Fiber Laser Market Size, Share, Trends, Industry Analysis Report: By Type (Infrared Fiber Laser, Ultraviolet Fiber Laser, Ultrafast Fiber Laser, and Visible Fiber Laser), Operation Mode, Output Power, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 119

- Format: PDF

- Report ID: PM5060

- Base Year: 2023

- Historical Data: 2019-2022

Fiber Laser Market Overview

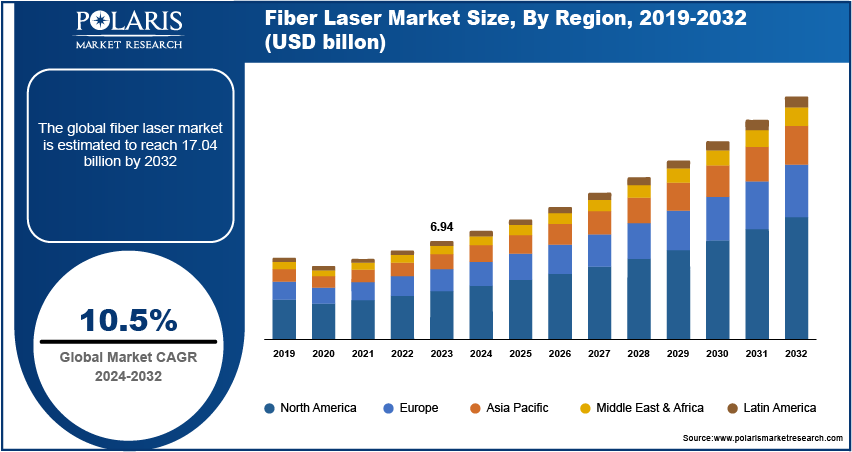

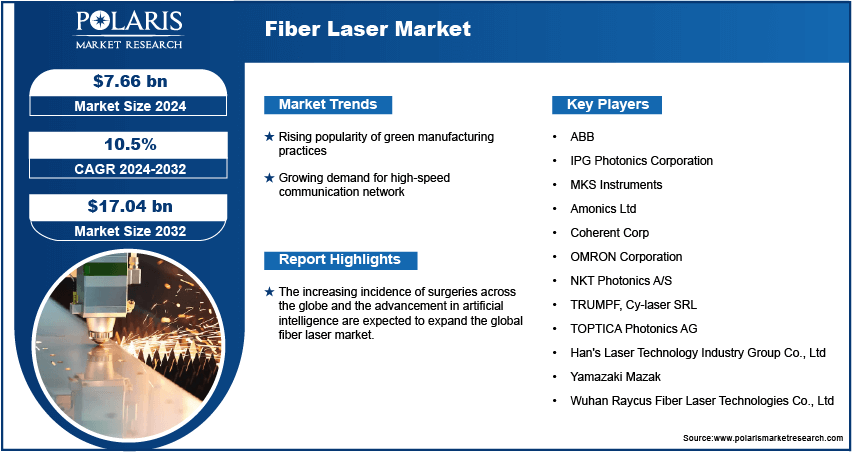

Global fiber laser market size was valued at USD 6.94 billion in 2023. The market is projected to grow from USD 7.66 billion in 2024 to USD 17.04 billion by 2032, exhibiting a CAGR of 10.5% during the forecast period.

Fiber lasers are advanced laser systems that utilize a fiber optic as the gain medium. The main components of these laser are the pump laser diodes, fiber gain medium, and optical components such as bragg gratings to form the laser cavity. These lasers are prominent for their high efficiency, producing significant power with minimal energy consumption. Fiber lasers further require less maintenance compared to traditional lasers due to their lack of moving parts and robust construction, which encourages their adoption in several industries.

The rising reliance on efficiency and precision in manufacturing is expected to expand the global fiber laser market. Fiber lasers offer exceptional beam quality, which allows for precise cutting, welding, and marking of materials. This precision is crucial in manufacturing industries where high tolerances and intricate designs are required.

The increasing incidence of surgeries across the globe is projected to boost the global market. Fiber lasers are widely used in surgeries as they enable minimally invasive surgical techniques, which are less traumatic to patients. Therefore, the rising incidence of surgries is propelling the market. For instance, according to a report published by the National Library of Medicine, 310 million major surgeries are performed each year worldwide.

To Understand More About this Research:Request a Free Sample Report

The market for the fiber laser market is driven by the advancement in artificial intelligence, as AI enhances the control and calibration of fiber lasers, ensuring consistent and reliable performance. This encourages key companies in the market to innovate and introduce AI-based fiber lasers, which ultimately enhances the sales of fiber lasers. For instance, in March 2021, Mitsubishi, a global integrated business enterprise, introduced AI-enabled fiber lasers for plate cutting.

Fiber Laser Market Drivers

Rising Popularity of Green Manufacturing Practices

The rising popularity of green manufacturing practices is estimated to drive the fiber laser market. Fiber lasers are highly efficient, converting a significant portion of electrical energy into laser light. This high energy efficiency results in lower power consumption compared to other laser types and traditional manufacturing processes, aligning with green manufacturing practices.

Growing Demand for High-Speed Communication Network

The growing demand for high-speed communication networks is projected to expand the fiber laser market. Fiber lasers are increasingly utilized to manufacture the advanced components required for high-speed communication networks, such as high-speed modulators and optical amplifiers. Thus, the rising preference for high-speed communication networks is propelling market growth.

Fiber Laser Market - Segment Insights

Fiber Laser Market- Type Insights

In terms of type, the global market is categorized into infrared fiber laser, ultraviolet fiber laser, ultrafast fiber laser, and visible fiber laser. The infrared segment held the major share of the market in 2023 due to its extensive applications across various industries such as aerospace, automotive, medical, and others. Infrared lasers are crucial in manufacturing processes such as cutting, welding, and others, where they provide the precision and power needed to handle a wide range of materials. Additionally, infrared lasers are integral to telecommunications, where they transmit data over long distances with minimal signal loss.

The ultrafast segment is expected to grow at a robust pace in the coming years, owing to its increasing adoption in areas requiring extreme precision and minimal thermal impact, such as micro-machining and biomedical applications. Ultrafast lasers generate incredibly short pulses, which makes them ideal for high-precision tasks such as laser ablation and imaging, where maintaining material integrity is crucial. Therefore, as industries continue to seek advanced solutions for complex manufacturing and medical procedures, the demand for ultrafast lasers is estimated to rise.

Fiber Laser Market- Industry Verticals Insights

Based on industry verticals, the global fiber laser market is segmented into telecommunication, medical, and automotive. The telecommunication segment accounted for a large market share in 2023 due to the crucial role of fiber lasers in high-speed data transmission. Telecommunication companies rely on fiber laser technologies to produce optical components and equipment that facilitate long-distance, high-bandwidth data communication. Additionally, the increasing demand for high internet speeds and the expansion of 5G networks propel the telecommunication sector in the market.

The medical segment is also projected to grow at a rapid pace during the forecast period, owing to the rising demand for advanced medical treatments and diagnostic tools. Lasers offer unparalleled precision in various medical applications, including surgical procedures, dermatological treatments, and imaging technologies. Additionally, ongoing advancements in laser technologies enhance their effectiveness and safety in medical applications, further driving the segment.

Fiber Laser- Regional Insights

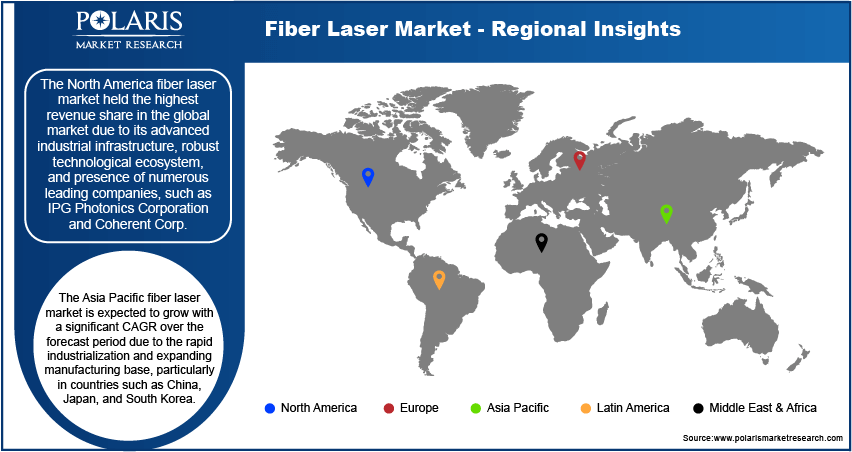

By region, the study provides the fiber laser market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America fiber laser market held the largest revenue share in the global market due to its advanced industrial infrastructure and robust technological ecosystem. The region's significant investments in manufacturing and telecommunications infrastructure drive the high demand for these technologies. Furthermore, North America is home to numerous major companies, such as IPG Photonics Corporation, Coherent Corp, and others, that help the region attain the highest market share. Additionally, increasing production of automobiles in the region boosts demand for fiber lasers as these lasers are utilized in the production of automobiles. For instance, according to data published by the European Automobile Manufacturers' Association, 14.9 million vehicles were produced in North America in 2022.

Asia Pacific fiber laser market is expected to grow with a significant CAGR over the forecast period due to the rapid industrialization and expanding manufacturing base, particularly in countries such as China, Japan, and South Korea. China's growing electronics, automotive, and metalworking industries are driving the expansion of the market as fiber lasers are widely used in automotive manufacturing and metalworking. Additionally, significant investments in telecommunications infrastructure and advancements in medical technology further boost the need for these laser solutions in the region. For instance, according to a report from GSMA (Global System for Mobile Communication), telecom operators are poised to allocate a staggering $259 billion towards enhancing their networks between the years 2023 and 2030.

Fiber Laser Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the fiber laser market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the fiber laser industry must offer innovative solutions.

The fiber laser market is fragmented, with the presence of numerous global and regional market players. The players are leveraging extensive resources and customer bases to enhance fiber laser capabilities. Major players in the fiber laser market include ABB; IPG Photonics Corporation; MKS Instruments; Amonics Ltd; Coherent Corp; OMRON Corporation; NKT Photonics A/S; TRUMPF; TOPTICA Photonics AG; Cy-laser SRL; Han's Laser Technology Industry Group Co., Ltd; Yamazaki Mazak; and Wuhan Raycus Fiber Laser Technologies Co., Ltd.

IPG Photonics Corporation is a prominent global provider of high-performance fiber lasers and amplifiers. The company specializes in developing innovative laser technologies for a wide range of applications. IPG Photonics is renowned for its advancements in fiber laser technology, which offers exceptional efficiency, reliability, and precision across various industrial, medical, and scientific applications. In May 2024, IPG Photonics, the world leader in fiber laser technology, announced the launch of LightWELD 2000 XR, the fourth product offering within its handheld laser welding and cleaning product line.

TRUMPF, founded in 1923, is a globally recognized leader in industrial machinery and laser technology, headquartered in Ditzingen, Germany. The company's fiber lasers are known for their high efficiency, precision, and versatility. In June 2022, TRUMPF announced the launch of its new fiber laser, the TruFiber 2000 P. TruFiber 2000 P is incredibly flexible, and suits a range of applications ranging from laser cutting to laser welding and additive manufacturing.

List of Key companies in Fiber Laser Market

- ABB

- IPG Photonics Corporation

- MKS Instruments

- Amonics Ltd

- Coherent Corp

- OMRON Corporation

- NKT Photonics A/S

- TRUMPF

- TOPTICA Photonics AG

- Cy-laser SRL

- Han's Laser Technology Industry Group Co., Ltd

- Yamazaki Mazak

- Wuhan Raycus Fiber Laser Technologies Co., Ltd

Fiber Laser Industry Developments

- June 2023: Coherent Corp., a leader in industrial lasers and laser subsystems, announced the introduction of FL-Arm Fiber Lasers to enhance the control of the welding process in battery manufacturing for electric vehicles (EVs).

- May 2022, Yamazaki Mazak, a leading manufacturer of advanced technology solutions, launched “FG-400 NEO”, a 3D fiber laser cutting machine for steel products worldwide.

- November 2020: MKS Instruments, a global provider of instruments, systems, subsystems, and process control solutions, introduced UV Hybrid Fiber Laser for high throughput and precision manufacturing.

Fiber Laser Market Segmentation

By Type Outlook (Revenue, USD billion, 2019 - 2032)

- Infrared Fiber Laser

- Ultraviolet Fiber Laser

- Ultrafast Fiber Laser

- Visible Fiber Laser

By Operation Mode Outlook (Revenue, USD billion, 2019 - 2032)

- Continuous Wave

- Pulsed

By Output Power Outlook (Revenue, USD billion, 2019 - 2032)

- Low

- Medium

- High

By Industry Vertical Outlook (Revenue, USD billion, 2019 - 2032)

- Telecommunications

- Automotive

- Medical

By Regional Outlook (Revenue, USD billion, 2019 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fiber Laser Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 6.94 billion |

|

Market Size Value in 2024 |

USD 7.66 billion |

|

Revenue Forecast in 2032 |

USD 17.04 billion |

|

CAGR |

10.5% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global fiber laser market size was valued at USD 6.94 billion in 2023 and is projected to grow to USD 17.04 billion by 2032.

The global market is expected to exhibit a CAGR of 10.5% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are ABB; IPG Photonics Corporation; MKS Instruments; Amonics Ltd; Coherent Corp; OMRON Corporation; NKT Photonics A/S; TRUMPF; TOPTICA Photonics AG; Cy-laser SRL; Han's Laser Technology Industry Group Co., Ltd; Yamazaki Mazak; and Wuhan Raycus Fiber Laser Technologies Co., Ltd.

The ultrafast type segment is projected for significant growth in the global market.

The telecommunication segment dominated the fiber laser market in 2023.