Fiber Optics Market Size, Share, Trends, Industry Analysis Report: By Fiber Type (Plastic and Glass), Cable Type, Deployment, Application, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 113

- Format: PDF

- Report ID: PM1455

- Base Year: 2023

- Historical Data: 2019-2022

Fiber Optics Market Overview

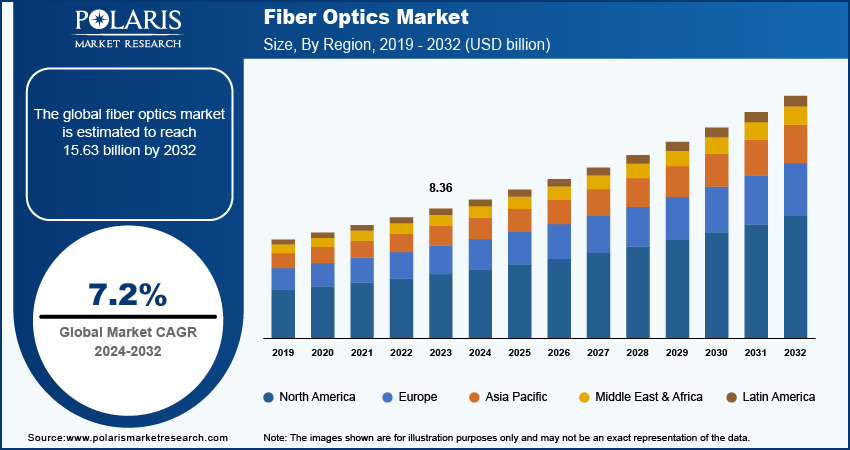

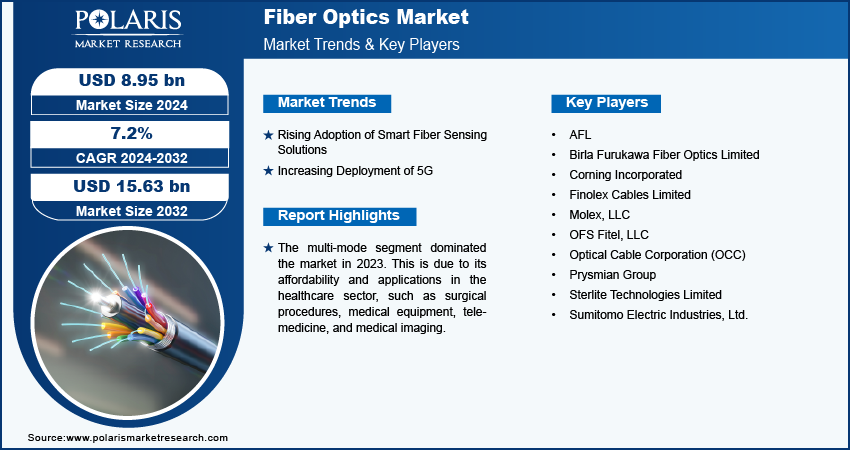

The fiber optics market size was valued at USD 8.36 billion in 2023. The market is projected to grow from USD 8.95 billion in 2024 to USD 15.63 billion by 2032, exhibiting a CAGR of 7.2% from 2024 to 2032.

The fiber optics market involves the production and sale of specialized cables and components for high-speed data transfer over long distances, which is crucial for telecommunications.

The fiber optics market is currently experiencing strong growth due to the increasing need for high-speed wired internet and broadband network infrastructures. Additionally, the rising number of internet users and the growing volume of generated data have resulted in a higher demand for new fiber optic cables and subsystems, further contributing to the fiber optics market expansion.

To Understand More About this Research: Request a Free Sample Report

Major companies are investing in and expanding their manufacturing facilities in response to the growing demand for fiber optics. This includes the installation of fiber draw towers and the integration of backward processes to manufacture essential glass pre-forms for the fiber drawing process.

For instance, in February 2024, Finolex Cables invested 580 crore rupees to establish a new manufacturing plant. In response to the increased demand for last mile connectivity due to the 5G rollout, Finolex Cables expanded its capacity for optic fibre cables from 4 million fiber km to 10 million fiber km.

Fiber Optics Market Trends and Drivers

Rising Adoption of Smart Fiber Sensing Solutions

The increasing adoption of smart fiber sensing solutions is driving the fiber optics market growth. These solutions allow for real-time monitoring and analysis of various parameters along the length of optical fibers. They utilize advanced technologies such as distributed fiber optic sensors (DFOS) and fiber Bragg gratings (FBG) to detect changes in temperature, strain, pressure, and vibrations with high precision and over large distances.

Smart fiber sensing solutions find applications in industries such as oil and gas, civil engineering, and healthcare, where continuous monitoring of infrastructure, pipelines, and patient conditions is essential for safety, efficiency, and cost-effectiveness.

In the oil and gas sector, these sensors can identify pipeline leaks, helping to prevent costly failures and minimize environmental impact. For instance, in March 2024, Sonatrach, the national oil company of Algeria, introduced a smart oil and gas pipeline inspection system created in partnership with Huawei. This advanced solution incorporates fiber optic sensing technology to enhance pipeline safety, monitoring, and overall performance.

Increasing Deployment of 5G

The fiber optics market is experiencing significant growth, driven by the widespread deployment of 5G in both advanced and emerging markets. This trend is creating favorable opportunities for fiber optics suppliers in the industry.

The deployment of 5G network relies on the utilization of optical fibers by organizations and industries, which can transmit large volumes of data at rapid speeds over long distances. Telecommunications companies are installing additional 5G base stations to stay ahead of the competition as 5G services are rolled out commercially.

For instance, according to a report published by the Ministry of Industry and Information Technology (MIIT) in March 2022, telecom service providers in China installed around 1.425 million 5G base stations. These stations require the deployment of fiber optics and are expected to accommodate network traffic for more than 500 million users across China, driving the fiber optics market revenue.

Fiber Optics Market Segment Insights

Fiber Optics Market Breakdown by Cable Type Insights

The fiber optics market segmentation, based on cable type, includes multi-mode and single-mode. The multi-mode segment dominated the market in 2023. This is due to its affordability and applications in the healthcare sector, such as surgical procedures, medical equipment, telemedicine, and medical imaging. Also, its versatility helps improve quality, effectiveness, and clarity in medical practices.

Multi-mode fiber optics is the preferred communication medium for critical missions due to its cost-effectiveness and high bandwidth capabilities. As a result, major players in the market are expanding their product range to meet the growing demand from various sectors.

For example, in January 2024, OFS launched the latest LaserWave Dual-Band OM4+ multi-mode optical fiber. This addition enhances their product portfolio alongside the existing OM5 and OM4 products, setting new standards in bandwidth and geometry performance.

Fiber Optics Market Breakdown by Deployment Insights

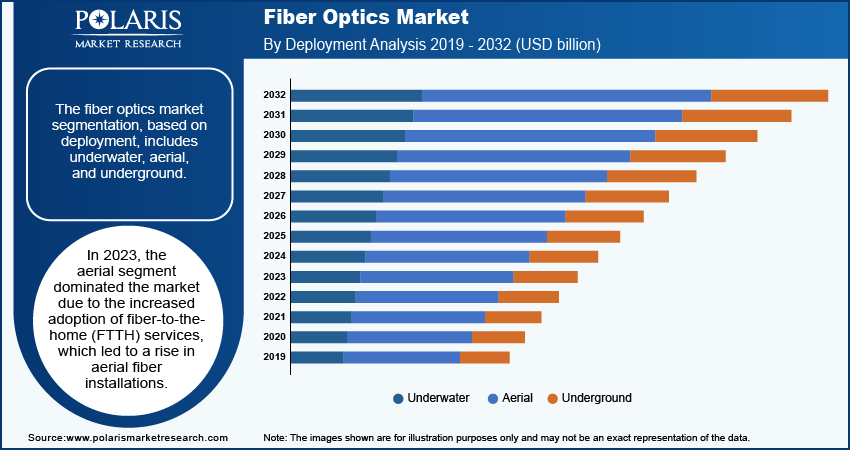

The fiber optics market segmentation, based on deployment, includes underwater, aerial, and underground. In 2023, the aerial segment dominated the market due to the increased adoption of fiber-to-the-home (FTTH) services, which led to a rise in aerial fiber installations.

Aerial fiber optic deployment offers quick installation along with lower repair and maintenance expenses. Hence, telecommunication companies are deploying aerial fibers for their cost-effectiveness, rapid deployment capabilities, and flexibility.

For instance, in January 2022, Orange S.A. extended its optical fiber network to around 63% of the 29 million eligible premises for FTTH in France. This expansion was primarily done through aerial installations, which resulted in a 20% growth in the number of covered premises

Fiber Optics Market Breakdown by Regional Insights

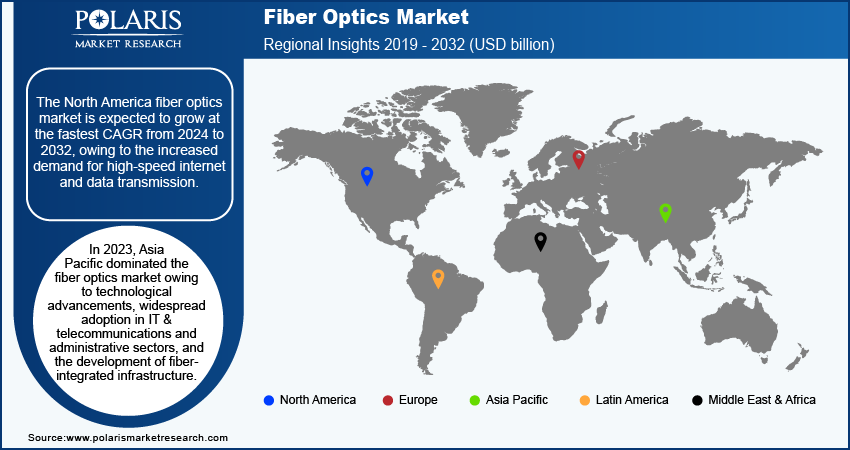

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America fiber optics market is expected to grow at the fastest CAGR from 2024 to 2032, owing to the increased demand for high-speed internet and data transmission. Moreover, the surge in smart city development, coupled with the growing use of industrial internet of things (IIoT) technology, has heightened the need for fiber optics in the region.

The US fiber optics market held a significant market share owing to the investments and agreements from various telecommunications and technology firms for the development of fiber optic networks. The growing utilization of fiber optics across different sectors, such as healthcare and defense, is driving the market expansion.

For instance, in February 2024, Sterlite Technologies signed an agreement with Lumos to construct 100% fiber optic internet infrastructure in the United States. Sterlite Technologies will provide specialized, purpose-built optical fiber cable designs to fulfill Lumos' network needs in the mid-Atlantic regions.

In 2023, Asia Pacific dominated the fiber optics market owing to technological advancements, widespread adoption in IT & telecommunications and administrative sectors, and the development of fiber-integrated infrastructure.

The increasing government initiatives to support fiber optics are driving the fiber optics market expansion during the forecast period. For instance, in January 2022, the Indian government revealed the merger of Bharat Sanchar Nigam Ltd (BSNL) and Bharat Broadband Network Ltd (BBNL) in order to establish the largest optic fiber cable (OFC) network across 16 states. This merger will grant BSNL full authority over BBNL's extensive 5.67 lakh km optical fiber network.

Several governments also collaborated with the market players for the underwater deployment of fiber optics and to enhance their product offerings in the Asia Pacific region. For instance, in January 2024, Alphabet collaborated with the Chilean government to construct the first undersea fiber-optic cable linking South America and the Asia Pacific region. The fiber optic cable will have a capacity of 144 terabytes and a 25-year lifespan.

Fiber Optics Market – Key Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the fiber optics market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the fiber optics market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the fiber optics market to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players in the fiber optics market include AFL; Birla Furukawa Fiber Optics Limited; Corning Incorporated; Finolex Cables Limited; Molex, LLC; OFS Fitel, LLC; Optical Cable Corporation (OCC); Prysmian Group; Sterlite Technologies Limited; and Sumitomo Electric Industries, Ltd.

Prysmian Group is a company in the energy and telecommunications cable industry, specializing in the design, production, and installation of a wide range of cables and systems. The company’s product portfolio, which includes high and medium-voltage cable systems, optical fibers, copper cables, submarine cable solutions, and connectivity components, caters to utilities, industrial sectors, and telecommunications. Prysmian operates numerous subsidiaries, including Prysmian Cables & Systems Ltd. and Prysmian Cables y Sistemas de México. In October 2021, Prysmian Group renewed its partnership agreement with Openreach for an additional three years. With the renewed alliance, Prysmian Group will offer its innovation and expertise to assist Openreach in implementing its enhanced Full Fiber broadband in the UK by 2025.

Sumitomo Electric Industries, Ltd. is a global manufacturer specializing in electric wire and optical fiber cables. The company operates across five sectors: automotive, info communications, energy and environment, electronics, and industrial materials. It has a diverse product portfolio that includes wiring harnesses, automotive hoses, telecommunication cables, optical devices, and power systems. Sumitomo Electric has a global presence in more than 40 countries across the Americas, Africa, Europe, the Middle East, and Asia Pacific. In November 2021, Sumitomo introduced the ITU-T G.654.E optical fibers and cables as part of its PureAdvance series. These products include ultra-low-loss optical fibers and cables specifically designed for broadband applications.

List of Key Companies in Fiber Optics Market

- AFL

- Birla Furukawa Fiber Optics Limited

- Corning Incorporated

- Finolex Cables Limited

- Molex, LLC

- OFS Fitel, LLC

- Optical Cable Corporation (OCC)

- Prysmian Group

- Sterlite Technologies Limited

- Sumitomo Electric Industries, Ltd.

Fiber Optics Industry Developments

May 2024: Runaya, a manufacturer of optical fiber cable components, announced that it aims to increase its capacity, expand exports, and boost revenues to Rs 500 crore within the next 3-4 years.

March 2024: OFSv launched the AllWave A2 9.2 Zero Water Peak Optical Fiber, which merges the bending performance and dependability of AllWave FLEX+ A2 Optical Fiber with the additional advantage of a 9.2 µm mode field diameter, enabling smooth integration of bend-insensitive fiber.

February 2024: HFCL established a manufacturing plant for optical fiber cables in Poland with an initial capacity of 3.25 million fiber km. This expansion is anticipated to address the increasing need for optical fiber cables in the European markets.

May 2022: Corning Incorporated revealed the enhancement of its MiniXtend cable collection by introducing MiniXtend HD cables for 72 to 12 fibers and MiniXtend XD cables for 192 and 288 fibers. These new cables offer high density, efficient use of duct space, and a decreased carbon footprint.

Fiber Optics Market Segmentation

By Fiber Type Outlook

- Plastic

- Glass

By Cable Type Outlook

- Multi-mode

- Single-mode

By Deployment Outlook

- Underwater

- Aerial

- Underground

By Application Outlook

- Medical

- Railway

- Oil & Gas

- Telecom

- Military & Aerospace

- BFSI

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fiber Optics Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 8.36 billion |

|

Market Size Value in 2024 |

USD 8.95 billion |

|

Revenue Forecast in 2032 |

USD 15.63 billion |

|

CAGR |

7.2% from 2024–2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The fiber optics market size was valued at USD 8.36 billion in 2023 and is projected to be valued at USD 15.63 billion in 2032.

The market is projected to grow at a CAGR of 7.2% from 2024 to 2032.

Asia Pacific held the largest share of the market.

The key players in the market are AFL; Birla Furukawa Fiber Optics Limited; Corning Incorporated; Finolex Cables Limited; Molex, LLC; OFS Fitel, LLC; Optical Cable Corporation (OCC); Prysmian Group; Sterlite Technologies Limited; and Sumitomo Electric Industries, Ltd.

The multi-mode segment dominated the market for fiber optics.

The aerial segment held the largest share of the market in 2023.