Flexible Foam Mold Release Agents Market for transportation Size, Share, Trends, Industry Analysis Report: By Vehicle Type [Automotive, Aerospace, Marine, Recreational Vehicles (RVs) & Specialty Vehicles, and Agricultural & Off-road Vehicles], Foam Type, Mold Release Agent Type, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM5393

- Base Year: 2024

- Historical Data: 2020-2023

Flexible Foam Mold Release Agents Market Overview

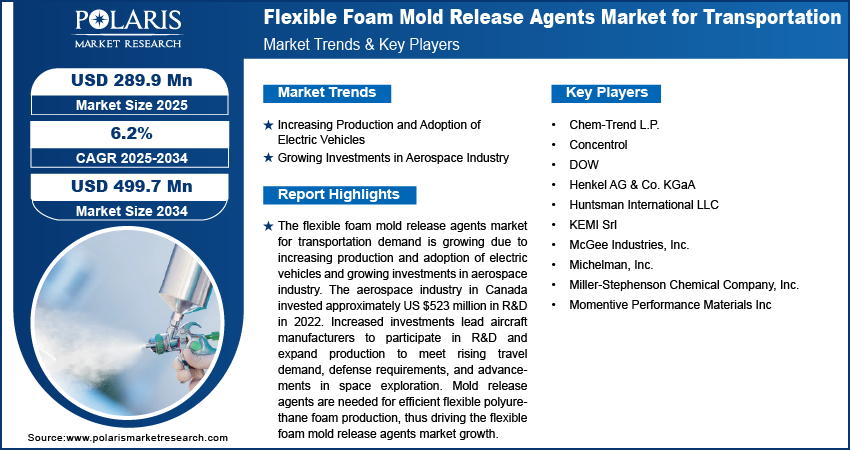

The flexible foam mold release agents market size was valued at USD 263.8 million in 2024. The market is projected to grow from USD 289.9 million in 2025 to USD 499.7 million by 2034, exhibiting a CAGR of 6.2% during 2025–2034.

Flexible foam release agents are key ingredients in producing the flexible polyurethane foams found in car, aircraft, bus, and train seats, backrests, and headrests. These agents are important for maintaining the foam's shape, surface quality, and structural integrity after demolding. Many flexible foam release agents function mainly by creating a barrier between the foam and the mold surface. This important barrier effectively prevents foam from sticking to the mold, thereby avoiding defects such as tearing, meaningful surface flaws, or incomplete demolding. Flexible foam release agents are available in various forms, including liquids, aerosols, and powders.

The rising production and sales of automobiles are driving the flexible foam mold release agents market demand for transportation. National Automobile Dealers Association published data that stated total vehicle sales in the US increased to 16.80 million in December from 16.65 million in November of 2024. Expanding vehicle manufacturing and adoption leads to a higher need for various automotive components, including seats, headrests, armrests, and insulation materials. Thus, rising production and sales of automobiles are boosting the flexible foam mold release agents market development.

To Understand More About this Research: Request a Free Sample Report

Flexible Foam Mold Release Agents Market Drivers Analysis

Increasing Production and Adoption of Electric Vehicles

The increasing production and adoption of electric vehicles propel the flexible foam mold release agents market demand. International Energy Agency published data stating that new electric car registrations in the US in 2023 increased by more than 40% compared to 2022. Expanding EV manufacturing requires a higher volume of lightweight and durable materials to enhance energy efficiency and performance. This drives EV manufacturers to prioritize flexible polyurethane foam for seating, insulation, and interior components, increasing the need for mold release agents that facilitate smooth production. These agents ensure clean mold separation, prevent defects, and improve surface quality, making them essential in EV component manufacturing.

Stricter emission standards and government policies are pushing automakers to phase out internal combustion engine vehicles and scale up EV production. This transition is driving the need for advanced mold release solutions, as the demand for lightweight materials such as flexible polyurethane foam continues to rise. This indicates that innovations in release agent formulations will further improve production efficiency and sustainability in the EV sector.

Growing Investments in Aerospace Industry

The growing investments in the aerospace industry are fueling the flexible foam mold release agents market growth. In 2022, leading companies from France aerospace industry invested approximately USD 4.4 billion in R&D. This investment fueled advancements in sustainable aviation, next-generation fighter jets (such as the FCAS program), and space exploration projects, reinforcing France's position as a global leader in aerospace innovation. Investments in the aerospace sector drive advancements in engineering, propelling the development of high-performance seating solutions with superior comfort, fire resistance, and durability.

These advancements align with emerging flexible foam mold release agents market trends as manufacturers seek more efficient solutions for precision molding and smooth surface finishes. The market analysis highlights the need for specialized formulations that cater to aerospace-grade polyurethane foam production. This creates a flexible foam mold release agents market opportunity, as manufacturers focus on enhancing foam quality and consistency. Moreover, as aerospace manufacturing scales up, the flexible foam mold release agents market revenue is expected to rise, with demand increasing across various types, including water-based and solvent-based solutions tailored for high-performance applications.

Flexible Foam Mold Release Agents Market Segment Insights

Flexible Foam Mold Release Agents Market Outlook by Vehicle Type Insights

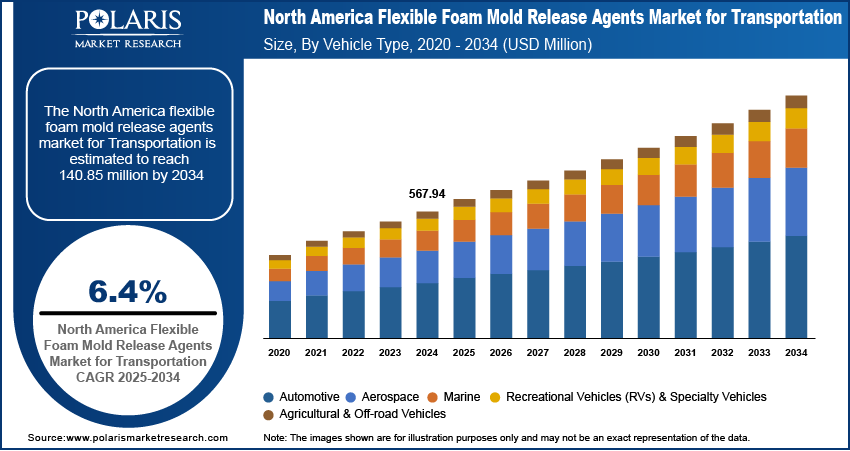

Based on vehicle type, the flexible foam mold release agents market has been segmented into automotive, aerospace, marine, agricultural & off-road vehicles, and recreational vehicles (RVs) & specialty vehicles.

In 2024, the automotive segment dominated the flexible foam mold release agents market share. The automotive sector includes passenger cars, commercial vehicles, and scooters. These vehicles rely heavily on flexible foam mold release agents to ensure high-quality foam components. These foams are used in seats, armrests, headrests, door panels, steering wheels, and acoustic insulation. The surge in automobile production has significantly contributed to the flexible foam mold release agents market expansion, as manufacturers increasingly adopt advanced release agents to ensure seamless and defect-free manufacturing. According to the European Automobile Manufacturers' Association, 14.901 million motor vehicles were produced in North America in 2022, underscoring the growing demand for mold release solutions. Additionally, technological advancements in automotive foam manufacturing are creating new growth opportunities for the flexible foam mold release agents industry players.

Flexible Foam Mold Release Agents Market Assessment by Foam Type Insights

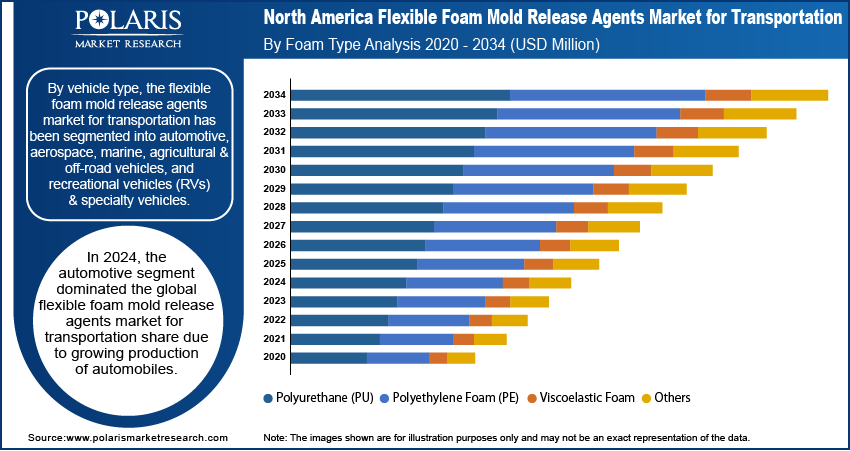

By foam type, the flexible foam mold release agents market has been segmented into polyurethane (PU), polyethylene foam (PE), viscoelastic foam, and others.

In 2024, the polyurethane (PU) segment dominated the flexible foam mold release agents market revenue share, mainly due to its wide adoption in the transportation industry owing to its lightweight, durability, and flexibility. PU foam is a polymer formed by reacting polyols with diisocyanates. It is classified into two main types: flexible and rigid. Flexible polyurethane foam is soft and resilient, commonly used in mattresses and automotive seating due to its cushioning properties. It provides comfort, absorbs impact, and enhances durability. On the other hand, rigid polyurethane foam is a high-density material with excellent thermal insulation properties. The widespread use of PU foam is driven by its energy efficiency, lightweight nature, and adaptability to different formulations and densities. This increasing reliance on PU foam presents a significant flexible foam mold release agents market opportunity.

Flexible Foam Mold Release Agents Market Breakdown by Regional Insights

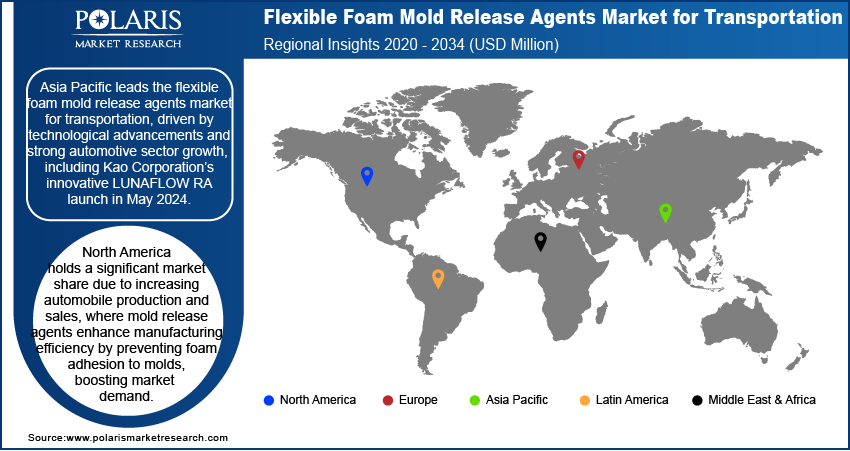

By region, the study provides flexible foam mold release agents market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The Asia Pacific flexible foam mold release agents market size accounted for USD 98.30 million in 2024 and is estimated to record a CAGR of 6.6% during the forecast period. China holds the largest market share in Asia Pacific, primarily driven by rapid growth in the automotive and transportation sectors. Factors that drive the China automotive industry are increasing domestic demand, strong government support for electric vehicles (EVs), and advancements in manufacturing technology. As the world's largest automotive market, China produced over 30 million vehicles in 2023, accounting for nearly 35% of global vehicle production. This expansion has significantly increased the market demand, as flexible polyurethane foams play a crucial role in vehicle interiors, seating, and insulation. As a result, the need for efficient mold release agents has surged to enhance manufacturing efficiency and product quality.

North America is expected to hold a substantial share of the flexible foam mold release agents market revenue during the forecast period. In 2023, North American airports experienced a resurgence in passenger traffic. Overall passenger numbers increased by 11.9% compared to 2022, with international travel seeing a remarkable 27.9% rise and domestic travel growing by 9.5%. The increasing airline travel in the region is driving both government and private aerospace companies to invest in the production of new airplanes, helicopters, and other aircraft. This expansion fuels the flexible foam mold release agents market demand, as airlines prioritize advanced seating solutions made of flexible foam to enhance passenger comfort on long-haul flights.

Growing government support for electric vehicle (EV) production in North America is propelling the flexible foam mold release agents market growth in the transportation sector. In October 2024, General Motors announced that it had sold over 370,000 EV units across North America since 2016, contributing to the flexible foam mold release agents market expansion in the region.

Flexible Foam Mold Release Agents Market – Key Players & Competitive Insights

The flexible foam mold release agents market for transportation is highly competitive, with the presence of key players such as DOW; Huntsman International LLC; Chem‑Trend L.P.; Henkel AG & Co. KGaA; Michelman, Inc.; McGee Industries, Inc.; Miller-Stephenson Chemical Company, Inc.; Concentrol; KEMI Srl; and Momentive Performance Materials Inc. These companies employ strategies such as strategic partnerships, technological advancements, product innovation, and global expansion to enhance their market presence. Competition from emerging companies and tech-driven disruptors is driving rapid progress in mold release technologies, with the introduction of novel materials and innovative designs. This dynamic environment boosts continuous innovation, pushing established players to adapt, evolve, and maintain their competitive edge in the flexible foam mold release agents market.

Dow is a chemical manufacturing conglomerate with a wide range of products. Dow Inc. offers consumer care, construction, and industrial materials science solutions across the US, Canada, Latin America, Europe, Africa, India, the Middle East, and Pacific. The company maintains 113 production facilities in 31 countries. Its portfolio includes six global business divisions, structured into three functioning segments, including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers polyurethane systems, propylene glycol, polyether polyols, and others. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, and others. Additionally, the portfolio includes silicone-based additives and surfactants that serve as internal mold release agents. The performance materials and coatings segment offers industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, standalone silicones, performance monomers and silicones, and home and personal care solutions. Dow offers high-performance flexible foam mold release agents, designed for polyurethane foam applications, ensuring smooth demolding, reduced defects, enhanced productivity, and compatibility with various manufacturing processes in automotive, furniture, and bedding industries.

Huntsman International LLC is a global manufacturer of diversified organic chemical products, operating in three primary segments—performance products, polyurethanes, and advanced materials. The polyurethanes segment produces essential chemicals such as polyether and polyester polyols, methyl diphenyl diisocyanate, and thermoplastic polyurethane, along with other co-products such as aniline and nitrobenzene. Under the performance products segment, Huntsman manufactures a wide range of amines such as ethyleneamines, polyetheramines, and specialty carbonates, as well as maleic anhydride. The advanced materials segment offers high-performance polymer formulations, including phenoxy, epoxy, and acrylic-based products; thermoset resins; and carbon nanomaterials. Huntsman International LLC provides advanced flexible foam mold release agents designed for polyurethane foam applications, offering superior surface finish, improved demolding efficiency, reduced build-up, and compatibility with automotive, furniture, and bedding industries.

List of Key Companies in Flexible Foam Mold Release Agents Market

- Chem‑Trend L.P.

- Concentrol

- DOW

- Henkel AG & Co. KGaA

- Huntsman International LLC

- KEMI Srl

- McGee Industries, Inc.

- Michelman, Inc.

- Miller-Stephenson Chemical Company, Inc.

- Momentive Performance Materials Inc

Flexible Foam Mold Release Agents Industry Developments

November 2023: Chem-Trend acquired the Mavcoat brand from Maverix Solutions, enhancing its mold release product portfolio and expanding local supply and service for global manufacturers across various molding industries.

Flexible Foam Mold Release Agents Market Segmentation

By Vehicle Type Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Aerospace

- Marine

- Recreational Vehicles (RVs) & Specialty Vehicles

- Agricultural & Off-road Vehicles

By Foam Type Outlook (Revenue, USD Million, 2020–2034)

- Polyurethane (PU)

- Polyethylene Foam (PE)

- Viscoelastic Foam

- Others

By Mold Release Agent Type Outlook (Revenue, USD Million, 2020–2034)

- Water-Based Release Agents

- Silicone-Based Release Agents

- Solvent-Based Release Agents

- Wax-Based Release Agents

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Flexible Foam Mold Release Agents Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 263.8 Million |

|

Market Size Value in 2025 |

USD 289.9 Million |

|

Revenue Forecast by 2034 |

USD 499.7 Million |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2024–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global flexible foam mold release agents market size was valued at USD 263.8 million in 2024 and is projected to grow to USD 499.7 million in 2034.

• The global market is expected to register a CAGR of 6.2% during the forecast period.

• Asia Pacific held the largest share of the global market in 2024.

• A few key players in the market are DOW; Huntsman International LLC; Chem?Trend L.P.; Henkel AG & Co. KGaA; Michelman, Inc.; McGee Industries, Inc.; Miller-Stephenson Chemical Company, Inc.; Concentrol; KEMI Srl; and Momentive Performance Materials Inc.

• The automotive segment dominated the market in 2024.