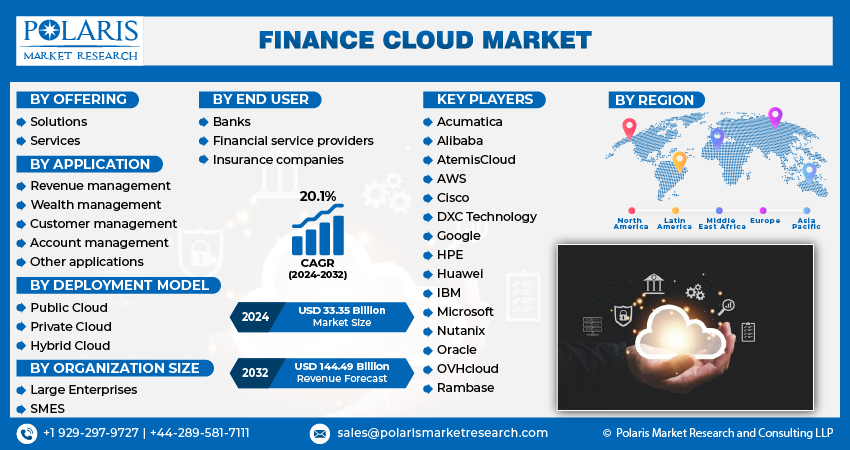

Finance Cloud Market Share, Size, Trends, Industry Analysis Report, By Offering (Solutions, Services); By Application; By Deployment Model; By Organization Size; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4424

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

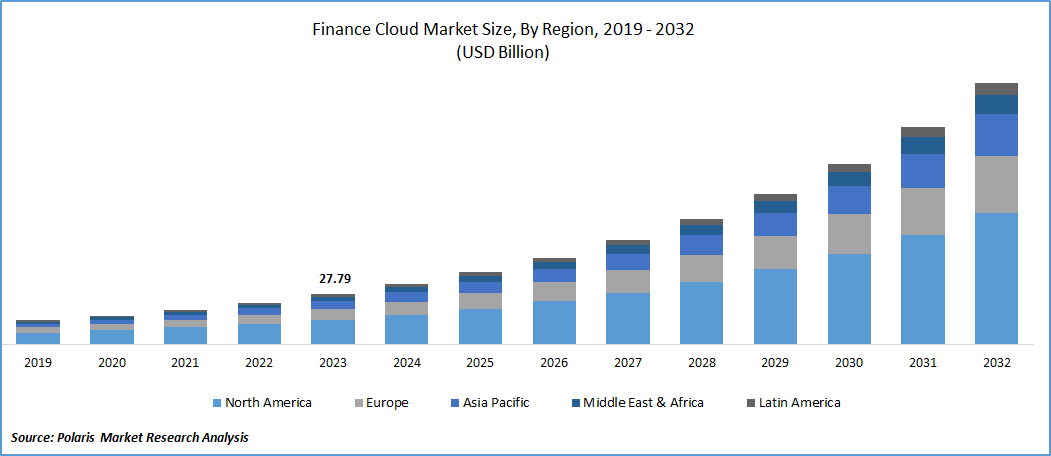

The global finance cloud market was valued at USD 27.79 billion in 2023 and is expected to grow at a CAGR of 20.1% during the forecast period.

The financial sector is undergoing a significant transition with technological advancements at the global level. The current move in the world is towards the adoption of cloud computing in the financial space, influenced by its scalability, security, compliance, and affordability. The faster processing speed is building its footprints in banking, insurance, and other financial institutions.

Based on the FBIIC (Financial and Banking Information and Infrastructure Committee) report, according to the American Bankers Association, more than 90 percent of the participants are changing their operations to the cloud. According to one of the other surveys, around two-thirds of the banks are likely to adopt at least 30 percent of their operations to the cloud in the coming three years; by that time, the FBIIC predicts that the cloud adoption will be tripled. The product innovations are driving new growth opportunities for cloud computing in the financial sector.

To Understand More About this Research:Request a Free Sample Report

- For instance, in 2023, SAP expanded its cloud offering with the release of SAP S/4HANA Cloud and a new premium package for RISE with SAP. This combines advanced financial solutions and AI technologies to accelerate business innovations.

Moreover, financial institutions are utilizing technology to automate most of the tasks with the evolution of artificial intelligence, machine learning, and deep learning with a view to lowering fraudulent activities and protecting their businesses

However, the challenges of data safety, protection, and governance, as well as the higher initial investments and maintenance costs, are key factors contributing to the slower adoption of cloud computing among financial institutions.

Growth Drivers

- Increasing awareness about the benefits associated with cloud computing in finance

The rising awareness about the benefits of cloud computing adoption in the financial industry is boosting its growth in the marketplace. The ability of technologies to resolve the drawbacks of banking and financial management is positively influencing the global demand for cloud computing. The presence of companies addressing the key challenges in the financial sector with the incorporation of technology is widening the potential of the finance cloud. For instance, in June, Google Cloud introduced anti-money laundering AI to ensure the efficient detection of money laundering cases for financial institutions.

The evolution of financial cloud technology is grabbing attention from financial institutions with its ability to create accessibility and increased affordability for the population, driven by the increased accessibility of the internet. Based on the SAP Q3 2023 report, it registered a revenue growth of 16% from the cloud, and IFRS cloud gross profit rose by 21%. This significant rise in the revenue of cloud computing companies is demonstrating the significant growth in adoption of cloud.

Report Segmentation

The market is primarily segmented based on offering, application, deployment model, organization size, end user and region.

|

By Offering |

By Application |

By Deployment Model |

By Organization Size |

By End User |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

- Services segment is expected to register the highest growth

The services segment will grow with rapid pace, due to prevalence of outsourcing from experienced professionals. The services segment offers cloud solutions without the need for installation or maintenance. The services managed professional segment is expected to witness dominant growth, which is highly influenced by its cost effectiveness.

The solutions segment led the market with a substantial revenue share in 2022, largely attributable to its ability to offer a customized consumer experience with an accurate and speedy response, enabling financial institutions to meet their consumer demand effectively.

By Application Analysis

- Wealth management segment accounted for the largest market share in 2023

The wealth management segment accounted for the largest share. The growth of this segment is mainly driven by the rising demand for investment and wealth creation services among the population.

The asset management segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in the need for real-time asset tracking, incredible insights, and the convenience of cloud systems.

By Deployment Model Analysis

- Public cloud segment held the significant market revenue share in 2023

The public cloud segment held a significant market share in revenue in 2022, which is highly accelerated due to its ability to assist in cost-cutting procedures as it charges for the only services utilised by the financial company. Its flexibility, scalability, and pay-as-you go model are gaining traction from more companies.

By Organization Size Analysis

- Large enterprise segment is registered significant growth in 2023

The large enterprises segment accounted for a significant growth share in 2023 and is expected to continue its trend in the coming years. This is attributable to its effectiveness in providing enhanced streamlining of business operations with appealing insights, which are essential in key decision-making.

Small and medium enterprises are expected to notice significant growth in the marketplace owing to ongoing preferences towards the adoption of the latest technologies to promote efficient business operations with lower investment.

By End User Analysis

- Banks segment dominated the finance cloud market over other end users in 2023

The banking segment witnessed a higher growth share over other end users in 2022, which is likely to stimulate its growth trajectory during the forecast period. This can be inferred from the increased consumer satisfaction, accessibility, and ease of operation with the penetration of internet users. One example is the unified payment interface (UPI).

Insurance and financial services provider segments are projected to witness reasonable growth in the coming years due to increasing concerns about uncertainty and the ability to provide alluring insights by automating repetitive tasks. The finance cloud facilitates risk assessment capability, which can promote smooth operations for investment banks.

Regional Insights

- North America region registered the largest share of the global market in 2023

North America dominated the global market. The growth of the segment market can be largely attributed to the presence of robust infrastructure, and the higher rate of internet users is encouraging financial institutions to adopt cloud computing to provide customized and qualitative services to their customers.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing government initiatives to promote financial inclusion in countries like India. The prevalence of global expansion activities by major players is showing a positive impact in the region.

For instance, in December 2023, Fair Isaac, a United States-based data and analytics company announced the launch of a new cloud-based platform for India. The early adopters of this technology include Indian major banks, such as HDFC Bank, Axis Bank, and AU Small Finance Bank. Furthermore, a Jaipur -based AU small finance company announced the 30% improvement in vehicle automation processes with the cloud adoption. This ongoing trend is likely to stimulate the demand for cloud computing for financial services in the region in the projected time frame.

Key Market Players & Competitive Insights

The finance cloud market is fragmented with the presence of several market players and is anticipated to witness competition due to the rising research and development activities to deploy advanced cloud computing systems. Collaborations and partnerships among the companies have been rising over the years, with a view to utilizing collaborative power to build efficient financial solutions. For instance, in October 2023, Moody's Corporation and Google Cloud entered into a strategic partnership to develop large language models (LLMs) to generate financial insights faster.

Some of the major players operating in the global market include:

- Acumatica

- Alibaba

- AtemisCloud

- AWS

- Cisco

- DXC Technology

- HPE

- Huawei

- IBM

- Microsoft

- Nutanix

- Oracle

- OVHcloud

- Rambase

Recent Developments

- In November 2023, Conga, a revenue lifecycle cloud solutions provider, unveiled its latest innovation, Conga revenue lifecycle cloud, to lower the complexities of revenue processing.

- In September 2023, Broadridge Financial Solutions entered into a collaboration with Salesforce to assist wealth management firms in adopting a digital transformation.

Finance Cloud Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 33.35 billion |

|

Revenue forecast in 2032 |

USD 144.49 billion |

|

CAGR |

20.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Application, By Deployment Model, By Organization Size, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Finance Cloud System Market include Acumatica, Alibaba, AtemisCloud, AWS, Cisco,

The global finance cloud market is expected to grow at a CAGR of 20.1% during the forecast period.

Finance Cloud Market report covering key segments are offering, application, deployment model, organization size, end user and region.

The key driving factors in Finance Cloud System Market are Increasing awareness about the benefits associated with cloud computing in finance

Finance Cloud Market Size Worth $ 144.49 Billion By 2032.