Fitness App Market Size, Share, Trends, Industry Analysis Report: By Type (Workout & Exercise Apps, Disease Management, Lifestyle Management, Nutrition & Diet, and Medication Adherence), Platform, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1571

- Base Year: 2024

- Historical Data: 2020-2023

Fitness App Market Overview

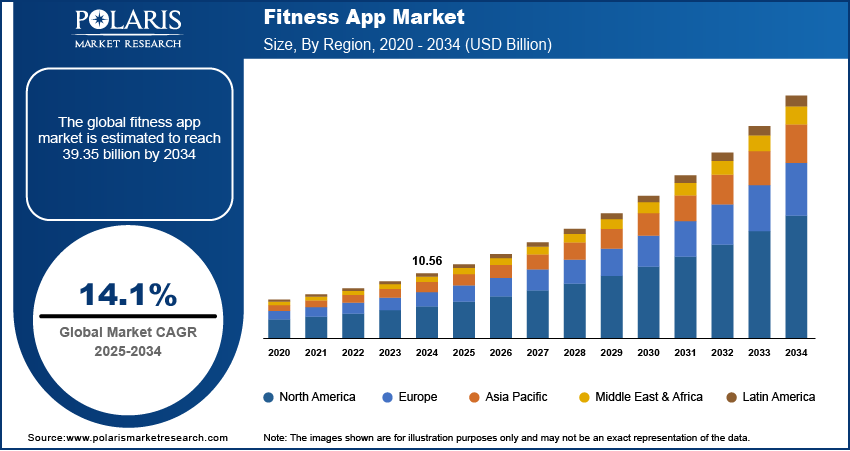

Fitness app market size was valued at USD 10.56 billion in 2024. The market is projected to grow from USD 12.02 billion in 2025 to USD 39.35 billion by 2034, exhibiting a CAGR of 14.1% during 2025-2034.

The global fitness app market focuses on digital platforms designed to improve physical health, offer personalized workout routines, track activity, monitor nutrition, and promote mindfulness. These apps use emerging technologies such as artificial intelligence (AI), machine learning, and wearable devices to offer users personalized experiences.

The market has grown significantly due to increasing health awareness, technological advancements, and the growing demand for at-home fitness solutions. With the rise of chronic diseases and lifestyle-related health issues, consumers are increasingly turning to digital platforms, including fitness apps, for convenience, flexibility, and real-time health insights. For instance, according to the data published by the World Health Organization, Noncommunicable diseases (NCDs) or chronic diseases killed at least 43 million people in 2021, equivalent to 75% of non-pandemic-related deaths globally.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of obesity worldwide is further fueling the fitness app market growth. According to the World Health Organization, in 2022, 1 in 8 people in the world were living with obesity. Fitness apps offer personalized solutions to address obesity. These apps provide workout plans, calorie tracking, and nutrition guidance, empowering users to achieve their weight-loss goals and overcome obesity. Fitness apps also integrate AI to analyze user data and recommend customized plans, enhancing effectiveness and user engagement, which increases its adoption among obese. Hence, as the prevalence of obesity increases globally, the demand for fitness apps spurs.

Fitness App Market Dynamics

Advancements in Wearable Technology

The advancement in technology is propelling the fitness app market revenue. Advanced wearables, such as smartwatches, fitness bands, and health trackers, rely on fitness apps to monitor metrics such as heart rate, steps, calories burned, sleep patterns, and even stress levels. Therefore, as wearable technology advances, users are drawn to fitness apps for personalized insights, goal tracking, and motivation.

Rising Smartphone Penetration in Emerging Nations

The rising smartphone penetration in emerging nations such as India is fueling the fitness app market expansion. According to data published by the World Economic Forum, India had over 700 million smartphone users, including 425 million in rural areas, as of January 2023. Smartphones allow users to conveniently download and use fitness apps to track their workouts, monitor health metrics, and access personalized fitness plans. Advanced features such as GPS tracking for outdoor activities and interactive video-based workouts are readily available on smartphones, enhancing the overall user experience. Moreover, the widespread availability of high-speed internet and affordable smartphones has expanded the reach of fitness apps to diverse demographics. This growing smartphone adoption, combined with increasing health awareness, has propelled the fitness app market.

Fitness App Market Segment Assessment

Fitness App Market Assessment by Type Insights

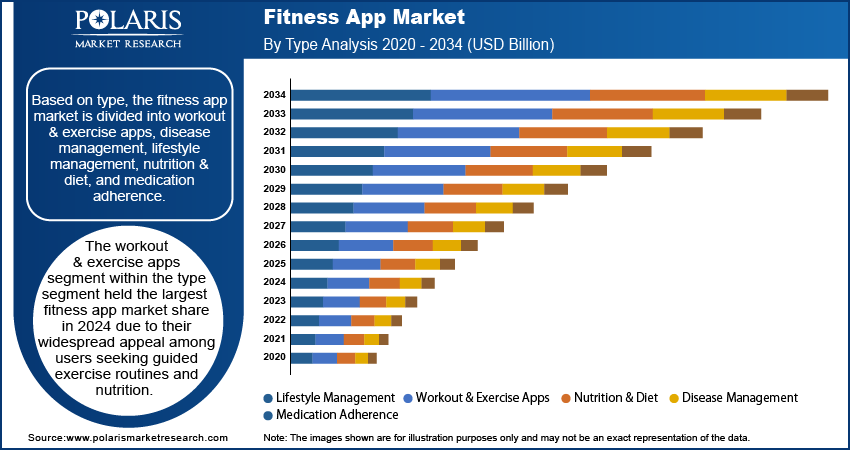

Based on type, the fitness app market is divided into workout & exercise apps, disease management, lifestyle management, nutrition & diet, and medication adherence. The workout & exercise apps held the largest fitness app market share in 2024 due to their ability to offer personalized workout plans, video tutorials, and real-time progress tracking, catering to users across various fitness levels. Additionally, the integration of gamification elements, such as challenges, leaderboards, and rewards, propelled users to adopt workout & exercise apps. The rising popularity of hybrid fitness approaches, combining virtual and in-person training, also contributed to the dominance of the segment.

Fitness App Market Evaluation by Platform Insights

In terms of platform, the fitness app market is segregated into Android, iOS, wearable devices, and web-based platforms. The Android segment dominated the market share in 2024 due to its widespread adoption and affordability. Fitness app developers prioritized creating feature-rich applications for Android, using the platform’s open-source nature to ensure compatibility with various devices. Additionally, the affordability of Android smartphones enabled users from different income groups to access workout and fitness exercise apps, thereby contributing to segment prominence.

Fitness App Market Regional Insights

By region, the report provides the fitness app market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to its high rate of smartphone penetration, increasing awareness of health and fitness, and a technologically advanced ecosystem. The region benefits from a culture of fitness, with widespread adoption of wearables such as Apple Watch, Fitbit, and Garmin, alongside fitness-focused apps such as Peloton and Nike Training Club. The market is further supported by high disposable income, increasing innovation & product launches, and strong investments in health tech. For instance, in September 2020, Apple unveiled Fitness+, which incorporates metrics from Apple Watch for users to visualize workouts right on their iPhone, iPad, or Apple TV, offering a first-of-its-kind personalized workout experience. These developments cater to the growing demand for personalized, interactive fitness experiences, further driving the market growth in the region.

The fitness app market in Asia Pacific is projected to grow at a rapid pace during the forecast period, with India leading the region driven by rising urbanization and rising disposable incomes. The rising smartphone usage, along with growing internet subscriptions in the region, is further fueling the market growth. For instance, as per the data published by the Global System for Mobile Communication, by the end of 2023, 1.8 billion people in Asia Pacific (63% of the population) subscribed to mobile services. Furthermore, the rising number of fitness centers in countries such as India and China are contributing to the fitness app market expansion in the region.

Fitness App Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the fitness app industry grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

Apple Inc., a multinational technology company headquartered in Cupertino, California, has made significant achievements in the fitness app sector with its Fitness application and the subscription service Apple Fitness+. Established in 1976, Apple has evolved from a computer manufacturer into a powerhouse of consumer electronics and software. The company’s commitment to innovation and user-friendly design has allowed it to dominate various markets, including personal computing, mobile devices, and digital services. The Fitness app, initially launched as Activity in 2015, serves as an exercise-tracking companion primarily for users of the Apple Watch. However, with advancements in iOS, it has become accessible to all iPhone users, regardless of whether they own an Apple Watch.

Garmin, a prominent player in the global technology market, is known for its innovative GPS navigation and wearable technology solutions. Founded in 1989 and headquartered in Schaffhausen, Switzerland, Garmin has established its presence across various sectors, including fitness, outdoor activities, aviation, marine, and automotive. In the fitness segment, Garmin has made substantial advancements with its suite of fitness apps and wearable devices. The Garmin Connect app serves as the central hub for users to track their health metrics and fitness activities. This app allows users to monitor various data points such as steps taken, calories burned, heart rate, sleep patterns, and even stress levels

Key Companies in Fitness App Market

- MyFitnessPal

- Strava

- Fitbit (Google)

- Nike

- Peloton

- Noom

- Apple

- Samsung

- Adidas

- Under Armour

- Zwift

- Garmin

Fitness App Market Developments

August 2024: MyFitnessPal, a health and nutrition app, launched the Quick Start High Protein Meal Plan on the MyFitnessPal app to help educate consumers on what protein is, how it benefits the body, strategies for adding more protein to meals and snacks throughout the day.

June 2024: Apple, a US-based computer and consumer electronics company famous for creating the iPhone, iPad, and Macintosh computers, announced the launch of watchOS 11. This OS offers features for Apple Watch that build on its leading sensor technology, advanced algorithms, and science-based approach to offer breakthrough insights into users’ health and fitness.

November 2021: Peloton, a company that offers interactive exercise classes, announced the launch of Peloton Guide, an AI-powered personal trainer that turns a TV into a fitness device.

Fitness App Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Workout & Exercise Apps

- Disease Management

- Lifestyle Management

- Nutrition & Diet

- Medication Adherence

By Platform Outlook (Revenue, USD Billion, 2020 - 2034)

- Android

- iOS

- Wearable Devices

- Web-Based Platforms

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Personal Use

- Commercial Use

- Rehabilitation & Healthcare

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fitness App Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.56 billion |

|

Revenue Forecast in 2025 |

USD 12.02 billion |

|

Revenue Forecast in 2034 |

USD 39.35 billion |

|

CAGR |

14.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global fitness app market size was valued at USD 10.56 billion in 2024 and is projected to grow to USD 39.35 billion by 2034.

The global market is projected to grow at a CAGR of 14.1% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are MyFitnessPal, Strava, Fitbit (Google), Nike, Peloton, Noom, Apple, Samsung Health, Adidas, Under Armour, Zwift, and Garmin.

The workout & exercise apps segment dominated the fitness app market in 2024.