Flip Flops Market Size, Share, Trends, Industry Analysis Report: By End User (Male and Female), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM3531

- Base Year: 2024

- Historical Data: 2020-2023

Flip Flops Market Overview

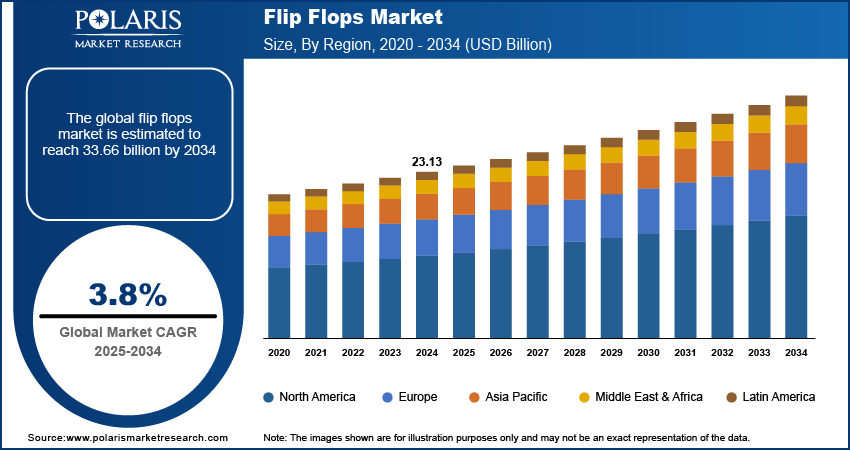

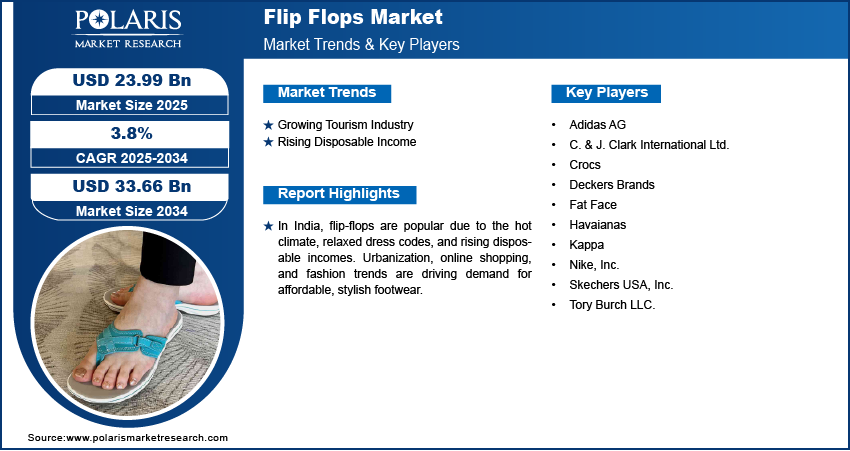

The global flip flops market size was valued at USD 23.13 billion in 2024. The market is projected to grow from USD 23.99 billion in 2025 to USD 33.66 billion by 2034, exhibiting a CAGR of 3.8% from 2025 to 2034.

Flip-flops are casual, lightweight sandals typically made of rubber or foam, with a Y-shaped strap that goes between the toes. They are often worn in warm weather, offering comfort and ease of wear for short trips or beach outings.

People are increasingly prioritizing comfort and convenience when it comes to footwear. This shift in preference is driven by the rising demand for casual footwear that offers ease and comfort throughout the day. Flip-flops perfectly align with this trend, as they are lightweight, breathable, and require minimal effort to wear. They are ideal for casual outings, lounging, and walking around, making them a popular choice for individuals seeking comfort over formal or restrictive shoes. This growing demand for comfortable footwear is driving the flip flops market expansion.

To Understand More About this Research: Request a Free Sample Report

The rise of e-commerce has greatly impacted the footwear market, including the flip-flop segment. According to the India Brand Equity Foundation, the Indian e-commerce sector alone is anticipated to achieve a valuation of USD 325 billion by 2030, showcasing the growth of the e-commerce sector. Online shopping provides consumers with easy access to a wide variety of flip-flops from different brands, styles, and price ranges. Consumers are more likely to make informed purchasing decisions with the ability to compare prices and read reviews. Additionally, e-commerce platforms also enable brands to reach global audiences, driving brand expansion, thereby driving the flip flops market growth.

Flip Flops Market Dynamics

Growing Tourism Industry

The global growth of the tourism industry, particularly in beach and resort destinations, has made flip-flops an essential item for travelers. According to the World Travel and Tourism Council, in 2023, the US tourism industry employed 18 million people, driving demand for comfortable footwear options, including flip-flops. These footwear options are ideal for the beach, poolside lounging, and other vacation activities, offering convenience and comfort in hot climates. Additionally, coastal regions, which attract a large number of tourists, have seen a rise in the demand for flip-flops. Resorts, hotels, and vacation spots also promote wearing flip-flops due to their practicality and ease of use, which is further driving the demand for flip-flops and contributing to the flip flops market development.

Rising Disposable Income

Disposable incomes are rising, particularly in developing regions, giving people greater spending power to buy a wider variety of products, including footwear. According to the US Bureau of Economic Analysis, in 2024, disposable income in the US rose by 0.1% each month. Higher-income levels, coupled with changing lifestyles, have contributed to the increasing popularity of flip-flops. The shift toward more casual and relaxed dress codes means people no longer feel the need to wear formal shoes for work or special occasions. Instead, many opt for comfortable and versatile footwear for daily wear. This change has broadened the consumer base for flip-flops, making them a preferred choice for both leisure activities and everyday use, thereby propelling the flip-flops market revenue.

Flip Flops Market Segment Analysis

Flip Flops Market Assessment by End User Outlook

The flip flops market assessment, based on end user, includes male and female. The female segment is expected to witness significant growth during the forecast period. Women are increasingly choosing flip-flops as their go-to footwear for daily wear, especially in warmer months, due to the focus on comfort. Fashion trends are further supporting this growth, as many brands now offer stylish and trendy designs specifically for women. Additionally, the rise in disposable incomes and the shift toward more relaxed dress codes across different environments contribute to the demand for flip-flops, thereby driving segmental growth in the global market.

Flip Flops Market Evaluation by Distribution Channel Outlook

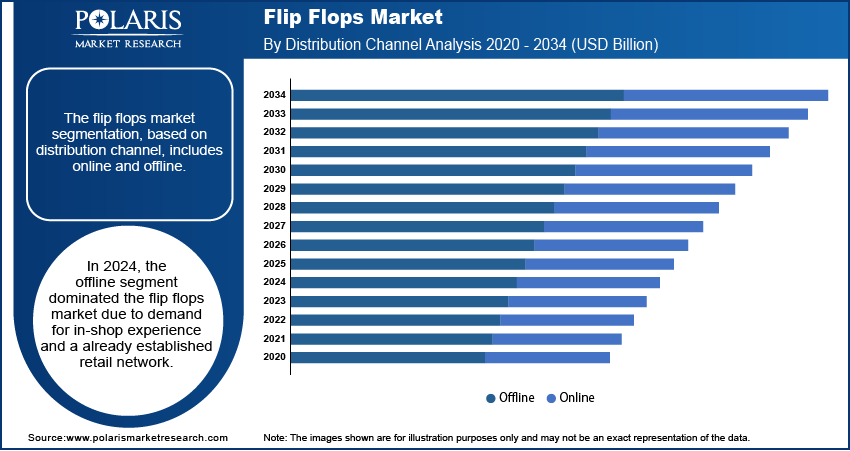

The flip flops market evaluation, based on distribution channel, includes online and offline. The offline segment dominated the flip flops market in 2024. Physical stores, including retail outlets and footwear shops, remain the preferred choice for many consumers when purchasing flip-flops. Shoppers enjoy the ability to try on the footwear for size and comfort before making a purchase. Additionally, in-store shopping allows customers to explore a variety of styles and brands in person. While online shopping is growing, offline retail continues to hold a strong position due to the immediate availability of products and the personal shopping experience it provides, driving its dominance in the flip flops market.

Flip Flops Market Regional Analysis

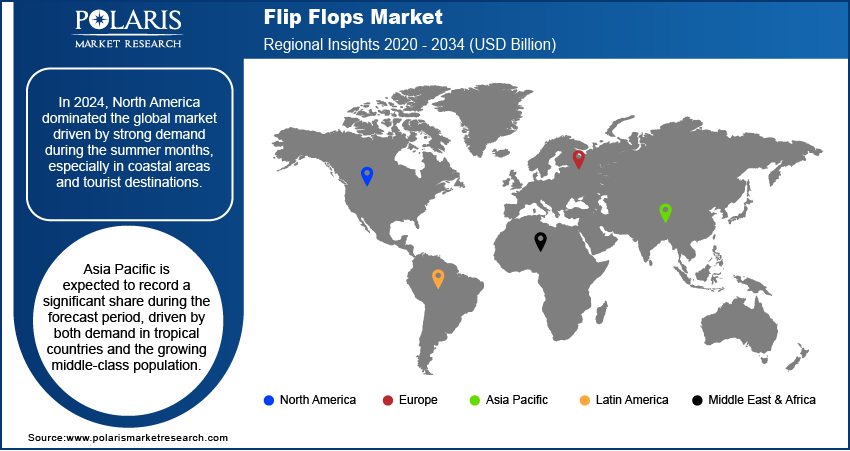

By region, the study provides the flip flops market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, driven by strong demand during the summer months, especially in coastal areas and tourist destinations. Consumers in the US and Canada prefer flip-flops for casual wear, beach outings, and vacations. The rising trend toward casual and comfortable footwear has contributed to growth in demand for flip flops, with many consumers choosing flip flops for outdoor activities and leisure. Additionally, a large network of retail stores supports the availability of flip flops in the region, thereby driving the regional flip flops market size.

Asia Pacific is expected to record a significant share during the forecast period, driven by both demand in tropical countries and the growing middle-class population. Countries like Thailand, Indonesia, and the Philippines have a long-standing tradition of wearing flip-flops due to their suitability for hot and humid climates. Additionally, countries such as China, Japan, and India have seen increased interest in casual footwear, including flip flops, as lifestyles become more relaxed. The expanding e-commerce, c2c e-commerce sector, and rising disposable incomes are further fueling the regional footprint in the global market.

The India flip flops market is experiencing substantial growth due to the country's hot climate and relaxed dress codes. The increasing middle-class population and their rising disposable income have led to higher demand for affordable yet comfortable footwear. Flip flops are widely used for daily activities, casual wear, and at home. The growing urbanization, with more people embracing casual lifestyles, is further contributing to the rise in demand, thereby driving the growth of the flip flop market in the country.

Flip Flops Market – Key Players and Competitive Insights

The flip flops market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. According to the flip flops market analysis, these companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive trend is amplified by continuous progress in product offerings. Major players in the flip flops market include Adidas AG; C. & J. Clark International Ltd.; Crocsl; Deckers Brands; Fat Face; Havaianas; Kappa; Nike, Inc.; Skechers USA, Inc.; and Tory Burch LLC.

Crocs, Inc. is an American footwear company based in Broomfield, Colorado. The company is known for its casual footwear made from a proprietary closed-cell resin called Croslite, which offers comfort and durability. Crocs operates primarily through retail and wholesale channels, designing, manufacturing, marketing, and distributing a variety of footwear and accessories for men, women, and children. The product range includes clogs, sandals, shoes, and accessories. The classic clogs are available in multiple colors, while the sandals include various styles, such as flips and slides. The company also produces sneakers and boots alongside Jibbitz decorations that allow for the personalization of the footwear. In 2022, Crocs expanded its product offerings by acquiring HeyDude, a brand that specializes in casual footwear, which enabled Crocs to diversify its product line further. Crocs operates on a global scale with a presence in the Americas, Asia Pacific, and Europe. The company distributes its products in over 90 countries through various channels. This includes more than 300 company-owned retail stores and kiosks, as well as e-commerce platforms. Additionally, Crocs collaborates with numerous retailers and distributors worldwide. The company has warehouse and distribution facilities located in the US and the Netherlands. Manufacturing primarily takes place in Vietnam and China.

Adidas AG is a German multinational corporation that specializes in athletic apparel and footwear. Headquartered in Herzogenaurach, Bavaria, Germany, it is one of the largest sportswear manufacturers in Europe and globally. Founded in 1949, Adidas is recognized for its three-stripes logo, which was acquired from Karhu Sports in 1952. The company is part of the Adidas Group, which also holds a stake in Bayern Munich and owns Runtastic, an Austrian fitness technology firm. Adidas produces a variety of athletic and sports lifestyle products. Its offerings include footwear, apparel such as t-shirts, jackets, and pants, and accessories like bags and fitness equipment. Footwear and apparel are the company's main segments, generating a significant portion of its sales. Adidas distributes its products through various channels, including its own stores, retail stores, e-commerce platforms, and mobile apps. Adidas operates globally across several regions, including the Americas, Europe, Middle East, and Africa (EMEA), and Asia Pacific. The EMEA region is a substantial market for the company, while Asia Pacific, particularly Greater China, is also important. Africa and the Middle East are part of its operations as well. Adidas offers a range of flip-flops alongside extensive collections of shoes (Originals, Samba, Campus, Stan Smith, Superstar, football, running, and training), apparel, and kids' wear.

List of Key Companies in Flip Flops Market

- Adidas AG

- C. & J. Clark International Ltd.

- Crocs

- Deckers Brands

- Fat Face

- Havaianas

- Kappa

- Nike, Inc.

- Skechers USA, Inc.

- Tory Burch LLC.

Flip Flops Industry Developments

In November 2023, Crocs created and released a three-piece clog collection inspired by Coca-Cola and Sprite. The new collection features All-Terrain and Classic styles, with playful polar bear prints and soda-themed Jibbitz.

Flip Flops Market Segmentation

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Male

- Female

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Flip Flops Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 23.13 billion |

|

Market Size Value in 2025 |

USD 23.99 billion |

|

Revenue Forecast by 2034 |

USD 33.66 billion |

|

CAGR |

3.8% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The flip flops market size was valued at USD 23.13 billion in 2024 and is projected to grow to USD 33.66 billion by 2034.

The global market is projected to register a CAGR of 3.8% during the forecast period, 2025–2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Adidas AG; C. & J. Clark International Ltd.; Crocsl; Deckers Brands; Fat Face; Havaianas; Kappa; Nike, Inc.; Skechers USA, Inc.; and Tory Burch LLC.

The offline segment dominated the flip flops market in 2024 due to demand for in-shop experience and an already established retail network.

The female segment is expected to witness the fastest growth during the forecast period as women are increasingly choosing flip-flops as their go-to footwear for daily wear, especially in warmer months, due to the focus on comfort.