Fiber Optic Components Market Size, Share, Trends, Industry Analysis Report: By Component (Cables, Active Optical Cables (AOC), Amplifiers, Splitters, Connectors, Circulators, Transceivers, and Others), Data Rate, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5539

- Base Year: 2024

- Historical Data: 2020-2023

Fiber Optic Components Market Overview

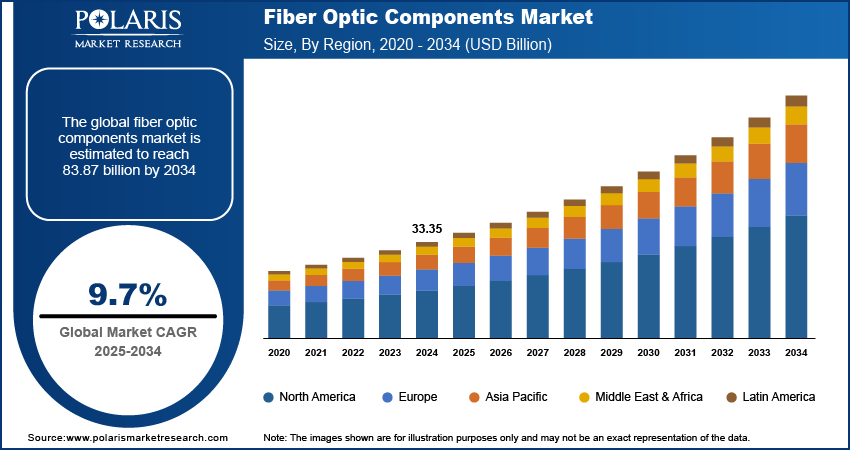

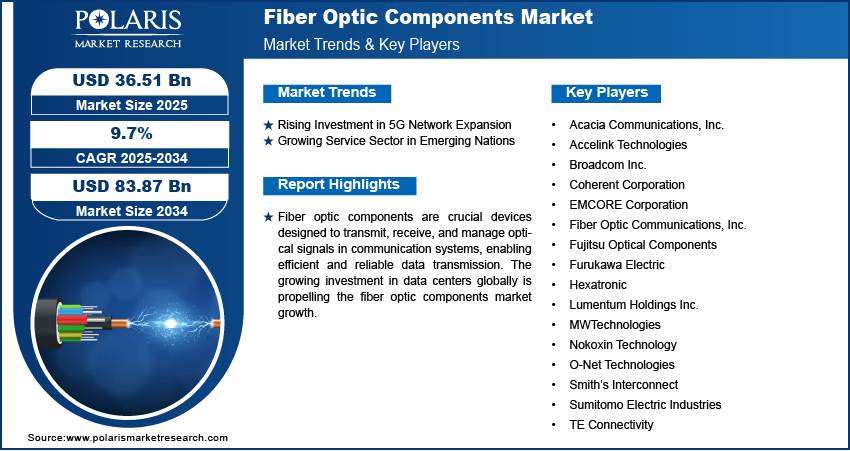

Fiber optic components market size was valued at USD 33.35 billion in 2024. The market is projected to grow from USD 36.51 billion in 2025 to USD 83.87 billion by 2034, exhibiting a CAGR of 9.7 % during 2025-2034.

Fiber optic components are crucial devices designed to transmit, receive, and manage optical signals in communication systems, enabling efficient and reliable data transmission. These components include fiber optic cables, connectors, couplers, circulators, isolators, and faceplates, each playing a vital role in the fiber optic network. The choice of fiber optic components depends on specific application requirements, such as distance, bandwidth, and cost considerations. Single-mode fibers are preferred for their high-speed and long-distance capabilities, while in local area networks (LANs), multimode fibers are more appropriate due to their cost-effectiveness and ease of installation.

The growing investment in data centers globally is propelling the fiber optic components market growth. Organizations worldwide are continuously expanding their data center infrastructure to support cloud computing, artificial intelligence, and big data analytics, which all depend on fast and reliable data transmission. Fiber optic components, such as transceivers, multiplexers, and fiber cables, enable seamless communication between servers and storage devices, ensuring efficient data processing and fast and reliable data transmission in data centers. Additionally, the growing adoption of IoT devices further amplifies data traffic, necessitating scalable and future-proof network solutions that fiber optic components provide. Therefore, the demand for fiber optic components is increasing with the investment in data centers globally. For instance, in January 2025, the president of the US, Donald Trump, announced a $20 billion investment to build data centers across the US. This large-scale investment aims to enhance the country’s digital infrastructure, support the growing demand for cloud services, and strengthen the backbone of high-speed internet connectivity, further driving the need for advanced fiber optic components in data transmission networks.

To Understand More About this Research: Request a Free Sample Report

The fiber optic components market demand is driven by the growing usage of fiber optic technology in military and aerospace. Fiber optics offer high data transmission speeds and security, which are crucial for military communications and aerospace operations. Military forces rely on fiber optic networks for secure, high-speed data transfer, enabling real-time communication and data sharing across various platforms and locations. This need for robust and secure communication systems drives investment in advanced fiber optic components, such as high-performance cables and connectors designed to withstand harsh environmental conditions.

The military and aerospace industries also require high-bandwidth, low-latency communication systems to support advanced surveillance and reconnaissance. Fiber optic cables excel in these areas, providing secure and reliable data transfer that is less susceptible to electromagnetic interference than traditional copper cables. This makes them ideal for applications such as unmanned aerial vehicles (UAVs), which need to transmit surveillance footage and sensor data in real time.

The aerospace industry also benefits from fiber optics components in avionics systems and aircraft interiors, where lightweight and compact components are essential. The growing integration of fiber optics components in these systems enhances communication speed, efficiency, and overall aircraft performance, ultimately increasing their adoption and propelling fiber optic components market expansion.

Fiber Optic Components Market Dynamics

Rising Investment in 5G Network Expansion

Fiber optic cables, a type of fiber optic component, are the backbone of 5G networks as they enable the transmission of massive amounts of data between cell towers, data centers, and user devices at high speeds. These components support the increased data traffic and ensure seamless connectivity offered by 5G networks. Additionally, the expansion of 5G networks drives the need for advanced fiber optic components such as transceivers, amplifiers, and multiplexers to handle higher bandwidths and longer transmission distances. Therefore, as governments and private sectors invest heavily in 5G networks, the demand for these components surges to meet the growing need for enhanced connectivity, driving fiber optic components market growth. For instance, the communication minister of India, Jyotiraditya Scindia, announced that nearly USD 51.6 billion has been invested in rolling out the 5G network across the country. This substantial investment aims to accelerate nationwide 5G deployment, enhance digital connectivity, and support emerging technologies such as IoT, AI, and smart cities, further boosting the demand for fiber optic components to ensure high-speed, reliable, and scalable network infrastructure.

Growing Service Sector in Emerging Nations

The service sector, including industries such as IT, telecommunications, healthcare, and education, relies heavily on high-bandwidth and low-latency networks to support operations and deliver services efficiently. Fiber optic components, such as cables, connectors, and transceivers, are essential for building and upgrading these networks to meet the increasing data transmission requirements. Additionally, the healthcare sector in these nations is increasingly adopting fiber optic components for minimally invasive surgeries and advanced medical treatments, which require high-speed data transfer and secure communication channels. Hence, as the services sector in emerging nations such as India, Brazil, and others grows, the demand for fiber optic components also spurs. For instance, as per the data published by the Indian Ministry of Finance, India’s services sector witnessed a real growth of more than 6% in 2022. This growth highlights the expanding digital infrastructure and increasing reliance on high-speed connectivity across industries, further driving the demand for fiber optic components to support seamless communication, data transfer, and technological advancements in emerging economies like India.

Fiber Optic Components Market Segment Analysis

Fiber Optic Components Market Evaluation by Component

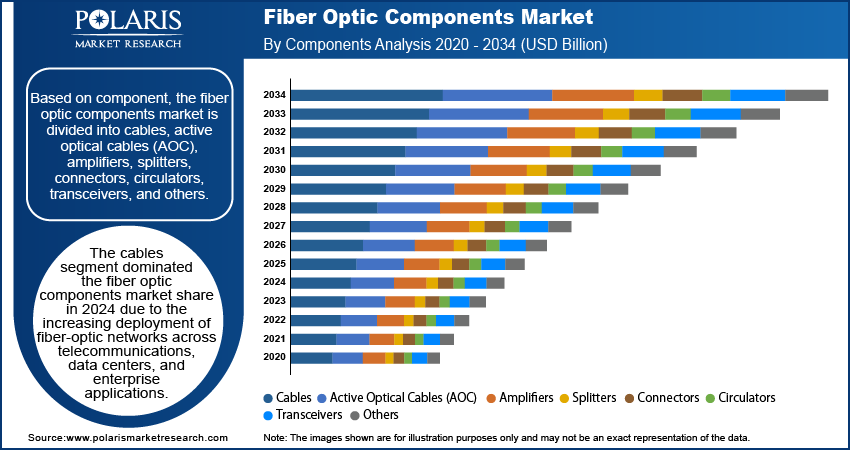

Based on component, the fiber optic components market is divided into cables, active optical cables (AOC), amplifiers, splitters, connectors, circulators, transceivers, and others. The cables segment dominated the fiber optic components market share in 2024 due to the increasing deployment of fiber-optic networks across telecommunications, data centers, and enterprise applications. Telecom providers invested heavily in expanding broadband infrastructure to support high-speed internet and 5G rollouts, driving the demand for fiber-optic cables. The rising penetration of cloud computing and hyperscale data centers also contributed to this growth, as data-intensive applications require robust, high-bandwidth connectivity. Governments worldwide launched initiatives to enhance digital infrastructure, further fueling cable installations. Additionally, advancements in cable manufacturing, such as reduced attenuation and improved durability, made fiber-optic cables more reliable and cost-effective, encouraging widespread adoption across industries such as telecom, IT, and others.

Fiber Optic Components Market Insight by Application

In terms of application, the fiber optic components market is segregated into communication, distributed sensing, and lighting. The communication segment accounted for a major market share in 2024 due to the rapid expansion of high-speed internet services, increasing mobile data traffic, and the widespread deployment of fiber-optic networks. Telecommunications companies invested heavily in upgrading network infrastructure to support 5G technology, broadband expansion, and fiber-to-the-home (FTTH) services. The rising adoption of cloud computing, video streaming, and remote work solutions further accelerated the demand for high-bandwidth, low-latency connectivity. Enterprises and data centers also expanded their network capabilities to handle growing data volumes, fueling the need for advanced optical communication systems. Governments and private organizations launched initiatives to improve digital connectivity, particularly in developing regions, driving segmental growth.

Fiber Optic Components Market Regional Analysis

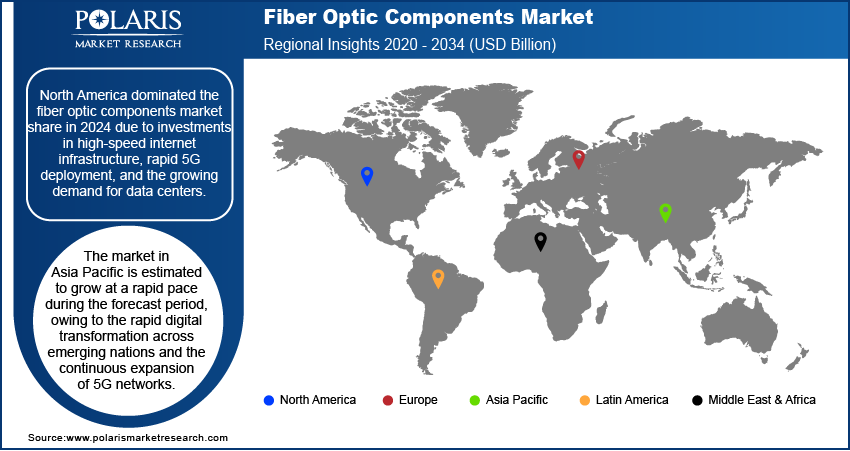

By region, the report provides fiber optic components market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market share in 2024 due to investments in high-speed internet infrastructure, rapid 5G deployment, and the growing demand for data centers. The US dominated the region, driven by aggressive fiber-optic network expansion, government-backed broadband initiatives, and rising cloud adoption. Major telecom providers upgraded their networks to support increasing data consumption, while hyperscale data center operators expanded their fiber-optic connectivity to handle the surge in AI, cloud computing, and streaming services, which propelled the demand for fiber optic components. The presence of major technology companies and network equipment manufacturers further strengthened North America's position in the fiber optic components market.

The fiber optic components market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to rapid digital transformation across emerging nations and the continuous expansion of 5G networks. China is estimated to hold the largest share of the market within the region during the forecast period due to extensive government investment in fiber-optic infrastructure, large-scale smart city projects, and the increasing adoption of high-speed broadband services. The rising demand for cloud computing, IoT, and industrial automation has pushed telecom providers and enterprises to accelerate fiber-optic deployments, thereby fueling the adoption of fiber optic components. Countries such as India and Japan are also witnessing significant demand for fiber optic components, driven by expanding internet penetration and growing enterprise reliance on high-speed connectivity.

Fiber Optic Components Key Market Players & Competitive Analysis Report

The competitive landscape of the fiber optic components market is characterized by intense rivalry among global and regional players focusing on technological advancements, strategic collaborations, and product innovations. Major companies invest heavily in R&D to enhance signal transmission efficiency, minimize latency, and develop next-generation fiber optic solutions catering to data centers, telecommunications, and industrial automation. Increasing demand for high-speed connectivity, 5G deployment, and cloud computing expansion is driving market dynamics, compelling firms to integrate advanced photonic technologies and AI-driven optical networking solutions. Mergers, acquisitions, and partnerships with telecom operators and cloud service providers remain key strategies for market expansion. Additionally, regulatory compliance and adherence to evolving industry standards shape competitive positioning. Companies emphasize manufacturing cost reductions and supply chain resilience amid fluctuating raw material prices and geopolitical trade policies. The growing focus on silicon photonics and coherent optics further intensifies competition, pushing players toward differentiated, high-performance fiber optic solutions.

The fiber optic components market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Acacia Communications, Inc.; Accelink Technologies; Broadcom Inc.; Coherent Corporation; EMCORE Corporation; Fiber Optic Communications, Inc.; Fujitsu Optical Components; Furukawa Electric; Hexatronic; Lumentum Holdings Inc.; MWTechnologies; Nokoxin Technology; O-Net Technologies; Smith's Interconnect; Sumitomo Electric Industries; and TE Connectivity.

Fiber Optic Communications, Inc. (FOCI), established in 1995, is a Taiwan-based company renowned for its crucial role in fiber optic technology. Founded by a core team from the prestigious Industrial Technology Research Institute (ITRI), the company specializes in designing, manufacturing, and marketing a wide range of high-performance fiber optic components and integrated modules. These components are crucial for enhancing the bandwidth and flexibility of modern communication networks, particularly in applications such as Fiber to the Home (FTTH) and high-speed optical cable systems under Light Peak technology.

TE Connectivity is a global company in connectivity and sensor solutions with a strong commitment to fiber optic technology since 1975. The company specializes in providing a comprehensive range of fiber optic components designed to enhance communication systems across various industries, particularly in automotive and telecommunications. TE's fiber optic solutions are integral to the Media Oriented System Transport (MOST) network, which facilitates high-speed multimedia data transmission in vehicles. The product offerings of the company include connectors, cable assemblies, and processing equipment. These solutions leverage 1000 μm Polymer Optical Fiber (POF) technology, supporting data speeds of 25 Mbps and 150 Mbps while ensuring minimal electromagnetic interference (EMI) and electromagnetic compatibility (EMC).

Key Companies in Fiber Optic Components Market

- Acacia Communications, Inc.

- Accelink Technologies

- Broadcom Inc.

- Coherent Corporation

- EMCORE Corporation

- Fiber Optic Communications, Inc.

- Fujitsu Optical Components

- Furukawa Electric

- Hexatronic

- Lumentum Holdings Inc.

- MWTechnologies

- Nokoxin Technology

- O-Net Technologies

- Smith’s Interconnect

- Sumitomo Electric Industries

- TE Connectivity

Fiber Optic Components Market Developments

May 2024: R&M, the globally active Swiss developer and provider of high-end infrastructure solutions for data and communications networks, opened a new fiber optic plant in India to serve data centers and 5G service users.

September 2024: I-PEX Inc. developed a multimode QSFP28-spec Active Optical Cable (AOC) LIGHTPASS-SP Q28, using silicon photonics ICs for outdoor communication equipment that requires reliability in long-term use in high-temperature environments.

March 2023: Jabil’s photonics business unit introduced an 800G active optical cable family for disaggregated data center and cloud environments, which boosts bandwidth with minimum latency and reduced power consumption.

Fiber Optic Components Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020-2034)

- Cables

- Active Optical Cables (AOC)

- Amplifiers

- Splitters

- Connectors

- Circulators

- Transceivers

- Others

By Data Rate Outlook (Revenue, USD Billion, 2020-2034)

- Less Than 10 GBPS

- 10 GBPS to 40 GBPS

- 41 GBPS to 100 GBPS

- More Than 100 GBPS

By Application Outlook (Revenue, USD Billion, 2020-2034)

- Communication

- Distributed Sensing

- Lighting

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fiber Optic Components Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 33.35 Billion |

|

Revenue Forecast in 2025 |

USD 36.51 Billion |

|

Revenue Forecast in 2034 |

USD 83.87 Billion |

|

CAGR |

9.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global fiber optic components market size was valued at USD 33.51 billion in 2024 and is projected to grow to USD 83.87 billion by 2034.

The global market is projected to register a CAGR of 9.7 % during the forecast period.

North America had the largest share of the global market in 2024

Some of the key players in the market are Acacia Communications, Inc.; Accelink Technologies; Broadcom Inc.; Coherent Corporation; EMCORE Corporation; Fiber Optic Communications, Inc.; Fujitsu Optical Components; Furukawa Electric; Hexatronic; Lumentum Holdings Inc.; MWTechnologies; Nokoxin Technology; O-Net Technologies; Smith's Interconnect; Sumitomo Electric Industries; and TE Connectivity.

The cables segment dominated the fiber optic components market in 2024, due to the increasing deployment of fiber-optic networks across telecommunications, data centers, and enterprise applications.

The communication segment accounted for a major market share in 2024 due to the rapid expansion of high-speed internet services, increasing mobile data traffic, and the widespread deployment of fiber-optic networks.