Flooring Market Size, Share, Trends, Industry Analysis Report

By Product [Ceramic Tiles, Vitrified (Porcelain) Tiles, Carpet, Vinyl, Luxury Vinyl Tiles (LVT)], By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM1269

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

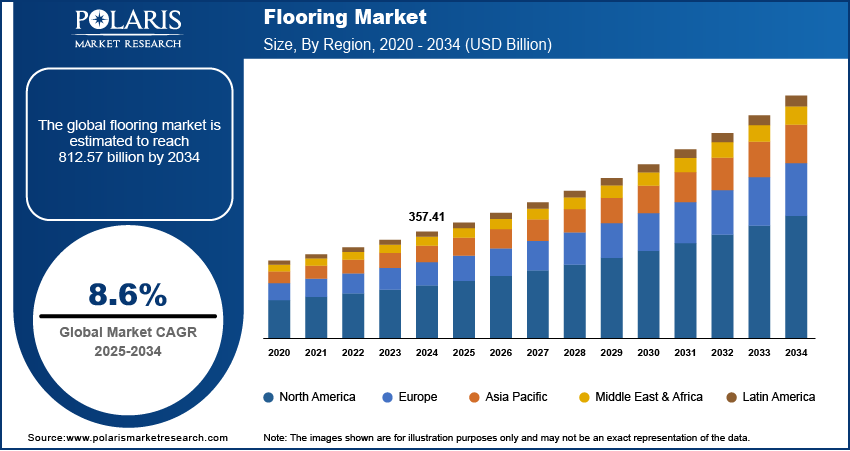

The flooring market size was valued at USD 357.41 billion in 2024 and is projected to register a CAGR of 8.6% from 2025 to 2034. The rising urbanization globally is propelling the demand for flooring products. As populations grow in urban areas, older buildings usually undergo renovations, further driving the need for modern and sustainable flooring solutions.

Key Insights

- The ceramic tiles segment held the largest share in 2024. It is due to their durability, water resistance, and aesthetic versatility.

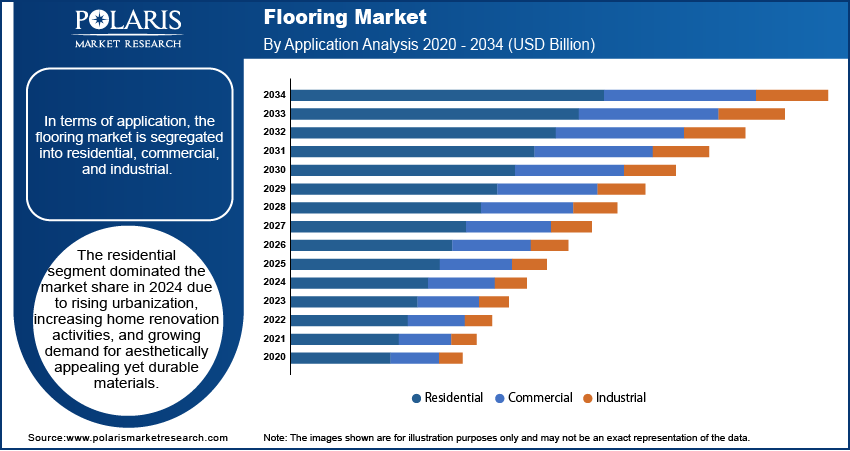

- The residential segment dominated the market share in 2024. The dominance is attributed to rising urbanization, increasing home renovation activities, and growing demand for aesthetically appealing yet durable materials.

- Asia Pacific accounted for a major global revenue share in 2024. The leading position is propelled by rapid urbanization, population growth, and significant infrastructure development across major economies.

- The North America industry is expected to expand at a rapid pace during the forecast period. The growth is driven by the rising renovation and remodeling activities, particularly in residential and commercial spaces.

Industry Dynamics

- Rising use of advanced techniques and materials to create innovative flooring, which resists wear, moisture, and stains, fuels the flooring industry.

- Increasing disposable income is prompting consumers to shift their preferences toward premium and customized flooring options. Thus, higher income levels contribute to more frequent renovations and remodels, contributing to the industry growth.

- The rising infrastructure investments in emerging nations are expected to provide lucrative opportunities in the coming years.

- High costs and susceptibility to damage from moisture hinder the market expansion.

Market Statistics

2024 Market Size: USD 357.41 billion

2034 Projected Market Size: USD 812.57 billion

CAGR (2025–2034): 8.6%

Asia Pacific: Largest market in 2024

AI Impact on Flooring Market

- Artificial intelligence (AI)-based design tools enable designers and customers to visualize flooring options in real time by using Augmented reality (AR) and virtual reality (VR). These systems simulate a variety of materials, colors, patterns, and textures without physical samples. It saves time and resources.

- AI tools monitor production equipment, such as cutters and presses, to prevent breakdowns and predict potential failure. It improves production efficiency and minimizes downtime.

- The technology supports the development of eco-friendly flooring made by using bio-based composites and recycled materials. This flooring complies with environmental standards.

To Understand More About this Research: Request a Free Sample Report

Flooring refers to the permanent covering of a floor that provides a walking surface and supports occupants, furniture, and equipment in a building. It is applied over the floor structure and meets requirements such as adequate strength, stability, fire resistance, soundproofing, damp resistance, and thermal insulation. Flooring materials vary widely, each suited for different applications based on durability, aesthetics, cost, and environmental conditions. The choice of flooring depends on factors such as budget, maintenance, climate, and aesthetic preferences. Proper selection of flooring ensures durability, functionality, and enhances the overall appeal of a space.

The rising urbanization globally is propelling the flooring market growth. According to data published by the United Nations Development Programme in 2024, cities host more than half of the global population and are projected to double by 2050. This expansion in urban population is leading to the construction of high-rise apartments, condominiums, and housing complexes, all of which require large quantities of flooring solutions. Additionally, as populations grow in urban areas, older buildings usually undergo renovations, further driving the need for modern and sustainable flooring solutions.

Urbanization fuels the development of commercial and institutional infrastructure, such as offices, shopping malls, hospitals, and schools. These spaces require specialized flooring that withstands heavy foot traffic while maintaining aesthetic appeal. Furthermore, urban lifestyles encourage higher disposable incomes and changing consumer preferences, leading to greater investments in flooring solutions in home and commercial interiors.

The flooring market demand is driven by the rising infrastructure investments in emerging nations. Governments and private developers in emerging nations such as India, Brazil, and others are allocating more funds to build hospitals, airports, metro systems, and smart cities, all of which require durable and high-performance flooring solutions. Additionally, infrastructure development spurs the growth of supporting facilities such as offices, retail centers, and hospitality venues, further expanding the market. New industrial parks and hospitality venues require commercial-grade flooring for corporate spaces, warehouses, and factories, boosting demand for solutions such as raised access flooring and others. Hence, as the infrastructure investments in emerging nations increase, the demand for flooring solutions also spurs. For instance, the Ministry of Information & Broadcasting of India published a report stating India's total infrastructure spending has grown exponentially, with budget allocations rising to USD 117 billion (₹10 lakh crore) in 2023–2024.

Market Dynamics

Advancement in Technique and Material

Manufacturers are using innovative techniques to create flooring that resists wear, moisture, and stains, which appeals to both residential and commercial customers. These improvements extend the lifespan of floors and reduce maintenance costs, encouraging more people to upgrade. New materials such as luxury vinyl, engineered wood adhesives, and eco-friendly composites are offering a wide range of flooring options for consumers with different needs and budgets. These varieties are increasing the attractiveness of flooring renovations and new installations, thereby fueling the flooring industry.

Rising Disposable Income Worldwide

Increasing disposable income is propelling consumers to shift their preferences toward premium and customized flooring options made with materials such as hardwood, luxury vinyl, or marble that offer a luxury look and feel. This is driving manufacturers to innovate and expand their flooring offerings. Moreover, increased spending allows people to hire professionals for flooring installation, which makes the process more convenient and appealing. Higher income levels also contribute to more frequent renovations and remodels, contributing to the flooring industry growth.

Segmental Insights

Market Evaluation by Product

Based on product, the market is divided into ceramic tiles, vitrified (Porcelain) tiles, carpet, vinyl, luxury vinyl tiles (LVT), vinyl composite tile, linoleum/rubber, wood & laminate, and others. The ceramic tiles segment held the largest flooring market share in 2024 due to their durability, water resistance, and aesthetic versatility. The rising demand for cost-effective, low-maintenance solutions in residential and commercial spaces, particularly in emerging economies such as India and China, significantly contributed to their dominance. Additionally, advancements in digital printing technology allowed manufacturers to produce ceramic tiles that mimic natural materials such as wood and stone, appealing to consumers seeking high-end designs at affordable prices. The construction boom in urban areas and the growing preference for hygienic, easy-to-clean surfaces in kitchens and bathrooms further contributed to ceramic tiles as the prominent choice.

The luxury vinyl tiles (LVT) segment is expected to grow at a robust pace in the coming years, owing to superior aesthetic appeal, high performance, and enhanced resilience compared to traditional vinyl and other surface materials. The rising demand for visually appealing yet affordable alternatives to natural wood and stone has further fueled LVT’s popularity in both residential and commercial renovations. Furthermore, the product’s water resistance, acoustic insulation, and compatibility with modern subfloor heating systems position it as a top choice in regions experiencing rapid urbanization and a growing preference for sustainable, low-maintenance interiors.

Market Insight by Application

In terms of application, the market is segregated into residential, commercial, and industrial. The residential segment dominated the market share in 2024 due to rising urbanization, increasing home renovation activities, and growing demand for aesthetically appealing yet durable materials. The surge in residential construction, particularly in developing regions such as Asia Pacific and the Middle East, played a crucial role in this dominance. Homeowners increasingly preferred options such as ceramic tiles, luxury vinyl planks, and wood and laminate flooring due to their affordability, ease of maintenance, and design versatility. Additionally, after the COVID-19 pandemic, there is a rise in the shift toward remote work. The change has led to higher investments in home improvements, further boosting demand for stylish and long-lasting flooring solutions.

The commercial segment is estimated to hold a significant share of the market in the coming years, owing to the rapid infrastructure development in corporate offices, retail spaces, healthcare facilities, and educational institutions. Businesses prioritize high-performance materials such as LVT, vinyl composite tiles, and porcelain slabs due to their durability, slip resistance, and ability to withstand heavy foot traffic. The growing emphasis on sustainable and hygienic surfacing in workplaces and public spaces is also driving demand for flooring. Furthermore, the hospitality and retail sectors are increasingly adopting premium designs that enhance aesthetics while meeting strict safety and maintenance requirements, ensuring robust growth for commercial applications.

Regional Outlook

By region, the report provides flooring market insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to rapid urbanization, population growth, and significant infrastructure development across major economies. The United Nations Human Settlements Programme stated that by 2050, the urban population in Asia is expected to grow by 50%. Countries such as China and India experience a surge in demand for floorings due to extensive residential and commercial construction, supported by expanding urbanization, government initiatives such as China’s New Urbanization Plan and India’s Smart Cities Mission. China dominated the regional market due to its massive housing sector, industrial expansion, and ongoing investments in public infrastructure. Consumers in the region also increasingly favored cost-effective and durable materials such as advanced ceramic and vitrified tiles, while domestic manufacturers scaled up production to meet growing local and export demand, contributing to the flooring industry expansion. Additionally, Southeast Asian nations such as Vietnam and Indonesia witnessed high construction activity, supporting the robust growth of the market.

The market in North America is expected to expand at a rapid pace during the forecast period, owing to the rising renovation and remodeling activities, particularly in residential and commercial spaces, where homeowners and businesses favor premium, high-performance floorings such as LVT and engineered wood. The strong focus on sustainability, along with stringent building regulations promoting eco-friendly and low-emission products, is further driving market expansion. Additionally, the US commercial sector, including healthcare, education, and corporate spaces, is increasingly adopting durable and aesthetically versatile flooring solutions to meet modern design and functionality standards, thereby contributing to market development.

Key Players and Competitive Analysis

The global flooring market is highly competitive, driven by mergers and acquisitions, product portfolio expansions, and strategic partnerships. Major players have strengthened their market positions through acquisitions. Product diversification is another key strategy, with companies investing in sustainable flooring solutions, including carbon-neutral carpets and recycled materials, to meet growing eco-conscious demand. Collaborations and partnerships are also shaping the market. Regional players are also expanding their presence through joint ventures to capture growth in emerging markets.

The market is fragmented, with the presence of numerous global and regional market players. A few major players are AHF Products; Atlas Concorde S.P.A.; Burke Flooring Products, Inc.; Crossville Inc.; Firbo Flooring; Gerflor; Interface, Inc.; Kajaria Ceramics Limited; Mannington Mills, Inc.; Mohawk Industries, Inc.; NOTION; Polyflor; Porcelanosa Group; RAK Ceramics; Shaw Industries, Inc.; and Tarkett, S.A.

Kajaria Ceramics Limited is India's largest and major manufacturer of ceramic and vitrified tiles, established in 1985 with over 35 years of industry presence. The company operates eight manufacturing plants across India, including locations in Uttar Pradesh, Rajasthan, Andhra Pradesh, and Gujarat, with a total annual production capacity of 73 million square meters. Kajaria’s product portfolio includes a wide range of floor tiles, ceramic, vitrified, and double-charge tiles, designed to cater to diverse aesthetic and functional needs. The vitrified tiles of the company are especially popular for flooring due to their durability, low porosity, and resistance to wear and stains, making them suitable for both residential and commercial high-traffic areas. These tiles come in various sizes; finishes such as matte, glossy, and polished; and designs, including digital prints and natural stone looks, allowing customers to choose styles that complement contemporary or classic interiors.

RAK Ceramics is one of the largest and most prominent global manufacturers of ceramic and porcelain tiles, established in 1989 and headquartered in the UAE. The company operates 23 manufacturing plants across the UAE, India, Bangladesh, and Europe, with an annual tile production capacity of approximately 118 million square meters. RAK Ceramics offers an extensive range of ceramic and vitrified floor tiles that cater to both residential and commercial applications. The product portfolio of the company includes ceramic floor tiles available in multiple sizes, such as 60x60 cm, 41.6x41.6 cm, and 33x33 cm, with a variety of colors and finishes to suit diverse design preferences. These tiles are manufactured using high-quality raw materials and advanced technology, ensuring they meet and exceed international quality standards.

Key Companies in Flooring Market

- AHF Products

- Atlas Concorde S.P.A.

- Burke Flooring Products, Inc.

- Crossville Inc.

- Firbo Flooring

- Gerflor

- Interface, Inc

- Kajaria Ceramics Limited

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- NOTION

- Polyflor

- Porcelanosa Group

- RAK Ceramics

- Shaw Industries, Inc.

- Tarkett, S.A.

Flooring Industry Developments

April 2024: Tarkett, a global flooring manufacturer, announced the launch of a non-PVC plank and tile flooring collection, Collective Pursuit. It is a high-performance flooring solution that aims to match the performance of luxury vinyl tile in dimensional stability, impact resistance, and ease of maintenance.

July 2024: AHF Products announced the launch of the next generation of hybrid, sustainable, resilient flooring solution, Ingenious Plank.

March 2021: NOTION, India’s major brand and producer of modernistic flooring, introduced an exclusive collection of “Engineered wooden flooring” for luxurious style, ease of installation, and environmentally friendly benefits.

Flooring Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Ceramic Tiles

- Vitrified (Porcelain) Tiles

- Carpet

- Vinyl

- Luxury Vinyl Tiles (LVT)

- Vinyl Composite Tile

- Linoleum/Rubber

- Wood & Laminate

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Flooring Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 357.41 Billion |

|

Market Forecast in 2025 |

USD 387.36 Billion |

|

Revenue Forecast in 2034 |

USD 812.57 Billion |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 357.41 billion in 2024 and is projected to grow to USD 812.57 billion by 2034.

The global market is projected to register a CAGR of 8.6% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are AHF Products; Atlas Concorde S.P.A.; Burke Flooring Products, Inc.; Crossville Inc.; Firbo Flooring; Gerflor; Interface, Inc.; Kajaria Ceramics Limited; Mannington Mills, Inc.; Mohawk Industries, Inc.; NOTION; Polyflor; Porcelanosa Group; RAK Ceramics; Shaw Industries, Inc.; and Tarkett, S.A.

The residential segment dominated the market revenue in 2024.

The luxury vinyl tiles (LVT) segment is expected to grow at the fastest pace in the coming years.