Global Fire Resistant Glass Market Size, Share, Trends, Industry Analysis Report: Information By Product Type (Ceramic Glass, Laminated Glass, Tempered Glass, Wired Glass, Others), By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 115

- Format: PDF

- Report ID: PM5004

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

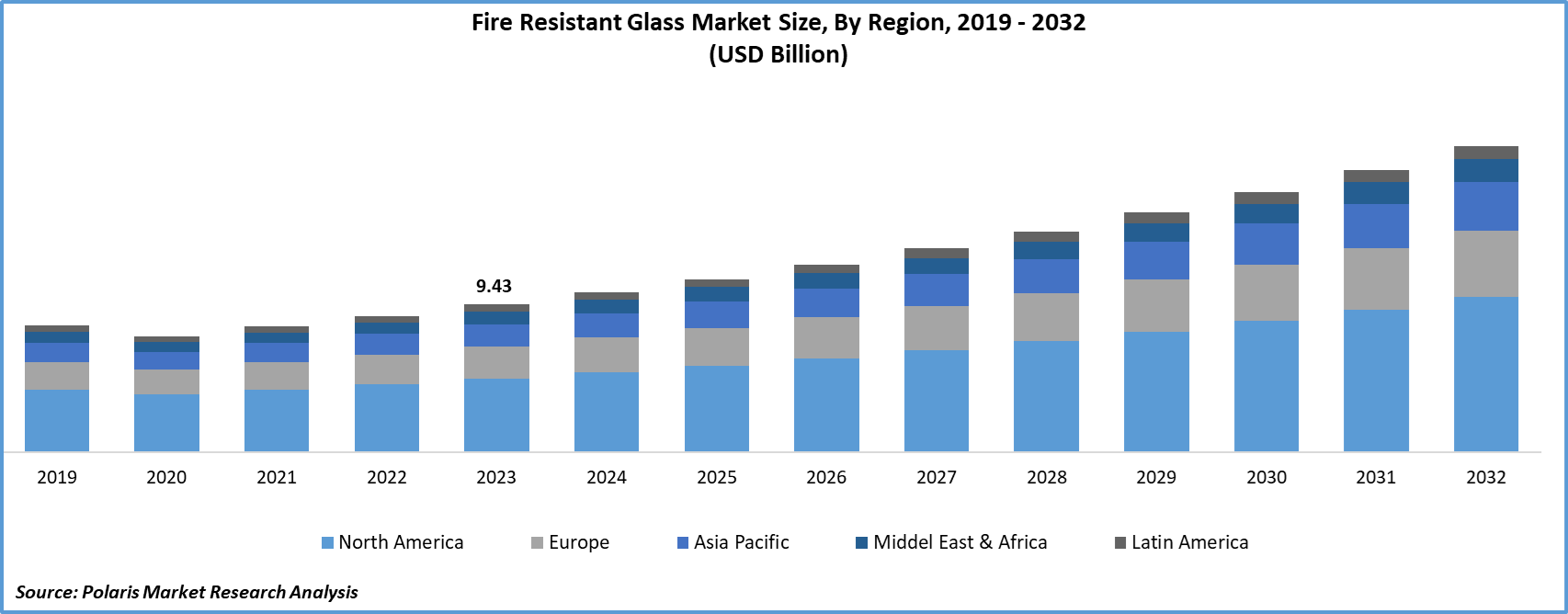

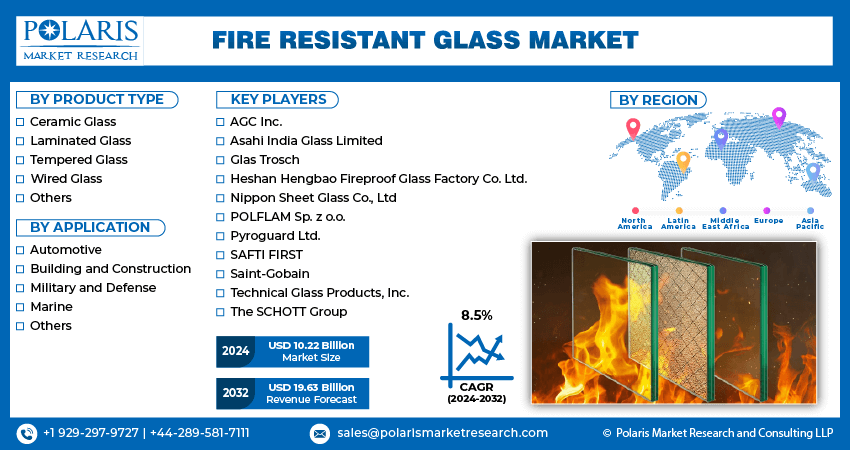

Global fire resistant glass market size was valued at USD 9.43 billion in 2023. The fire resistant glass industry is projected to grow from USD 10.22 billion in 2024 to USD 19.63 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.5% during the forecast period (2024 - 2032).

Fire resistant glass refers to a specially treated type of glass engineered to withstand the damaging effects of fire and smoke. The growth of the fire resistant glass market is being fueled by the escalating frequency of fire incidents worldwide due to inadequate fire safety measures during construction. For instance, data from the National Fire Protection Association reveals that local fire units in the United States reported approximately 1.5 million fires in 2022, leading to 3,790 civilian fire deaths and 13,250 reported civilian fire injuries. This surge in fire incidents has intensified the demand for effective fire resistant building solutions. Consequently, property owners and developers are demonstrating a growing inclination towards investing in fire resistant glass as a proactive measure to minimize potential fire damage, thereby propelling the fire resistant glass market growth.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the growth in the construction sector is significantly driving the fire resistant glass market, as increasing construction activities and spending necessitate the use of advanced fire safety measures. For instance, according to Statistics Canada, the total investment in building construction in April 2024 was USD 20.5 billion, of which USD 14.2 billion was invested in the residential sector. This heightened investment in the construction sector has resulted in the emphasis on safety, prompting builders and developers to incorporate fire resistant materials, including glass, to protect occupants and property from potential fire hazards. Moreover, the focus on constructing high-rise buildings and complex infrastructure projects requires materials that are able to withstand fire and prevent its spread, further boosting the demand for fire resistant glass.

Fire Resistant Glass Market Trends

Technologically Advanced Product Launches is Driving the Market Size

Market CAGR for fire resistant glass is driven by technologically advanced product launches. The innovations in glass manufacturing are enhancing performance, safety, and aesthetic appeal. Manufacturers are continuously investing in R&D and collaborating to create products that meet increasingly stringent fire safety standards and address the evolving needs of architects and builders. For instance, in December 2023, POLFLAM introduced a low-carbon alternative for standard fire resistant glass in collaboration with PILKINGTON, a part of the NSG Group. The innovation involves the use of hydrogel interlayer technology combined with Pilkington Mirai low-carbon float glass, which boasts a 50% reduction in embodied carbon compared to regular float glass. These innovative solutions comply with the building codes and cater to the demand for sustainable and energy-efficient materials. As a result, technologically advanced products are gaining traction, thereby driving the growth of fire resistant glass market.

Stringent Building Safety Regulations Are Driving the Fire Resistant Glass Market Growth

Governments and regulatory bodies worldwide are implementing and enforcing comprehensive building construction and fire safety standards. For instance, in the United States, the Building Codes created by the International Code Council represent legal regulations that establish the minimum criteria for structural systems, plumbing, HVAC, natural gas systems, and other elements of both residential and commercial buildings. Furthermore, the Construction Products Regulation (CPR) establishes standards for fire safety in buildings across all European countries. These regulations mandate the use of fire resistant materials in construction to ensure buildings are able to withstand fires. Compliance with strict codes necessitates the integration of advanced fire resistant products, including specialized glass, into building designs. As a result, contractors are adopting fire resistant glass to mitigate the damage and to comply with regulations, thereby driving the fire resistant glass market size.

Fire Resistant Glass Market Segment Insights

Fire Resistant Glass Product Type Insights

The global fire resistant glass market segmentation, based on product type, includes ceramic glass, laminated glass, tempered glass, wired glass, and others. The ceramic glass segment accounted for the largest revenue share in the market due to its superior properties and versatility in various applications in several industries, including construction and electronics. Ceramic glass is known for its exceptional heat resistance, stability under high temperatures, and ability to maintain transparency during a fire, making it an ideal choice for fire protection. Furthermore, ceramic glass withstands intense heat without shattering and prevents the spread of flames and smoke. These characteristics are crucial for meeting stringent building safety regulations, leading to its widespread adoption in commercial, residential, and industrial buildings. Thus, the high performance and versatility of ceramic glass drive its dominant revenue share in the global fire resistant glass market.

Fire Resistant Glass Application Insights

The global fire resistant glass market segmentation, based on application, includes automotive, building and construction, military and defense, marine, and others. The marine segment of the market is expected to grow with a significant CAGR due to the growing marine industry and its increasing adoption of fire resistant glass for diverse applications such as high-performance flooring, walls, and ceilings. The marine industry across the globe is growing with an increase in tourism sector. For instance, according to NOAA Office for Coastal Management, the U.S. marine economy experienced a 7.4% increase in its contribution to the Gross Domestic Product (GDP) in 2021. The tourism and recreation sector showed the most significant expansion, growing by 27.3%, equivalent to USD 49.8 billion. This surge in marine tourism has led to a higher demand for recreational boats, yachts, and cruise ships, which in turn necessitates stringent safety measures to protect passengers and assets. The increasing number of tourists and recreational activities on the water heightens the need for advanced safety features, including fire resistant glass in windows, doors, and partitions. Consequently, the growing marine industry is expected to drive the growth in marine applications of fire resistant glass.

Fire Resistant Glass Regional Insights

By region, the study provides the fire resistant glass market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North American fire resistant glass market held the highest revenue share due to the increased military and defense spending with a focus on upgradation and national security. For instance, in fiscal year 2020, the U.S. government spent a combined total of USD 837 billion on national defense and the military. This significant investment is enhancing the safety and resilience of its defense infrastructure. Furthermore, there is a substantial demand for advanced materials that provide superior protection against various events, including fire incidents and harsh weather conditions. Consequently, demand for fire resistant glass is increasing due to its military and defense applications, such as in the construction of secure facilities, vehicles, and equipment that require both transparency and high fire resistance. As a result, the investments to enhance the safety standards within the defense sector contribute to the dominance of the North America fire resistant glass market.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia Pacific fire resistant glass market is anticipated to grow significantly due to the presence of several glass manufacturers, including AGC Inc., Asahi India Glass Limited, Heshan Hengbao Fireproof Glass Factory Co. Ltd., and Nippon Sheet Glass Co., Ltd. The proliferation of manufacturers is enhancing the availability and variety of fire resistant glass products and fostering competitive pricing. Furthermore, local production capabilities are reducing import dependencies, lowering costs, and improving supply chain efficiency. As a result, the fire resistant glass market in the region is expected to grow at a significant CAGR over the forecast period.

Moreover, the China fire resistant glass market is expected to experience substantial growth driven by the expansion of airports. For instance, the Civil Aviation Administration of China reported a 2.4% increase in the number of certified transport airports in 2022 compared to 2021, reaching a total of 254. This marked a net increase of 2.4% from 2021. The airport buildings have stringent safety and fire protection regulations. Thus, the demand for high-quality fire resistant materials, including glass, stucco, and steel, is rising to meet safety regulations. As a result of the increasing demand and adoption of fire resistant glass in airport construction, the market for fire resistant glass is expected to grow significantly.

Fire Resistant Glass Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product types, which will help the fire resistant glass market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the fire resistant glass industry must offer cost-effective solutions.

The fire resistant glass market is distinguished by the presence of several key players that innovate continuously to maintain and enhance market positions. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the fire resistant glass market include AGC Inc., Asahi India Glass Limited, Glas Trösch, Heshan Hengbao Fireproof Glass Factory Co. Ltd., Nippon Sheet Glass Co., Ltd, POLFLAM Sp. z o.o., Pyroguard Ltd., SAFTI FIRST, Saint-Gobain, Technical Glass Products, Inc., and The SCHOTT Group.

Asahi India Glass Limited is an integrated glass and windows solutions company that operates in three segments, including automotive, architectural, and consumer. The company engages in the production and delivery of advanced glass products and solutions to retail and institutional customers through its Strategic Business Units (SBUs). It provides comprehensive solutions across the entire value chain in all three segments, encompassing the manufacturing of float glass, glass processing, fabrication, and installation. AIS serves customers in both domestic and international markets. In September 2023, Asahi India Glass Limited started producing fire resistant glass at its Roorkee Plant, further solidifying its presence in India’s glass and window solutions sector. The facility is responsible for manufacturing FRG under the AIS Pyrobel-T brand, ensuring compliance with international standards for integrity and insulation.

Saint-Gobain designs, manufactures and distributes materials and solutions for the construction and industrial markets worldwide. The company provides mortars, exterior products, construction chemicals, pipes, adhesives, abrasives, sealants, composites, tapes, films, insulation cladding solutions, polymer shakes, ceramics, shingles, and more. Saint-Gobain serves construction, industrial, housing, and automotive sectors worldwide. In May 2024, Saint-Gobain finalized an agreement to purchase Fibroplac and Falper companies. These acquisitions are in line with Saint-Gobain's "Grow & Impact" strategy, which is currently being executed in Portugal to strengthen the company's role in environment-friendly and lightweight construction materials.

Key companies in the fire resistant glass market include

- AGC Inc.

- Asahi India Glass Limited

- Glas Trosch

- Heshan Hengbao Fireproof Glass Factory Co. Ltd.

- Nippon Sheet Glass Co., Ltd

- POLFLAM Sp. z o.o.

- Pyroguard Ltd.

- SAFTI FIRST

- Saint-Gobain

- Technical Glass Products, Inc.

- The SCHOTT Group

Fire Resistant Glass Industry Developments

- January 2024: Clestra Asia introduced a new single-glazed, fire-rated partition system. The system is rated for both 'Insulation & Integrity' and is designed for classifying sensitive areas. It offers high-level fire protection while delivering acoustic insulation performance.

- August 2022: Promat UK has introduced SYSTEMGLAS Stratum, a fire-rated walk-on glass flooring system. The new solution is designed to assist architects in integrating passive fire protection into designs.

- October 2023: Neaco, an architectural product manufacturer, introduced Clearview A2, a fire-rated glass balcony system. The system is engineered to inhibit the propagation of flames and smoke, offering a sleek and fully compliant solution for balconies and various other installations situated at heights exceeding 18 meters.

Fire Resistant Glass Market Segmentation

Fire Resistant Glass Product Type Outlook

- Ceramic Glass

- Laminated Glass

- Tempered Glass

- Wired Glass

- Others

Fire Resistant Glass Application Outlook

- Automotive

- Building and Construction

- Military and Defense

- Marine

- Others

Fire Resistant Glass Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fire Resistant Glass Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 9.43 billion |

|

Market Size Value in 2024 |

USD 10.22 billion |

|

Revenue Forecast in 2032 |

USD 19.63 billion |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global fire resistant glass market size was valued at USD 9.43 billion in 2023 and is projected to grow to USD 19.63 billion by 2032.

The global market is projected to grow at a CAGR of 8.5% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are AGC Inc., Asahi India Glass Limited, Glas Trösch, Heshan Hengbao Fireproof Glass Factory Co. Ltd., Nippon Sheet Glass Co., Ltd, POLFLAM Sp. z o.o., Pyroguard Ltd., SAFTI FIRST, Saint-Gobain, Technical Glass Products, Inc., and The SCHOTT Group.

The ceramic glass segment held the highest share in the fire resistant glass market in 2023.

The marine category had the highest CAGR in the global market.