Financial Wellness Software Market Share, Size, Trends, Industry Analysis Report, By Platform (Web-based, Cloud-based); By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4307

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

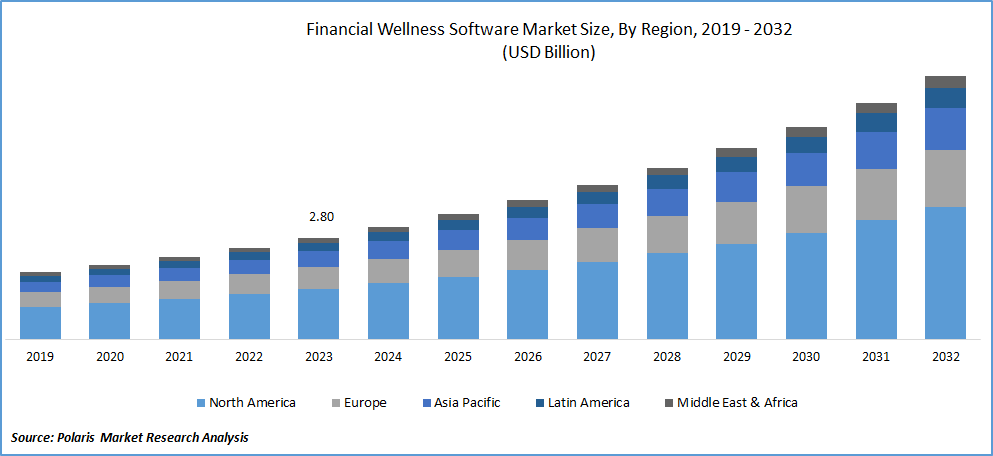

The global financial wellness software market was valued at USD 2.80 billion in 2023 and is expected to grow at a CAGR of 11.2% during the forecast period.

The widespread shift to remote work has expedited the adoption of cloud-based and web-based financial wellness software. The ease of access and the ability to manage finances from any location has become pivotal, with remote employees requiring online solutions that can serve their needs regardless of their physical location. This trend has opened up opportunities for software providers to cater to remote workforces.

In addition, companies operating in the market are introducing new solutions with enhanced capabilities to cater to the growing consumer demand.

- For instance, in September 2023, MobiKwik introduced "Lens," a financial offering designed to empower users with insights into their finances and support their journey towards financial well-being.

'

'

To Understand More About this Research: Request a Free Sample Report

The financial industry is subject to increasingly stringent regulations and data privacy requirements. Financial wellness software providers that prioritize data security and compliance have a competitive advantage. They can capitalize on the growing demand for secure solutions by offering advanced encryption, strict compliance measures, and adherence to financial regulations. The ability to tailor software to meet the specific needs of different demographics and organizations is an attractive opportunity. Software providers can create solutions that align with the unique financial goals and preferences of diverse user groups, including employees of varying age groups, income levels, and financial circumstances.

The Financial Wellness Software Market has witnessed significant shifts post-COVID-19. The pandemic heightened the demand for tools to manage finances, reduce stress, and improve financial well-being. Providers adapted by offering mobile and web-based solutions for remote work environments. Customization became essential, allowing users to address specific financial challenges. Mental health resources and integration with banking and investment platforms gained prominence. Data security and compliance became paramount in light of data privacy concerns. Employers recognized financial wellness as a critical employee benefit, expanding well-being programs. ESG and sustainable finance elements were integrated into the software, and governments collaborated to support financial wellness initiatives. This market is poised for continued growth as financial well-being takes center stage post-pandemic.

Growth Drivers

Rising Financial Stress

As financial stress continues to rise, driven by factors like increasing debt, economic uncertainty, and healthcare costs, the demand for financial wellness software has surged. Employees and individuals alike are seeking solutions to reduce financial stress and enhance their overall well-being. Employers are particularly motivated to address this issue, recognizing its impact on job performance and employee retention.

Employers are increasingly embracing financial wellness software as a fundamental component of their employee benefits packages. Recognizing the symbiotic relationship between employee financial health and workplace productivity, organizations are actively promoting these solutions. They are also considering financial wellness as part of a holistic well-being strategy that encompasses mental, physical, and financial health.

Different generations have unique financial needs and preferences. Software that offers customization to address the financial concerns of Baby Boomers, Gen X, Millennials, and Gen Z presents an opportunity for providers to cater to these diverse demographics. Customization may involve age-appropriate financial advice, investment strategies, and retirement planning guidance.

Report Segmentation

The market is primarily segmented based on platform, end use, and region.

|

By Platform |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

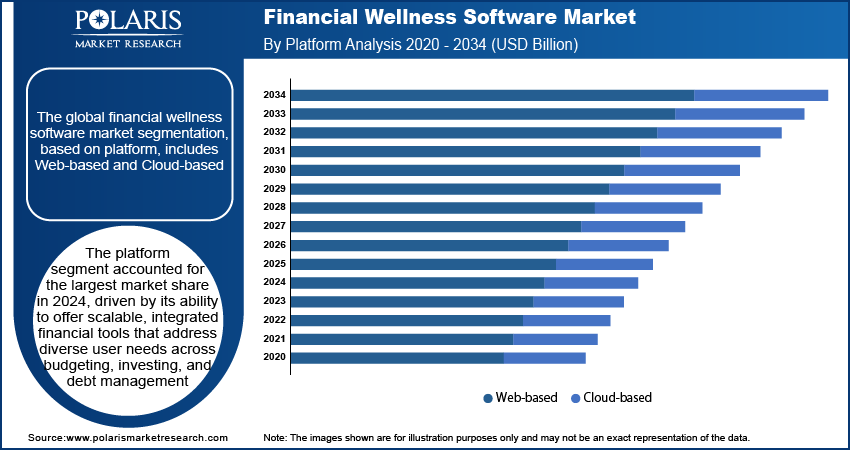

By Platform Analysis

The cloud-based segment is expected to witness the fastest CAGR during the forecast period.

The cloud-based segment is expected to witness the fastest CAGR during the forecast period. Cloud-based financial wellness software is a digital tool designed to improve the financial well-being of individuals or employees by offering accessible online resources and features through cloud computing technology. Users can access the software from anywhere with an internet connection, making it convenient for individuals to manage their finances, whether at home, work, or on the go. Cloud-based solutions often prioritize data security, employing encryption and compliance measures to safeguard sensitive financial information. These platforms can scale easily to accommodate the needs of both small and large organizations, making them versatile for businesses of varying sizes. Cloud-based systems allow for collaboration and real-time sharing of financial data among users, making it valuable for teams, employers, and financial advisors.

Web-based financial wellness software is a digital platform accessible through internet browsers, designed to assist individuals and employees in managing their financial well-being. These platforms often feature intuitive interfaces that are easy to navigate, ensuring a positive user experience. Some platforms offer data analytics and reporting capabilities, providing insights into financial behaviors and progress.

By End-Use Analysis

The corporate segment held a significant revenue share in 2023

The corporate segment held a significant revenue share in 2023. Financial wellness software employed by corporations is a valuable employee benefit aimed at enhancing the financial well-being of their workforce. Integrated into employee benefits programs, these solutions offer features for budgeting, debt management, savings, investments, and retirement planning. Employees gain access to educational resources, personalized financial counseling, and tools for expense tracking. The software fosters savings, emergency funds, and debt reduction, helping employees make informed financial decisions. Customizable to align with specific employee demographics and company goals, it's a vital component of employee well-being initiatives. Data security and compliance ensure the protection of sensitive information, demonstrating a corporate commitment to employees' financial success.

Regional Insights

North America region accounted for the largest market share in 2023

In 2023 North American region accounted for the largest market share. The North American market is on the rise, fueled by employers' increasing recognition of the importance of financial well-being for their employees. Many companies offer these software solutions as part of their employee benefits packages, empowering individuals to manage their finances, reduce stress, and plan for the future. These software offerings encompass a wide range of tools, from budgeting and debt management to retirement planning and investment guidance. Furthermore, they often integrate with retirement plans, emphasizing informed decision-making. With a focus on education, customization, and data security, the market is competitive, with continuous innovation and potential for growth as organizations prioritize their employees' financial health.

The Asia Pacific region is anticipated to experience the fastest growth during the projected period. As financial literacy in Asia continues to improve, individuals and organizations are increasingly recognizing the significance of financial wellness. This awareness fuels the demand for software solutions that help users manage their money more effectively. Financial wellness software providers in Asia-Pacific often tailor their solutions to the unique needs and preferences of local markets. Customization allows users to access tools and resources relevant to their specific financial circumstances. Some Asian governments have taken steps to promote financial literacy and well-being, further driving the adoption of financial wellness software among the population.

Key Market Players & Competitive Insights

The financial wellness software market is fragmented and is anticipated to witness competition due to several players' presence. Major market players are constantly introducing new products to strengthen their position in the market. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Alight Solutions

- Best Money Moves

- BrightPlan

- Edelman Financial Engines

- LearnLux

- Mercer

- MoneyManagement International (MMI)

- Savology

- Your Money Line

- Financial Fitness Group

Recent Developments

- In December 2022, Lincoln Financial Group's Workplace Solutions division unveiled an extension of its financial wellness initiative, introducing a novel marketplace connecting individuals with partner companies that provide solutions for enhancing financial well-being.

Financial Wellness Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.11 billion |

|

Revenue forecast in 2032 |

USD 7.27 billion |

|

CAGR |

11.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Platform, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Financial Wellness Software Market report covering key segments are platform, end use, and region.

The global financial wellness software market size is expected to reach USD 7.27 billion by 2032.

The global financial wellness software market is expected to grow at a CAGR of 11.2% during the forecast period.

North America regions is leading the global market.

Rising Financial Stress are the key driving factors in Financial Wellness Software Market