Fire Protection System Market Share, Size, Trends, Industry Analysis Report, By Product, By Service, By Application (Commercial, Industrial, Residential), By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 119

- Format: PDF

- Report ID: PM2009

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

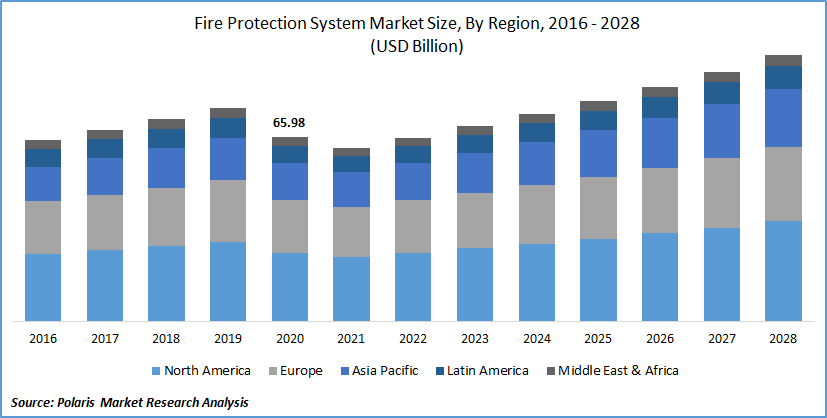

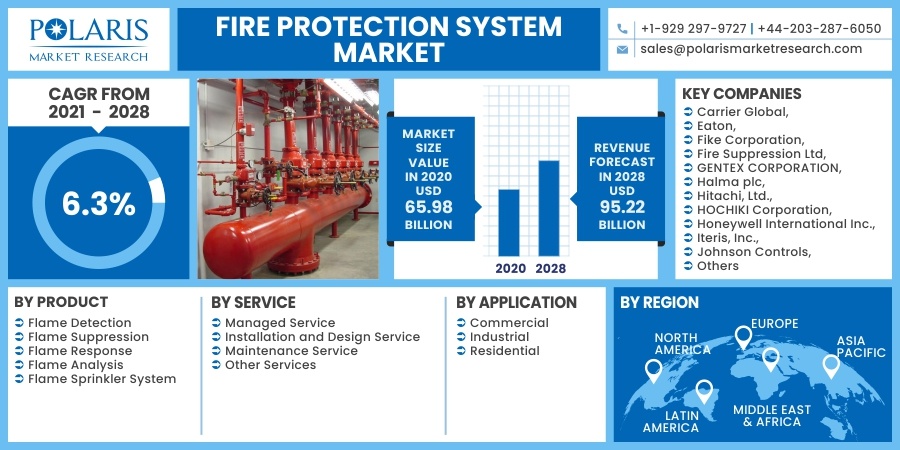

The global fire protection system market was valued at USD 65.98 billion in 2020 and is expected to grow at a CAGR of 6.3% during the forecast period. The rising market demand for fire protection systems due to the growth of the construction industry and growing concern regarding public protection is propelling market growth across the globe. In addition, the increasing framework of standards, codes, and laws by the diverse regulatory bodies coupled with the escalating implementation of the fire protection system by the various companies may contribute to the fire protection system market demand.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Moreover, increasing penetration of the wireless technologies in fire detection along with developments in sensor capabilities & communication channel technology, and IoT devices may lead to the adoption of the new-tech flame protection system solutions, which in turn, act as a catalyzing factor for the fire protection system market development over the upcoming years.

For instance, in October 2020, Honeywell International Inc. introduced a novel cloud platform for flame protection systems. This new platform facilitates professionals to lessen the troubles, helps in observance, and decreases the time needed to design, deploy, commission, and manage the protection of systems which in turn will boost the market development of the fire protection system industry.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing number of technological developments in flame protection solutions and their penetration across various smart buildings is a significant driving factor that propels the market demand. Advancements in smart sensors and predictive systems that facilitate efficient working in the heated environment create a huge opportunity for vendors to install these sensors in flame protection systems market.

In addition, the proliferation of smoke detectors is growing with the integration of the IoT and big data technologies along with numerous flame protection systems. For instance, in 2018, Huawei Technologies introduced the company’s new plug-and-use smoke detectors, with less than 3000 mAh capacity that offers high power competence, which can work from 3 to 5 years on batteries.

The progression of the IoT and big data technologies in the smoke detectors help in easy linking and programmable to the Wi-Fi networks in homes and commercial spaces, which presents smoke detection alerts and aids in easy monitoring of the battery status and management with the help of mobile devices.

These features help in rapid response times, reduce the chances of huge tragedy, and provide more information for effective planning evacuation to rescue and flame suppression. Also, it can be easily connected with the cellular networks and low power wide area (LPWA).

Furthermore, the launch of various flame protection solutions with IoT-based technologies positively influences market demand. For instance, in June 2021, Semtech Corporation- a supplier of high-performance analog and advanced algorithms and mixed-signal semiconductors, declared that the LDT incorporated Semtech’s LoRa devices into its system.

This device uses sensors and includes a network-based camera to identify any passive infrared, flames, alarming changes, smoke, and temperature inside a commercial space in real-time. Hence, these prominent factors contribute to the fire protection system market growth around the world in the near future.

Report Scope

The market is primarily segmented on the basis of product, service, application, and region.

|

By Product |

By Service |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The flame detection product segment was the leading segment in terms of revenue generation in 2020. It facilitates detecting and alerting people through audio and video equipment during the tragedies such as carbon monoxide, smoke, fire, and other emergencies. The flame analysis segment is estimated to show substantial growth in the forecasting period due to the growing market demand for flame analysis that assists in creating suitable decisions during fire prevention which will increase the flame protection solution market.

Flame analysis generally utilizes fire mapping & analysis software and fire modeling & simulation software. It acts as an effective form of the fire protection system, as it helps in conversant management that provides maximum competence of the system. Hence, these factors exhibit considerable segment growth which will contribute to the market growth.

Insight by Service

The installation segment is accounted for the largest revenue in 2020. These services are progressively more chosen because of the subject-matter expertise presented by dealers. Fire protection systems are inaugurated in all types of buildings as the population increasingly comprehends the advantages they provide across small, mid-size, and large facilities. Thus, these factors may create lucrative segment growth around the world which in turn will contribute to the market development.

The maintenance services segment is expected to show the highest CAGR in the near future, owing to factors like the increasing requirement for checking and managing the fire protection systems. Such systems play a significant role in detecting and aware people in case of fire or smoke, if any fault causes in the system may create higher chances of accidents and asset & life losses.

Accordingly, regular maintenance is a crucial factor for decreasing the risks of failure and extending the system's life. This service comprises constant assessment and service of the equipment to make sure to fulfill all the important fire protection standards in the occurrence of a crisis. Hence, these factors act as catalyzing factors for segment growth.

Geographic Overview

Geographically, North America is the most significant revenue contributor in 2020 and is expected to dominate the global market in the forecasting period due to the rising market demand for smart buildings and intelligent houses to maintain optimum protection. Additionally, the existence of leading market competitors such as Honeywell International, Inc., GENTEX Corp., and Raytheon Technologies Corporation are actively promoting the awareness of the fire protection system is the certain factors that lead the market growth.

Moreover, the growing number of investments in the infrastructural development activities and increasing concern regarding fire safety is the further factors that may accelerate the market demand across the region. For example, the Government of the United States invested approximately USD 358.9 billion on commercial construction buildings in 2018. Hence, it may impel the market demand in North America over the upcoming scenario.

Moreover, the Asia Pacific is projected to grow at the highest CAGR globally in the upcoming years. Due to the factors such as emerging urbanization, especially in developing nations such as China and India, the increasing number of construction activities tied with the growing responsiveness for the fire protection systems fuel the market growth.

For instance, in 2019, the National Cultural Heritage Administration (NCHA) had around six fire accidents at the heritage sites. Also, the economic advancements and technological development, and rising government initiatives for installing fire protection systems are some prominent factors that have gained considerable prominence in the market.

Competitive Insight

Major players in the marketplace include Carrier Global, Eaton, Fike Corporation, Fire Suppression Ltd, GENTEX CORPORATION, Halma plc, Hitachi, Ltd., HOCHIKI Corporation, Honeywell International Inc., Iteris, Inc., Johnson Controls, Minimax Viking GmbH, MSA, Napco Security Technologies, Inc., Raytheon Technologies Corporation, Robert Bosch GmbH, Schrack Seconet AG, Securiton AG, and Siemens.

Fire Protection System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 65.98 billion |

|

Revenue forecast in 2028 |

USD 95.22 billion |

|

CAGR |

6.3% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Service, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Carrier Global, Eaton, Fike Corporation, Fire Suppression Ltd, GENTEX CORPORATION, Halma plc, Hitachi, Ltd., HOCHIKI Corporation, Honeywell International Inc., Iteris, Inc., Johnson Controls, Minimax Viking GmbH, MSA, Napco Security Technologies, Inc., Raytheon Technologies Corporation, Robert Bosch GmbH, Schrack Seconet AG, Securiton AG, and Siemens. |