular portfolio through strategic investments and acquisitions, positioning itself as a significant competitor in this space.

List of Key Companies

- Medtronic

- Stryker Corporation

- Johnson & Johnson (via its subsidiary, Neurovascular)

- Abbott Laboratories

- Terumo Corporation

- Penumbra, Inc.

- Asahi Intecc

- Balt Extrusion

- Cook Medical

- Endospan

- Neuroform

- EndoMed Systems

Flow Diverters Industry Developments

- In March 2024, Medtronic announced the initiation of a new clinical study aimed at evaluating the long-term outcomes of its flow diverter devices for intracranial aneurysm treatment, further demonstrating its commitment to advancing patient care through evidence-based solutions.

- In January 2024, Stryker received FDA approval for its latest neurovascular device aimed at improving patient outcomes in the treatment of challenging aneurysms, reflecting the company’s ongoing focus on innovation and expanding its product range within the neurovascular field.

Market Segmentation

By Flow Diverter Type Outlook

- Pipeline Embolization Device (PED)

- Flow Modulation Device (FMD)

- Stent-Assisted Coiling (SAC)

- Others

By Application Outlook

- Intracranial Aneurysms

- Arteriovenous Malformations

- Carotid Artery Disease

- Others

By Material Outlook

- Nitinol

- Cobalt-Chromium Alloy

- Stainless Steel

- Others

By Delivery System Outlook

- Over-the-Wire Delivery System

- Catheter-Based Delivery System

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 454.99 million |

|

Market Size Value in 2025 |

USD 515.36 million |

|

Revenue Forecast by 2034 |

USD 1,596.17 million |

|

CAGR |

13.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The flow diverters market has been segmented into detailed segments of flow diverter type, application, material, and delivery system. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the flow diverters market focuses on expanding product offerings, improving device efficiency, and increasing geographic presence. Companies are investing heavily in research and development to introduce advanced flow diverters with enhanced safety features and better patient outcomes. Strategic partnerships, acquisitions, and collaborations with healthcare providers are common to strengthen market position and expand distribution networks. Additionally, players are increasing their focus on emerging markets, where rising healthcare infrastructure and awareness are driving demand for advanced treatment options. Marketing efforts emphasize clinical evidence, patient success stories, and the benefits of minimally invasive procedures to encourage adoption among healthcare professionals.

FAQ's

The flow diverters market size was valued at USD 454.99 million in 2024 and is projected to grow to USD 1,596.17 million by 2034.

The market is projected to register a CAGR of 13.4% from 2025 to 2034.

North America had the largest share of the market.

A few of the key players in the flow diverters market include Medtronic; Stryker Corporation; Johnson & Johnson (via its subsidiary, Neurovascular); Abbott Laboratories; Terumo Corporation; Boston Scientific; MicroVention (a subsidiary of Terumo); Sequent Medical (now part of Johnson & Johnson); and Penumbra, Inc. Other notable companies are Asahi Intecc, Balt Extrusion, Cook Medical, Endospan, Neuroform, and EndoMed Systems.

The pipeline embolization device (PED) segment accounted for the largest share of the market in 2024.

The intracranial aneurysms segment accounted for the largest share of the market in 2024.

Flow diverters are specialized medical devices used to treat cerebrovascular conditions, particularly intracranial aneurysms. These devices are typically placed in the blood vessels of the brain through a minimally invasive procedure, such as endovascular surgery. The primary function of a flow diverter is to redirect blood flow away from the aneurysm, promoting healing and reducing the risk of rupture. Unlike traditional treatments, which often involve coils or surgical clipping, flow diverters are designed to create a new path for blood flow while allowing the aneurysm to gradually heal and close off. They are made from materials like nitinol, which allows them to conform to the vessel walls and effectively treat complex aneurysms in difficult-to-reach locations.

A few key trends in the flow diverters market are described below: Technological Advancements: Continuous innovation in device design, including improvements in materials, flexibility, and delivery systems, to enhance safety and efficacy. Minimally Invasive Procedures: Increasing preference for flow diverters due to their ability to treat complex conditions with less trauma, shorter recovery times, and fewer complications compared to traditional surgical methods. Growth in Emerging Markets: Rising adoption of flow diverters in regions like Asia Pacific and Latin America due to improving healthcare infrastructure and increasing awareness of cerebrovascular diseases. Focus on Clinical Evidence: A growing emphasis on collecting long-term clinical data to demonstrate the safety and effectiveness of flow diverters, which supports their adoption.

A new company entering the flow diverters market could focus on innovating in areas such as improving device biocompatibility, reducing complications, and enhancing ease of deployment. Prioritizing advancements in minimally invasive techniques and ensuring quicker recovery times for patients could provide a competitive edge. Additionally, offering cost-effective solutions without compromising on quality would be crucial, particularly in emerging markets where affordability is a key factor. Developing strong partnerships with healthcare providers and investing in clinical trials to demonstrate product efficacy and long-term outcomes would also help in gaining market trust and positioning the company as a credible player.

Companies manufacturing, distributing, or purchasing flow diverters and related products, and other consulting firms must buy the report.