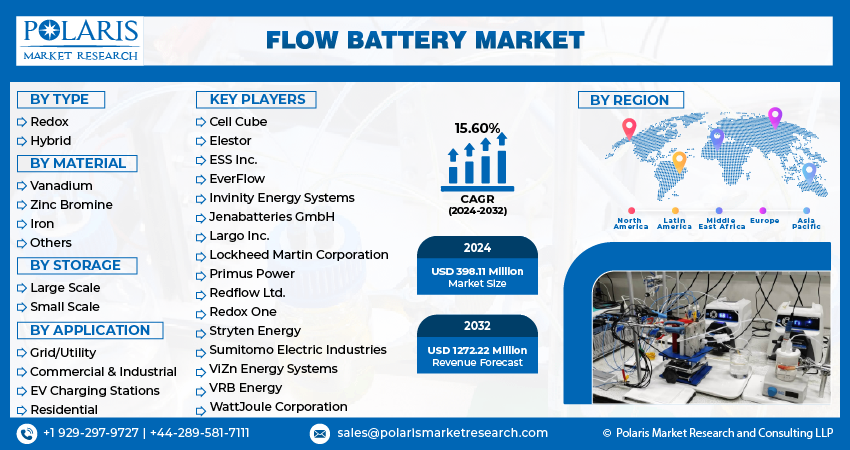

Flow Battery Market Share, Size, Trends, Industry Analysis Report, By Type (Redox, Hybrid), By Material (Vanadium, Zink Bromine, Iron, Others), By Application (Commercial & Industrial, EV Charging Stations, Residential), By Storage (Large, Small), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4013

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

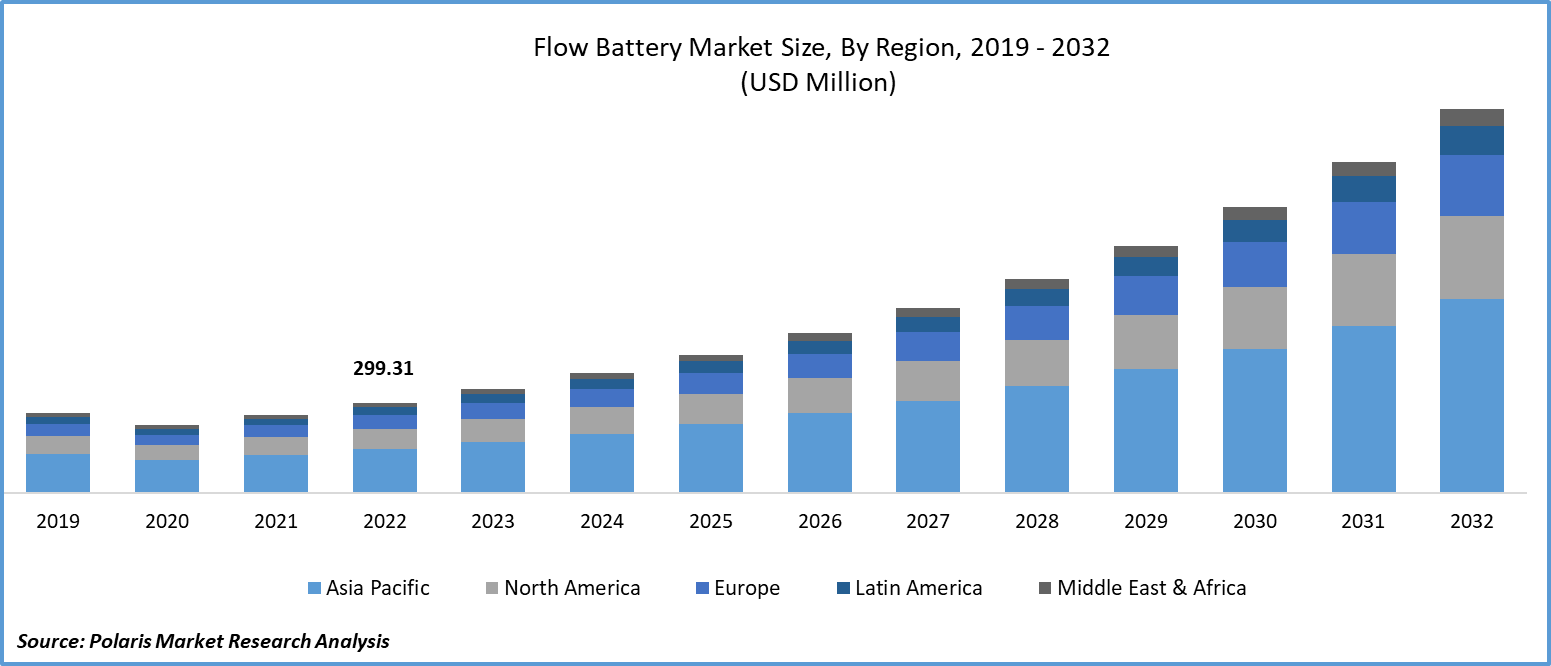

The global flow battery market was valued at USD 345.1 million in 2023 and is expected to grow at a CAGR of 15.6% during the forecast period.

The primary driver behind the market's growth is the escalating global demand for energy storage systems. According to the U.S. Department of Energy, the energy storage market is expected to exceed 2,500 gigawatt-hours (GWh) by 2030. Additionally, the proliferation of electric vehicle (EV) charging stations worldwide is fueling market expansion.

To Understand More About this Research: Request a Free Sample Report

For instance, The International Energy Agency (IEA) reported that by the end of 2022, the global count of public EV charging points had reached 2.7 million units. Notably, 900,000 of such charging points were recently installed in 2022. This surge underscores the significant growth in the flow battery market.

A flow battery is a re-chargeable energy system in which electrolyte flows through one or more electro-chemical cells originating from the reservoirs or the tanks. These batteries are specifically used in stationary applications and are typically water-based. Flow batteries are particularly well-suited for storing energy generated from renewable sources like wind and solar power. They enable efficient storage of excess energy produced during periods of high generation, allowing for its use during times of low production or high demand. This capability helps stabilize the grid and enhance the reliability of renewable energy sources. Moreover, these batteries serve as backup power sources during power outages. They can be rapidly deployed and provide continuous power for extended periods, making them highly valuable for critical infrastructures and grid operators.

Several factors, such as electrolyte volume, active species concentration, cell voltage, and stack count, play a crucial role in determining the performance of Redox Flow Batteries (RFBs). These variables significantly influence the overall characteristics of RFBs. Increasing the volume of electrolyte tanks and adding more battery cells can boost the power and energy density of RFBs. Achieving a high energy density in RFBs is essential, requiring a high solubility of redox species in the electrolyte. Moreover, RFBs with the high voltage benefit from a low potential for the anolyte & high potential for catholyte. Optimizing these factors enhances the efficiency and performance of RFBs, enabling more effective utilization of their energy storage capacities.

The evolving technology of redox flow batteries (RFBs) is centered around the exploration of alternative materials for electrodes and electrolytes, along with inventive designs for flow cells and membranes. These innovations aim to enhance energy efficiency and cost-effectiveness. Organic compounds like quinones are being investigated as substitutes for costly metal ions in the electrolyte solution, providing a more economical and sustainable choice. Optimization of flow cell design can increase power density and efficiency, while employing specific membranes with improved selectivity and reduced resistance further boosts performance.

The Flow Battery Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Drivers

Renewable Energy Integration

The increasing penetration of renewable energy sources, such as wind and solar, has created a need for energy storage solutions like flow batteries. They can store excess energy when generation is high and release it when needed, helping to stabilize the grid.

The demand for flow batteries is on the rise because of their distinct advantages over traditional batteries. Key benefits include scalability, extended cycle life, minimal maintenance, eco-friendliness, energy optimization, and peak load management, among others. In the realm of electric vehicle (EV) charging stations, flow batteries are gaining popularity due to their quick charging capabilities, scalability, efficient energy usage, and eco-friendly features. However, the high manufacturing and installation costs pose a significant challenge to market expansion. Flow batteries tend to be pricier than alternative energy storage technologies like lead-acid and lithium-ion batteries.

Report Segmentation

The market is primarily segmented based on type, material, storage, application, and region.

|

By Type |

By Material |

By Storage |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Redox Segment Accounted for the Largest Market Share in 2022

Redox segment held the largest revenue share. This substantial share is attributed to the extensive applications of redox flow batteries. In various industries, the predominant type of flow batteries used is vanadium flow batteries, which fall under the category of redox flow batteries. The functioning of flow batteries revolves around redox reactions, which refer to reduction-oxidation reactions. Flow batteries are commonly known as redox flow batteries (RFBs) because of the chemical processes integral to their operation.

Hybrid batteries are designed with two distinct materials integrated into a single battery system. Various examples of these batteries include Zn-Br, Fe-Cr, Zn-Ce, bromine-polysulfide, & manganese-hydrogen peroxide batteries. In these hybrid systems, the anode & cathode are composed of dissimilar materials. For instance, a Zn-Ce flow battery features a Zn based anode & a Ce-based cathode.

By Storage Analysis

Large Scale Storage Segment Held the Significant Market Share

Large scale storage segment held the majority market share. This supremacy is due to the scalability of these batteries. Flow batteries enjoy economies of scale; as the size increases, the cost/unit of energy decreases. Hence, they become more economically viable for significant installations, where the initial investment is justified by the increased capacity and extended cycle life. These batteries find extensive applications in the grid & utility sector, providing benefits such as enhanced grid stability, management of the energy fluctuations, & supplying power during periods of peak demand.

Small scale batteries will grow at the rapid pace. These batteries are compact and portable, making them suitable for various applications including electric vehicle (EV) charging stations, residential buildings, & the telecommunications sector.

By Application Analysis

Grid/Utility Segment Held the Largest Share over the Forecast Period

Grid/utility segment held the largest share. This is primarily due to crucial role of flow batteries in integrating with the grid, enhancing grid resilience, cutting down energy transmission costs, delivering environmental benefits, and demonstrating remarkable scalability. Flow batteries serve as a dependable and effective solution for storing electrical energy. They have the capability to absorb surplus electricity during periods of excess supply and release it when demand arises, thereby aiding in stabilizing the electrical grid.

EV charging stations segment will grow rapidly. This growth is linked to the rising global production and adoption of electric vehicles. Furthermore, government backing for renewable resources and electric vehicles is expected to drive demand, thereby leading to a surge in the installation of EV charging stations. Flow batteries are well-suited for EV charging stations due to their compact size, high scalability, and eco-friendly nature.

Regional Insights

Asia Pacific Dominated the Global Market in 2022

APAC emerged as the largest region. This strong presence can be attributed to the widespread adoption of flow batteries in major economies like China, Australia, & Japan. These countries have rapidly embraced these batteries, particularly in utility, industrial, and commercial sectors. Moreover, government initiatives and investments in flow batteries are playing a pivotal role in driving market growth. For instance, in August 2023, the Australian government allocated USD 24 million to bolster the local flow battery industry. This investment aims to enhance Queensland's domestic battery capacity, supporting the state in meeting its renewable energy goals.

Europe region will grow rapidly. The region is increasingly prioritizing renewable energies, aiming to become the world's first climate-neutral area by 2050, as outlined by the European Commission. Additionally, data from the European Environment Agency (EEA) revealed that 22% of the European Union's energy consumption came from renewable sources in 2021. Notably, the proportion of renewable energy used in EU transportation surged from 2% in 2005 to nearly, 10.2%, in 2020. These factors are anticipated to boost the demand for these batteries in the region in the upcoming years.

Key Market Players & Competitive Insights

The market is fiercely competitive, with numerous manufacturers holding a significant portion of the industry share. Key players employ strategies such as mergers, acquisitions, capacity expansions, and innovations to enhance and sustain their global presence.

Some of the major players operating in the global market include:

- Cell Cube

- Elestor

- ESS Inc.

- EverFlow

- Invinity Energy Systems

- Jenabatteries GmbH

- Largo Inc.

- Lockheed Martin Corporation

- Primus Power

- Redflow Ltd.

- Redox One

- Stryten Energy

- Sumitomo Electric Industries

- ViZn Energy Systems

- VRB Energy

- WattJoule Corporation

Recent Developments

- In December 2022, Enerox (CellCube), partnered with the North Harbour Clean Energy PTY (NHCE), an Australian company specializing in clean energy storage.

Flow Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 398.11 million |

|

Revenue forecast in 2032 |

USD 1272.22 million |

|

CAGR |

15.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Material, By Storage, By Application, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Gain profound insights into the 2024 Flow Battery Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Dental Insurance Market Size, Share 2024 Research Report

Mycoplasma Testing Market Size, Share 2024 Research Report

Advanced Therapy Medicinal Products CDMO Market Size, Share 2024 Research Report

Cell Therapy Market Size, Share 2024 Research Report

Animal Pregnancy Kit Market Size, Share 2024 Research Report