Fishing Apparel and Equipment Market Size, Share, Trends, Industry Analysis Report: By Category (Apparel, Footwear, and Equipment), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 123

- Format: PDF

- Report ID: PM5209

- Base Year: 2024

- Historical Data: 2020-2023

Fishing Apparel and Equipment Market Overview

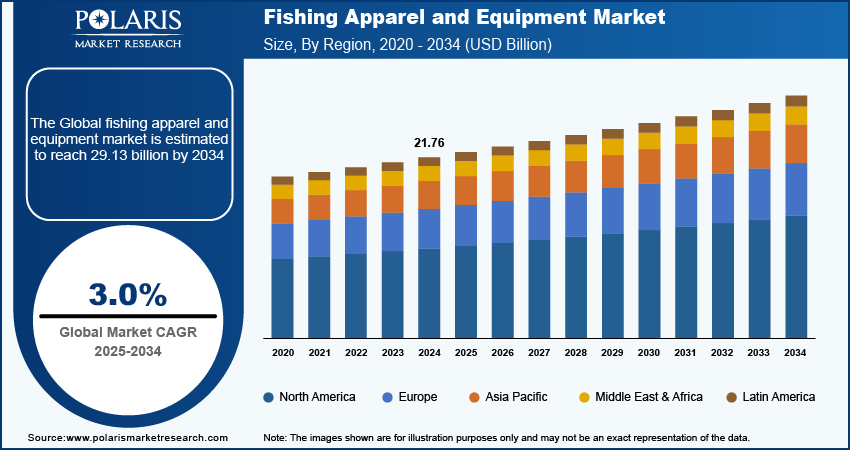

The fishing apparel and equipment market size was valued at USD 21.76 billion in 2024. The market is projected to grow from USD 22.40 billion in 2025 to USD 29.13 billion by 2034, exhibiting a CAGR of 3.0% during 2025–2034.

The fishing apparel and equipment market has been experiencing robust growth, driven by the rising popularity of recreational fishing and increasing consumer demand for high-quality gear. As more people engage in fishing as a leisure activity, there is a growing need for specialized equipment such as rods, reels, lines, and lures, as well as functional apparel such as waterproof jackets, UV-protective clothing, and waders. Technological advancements in fishing gear, including smart fish finders, made with lightweight, durable materials are attracting novice and seasoned anglers. Additionally, the market is benefiting from trends in sustainability as consumer awareness, and demand for eco-friendly materials and responsible manufacturing practices continue to grow. With the expansion of fishing tournaments, community events, and outdoor recreation activities, the fishing apparel & equipment market is expected to continue its upward trajectory, appealing to a broad and diverse audience.

To Understand More About this Research: Request a Free Sample Report

Fishing Apparel and Equipment Market Trends

Technological Advancements in Fishing Apparel and Equipment

Technological advancements in fishing apparel and equipment significantly enhance the fishing experience for anglers of all skill levels. Innovations such as high-performance rods and reels, such as the Shimano Stella spinning reels, improve drag performance and reduce weight, catering to serious anglers seeking superior gear. Additionally, smart fishing accessories, such as those from Lowrance and Garmin, utilize advanced sonar and GPS tracking to help anglers locate fish more effectively. Also, the Lowrance HDS Live series offers integrated sonar technology and wireless connectivity, enabling users to access fishing maps via smartphone.

The fishing apparel and equipment market is evolving with the introduction of lightweight materials like carbon fiber in rod construction, making fishing rods both durable and comfortable for long sessions. Brands like G. Loomis have responded by offering high-performance rods tailored for various techniques. These innovations enhance efficiency and motivate both novice and experienced anglers to invest in quality gear, improving their overall experience. As a result, the market is poised for significant growth, driven by rising demand for specialized products that enhance the angling journey.

Increasing Popularity of Recreational Fishing

The increasing popularity of recreational fishing has transformed it into a favored leisure activity, significantly driving demand for quality fishing gear and apparel. This trend is evident in the growing participation in fishing tournaments, such as the Bassmaster Elite Series, which attracts thousands of anglers and spectators each year, promoting community engagement and competitive spirit.

Local fishing events and initiatives, such as the Take Me Fishing campaign in the U.S., aim to introduce families and individuals to fishing, further boosting participation rates. For instance, in 2020, recreational fishing saw significant increases in participation across various demographics. Approximately 19.7 million females participated in fishing, marking a 10% increase compared to 2019. The youth segment also experienced a remarkable surge, with 13.5 million anglers aged 6 to 17 engaging in fishing activities. Hispanic Americans reached their highest recorded participation in 14 years, with 5 million individuals going fishing. Overall, nearly 55 million Americans participated in fishing at least once in 2020.

African Americans led participation rates in recreational fishing over the past three years, showing a 7.4% increase from 2020 and a 14.6% growth since 2019. In 2020, Hispanic fishing participants also reached a record 4.4 million. Encouragingly, more than 55% of individuals who tried fishing in 2021 expressed their intention to continue, signaling a positive trend for the future. As the popularity of recreational fishing rises, the demand for fishing apparel and equipment is expected to grow significantly in the coming years.

Fishing Apparel and Equipment Market Segment Insights

Fishing Apparel and Equipment Market Breakdown, by Category Insights

The fishing apparel and equipment market segmentation, based on category, includes apparel, footwear, and equipment. In 2024, the equipment segment accounted for the largest market share due to the growing popularity of fishing as a leisure activity and the increasing number of individuals turning to fishing to connect with nature, relax, and bond with family. As a result, consumers are more willing to invest in premium equipment to elevate their experience. Innovations in fishing gear, including lightweight, durable, and high-performance products such as advanced rods and precision reels, appeal to consumers by enhancing comfort and effectiveness. These technological advancements boost fishing success and enjoyment, prompting anglers to upgrade their gear or explore new equipment options.

The apparel segment is expected to register a significant CAGR during the forecast period, driven by the increasing popularity of fishing, which fuels the demand for specialized clothing that provides comfort, safety, and performance. Anglers seek apparel offering protection from harsh weather, UV rays, and water exposure, such as moisture-wicking shirts, waterproof jackets, and breathable waders. Furthermore, advancements in fabric technology and a focus on sustainability are expected to drive the growth of the apparel segment as consumers seek gear that meets practical needs and aligns with their personal style and environmental values.

Fishing Apparel and Equipment Market Breakdown, by Distribution Channel Insights

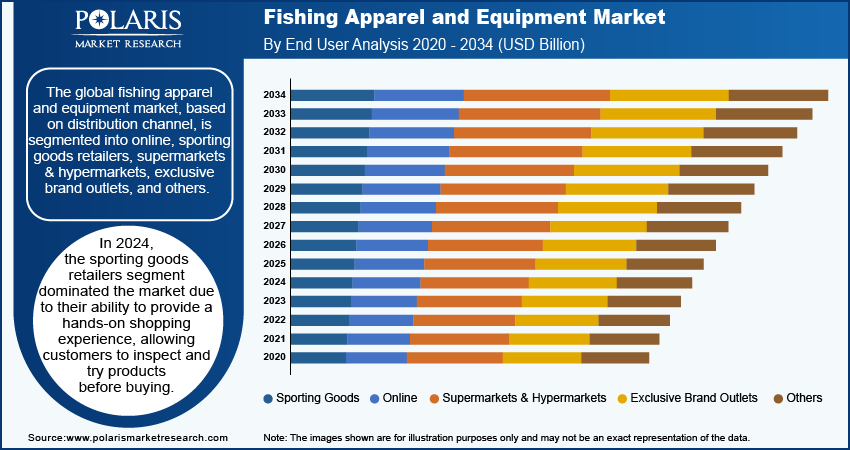

The global fishing apparel and equipment market, based on distribution channel, is segmented into online, sporting goods retailers, supermarkets & hypermarkets, exclusive brand outlets, and others. In 2024, the sporting goods retailers segment dominated the market due to their ability to provide a hands-on shopping experience, allowing customers to inspect and try products before buying. This is especially important for anglers seeking the right fit and performance in gear such as rods, reels, and apparel. These retailers offer expert advice, personalized recommendations, and a community atmosphere with fishing-related events and demonstrations. The credibility of established sporting goods chains, combined with exclusive access to popular brands and new products, makes them the preferred choice for many anglers, maintaining their market dominance.

The online segment is expected to grow in the coming years due to its convenience, extensive product variety, and competitive pricing. E-commerce platforms allow consumers to compare products, read reviews, and access specialized fishing gear not found in local stores. Advancements in technology and secure payment options have made it easier for anglers to find the latest products. Exclusive online promotions, discounts, and direct-to-consumer brands enhance the appeal of purchasing fishing gear online. The increasing use of mobile devices solidifies the online channel’s leading position in the market.

Fishing Apparel and Equipment Market – Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the fishing apparel and equipment market, driven by a rich fishing culture and numerous recreational opportunities that attract millions of enthusiasts each year. The high demand for essential fishing gear highlights the sport's popularity, with retail channels enhancing accessibility. Additionally, the integration of technology into fishing equipment strengthens the equipment segment, which continues to thrive in North America. This growth is fueled by innovation, tradition, and a deep passion for fishing.

The Asia Pacific fishing apparel and equipment market is set for growth during the forecast period, particularly in Japan and Australia, where fishing is a cherished cultural pastime. In Japan, fishing plays a crucial role in culinary traditions, driving demand for high-quality gear like precision rods and reels, as well as advanced technologies such as smart depth finders. Meanwhile, Australia's extensive coastlines and diverse aquatic ecosystems nurture a vibrant fishing culture, leading anglers to seek durable and efficient equipment for both freshwater and saltwater fishing. Community events and fishing tournaments further encourage investments in high-performance gear, making the equipment segment a vital part of the market in this region.

Fishing Apparel and Equipment Market – Key Players and Competitive Insights

The competitive landscape of the fishing apparel and equipment market is marked by a diverse mix of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major companies in the industry leverage their extensive research and development capabilities and broad distribution networks to provide a wide range of advanced fishing apparel and equipment. These companies focus on product innovation, enhancing features such as safety, functionality, and durability to meet the evolving demands of anglers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific fishing needs or local market preferences. Competitive strategies often include mergers and acquisitions, collaborations with fishing organizations, and investments in emerging markets to broaden their reach and strengthen their market presence. Overall, the dynamic competition in this market drives continuous advancements in gear quality and performance, benefiting consumers and enhancing their fishing experiences. A few major players are Simms Fishing Products; Pure Fishing, Inc.; AFTCO (American Fishing Tackle Company); Columbia Sportswear Company; Mustad Fishing; Shimano Inc.; Rapala VMC Corporation; Grundéns USA Ltd.; Cabela's (Bass Pro Shops); and Patagonia, Inc.

Simms Fishing Products, a manufacturer of waders, outerwear, footwear, and technical fishing apparel, launched an all-new product collection designed and developed to meet the demands of all anglers. Simms’ Spring 2024 line had put innovation and innovative technology at the forefront but also authentically encompassing the angling lifestyle.

Pure Fishing Inc., a fishing tackle company, completed its acquisition of Plano Synergy Holdings Inc. on April 16, 2021. As part of this transaction, Pure Fishing sold Plano Synergy's archery and hunting accessories brands to GSM Outdoors while retaining ownership of the iconic Plano and Frabill brands, along with Plano’s storage business and the Creative Options and Caboodles brands. This strategic acquisition marks Pure Fishing's third deal in two years under the ownership of private equity firm Sycamore Partners, enhancing its presence in the global fishing tackle market.

Key Companies in Fishing Apparel and Equipment Market

- Simms Fishing Products

- Pure Fishing, Inc.

- AFTCO (American Fishing Tackle Company)

- Columbia Sportswear Company

- Mustad Fishing

- Shimano Inc.

- Rapala VMC Corporation

- Grundéns USA Ltd.

- Cabela's (Bass Pro Shops)

- Patagonia, Inc.

Fishing Apparel and Equipment Industry Developments

In September 2023, AFTCO announced the launch of its new line of sustainable fishing apparel made from recycled materials aimed at environmentally conscious anglers.

In June 2023, Mustad unveiled a new series of hooks designed for specific fishing techniques, enhancing the efficiency and effectiveness of anglers across various fishing environments.

In March 2021, Patagonia announced its commitment to sustainability by pledging to use 100% recycled materials in its fishing apparel line by 2025, reinforcing its dedication to environmental responsibility.

Fishing Apparel and Equipment Market Segmentation

By Category Outlook (Revenue, USD Billion, 2020–2034)

-

- Apparel

- Hats

- Jackets

- Waders

- Others

- Footwear

- Equipment

- Rods, Reels, and Components

- Lines and Leaders

- Lures, Flies, and Artificial Baits

- Hooks, Sinkers, and Terminal Tackle

- Depth Finders and Fish Finders

- Creels, Strings, and Landing Nets

- Other

- Apparel

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

-

- Online

- Sporting Goods Retailers

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fishing Apparel and Equipment Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.76 billion |

|

Market Size Value in 2025 |

USD 22.40 billion |

|

Revenue Forecast by 2034 |

USD 29.13 billion |

|

CAGR |

3.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global fishing apparel and equipment market size was valued at USD 21.76 billion in 2024 and is projected to grow to USD 29.13 billion by 2034.

The global market is projected to register a CAGR of 3.0% during the forecast period.

North America held the largest share of the global market in 2024 due to the region's rich fishing culture and recreational opportunities that attract millions of fishing enthusiasts each year.

A few key players in the market are Simms Fishing Products; Pure Fishing, Inc.; AFTCO (American Fishing Tackle Company); Columbia Sportswear Company; Mustad Fishing; Shimano Inc.; Rapala VMC Corporation; Grundéns USA Ltd.; Cabela's (Bass Pro Shops); and Patagonia, Inc.

The sporting goods retailers segment dominated the market in 2024 due to their ability to provide a hands-on shopping experience, allowing customers to inspect and try products before buying.

The fishing equipment segment accounted for the largest market share in 2024 due to the growing popularity of fishing as a leisure activity and the increase in the number of individuals turning to fishing to connect with nature, relax, and bond with family. They are increasingly willing to invest in premium equipment to elevate their experience.