Fire-resistant Coatings Market Share, Size, Trends, Industry Analysis Report, By Type (Intumescent, Cementitious); By Technology (Water-borne, Solvent-borne); By Substrate (Metal, Wood, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM2437

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

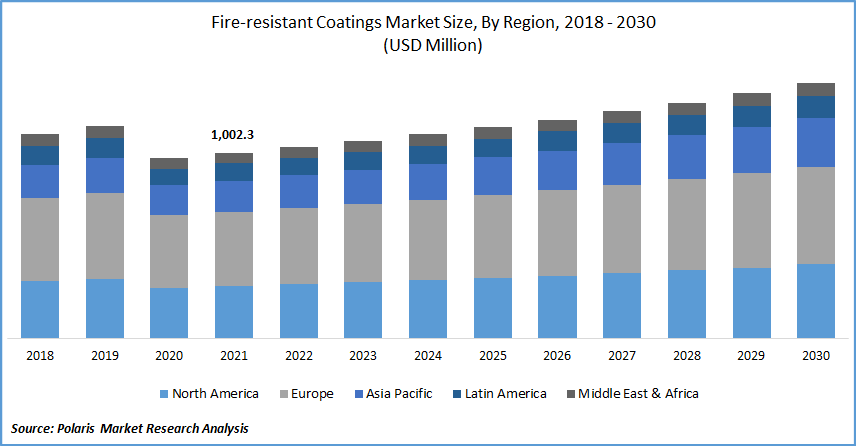

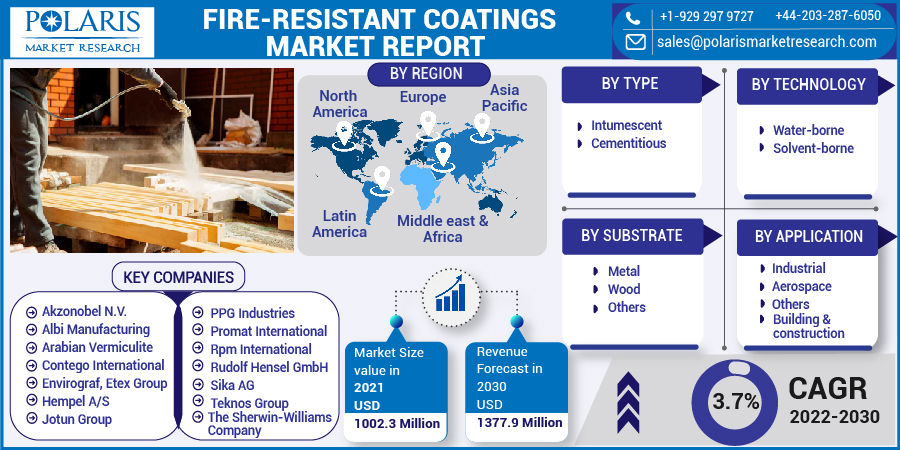

The global fire-resistant coatings market was valued at USD 1,002.3 million in 2021 and is expected to grow at a CAGR of 3.7% during the forecast period. Significant growth of the building & construction sector across the globe primarily drives the global market. The ongoing trend among the governments to increase focus on infrastructure projects has led to the building & construction sector growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

In addition, these help to slow down the spread of flames of fire. This is enabled by agents in the coatings that interrupt the combustion. Hence, buildings such as residential, theaters, hospitals, schools, cinemas, auditoriums, churches, and hotels are utilizing fire-resistant coatings to meet fire prevention standards. This factor has further boosted the growth of the global fire-resistant coatings market.

Fire-resistant coatings reduce combustion and flammability of building materials it coats, delay the expansion of fires, are suitable for both outdoor and indoor surfaces, and can be applied with the help of a brush, spray gun, or roller. The aforementioned features of fire-resistant coats are further boosting the growth of the global fire-resistant coatings market.

During the Covid-19 pandemic, the global business ecosystem was disrupted. However, this pandemic has negatively impacted a large volume of fire-resistant coatings companies in multiple dimensions. This is attributed to the fact that demand and consumption of fire-resistant coatings have been significantly impacted by the lockdowns and social distancing measures introduced by the governments.

However, the fire fire-resistant coating industry is anticipated to witness growth in the post-pandemic period due to the economic recovery of countries. In addition, the industry players operating in the market have also re-orient their strategies to tackle challenges posed by the COVID-19 pandemic on the fire-resistant coatings market.

Industry Dynamics

Growth Drivers

The growth of the global industry is mainly driven by rising awareness, supportive regulations, and increased emphasis on fire safety measures across the globe. In the U.S., the National Fire Protection Association (NFPA) and the International Code Council (ICC) have recommended several norms and standards pertaining to fire protection and safety in infrastructure, buildings, and the industrial sector.

Such regulations and standards boost the growth of the global industry. In addition, the industry players are offering fire-resistant coatings solutions that meet fire prevention standards by different governments. For instance, The ICA Group, one of the leading providers of wood coatings and glass paints offers, promotes a line of products for meeting the stringent regulations associated with the fire prevention, such as the Italian standard UNI 9796, the European standard UNI EN 13501, and the British Standard.

Know more about this report: Request for sample pages

Report Segmentation

The global market is primarily segmented on the basis of type, technology, application, substrate, and region.

|

By Type |

By Technology |

By Application |

By Substrate |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Type

The intumescent segment is dominated the global market. This type of coating is either waterborne or solvent-borne and is mainly preferred in buildings and construction applications. In addition, it is advantageous as compared to cementitious substitutes, as they are thinner, significantly reduce the overall weight of the structures & substrates and exhibit better fire protection properties.

In addition, intumescent coats decompose at high temperatures to produce an expanded, insulative, and porous barrier to the substrate, be it steel, wood, aluminum, or textile. The aforementioned features associated with the intumescent type of fire-resistant coating fuel growth of this segment.

Insight by Technology

The waterborne technology segment is expected to contribute the largest revenue in 2021, owing to the surge in demand for green products. In addition, this type of coating technology involves reduced risk of fire, easy cleanup, and results in less exposure to Volatile Organic Compounds (VOCs).

However, the solvent-borne segment is expected to witness the highest CAGR during the forecast period due to the fact that the solvent-borne coats are generally more durable as compared with the waterborne coatings. In addition, solvent-based fire-resistant coatings are commonly used as a thermal barrier for construction buildings during fire hazards; hence, the growth of the global construction industry fuels the growth of this segment.

Insight by Application

Building & construction segment dominated the global market in 2021. The incorporation of fire-resistant building materials in the construction of buildings is fueling the demand for fire-resistant coats in building & construction applications. Increasing urbanization and population, the housing market, and infrastructure development trend across the developing countries have boosted the growth of this segment.

On the other hand, in January 2022, the Ministry of Housing and Urban-Rural Development, China, introduced a five-year development plan for the construction industry. Such initiatives are expected to create lucrative growth opportunities for the global market.

Geographic Overview

Europe is the largest revenue contributor in the global market due to several regulations pertaining to fire safety in the manufacturing and, building & construction sectors. The countries such as Germany and the UK dominate the Europe region. In addition, a number of industry players offer fire-resistant coatings products complying with European regulations. For instance, ICA Group offers Prometea fire-retardant coatings, which complies with European fire prevention regulations for public buildings such as hospitals, theaters, cinemas, and schools.

On the other hand, Asia Pacific is anticipated to witness the highest growth in the global market. Growing awareness and the emphasis on safety measures in countries such as India and China fuel the growth of the industry in this region. In addition, increasing foreign direct investment (FDI) for the economic development of South East Asia is projected to boost the building and construction industry in the region. This factor has further created lucrative growth opportunities for the industry.

Competitive Insights

Some of the major players operating the market include Akzonobel N.V., Albi Manufacturing, Arabian Vermiculite, Contego International, Envirograf, Etex Group, Hempel A/S, Jotun Group, PPG Industries, Promat International, Rpm International, Rudolf Hensel GmbH, Sika AG, Teknos Group, and The Sherwin-Williams Company. The market players are offering various strategies to increase their geographical presence and generate new revenue streams.

For instance, in August 2020, Hempel launched Hempafire Optima 500, the new waterborne flame-retardant coatings. These products are aimed at offering the protection of structural steel and help in the avoidance of losing load-bearing strength during the spread of a fire.

Fire-resistant Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1,002.3 Million |

|

Revenue forecast in 2030 |

USD 1,377.9 Million |

|

CAGR |

3.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Technology, By Application, By Substrate, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Akzonobel N.V., Albi Manufacturing, Arabian Vermiculite, Contego International, Envirograf, Etex Group, Hempel A/S, Jotun Group, PPG Industries, Promat International, Rpm International, Rudolf Hensel GmbH, Sika AG, Teknos Group, and The Sherwin-Williams Company |